Published on December 16, 2020 by Rajkumar Bodduna

The dramatic market crash of 2020 is still fresh in our minds.

The stock-market started to crash on 9 March 2020 with a large 2,014-point drop in the Dow Jones Index in a single day, followed by two more drops of 2,353 points on 12 March and 2,997 points on 16 March. This signalled the start of a bear market and ended the bull market. The Dow’s drop was the worst single-day drop in US history.

Traders forecast a global economic recession and reacted to the market crash amid global fears about the spread of the coronavirus and the drop in oil prices by selling stocks, resulting in stock markets reaching their lowest price levels and increasing market volatility.

The major reasons for the rally in the bear market:

-

Oil prices reaching their lowest of all time

-

Increase in the number of infections globally

-

Liquidity crunch in the market

Unlike during previous crashes, asset management companies (AMCs) and portfolio managers had time to strategise their portfolios this time around. The stock markets did not shut to control the emotional selling in the markets, and AMCs continued trading with their work-from-home setups.

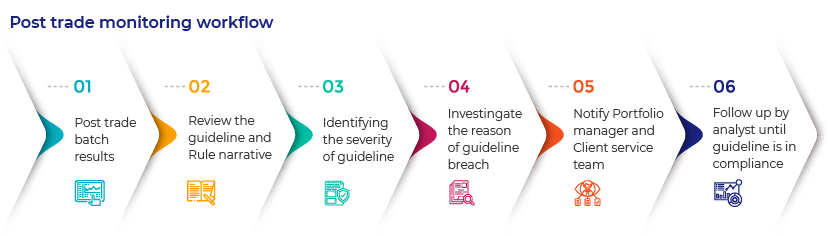

The market crash led to more volatile share prices that resulted in fluctuations in portfolio concentration limits and market capitalisation rules. When guidelines are beached, analysts investigate the cause of the failure and notify the respective teams. Post-trade workflow is outlined below.

One of the challenges analysts face is in handling the spike in guideline violations and ascertaining the reason for failure such as market movement, trading or other factors.

There was a spike in email communications as well; however, post-trade teams ensured they notified the trading desk in a timely manner, to remain compliant, and helped initiate communication between the investor and the end client.

AMCs use multiple levels of alert systems to reduce the number of breaches in the following day’s post-trade batch; these include open orders, pre-trade fails and close-of-the-day alerts. Even a pre-trade system may sometimes fail to capture guideline breaches because of the timing of trades. When a trade is submitted, it may pass through a pre-trade system but eventually fail in the post-trade system due to market volatility, rating changes or corporate actions.

The following are the most frequent breaches we as investment compliance support professionals face when handling large numbers of breaches.

-

Market-cap limits: For equity investments, it is advised that portfolios be invested in within market-cap limits. The market cap of most securities have dropped sharply, breaching client guidelines.

-

Exposure rules: It is important to comply with exposure limits that curtail a portfolio manager’s ability to invest. Market volatility has increased the number of breaches of maximum and minimum limit guidelines. Concentration rules are difficult to manage in pre-/post-trade monitoring, while dealing with market volatility and ensuring AUM remains compliant with regulations.

-

Dividend-paying investments: Some companies have declared they will not to pay a dividend for the year and some have postponed dividend payments, breaching guidelines, as clients are interested in investing only if a company pays dividends.

-

Rating changes: Different clients have different investment restrictions and amid the pandemic, bond ratings have changed as credit quality has decreased. Portfolio managers have to comply with client guidelines when bond ratings drop. They have to sell or seek permission to hold. Bonds ratings may be downgraded for many reasons. A client who wants to invest money would look to invest in bonds whose credit quality is improving and sell bonds when credit quality is declining.

-

Currency hedging: It is difficult to maintain hedge ratios amid global currency fluctuations, when there is a difference between spot FX and the settlement amount.

-

Regulatory guidelines: It is the portfolio manager’s duty to comply with client guidelines; however, it is also important to meet regulatory requirements such as the US 1940 Act, Undertakings for the Collective Investment in Transferable Securities (UCITS), and Alternative Investment Fund Managers Directive (AIFMD). Regulatory breaches need to be corrected as soon as practicable; it is the analyst’s duty to see the portfolio manager ensures the guidelines are in compliance.

AMCs cannot avoid compliance, and they need to make sure they are not penalised by regulatory bodies and they do not breach client contracts. However, a few amendments to investment management agreements (IMAs) could help portfolio managers handle market volatility during a crisis. (An IMA is an agreement between the investor and the AMC that outlines the investment plan and return objectives.)

-

Portfolio managers can make suggestions to their clients or clients could provide the portfolio managers with flexibility and re-review the guidelines wherever possible

-

Instead of correcting passive breaches, clients can give provide the portfolio managers with some flexibility to hold securities or let breaches auto-correct by market movement. Otherwise, portfolio managers may have to sell the securities at a loss. This could help the portfolio managers to weather the liquidity crunch in the market.

How Acuity Knowledge Partners can help

We are experienced in the fields of pre- and post-trade monitoring, decoding IMAs and coding rules in applications.

To ensure business continuity in these challenging circumstances, we have adopted a work-from-home model to serve clients effectively.

Sources:

https://www.investopedia.com/terms/p/post-trade-processing.asp

Tags:

What's your view?

About the Author

Raj is an Investment Guidelines Professional with 2+ years of experience in Coding, Monitoring, Reporting, and Testing in Compliance Systems. He is adept at logical coding and monitoring of investment guidelines in Sentinel. He holds an MBA in Finance and Marketing.

Comments

17-Dec-2020 03:58:34 am

Interesting read.

Like the way we think?

Next time we post something new, we'll send it to your inbox