Published on February 24, 2025 by Vyas Pandey

US Mortgage Market Overview 2025

The US housing market, believed to be bigger than the US stock market, is showing signs of recovery, with home sales increasing 4.9% m/m in November 2024, shaping broader mortgage industry trends 2025. Existing-home sales grew at the fastest since June 2021 in November 2024.

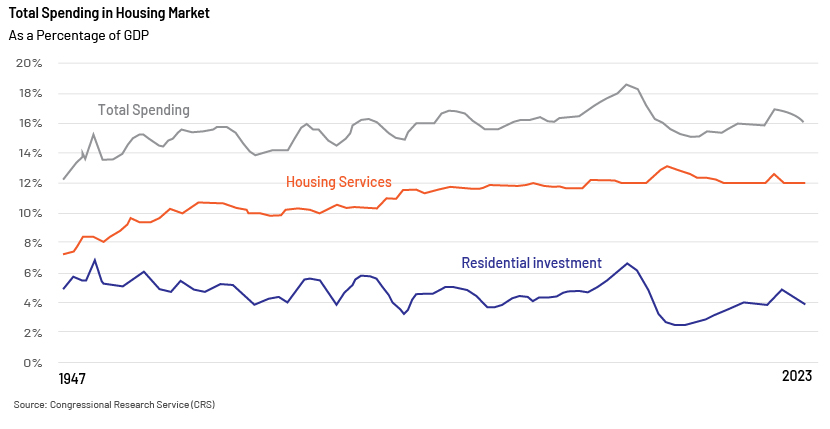

The housing market is a leading measure of economic growth, accounting for 16.1% of GDP in 2023, and remains central to the mortgage industry outlook 2025 Of this, spending on residential fixed investment was about USD1.1tn, accounting for about 4.0% of GDP, while spending on housing services was about USD3.3tn, accounting for 12.1% of GDP. Residential investment as a percentage of GDP moved up but remained well below its high before the 2007 market crash. After the pandemic, it started declining again but is still above levels seen during the 2007 market crash.

Key US Mortgage Industry Statistics 2025 (LendingTree Data)

The housing construction sector employed about 1m before the 2007 housing-market crash. Employment numbers decreased before picking up from 2011; they reached 958,000 by November 2024, according to the Bureau of Labor Statistics. Housing construction activity has declined due to a slowdown in multifamily construction, which decreased 28.8% from November 2023. The Housing Market Index stood at 46 in December 2024, according to the National Association of Home Builders, indicating weak building conditions in the near term.

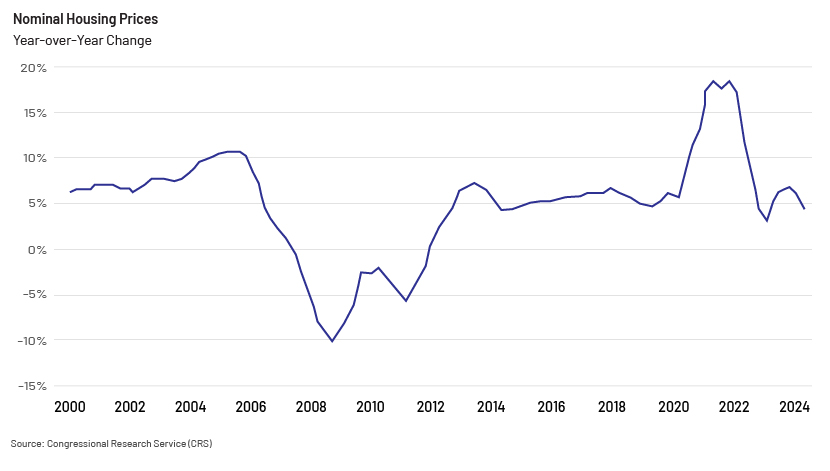

The housing market witnessed rapid price growth in 2020, but this has since slowed to rates comparable to those in 2012-19. The average housing price has been increasing since 2012, after falling amid the 2007-09 recession. Housing prices saw exponential growth in 2020, but growth slowed again to the average growth rate over 2012-19. US housing prices rose 4.5% y/y in October 2024, but subsequently continued to slow from the highs the market witnessed in 2022. The price increase was due to limited housing inventory and weak demand, driven by higher mortgage rates affecting affordability.

