Published on April 25, 2025 by Jatin Aggarwal

President Trump took back the White House in November 2024, pledging to address inflation and an ailing economy. Since the start of the pandemic, followed by the Russia-Ukraine war, inflation has been a major concern for Americans, but despite the concerns, the country avoided a recession in 2024. Americans turned their hopes back to Trump, believing he would govern as a traditional Republican, with a focus on bringing inflation under control, cutting taxes and imposing regulations in America’s interest. However, things have not gone as expected, and President Trump's aggressive measures have caught people off guard, making them rethink their assumptions.

His notion of a trade deficit as a bad thing has driven him to take strict measures against leading trade partners such as China, Japan, Vietnam, India, Taiwan, South Korea and the EU. On 2 April 2024, which he refers to as “Liberation Day”, he imposed sweeping tariffs on almost every country by placing a 10% uniform tariff on all imports plus “reciprocal” tariffs of up to 50% on many nations. The effective US import tax rate shot up to 22% from a mere 2.4% in 2024, levels last seen in 1910, according to Fitch Ratings. A few nations retaliated and imposed tariffs back on the US, while the majority showed an intent of negotiation. On 9 April 2025, he paused tariffs on most of the countries for 90 days, except those on China, which received no reprieve; in fact, further tariffs were slapped on China, taking the total tariff to 145% on Chinese imports. The trade war started by President Trump escalated further as China retaliated, with a 125% tariff on US imports. On 16 April 2025, the US increased the punitive tariffs on some of the Chinese imports to 245% in response to China’s retaliation. According to China, any further tariffs would be economically meaningless and would be a joke in the history of the world economy.

President Trump believes such tariffs will promote fair trade, improve investments in the US and tap new sources of revenue that would help offset the tax cuts planned by the Republicans. He has pledged to protect domestic interests and US manufacturers by raising import barriers and making them competitive in the domestic market. He says current trade gaps are unfair and has been calling the largest trading allies to eliminate them. However, Americans fear that such tariffs would only hurt the US as the cost of imports rises, leading to a spike in inflation, and trim down their spending power. Although recent inflation data has been cooler than expected, higher tariffs, coupled with weaker growth, would eventually force the Federal Reserve (Fed) to pause interest rate cuts, as lowering interest rates to boost the economy would worsen inflation.

President Trump also plans to eliminate funding for organisations such as USAID and cut staff across the federal government. The Department of Government Efficiency (DOGE), led by Elon Musk, has taken steps that could lead to 500,000 job losses, directly or indirectly, according to Evercore ISI. In its 2Q25 earnings call, Accenture’s CEO Julie Sweet confirmed the ongoing uncertainty due to the cost-cutting plans. She says the General Services Administration has asked all federal agencies to review their contracts with the same consultants.

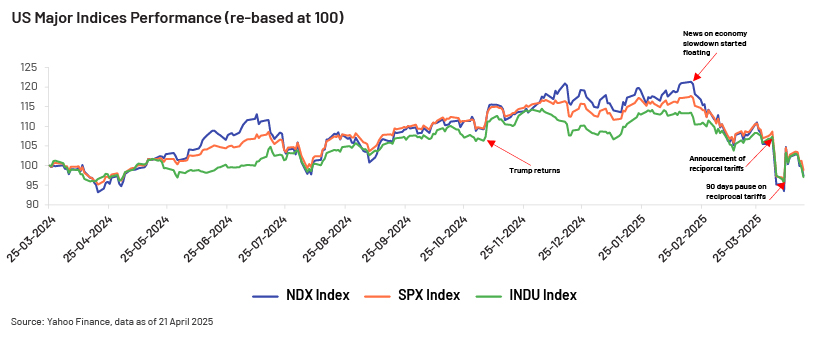

After the Republicans registered their victory, there was optimism due to expectations of faster economic growth, tax cuts and an improved job environment. However, with growing concerns of an economic slowdown and uncertainty over the global trade demand/supply balance, a number of US indices have started seeing a sharp correction. On 2 April 2025, Trump imposed sweeping tariffs on most of the trading nations and on Thursday (3 April 2025) open, US stocks tumbled, with the major indices correcting as much as 5%, absorbing the impact of the tariffs. Since the announcement on 2 April 2025, major US indices have fallen 9-10%1. All major indices are currently trading below their levels on election day in November 2024.

US economic policymakers were focused primarily on protecting the US economy from a hard landing by controlling inflation without a recession, but President Trump's new world order has altered the game. A series of tariff measures on trading allies and trade uncertainty have reignited recessionary concerns. The USD has been supreme in the global financial system for years, enabling the government to borrow cheaply, but the Trump administration is intent on changing global trade dynamics and wants a weaker currency, in order to boost domestic manufacturing. A weaker USD would have serious repercussions, making imports expensive and boosting inflation, adding to the woes of already-struggling Americans. On 3 April 2025, the USD dropped to its lowest level so far this year due to weak growth sentiment and concerns relating to the curtailment of international fund flow into the country. The USD has continued its fall since the beginning of this year, going below 100 level mark and recording correction of ~9%1 this year. The negative impact of an economic slowdown would be greater than the income generated by the tariffs, according to the Organisation for Economic Co-operation and Development (OECD).

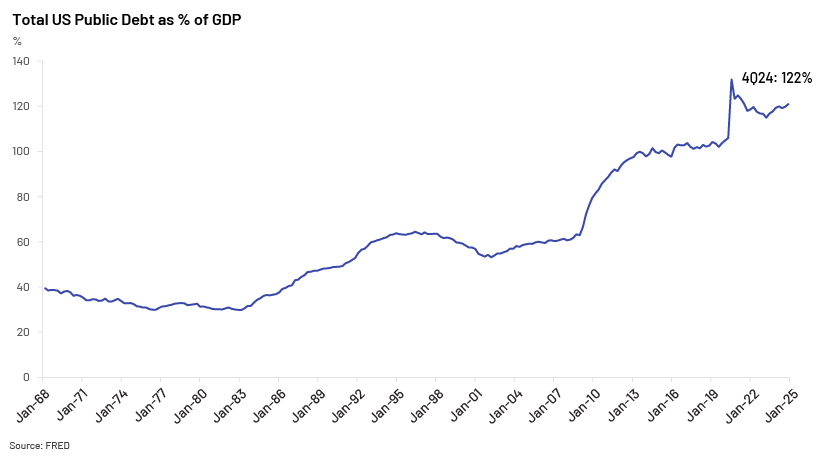

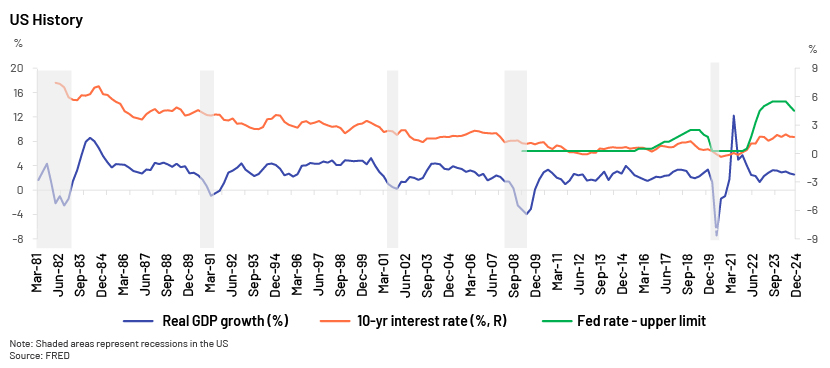

When the US economy rebounded after the pandemic, it was widely thought that it would be sustainable, but long-term trends indicate otherwise. US GDP growth slowed to 2.5% in 4Q24 from 3.2% in 4Q23. The Fed now expects GDP growth of 1.7% in 2025 versus its previous estimate of 2.1%. It reduced its benchmark rate range to 4.25-4.5% in December 2024 from the peak 5.25-5.5% and has kept rates steady since but has hinted at two cuts in 2025. However, given the current recessionary concerns and worries of inflation spiking due to the tariff war, the Fed’s ability to cut rates would be limited. Concerns of an economic slowdown have also led to a sharp correction in energy prices, with US oil futures falling >7% in early trades on 3 April 2025, and down ~12% since then1. The US debt/GDP ratio has been rising for years and remains a concern. The confidence of US companies has started to fade versus the optimism at the start of the year, according to S&P Global’s Future Expectations Index. Sentiment dropped to its second-lowest level in the past 30 months in March 2025. Although the tariff announcements have improved sentiment surrounding the US manufacturing sector, confidence in the service sector has been diminishing owing to spending cuts and macro uncertainty. US factories have reported a steep rise in input costs, primarily due to tariffs, resulting in high inflation, as these costs are passed through to customers. There is nearly a 50% chance of a US recession, according to a recent survey conducted by Deutsche Bank. The US economy will be hit by a recession later this year, according to JP Morgan. Although US hiring remains strong, a recent survey suggests that US consumer sentiment has fallen to its lowest since March 2022.

Conclusion

