Published on January 4, 2024 by Sanyam Jain

The metaverse – an overview

The metaverse is a new asset class in the digital world that uses virtual reality (VR), augmented reality (AR) and other advanced internet technologies to enable a realistic, virtual personal and business experience. It facilitates digital interaction where the real world is rebuilt via virtual experiences in a connected world. In this virtual space, users are not only passive observers of digital content but are also able to be fully engaged, bridging the gap between the digital and physical worlds. This limitless reality, known as the metaverse, is set to revolutionise human interaction. Recognising its significant potential, an increasing number of businesses, creators and consumers are embracing it.

Use of the metaverse for the real estate sector

The metaverse real estate sector is not as distinctive as property in the physical world. It basically has a virtual presence in 3D cities where users can enjoy stimulating real-life pursuits such as meeting, gaming and trading. It includes parcels of virtual land in the metaverse world. They are mainly pixels but not just digital images, and work in a more immersive way.

There are extensive use cases of how commercial real estate can engage with the metaverse through the creative lifecycle, for example, strategic planning, 3D tours of properties or land, acquiring virtual land plots, building information modelling (BIM) and opportunities to access new consumer contacts and create new channels of footfall.

Real estate properties in the metaverse are virtual spaces where an investor can buy, sell or rent their virtual properties using metaverse tokens or cryptocurrencies.

Real estate in the metaverse is developing rapidly as investment in the virtual world increases, offering new opportunities for real estate investment banking to explore innovative strategies. Investing in the metaverse is the same as buying a non-fungible token (NFT). The legal document of ownership is a unique ID on the blockchain system. Most developers and financial institutions have made virtual real estate investments or multi-company partnerships to access virtual-world technology.

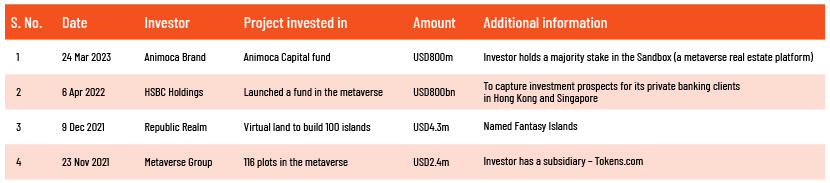

Investment in the metaverse

Reputed players in the technology sector, including large technology companies, venture capital (VC) firms, private equity (PE) firms, startups and well-known brands, have recognised the potential of the metaverse and made substantial investments, according to McKinsey. McKinsey predicts that the metaverse’s market value could reach approximately USD5tn by 2030. Companies, VC firms and PE firms had invested over USD120bn in the metaverse from January to May 2022, surpassing total investment of USD57bn in 2021. Early-stage investors in the metaverse have reaped substantial returns due to the popularity it gained in 2022.

Factors driving investment in the metaverse

The future of the metaverse is likely to be shaped by drivers such as a significant increase in investments, with several big tech firms committing billions of dollars to grow the metaverse. Advancements in Web3 may also unlock the potential for a more decentralised internet. Media attention has also grown, with ️Google reporting that in January 2023, there were around 1.9m searches globally for "metaverse". Furthermore, the commercial availability of VR and AR technologies and the younger generations' adoption of technology (as evidenced by the adoption of cryptocurrencies) may fundamentally shift how people see the virtual world and lead to transformative change. Statista reveals that the AR software market segment is the largest, projected to reach a market value of USD11.9bn in 2023. It expects it to grow at an annual CAGR of 12.6% (2023-28), leading to an estimated market value of USD58.1bn by 2028.

Risks of investing in the metaverse

Technology plays a pivotal role in driving innovation, and the metaverse is increasingly shaped by technological advancements. The emergence of VR and AR, along with the implementation of the 5G network, is set to revolutionise the immersive virtual experience. Furthermore, the metaverse has witnessed a surge in the participation of leading tech companies and renowned brands. Prominent players such as Roblox, Microsoft, Meta and NVIDIA are actively engaged in transforming the metaverse into a thriving commercial venture.

If a metaverse platform goes offline permanently, all the land and assets in the metaverse will become non-existent. On 20 September 2023, a report by dappGambl based on data provided by NFT Scan and Coin Market Cap showed that over 95% of investors had a market cap of zero ether. It estimates that around 23m investors hold these worthless assets. Meta’s Reality Labs division that provides metaverse services has lost around USD46.5bn since 2019, according to the company’s latest earnings report (published 27 October 2023).

Outlook

Metaverse real estate is a growing market. Due to its substantial ability to create exciting new experiences, companies and investors alike are investing in this market. A KPMG study shows that 90% of the investors surveyed firmly believe that the metaverse is the next phase of the internet. They envision a future where the metaverse is extensively utilised for work meetings, training sessions and learning experiences. More than half of the investors surveyed recognise the advantages of early investment, with 63% of the venture capitalists surveyed showing particular interest as the technologies and experiences within the metaverse continue to evolve. A substantial 75% of the investors surveyed intend to either maintain or increase their investments in the metaverse over the next five years.

How Acuity Knowledge Partners can help

We are experienced in providing analytics and business intelligence services across sectors, including the real estate sector. We invest in learning how the metaverse can enhance the real estate sector and provide real estate investors with a talent pool for conducting thorough research.

Sources:

-

HSBC Launches Portfolio on Metaverse for Rich Asian Clients – BNN Bloomberg

-

Animoca Brands cuts metaverse fund target to $800M: Report (cointelegraph.com)

-

NFT Crash: 95% of the Market May Now Be Worthless, Study Finds (businessinsider.com)

-

Investors remain bullish on the metaverse | KPMG (venturebeat.com)

-

48 Metaverse Statistics | Market Size & Growth (2023) (influencermarketinghub.com)

What's your view?

About the Author

Sanyam Jain is part of the Private Market team at Acuity Knowledge Partners. He has 2 years of experience in Research and currently supports private equity clients with research assignments including industry research, company analysis, data research and Company presentation. He holds a Master’s degree in Business Administration with specializing in Finance and Business Analytics.

Like the way we think?

Next time we post something new, we'll send it to your inbox