Published on by Mario Menjivar

As 2025 dawns, the US economy finds itself navigating a complex landscape. From inflation concerns and Federal Reserve (Fed) policy to labour-market dynamics and global uncertainties, the economic narrative remains a blend of resilience and challenges. To understand the current state of the economy, we must examine key indicators such as inflation, growth, employment and external factors.

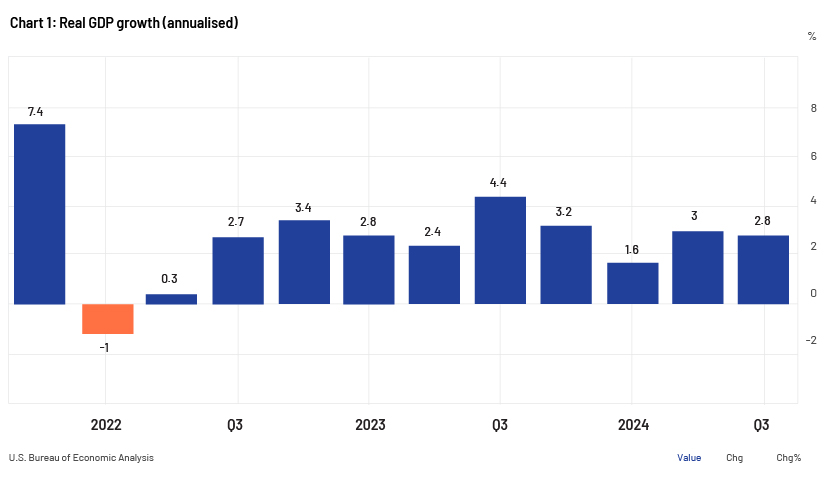

Economic growth: resilient but moderating

Economic growth in the US remained moderate in 2024, with real GDP growing at an annualised rate of 2.8% in the third quarter, less than the 3% reported in the second quarter, reflecting steady but unspectacular progress. Consumer spending, one of the most important drivers in the economy, is showing signs of slowing due to high interest rates and overall cautious sentiment. However, some sectors such as technology and healthcare demonstrated strong performance, providing pockets of growth.

Moreover, the economy has shown an uneven recovery since the pandemic that continues to shape the US landscape. Urban centres have bounced back robustly, while rural areas and small cities are still facing challenges due to lower investment and a slower pace of job creation. These disparities highlight the need for targeted policies to ensure a strong recovery across the board.

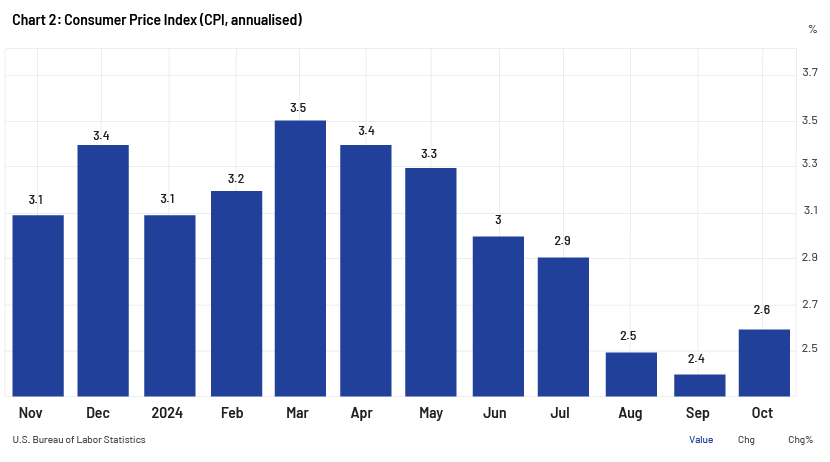

Inflation: cooling but still elevated

Inflation has been in focus in recent years, becoming one of the main concerns for consumers and policymakers. It now shows signs of cooling but is still above the Fed's 2% target. In the 12 months to October, the CPI advanced 2.6%, after climbing 2.4% in September. While energy prices are stabilising, housing and healthcare prices remain high.

The Fed's aggressive rate hikes in recent years have succeeded in subduing inflation to some extent, with the benchmark interest rate now hovering at 4.50-4.75% after the latest 50bps cut. However, these levels continue to dampen business investment and consumer spending, creating a balancing act for policymakers. Current Fed forecasts put the target at 3.5% by the end of 2025 and at 3% by June 2026.