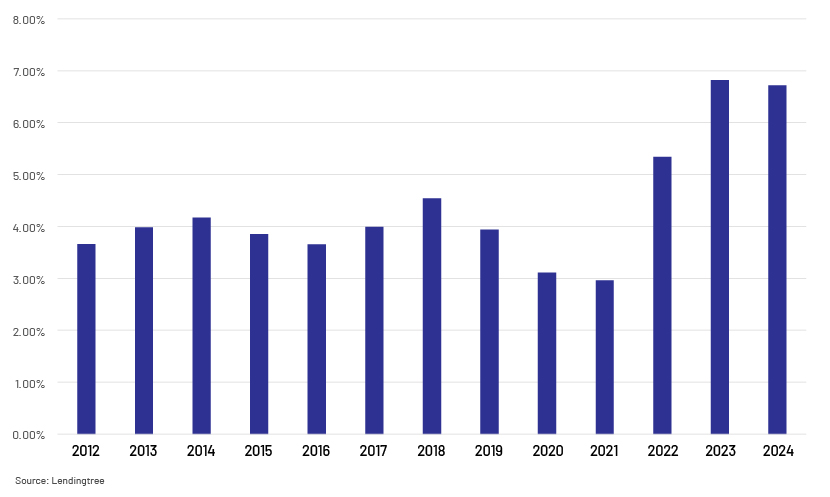

The following chart explains the y/y changes in nominal housing prices:

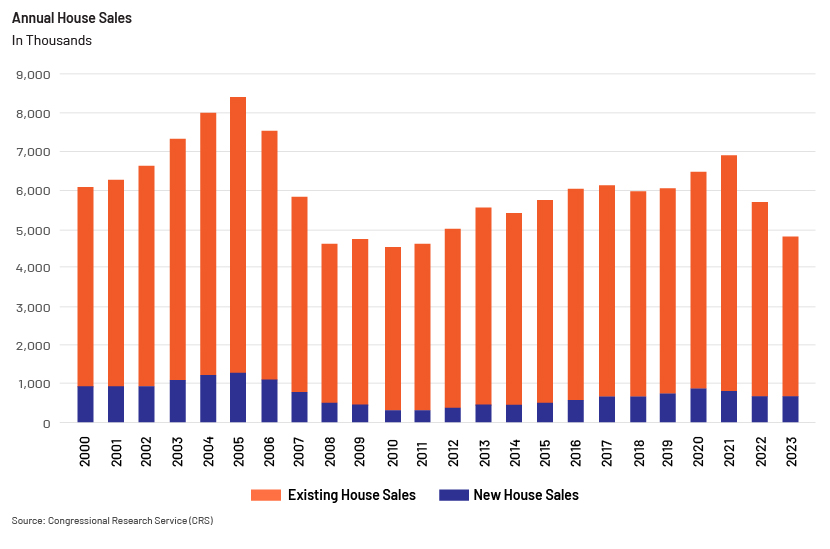

Home sales began to recover from the recession of 2007-09 but have yet to reach pre-recession levels, a key highlight in current mortgage trends 2025. Existing-home sales increased 4.2% compared to the 18.7% decrease in new-home sales in 2023.

The following are details of annual house sales:

