Published on June 4, 2019 by Avinash Kumar and Jeetendra Prakash, CFA

The US has seen one of its longest expansionary cycles, with the current expansion touching close to 120 months, similar to the expansion witnessed during 1991-2001. The question all investors are now asking is – how long will the expansion continue?

During the last quarter of 2018, capital markets in the US showed increasing signs of stress as the US Federal Reserve continued with its dual monetary tightening policy by (i) increasing Fed fund target rates and (ii) reducing the size of its balance sheet. Consequently, many leading indicators hinted at an increasing probability of recession. For instance, the unemployment rate (hovering at around 3.8%) has fallen below full employment levels (4.5%) and, the NY Fed said 2020 recession probability had increased to 30% (higher than the estimate as of May 2007, before the housing bubble burst) in April 2019. This has prompted the Federal Reserve to continue with monetary tightening and shift to a broadly neutral stance. Furthermore, weak economic indicators, low growth, and inflation led the European Central Bank to postpone its monetary tightening to 2H20 (vs. the earlier target of 2H19).

The more accommodative stance by central banks has perhaps alleviated concerns of a possible recession in the near term. Nonetheless, significantly high debt (nonfinancial debt to GDP at 248% as on 3Q18 vs. 229% as on 2007) leaves the economy more vulnerable to a downturn. Further, after hitting historical lows of less than 2% (and well below the historical average of over 4%) in early 2019, default rates would trend upward in 2019, more specifically during 2H, due to slowing growth, as per Acuity’s. Although this does not set alarm bells ringing, it does call for a more cautious approach from investors.

Recessions in the past have been triggered by different factors such as the dot-com bubble in 2001 and the housing bubble in 2008. We believe leveraged loans could be at the heart of the next recession. Institutional US leveraged loan balance outstanding has swelled to USD1.2 trillion (c. 2.5x in the last decade), driven by high demand from yield-hungry investors, given the sustained low-yield environment until 2016-17. A noteworthy point is that tightening regulations emanating from the Dodd-Frank Act on regulated financial institutions and banks have made space for asset managers, private equity funds, and other intermediaries, which are key participants in this leveraged loan buildup. Leveraged loan issuances in the last 3-4 years have seen weakening credit protection (about 85% of outstanding loans are covenant-lite vs. 23% in 2007) – a trend particularly worrisome in the current slowing-growth environment.

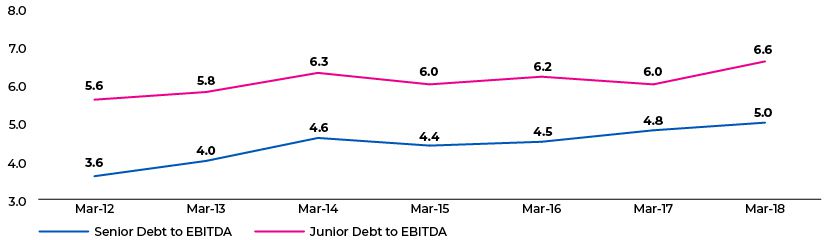

Additionally, debt-funded shareholder returns (dividend payouts and share buybacks) and levered buyouts (LBOs) have been deteriorating the credit quality of issuers. This is evident in the rating of new LBOs – 44% of first-time issuers were assigned a B3 rating in 2018 against 39% in 2017, with total debt to EBITDA at 6.4x as of end-2018 compared with 5.3x in 2011. The majority of outstanding US leveraged loans are rated in the single B category.