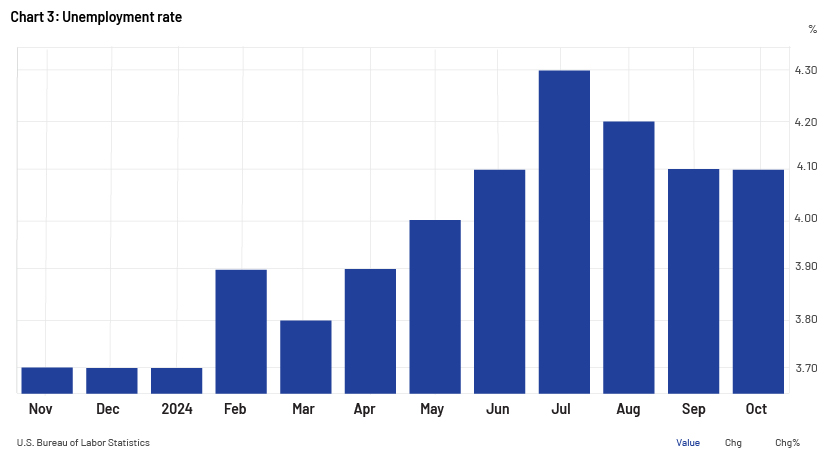

Labour market: resilient but cooling

The US labour market has been a bright spot in the economy but is starting to show signs of cooling. The unemployment rate currently sits at 4.1%, unchanged compared to September 2024 and slightly above historical lows, but still indicative of a strong job market. Wage growth has moderated, easing inflationary pressures, but remains robust in sectors such as technology, construction and hospitality.

Labour-force participation rates are still below pre-pandemic levels, particularly among older workers and caregivers. Although there are more Americans participating in the workforce today than before the pandemic, the overall share of the population participating in the labour force has dropped, according to the US Chamber of Commerce. It estimates there are 8m job openings in the US and only 6.8m unemployed. If labour-force participation was the same as it was in February 2020, there would be more than 2m additional Americans in the workforce to fill those jobs.

Labour-force participation dropped from 67.2% in January 2001 to 63.3% in February 2020 and to 62.7% in October 2024. The pandemic had driven more than 3m adults into early retirement as of October 2021. The number of adults 55 and older exiting the labour force due to retirement grew from 48.1% in 3Q19 to 50.3% in 3Q21. Additionally, the share of the older generation continues to increase; this trend will likely continue as the younger generations have fewer children than did the older generations.

This dynamic has contributed to tight labour markets in certain sectors, driving up wages and exacerbating inflation in some. Policymakers face the challenge of encouraging broader participation while managing wage-driven inflation.

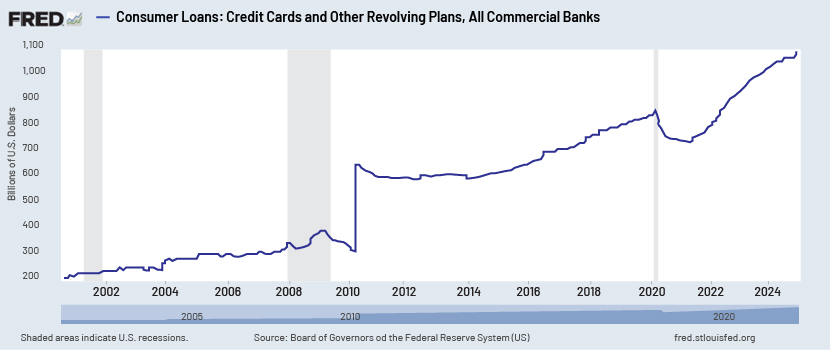

Consumer behaviour: cautious amid uncertainty

American consumers, who drive a large part of the economy, have become more cautious as elevated interest rates have increased the cost of borrowing, making large purchases such as homes and cars less affordable. Credit card debt has surged, crossing the USD1tn mark for the first time as Americans face higher prices and lower savings than in previous years.

Retailers are reporting mixed results as consumers prioritise essentials over discretionary spending. Ecommerce continues to grow, but brick-and-mortar stores are facing headwinds. Target’s (TGT’s) recent results show how consumer behaviour is starting to make a dent in sales, having missed on the top and bottom lines versus Street expectations, despite proposed discounts, reflecting a broader trend of frugality amid economic uncertainty.

Housing market: a tipping point

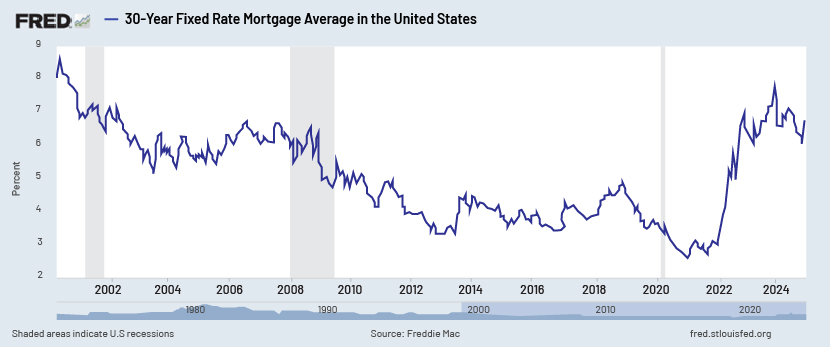

The US housing market remains a significant pressure point. High mortgage rates, which exceeded 7% for a 30-year fixed loan, have cooled demand, leading to lower home sales. Prices have started to stabilise, but affordability remains an issue, as mortgage payments represent a larger part of take-home pay than in previous years. Fed data shows that after rate cuts, the current 30-year fixed-rate mortgage average in the US sits at ~7%.