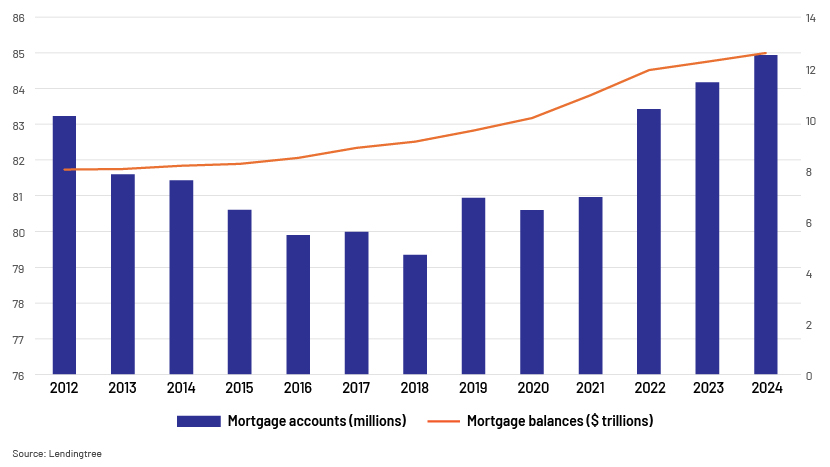

Due to the low mortgage rates amid the pandemic, there was real estate buying, leading to growth in the housing market. This led to an increase in outstanding mortgage debt, which has grown by over USD3tn since end-2019, largely due to additional mortgage accounts and mortgages with high value.

The following are details of outstanding mortgages:

Average mortgage rates reached their lowest in history (2.65%) during the first week of 2021, before climbing sharply, influencing the mortgage industry outlook 2025. They then rebounded quickly, climbing to their highest since 2002 (7.08%) by October 2022. While rates have fluctuated, climbing to as high as 7.79% in 2023, they have yet to fall back below 6.00%. Mortgage rates were at 6.85% in December 2024, with the 30-year fixed-rate mortgage at 6.72%. Higher mortgage rates have reduced purchasing and refinancing activity.

The following are details of historical mortgage rates for 30-year conventional mortgages:

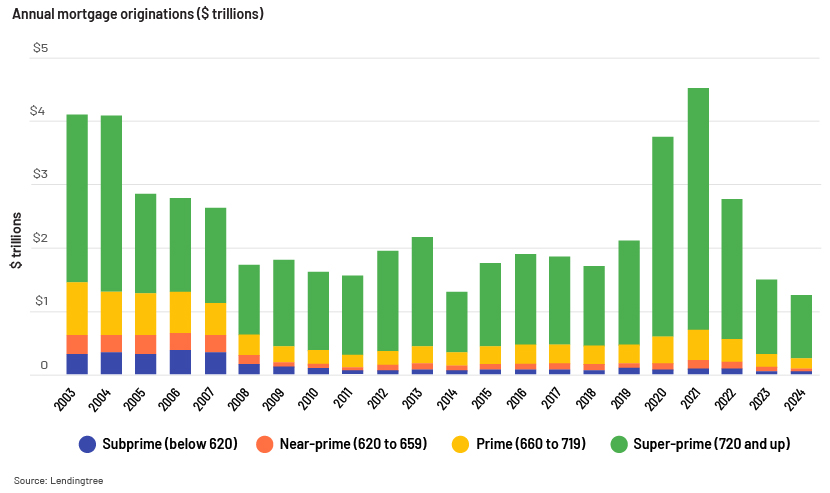

Mortgage originations reduced sharply as rates rose from their 2021 lows to their highest in nearly 20 years. Mortgage originations totalled USD2.75tn in 2022 versus USD4.51tn in 2021. Originations continued to drop, to USD1.50tn in 2023. The pace rebounded slightly over the first three quarters of 2024, with USD1.23tn worth of originations, compared with USD1.10tn in the first three quarters of 2023.

The following are details of annual mortgage originations:

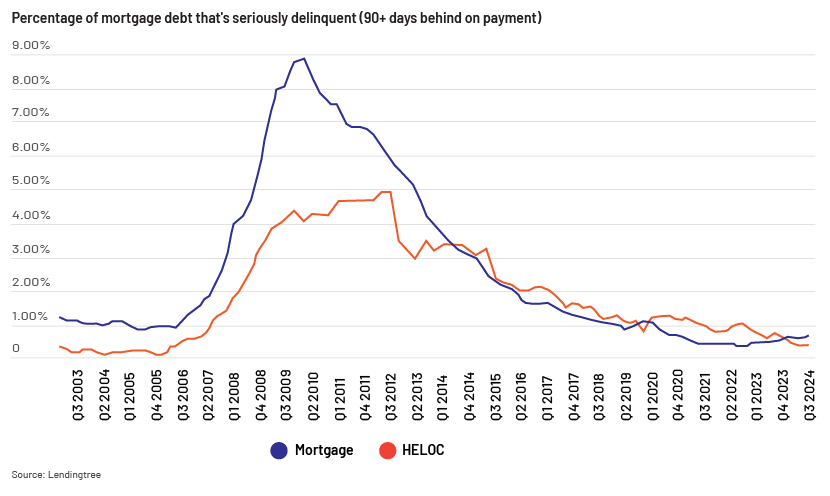

As of 3Q 2024, 0.71% of all mortgage debt was seriously delinquent, by 90 days or more, according to the Federal Reserve Bank of New York – an important factor shaping lender housing outlook in 2025. However, the percentage of mortgage debt seriously delinquent remains below levels amid the pandemic. According to the Mortgage Bankers Association’s mortgage delinquency survey, 3.92% of outstanding mortgage debt was in some stage of delinquency as of 3Q 2024, 30bps higher y/y. 30 days+ delinquent loans rose 9bps compared to 3Q 2023. Seriously delinquent loans (90 days+ or in foreclosure) increased 3bps y/y from 3Q 2023.

The following shows the percentage of seriously delinquent mortgage debt:

The following are key statistics on the US mortgage sector, according to LendingTree:

-

Americans owe USD12.6tn on 84.9m mortgages, representing 70.2% of US consumer debt

-

Additionally, Americans owe USD387bn on 13.2m home equity lines of credit (HELOCs), which translates into 2.2% of US consumer debt

-

The average interest rate for a 30-year mortgage was 6.72% in 2024

-

Until 3Q 2024, Americans originated USD1.23tn in new mortgage debt; 80.6% of this was issued to super-prime borrowers with credit scores of at least 720

-

In 3Q 2024, American households held nearly USD34.9tn, or 72.4% of the total value of residential real estate assets in the US, in real estate equity, up by USD2.5tn from 3Q 2023

The housing market has been slow in recent years, hampered by high mortgage rates and high housing prices. However, the overall environment looks positive for mortgage sector growth in 2025.

What Are the Mortgage Industry Trends for 2025?

The US labour market started showing signs of cooling in late 2024, and we expect this to persist in 2025. Modestly higher unemployment and slower job gains will likely reduce some of the pressure on inflation. Based on this, we expect the US economy to grow in 2025, although the pace of growth will likely be moderate.

Federal Reserve (Fed) rates: With the labour market showing a positive trend, there is a remote possibility of a Fed rate cut in 2025. We expect two 25bps rate cuts, bringing the rate to 3.75-4.0% by end-2025.

Inflation: Although inflation is slightly higher than the Fed’s target of 2% annual growth, the latest personal consumption expenditure (PCE) price index shows inflation grew by 2.4% from November 2023 to November 2024. This means that inflation growth has largely been tamed compared to where it was in 2022 and 2023. We expect inflation to be stable in 2025.

Mortgage rates: The 30-year mortgage rate dropped below 3% amid the pandemic in 2020 but increased to more than 6% by December 2024 due to the increasing Fed rate. We expect the mortgage rate to be above the 6% mark but expect some relief by end-2025.

Housing supply: The housing shortage persists, mainly due to under-building of properties during the past 10 years. This has started to recover, but the rate lock-in factor has inversely affected growth. High financing costs are impacting new-home construction, although it would still exceed the existing-home market, mainly due to builders’ ability to offer incentives such as mortgage rate buydowns and the shortage of existing-home inventory. Prospective buyers and sellers who did not initiate transactions in 2024, hoping for lower rates in 2025, would be planning to transact in 2025. This would increase housing sales in 2025 compared to 2024 but would still be below historical averages.

Home ownership: We expect the next few years to be favourable for the housing market, as we believe the housing shortage will reduce as baby boomers move out of home ownership and these homes require updating/remodelling. We also expect home affordability to improve in 2025, depending on the decline in rates, positive income growth and stable housing prices.

Housing prices: We expect housing prices to grow 3-5% in 2025. Beyond 2025, an overall weakening of the economy due to tariffs and mass deportation may push housing prices lower as a struggling economy leads to higher unemployment, lower wages and decreased homebuyer demand.

The US’s post-pandemic economic recovery has been smoother than expected. However, pain points remain – from high interest rates to steep housing prices. We expect the proposed economic policies, such as tariffs and mass deportations, to weaken the broader economy while pushing inflation and interest rates higher in 2025. However, we expect the housing market to grow, as certain indicators show steady growth.

