Published on July 9, 2024 by Sanyam Jain

Bankruptcy and several other forms of restructuring are affected by macroeconomic factors such as interest rates and inflation that influence the performance and management of a company’s operations.

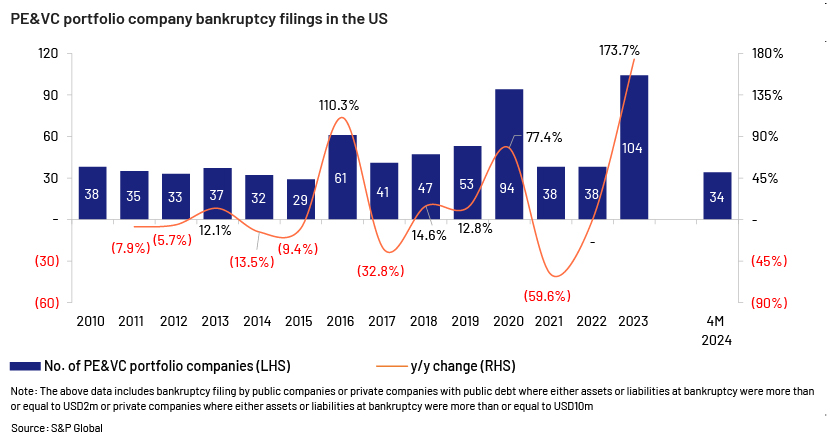

Private equity (PE)- and venture capital (VC)-funded firms in the US filed 104 bankruptcies in 2023, growing at 173.7% y/y, driven by tightening credit and rising interest rates that resulted in highly leveraged companies failing to perform. Bankruptcies in 2023 surpassed the 94 recorded in 2020 due to the pandemic and were the highest since 2010. In the first four months of 2024, 34 portfolio companies in the US PE&VC space filed for bankruptcy.

These statistics indicate the distress these companies were in. When faced with pressure, companies try to delay restructuring as far as possible, considering it as a last resort. Hence, even before a company declares bankruptcy or acknowledges signs of distress, it could face challenges. As a result, the number of companies in distress could be higher than the statistics reveal.

Furthermore, it usually takes 12-18 months to feel the impact of the macro environment on restructuring trends, according to PwC. 2023 saw a large number of bankruptcies; this trend has continued in 2024, and many struggling companies are closely monitoring interest rates, watching for rate cuts, an optimistic economic outlook and a positive geopolitical environment so their squeezed profit margins could recover. Hence, even if economic conditions begin to improve, a large number of distressed companies may still require support in the short to medium term.

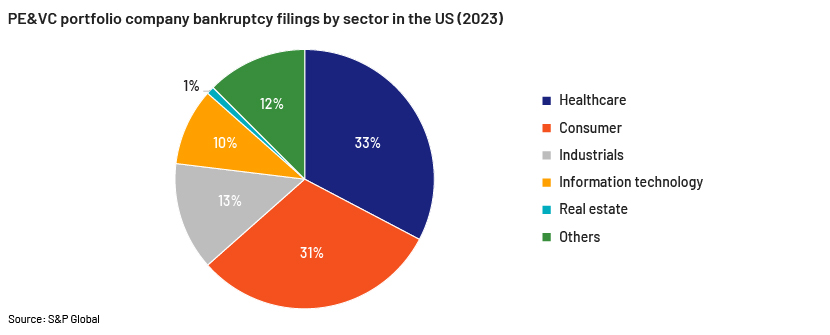

A number of US sectors faced insolvency in 2023

A number of PE-owned companies filed bankruptcy in 2023 due to factors such as rising interest rates, high labour costs, difficulties in paying down debt and facing a funding crunch.

Some sectors witnessed more bankruptcy than others: the healthcare and consumer sectors accounted for close to two-thirds of the bankruptcies in the US in 2023.

Dry-powder inventory has increased again

Private-market assets under management reached USD13.1tn as of 30 June 2023, growing at an impressive annual growth rate of nearly 20% since 2018. Dry powder – the amount of capital committed but not yet deployed – also increased significantly, to USD3.7tn, marking the ninth consecutive year of growth in dry-powder reserves. Additionally, PE-sector dry-powder inventory – the amount of capital available to general partners expressed as a multiple of annual deployment –increased for the second consecutive year.

Sectors with a large number of distressed companies

-

Health services: The PE sector’s heavy reliance on debt to finance healthcare investments is a major drawback for portfolio companies, especially amid increasing interest rates and rising labour costs for healthcare firms. Healthcare companies owned by PE firms have recently executed distressed exchanges to avoid bankruptcy. US Renal Care, the third-largest dialysis provider in the US, owned by PE investors including Bain Capital and Summit Partners, is an example.

-

Consumer: This sector faced insolvency for reasons such as labour-market issues, shifting consumer spending habits and higher costs of operations. During economic downturns, companies that reinvested more in this sector experienced faster growth than those that reinvested less. Consumer companies that start building reserves now may be able to invest during the next downturn. This requires tough decisions such as disposing of underperforming assets; reviewing debt levels, cash utilisation, dividend policies and share-buyback programmes; and focusing on strategic capital investments.

Drivers of the surge in bankruptcies

PE firms generally use far more debt than do other businesses. Leveraged buyouts saw debt levels peak at 7.1x earnings (EBITDA) in 2022, according to Bain & Company, the highest in 15 years. In contrast, publicly traded healthcare companies typically maintain average debt-to-EBITDA ratios of 3x. Moody's categorises debt/EBITDA ratios exceeding 7x as very high and ratios of 8x or 9x as excessive. Excessive leverage often arises from leveraged buyouts and ambitious expansion strategies funded by debt.

Trends shaping the future of the US economy and restructuring

The upcoming US presidential election is expected to impact global geopolitics more than previous elections. Companies may face increased difficulty in terms of capex amid rising interest expenses and decelerating revenue growth. Additionally, the longer elevated interest rates last, the higher the likelihood of small companies filing for bankruptcy. Consumer spending is expected to rise more slowly due to the slowdown in job creation and the gradual tightening of lending criteria by financial institutions. Inflation trends are stabilising but are forecast to remain higher than the Federal Reserve's 2% benchmark in the short term. The market is monitoring the USD6tn in cash in money-market and treasury funds that could be invested in other asset classes to boost restructuring deals.

How Acuity Knowledge Partners can help

We have over 14 years of experience in assisting with distressed investing strategies and providing analytics and business intelligence to the private-markets sector. We help clients analyse distressed opportunities in sectors such as buyout, credit and real estate. Our support areas include target screening, industry studies, company valuation, investment memos and due diligence.

Sources:

-

US private equity portfolio company bankruptcies spiked to record high in 2023 (spglobal.com)

-

Leading companies filing for bankruptcy – 2024 | Intellizence

-

Bankruptcies among private equity portfolio companies on track for 13-year high (spglobal.com)

-

Private equity healthcare bankruptcies are on the rise (pestakeholder.org)

-

Watch why so many US companies are going bankrupt – Bloomberg

-

Investing in the consumer (edwardjones.com) Bankruptcy rate for PE VC backed companies relatively high | Pensions & Investments

-

2024 Economic Outlook: Insights & Trends | J.P. Morgan (jpmorgan.com)

What's your view?

About the Author

Sanyam Jain is part of the Private Market team at Acuity Knowledge Partners. He has 2 years of experience in Research and currently supports private equity clients with research assignments including industry research, company analysis, data research and Company presentation. He holds a Master’s degree in Business Administration with specializing in Finance and Business Analytics.

Like the way we think?

Next time we post something new, we'll send it to your inbox