The US has been viewed as the major contributor over the years to developing a liberal, rules-based international system; this is now seeing a major shift in President Trump’s second term. The protectionist measures being implemented are considered to be the biggest upheaval in global trade and continue to cloud the macro environment, even if they come at the cost of a recession. All the tariff threats have become a harsh reality, and the experts expect potential ripple effects across the currency markets and global trade. Retaliation by China, the EU and other major trading allies would only make things worse, and the economic war between the world’s leading economies would make everyone suffer. Global experts expect a significant dip in the USD, primarily because US interest rates are higher than those in almost all developed economies, and the cost of doing business in the US to spike. Plummeting foreign investment and the Fed's inability to cut interest rates due to inflationary concerns would make the situation more difficult. The Fed revised its GDP growth assumption to 1.7% for 2025 at a recent meeting from 2.1% previously, with inflation now expected at 2.7% versus 2.5% previously. Due to ongoing trade tensions, the OECD has revised its global GDP growth outlook to 3.1% for 2025 and 3% for 2026 from 3.3% for both years.

A tariff-led approach could put the US in danger, and ongoing global uncertainty and the Trump administration’s actions may force the economy towards a hard landing. President Trump's aggressive trade policies have stoked the trade war and put the world on its toes. Global economies are likely to see a paradigm shift, with mounting inflation, reduced demand and consumption, and millions of jobs lost putting them on a downward spiral.

How Acuity Knowledge Partners can help

We provide bespoke research and analytics services to financial institutions, consulting companies and asset managers so they can identify global themes and capitalise on opportunities across the industry value chain. Our large pool of CAs, MBAs and CFAs help a diversified global client base, providing a wide range of services including financial modelling, deep-down fundamental research, and market and industry research.

1Prices as of 21 April 2025

Sources:

-

Inside Trump's "Liberation Day" Tariff Plan On Imports Worth Trillions

-

Trump Administration Ordered to Reinstate Thousands of Fired Workers – WSJ

-

Accenture CEO: ‘Ongoing Uncertainty’ From Trump Cost-Cutting Plans

-

Trump trade war to sap Canadian, Mexican and US growth, OECD says | Reuters

-

Trump's Tariff Tantrums Will Hurt America But Offer India A Golden Opportunity

-

Trump stokes trade war as world reels from tariff shock – CNA

What's your view?

About the Author

Jatin is an equity research professional with over 9 years of industry experience. Over the years, he has led various client engagements with different buy-side and sell-side firms globally. He has expertise in conducting fundamental research, writing reports, and building financial models. Currently, he is working with a US based hedge fund and assisting them in Equity Capital markets (ECM). Jatin has cleared all three levels of CFA (USA) and done MBA in Financial Analysis. He has also earned the Financial Modelling & Valuation Analyst (FMVA®) certification provided by CFI institute of Canada.

Like the way we think?

Next time we post something new, we'll send it to your inbox