We expect the pace of housing price appreciation to moderate from 2024 levels in 2025, while still on a positive trajectory. Housing price growth, together with increased home sales, is likely to drive purchase volumes higher than in 2024. The slightly lower rates in 2025 should also drive higher refinance volumes. This increase in both purchase and refinance volumes is likely to boost total origination volumes in 2025, offering a promising outlook for 2025.

The following are key housing indicators forecast for 2025:

| 2025 forecast | 2024 estimate | 2023 | 2013-19 average | |

| Mortgage rates | 6.3% (avg.); 6.2% (year-end) | 6.7% (avg.); 6.7% (year-end) | 6.8% (avg.); 6.6% (year-end) | 4.0% (avg.) |

| Existing-home median price appr. (y/y) | 3.70% | 4.00% | 1.10% | 6.50% |

| Existing-home sales (y/y | annual total) | 1.5%; 4.07m | 1.8%; 4.02m | 18.7%; 4.09m | 2.1%; 5.28m |

| Existing-home for-sale inventory (y/y) | 11.70% | 15.20% | 4.40% | 3.60% |

| Single-family-home housing starts (y/y | annual) | 13.8%; 1.1m | 4.4%; 1.0m | 5.7%; 0.9m | 0.8m |

| Homeownership rate | 65.30% | 65.60% | 65.90% | 64.20% |

| Rent growth | 0.10% | 0.20% | 1.20% | 5.20% |

Source: Realtor.com

What Factors Will Affect Mortgage Lenders in 2025?

Competitive loan market: With the availability of government funds and low interest rates amid the pandemic, the market saw increased home purchase and mortgage refinancing demand. This reduced housing supply and activity in the refinancing market, which means lenders now have to compete for fewer loans. They also face competition from non-traditional lenders.

Policy changes: Certain policy changes were implemented in August 2024, and these may impact the housing sector and mortgage lenders. Lenders also have to ensure they adhere to regulatory guidelines. US financial institutions pay billions in penalties every year for regulatory non-compliance, a significant portion of which is attributed to the mortgage sector.

Workforce requirements: The loan officer population has dropped 43% from its 2021 peak, making recruiting a top priority for mortgage lenders. The mortgage sector also experiences cyclical workloads and would require trained staff for additional workloads. Maintaining a large pool of resources is not cost-effective, and lenders would need to devise cost-effective measures to meet the market's changing demands.

Time to market: With increasing competition in market, consumers are looking for quick loan approval. Loan applications are complex and time-consuming, so lenders are devising solutions to reduce time to market while focusing on accuracy and speed.

Lending transformation: Technology is playing a key role in mortgage lending, and many lenders are now exploring digital strategies to enhance rather than replace the human element. They are looking to automate repetitive tasks so as to channel human capital to high-value tasks.

Tech-driven homebuyers: Traditional mortgage lenders are trying to come up with streamlined, automated and personalised services to attract the new generation of customers, as these tech-savvy borrowers are moving to non-traditional lenders they see as more tech-forward, customer-friendly and transparent.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners have nearly 20 years of experience in supporting global banks across the loan lifecycle. Our retail lending services offer origination, processing, underwriting, closing and post-closing support across consumer mortgage and other retail products, covering the range of basic to complex tasks. Leveraging a mix of people, process and technology, we provide tailormade solutions to our 90+ banking clients in the retail, business, middle-market, real estate and leveraged finance segments.

Sources

-

https://www.lendingtree.com/home/mortgage/u-s-mortgage-market-statistics/

-

https://www.realtor.com/research/2025-national-housing-forecast/

Tags:

What's your view?

About the Author

Vyas Pandey has over 18 years of experience in working with leading global banks & financial institutions and PE firms. He has led various client engagements focusing on investment banking and commercial lending domain. He has managed teams supporting global banks across first line of defense and second line of defense. He has expertise in a broad range of banking work products covering valuations, business research, investment research, credit analysis, portfolio monitoring, and underwriting. Vyas holds an MBA with majors in Finance and a B Sc. in Math.

Like the way we think?

Next time we post something new, we'll send it to your inbox