US LBO debt multiples continue to rise

Source: Moody’s

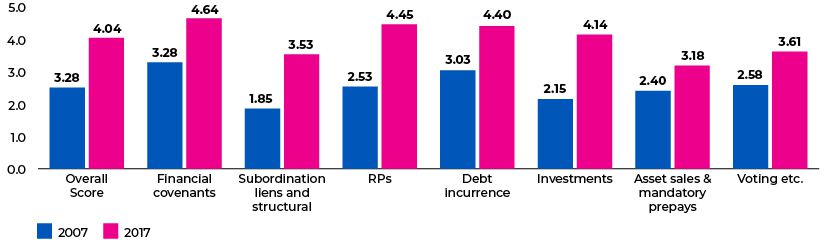

Further, strong demand from yield-hungry and more passive investors intending to remain fully invested allowed borrowers to be more flexible in structuring credit agreements and bond indentures in the last few years. Borrowers structured credit agreements in a way that allowed them to make collateral stripping asset transfer, retain an increased portion of asset-sale proceeds, and issue dilutive incremental first-lien loans, which effectively reduced collateral support. About 85% of outstanding leveraged loans are covenant-lite against 23% in 2007.

Covenants are weaker than 2007 across risk categories

Source: Moody’s; covenant quality score on a scale to 1 (strongest) to 5 (weakest)

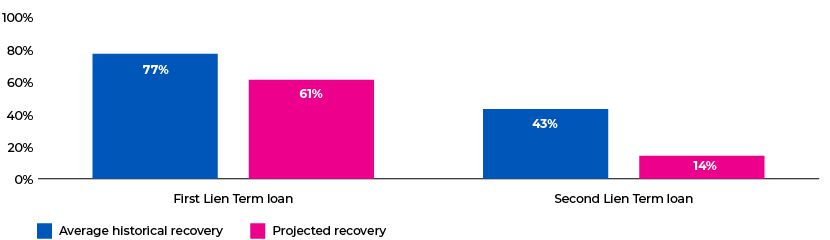

In a nutshell, we foresee lower recoveries for lenders in the next downturn on the back of aggressive financial policies (particularly relating to PE-owned firms that have taken advantage of accommodative credit markets since the start of the quantitative easing), deteriorating debt cushions (emanating from a higher proportion of first-lien debt in the capital structure), fewer lender protection, and deterioration in overall credit quality.

Lower recoveries expected in the coming downturn

Source: Moody’s

In its April outlook, the IMF revised downward its GDP growth outlook for the US by 20bps to 2.1% in 2019 vs. over 4% achieved in 2Q18, clearly indicating that the best of the economic cycle is behind us. The fact that the past upcycle saw an increase in leverage instead of deleveraging makes investors more vulnerable to downturn. We need to be cautious and adjust our portfolio to be better prepared for a volatile environment and the expected downturn. Rather than looking back and extrapolating, we should look forward and factor expected volatility in our investment decisions. Patience and good credit selection are very important to generate returns as volatility rises. Diversification of risk is one of the key strategies to derisk; investments in gold and some of the higher-growing emerging market debt are viewed as alternative strategies by asset managers.

With recession clouds around the corner and a weaker lending standard in leveraged credit markets, we foresee an increased volume of defaults across credit markets compared with previous credit cycles. Macro conditions seem ripe for distressed debt investors to enter and identify opportunities at an early stage. We have learnt from the 2008-09 experience that identifying investable distressed debt opportunities is a long, drawn-out process.

We have an upcoming webinar where we will discuss how one can build a proprietary and scalable distressed debt investing process ahead of a cycle.

Sources:

1. Moody’s

What's your view?

About the Authors

Avinash Kumar has over 11 years of work experience in investment research. He currently leads multiple client engagements and is actively involved in training, quality control of deliverables, and client discussions. He is also a part of Projects and Transitions team and is responsible for handling various fixed income pilots and projects. He holds an MBA (Finance) and a bachelor’s degree in Business Administration.

Jeetendra Prakash has close to 15 years of work experience in investment research, with a focus on oil and gas and real estate. He currently supports a large US-based hedge fund. The process involves credit research of high-yield and investment grade credits for different strategies. In addition, he is also actively involved in training and quality control of deliverables. He holds an MBA and is also a CFA charter holder.

Like the way we think?

Next time we post something new, we'll send it to your inbox