As a result, the renting market has seen steady demand but faces some challenges of its own. Rising rents, driven by limited supply, continue to strain household budgets. Policymakers have been focusing on addressing this with reforms and incentives for affordable housing, but the effects are unlikely to be felt in the short term.

Global headwinds and opportunities

All things considered, the global economy presents both challenges and opportunities for the US economy. Geopolitical tensions, including conflicts in Eastern Europe and the Middle East, have disrupted supply chains and increased energy-market volatility. At the same time, the transition to renewable energy and technological advancements present opportunities for economic growth and innovation. Nonetheless, with President-elect Donald Trump's position on energy, efforts at stabilisation may target increasing efficiency in domestic energy production rather than green energy innovation.

Trade relationships with key partners such as China and Europe remain somewhat strained, with disputes over tariffs, technology and information. However, the US continues to benefit from its strong position in sectors such as artificial intelligence, semiconductors and pharmaceuticals.

Looking ahead: the US economy in 2025 and beyond

The US economy is at a crossroads, facing a mix of headwinds and tailwinds. Policymakers would need to navigate key considerations in the coming months:

Monetary policy: The Fed faces the challenge of balancing inflation control with economic growth. The pace and size of rate cuts could lead to a spike in inflation, while being too cautious could stagnate growth. The Fed's policy stance and forecasts could also be altered by the tariffs proposed by Trump.

Fiscal policy: Government spending will be in focus as the US reaches record debt levels. Trump's stance on the economy may benefit infrastructure, while the new Department of Government Efficiency led by Elon Musk and Vivek Ramaswamy looks to cut unnecessary spending, but the actual impact will be seen after he takes office again in January.

Labour-market dynamics: Some of the impact of slower growth can already be seen, with layoffs in tech, consulting and other sectors as companies switch focus to enhance efficiency and profitability amid an uncertain economy. However, the labour market remains resilient.

Global uncertainty: Managing geopolitical risks will be crucial for the US economy in the coming years. Should the Russia-Ukraine and Israel-Iran conflicts come to an end, the economy would benefit from stability in global markets. However, Trump's plans to impose tariffs on foreign products to incentivise domestic production could backfire and translate into higher prices for consumers.

Conclusion

Fed representatives and the new administration would face significant challenges. Policies put in place this year would set the tone for possible outcomes, whether good or bad, that would shape the US economy. Corporate tax cuts could lead to benefits for investors and corporations as they increase profits, but tariffs on foreign products could lead to a new inflation spike that could change the Fed's current forecasts.

The American consumer has been resilient despite high inflation in recent years and low employment, but the spike in credit-card debt and the Fed's cautious approach to rate cuts could lead to an increase in credit delinquency and put pressure on the economy. Leading indicators such as the Producer Price Index (PPI) indicate that the fight against inflation may not be over and that the path ahead is still unclear.

Geopolitical risk remains a concern not only due to the effects of war on supply chains and energy-price volatility but also from the perspective of trade. Ontario's premier recently informed the public that Canada could cut US energy supplies in retaliation to tariffs, while Mexico's president has been vocal about the effect tariffs would have on jobs and has hinted at retaliation as well, adding to a set of variables that could affect the economy in the coming years.

How Acuity Knowledge Partners can help

We work with asset managers as an extension of their research teams and help build their proprietary research products across equity and credit. Apart from research and advisory, we also provide services in areas such as sales and marketing, fund accounting services, investment compliance and risk management. Our integrated solutions across asset classes and functions help asset managers improve investment performance, enhance client servicing, attract new client assets and retain assets in the current complex business environment. Partnering with us, our clients have been able to achieve cost savings of 50-60% versus performing these functions in-house.

Tags:

What's your view?

About the Author

Mario has five years of experience in commercial financial institutions, corporate credit and equity research. He previously supported a large sell-side firm, based in Europe and the US, covering corporate research on the energy; mining; and technology, media, and telecommunications (TMT) sectors in Latin America. He currently supports one of the largest asset managers on the buy side covering sectors such as payroll, IT services and payments. He actively contributes to creating models and conducting research to support investment cases. Mario holds a bachelor's degree in business and economics and an MBA with a focus on Finance from INCAE Business School.

Like the way we think?

Next time we post something new, we'll send it to your inbox