Published on September 30, 2021 by Shanteri K Rao

Understanding niche marketing

If you are a wealth manager, your clients tend to be your most important asset and a means to achieving greater success. In order to ensure that yours is a going concern, it is essential to develop and maintain lasting relationships with clients. Apart from retaining existing clients, you will also need to expand your client base. This can happen only when you are fully aware of their needs and goals in the same sense as they are.

Niche marketing is one of the ways through which you can attain a dedicated clientele and enhanced footfall. Using this strategy, you can target a specific group and grow a deeper cognisance of their needs, demands and preferences. It not only enables you to create stronger relationships but also lends greater efficiency to your advisory model. This, in turn, helps to generate frequent referrals, opening up opportunities to upsell and cross-sell the offerings in your wealth management basket.

Niches are subsets within a larger group that have distinct requirements. Once you understand these specifications, you can alter your marketing strategies to attract clients in a particular niche. As a wealth manager, when you follow niche marketing, you aim to serve the client in a better manner than peers who focus on a broader set of audiences.

For instance, in the retirement planning domain, you may choose to offer services only to niche client segments such as working women and doctors. Likewise, as a financial planner, instead of attending to clients across age groups, you can build greater loyalty by serving only a specific group, such as millennials. A 2021 Northwestern Mutual survey found that 23% of millennials were looking to hire financial advisors owing to the financially debilitating impact of the 1pandemic.

Why embracing a niche is necessary for wealth managers

Whether you are a budding entrepreneur or an experienced wealth advisor, the sooner you discover your niche and establish yourself in it, the easier it will be for you to succeed.

Larger players generally have the ability to provide integrated offerings by leveraging their scale. However, small and midsized players might be at high risk of failing or getting absorbed by large players unless they are able to stand out and demonstrate their unique features.

A senior wealth management expert at Acuity Knowledge Partners says, “Niche marketing helps wealth advisors strengthen marketing efforts and client retention. In this digital era, this is necessary for advisors to prove their value proposition over competitors.” A Capgemini study conducted in 2021 labelled niche marketing as a high business impact activity that wealth managers need to place in top priority.2

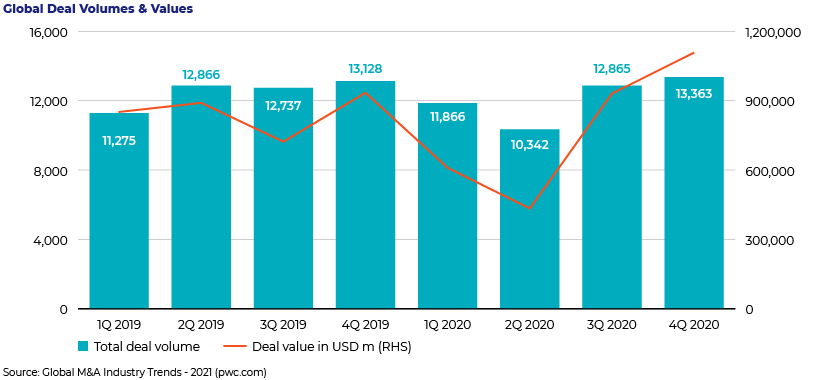

Keith Hale, Executive Chairman of TrustQuay, predicts that in the next five years, the wealth management industry would shrink from a thousand firms to a small group of global players operating alongside specialists who focus on specific niches.3 The graph below shows the industry recorded an 18% surge in M&A globally from 1Q19 to 4Q20.

|

Total deal volume |

Deal value (USDm) |

|

|---|---|---|

|

1Q19 |

11,275 |

851,156 |

|

2Q19 |

12,866 |

890,533 |

|

3Q19 |

12,737 |

722,646 |

|

4Q19 |

13,128 |

934,236 |

|

1Q20 |

11,866 |

609,418 |

|

2Q20 |

10,342 |

433,471 |

Therefore, implementing niche marketing makes sense to render longevity to your business. From a profitability standpoint as well, adopting this marketing strategy enables you to spot opportunities amid revenue and margin pressures. Over the past decade, the average expense ratio of mutual funds has reduced by as much as c.56%.4 Besides, the general preference for low-cost funds over expensive ones proves that price-conscious investors may pull down these ratios further, eroding the already slim operating margins of wealth managers. Hence, apart from bringing in cost transformations, adopting niche marketing can enable wealth managers to clearly differentiate their offerings.

Additionally, they can target customer segments, such as women and the mass-affluent market, that have remained overlooked for a considerable period of time. Wealthtech firms such as Ellevest and Portfolia, for instance, proactively offer customised digital investment platforms to female investors.

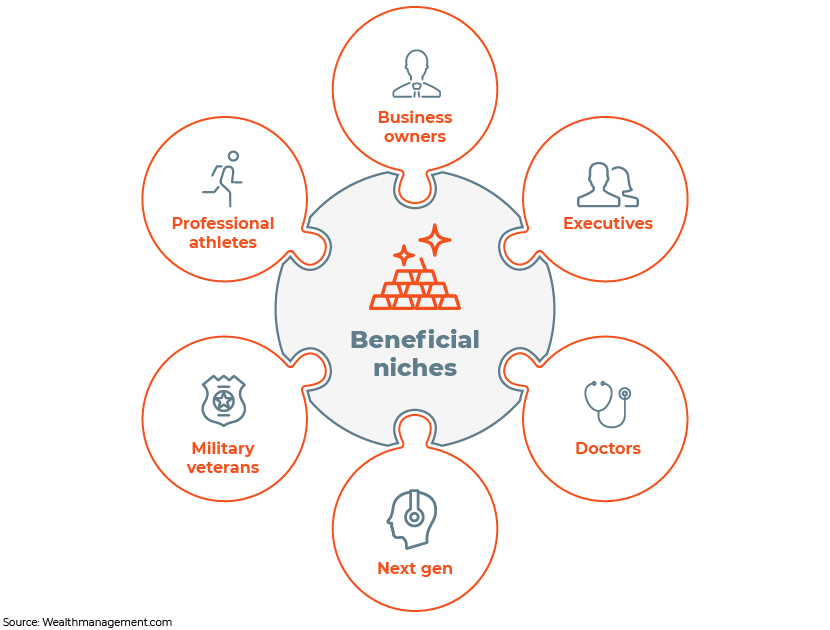

Some of the other most beneficial niches in the wealth management domain are given below.

Allworth Financial, an independent financial advisor specialising in retirement planning, with USD10bn in assets under management (AUM; as of December 2020), admits that even though generic clients comprised a significant portion of its total AUM, the firm would have never achieved its current status had it not spent the first decade focused on becoming the “go to” firm for its chosen niche.5 Likewise, RAA, a Dallas-based advisor, accumulated over USD2.8bn in AUM by focusing solely on serving airline pilots.

Having said that, niche marketing is not a conservative strategy and comes with its own share of risks. Given that it is a segment-focused practise, it may increase your vulnerability to sudden market changes. Hence, a more effective strategy would be to have at least two or three niches in your portfolio as a buffer against possible downturns. That way, if one tanks, you may continue business with the resilient ones.

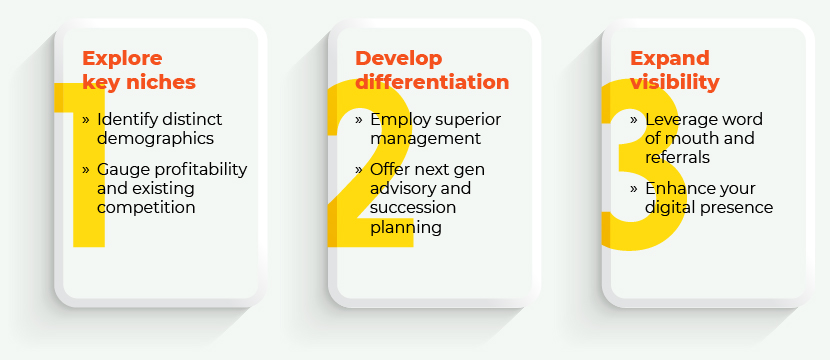

Factors to consider while developing niches

While focusing on a niche, your main objective should be to address the concerns of the specific subset more effectively than your competitors. In this pursuit, you may consider the following thumb rules:

How Acuity Knowledge Partners can help

Getting invaluable insights on niche segments is the foundation for all niche marketing efforts. Additionally, you need to ensure an omni-channel digital presence.

We at Acuity can efficiently support wealth managers evolve in this rapidly changing market. Our managed solutions are handled by skilled, financially adept personnel who deliver solutions across the presales, client services and digital marketing landscapes. Under our marketing and reporting solutions suite, we support and enhance bespoke collateral such as collectives/fund investment research reports, competitor analysis, fund factsheets and presentations, commentaries and talking points; we also provide support on design and slide library management solutions such as Seismic, UpSlide and Shufflrr.

Acuity uses the latest in automation tools to elevate your wealth management collateral in the most hassle-free manner, providing solutions that are pivotal to increasing output volumes and staving off competition. Additionally, our Digital Marketing arm covers web solutions across the digital marketing value chain, enabling advisors to maintain a unique digital footprint. By creating an offshore model that is similar to that of our clients, Acuity is able to deliver economies of both scale and scope and ensure that strategic goals are met.

Sources

1 Newsroom | Northwestern Mutual - Planning & Progress Study 2021

2 Brochure Portrait (capgemini.com)

3 Wealth industry consolidation to rise amid "unprecedented change" | Wealth Professional

Tags:

What's your view?

About the Author

Shanteri K Rao has over 7 years of experience in developing content for personal finance, wealth management and mutual funds. At Acuity, her responsibilities as a Delivery Lead include creating high-quality and insightful content via blogs, whitepapers, thought leadership pieces, investment commentaries and attribution reports. Additionally, she is actively involved in working with teams to identify efficiencies and improve work flow, training team members on trending concepts in asset management domain, and implementing industry best practices in the Acuity team for content development. Previously, she has worked with leading Indian fin-tech startups like Paytm Money and Cleartax where she assumed the role of lead content strategist..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox