Published on January 12, 2022 by Shanteri K Rao

The year 2021 was a mixed bag of opportunities and challenges. Despite the pandemic-induced disruptions, wealth managers were able to reach a wider spectrum of users and acquire clients through technology platforms in a cost-effective way. Millennials, women and Gen X investors entered mainstream investing amid the emphasis on DIY investing, alternative investments and a quest for value. Client reporting evolved as wealth managers switched from static, data-heavy reports to interactive presentations.

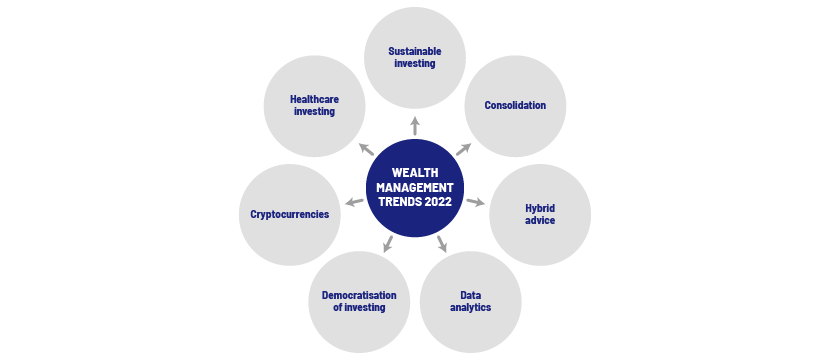

As wealth management firms’ battle to acquire unexplored segments intensifies, we take a look at trends likely to gain prominence in 2022.

-

Strong focus on sustainable investing

Amid climate change-related concerns, investors, particularly high-net-worth individuals (HNWIs), expect their wealth managers to integrate ESG strategies into their portfolios. This could be done by designing an investment strategy around ESG factors and incorporating ESG scores into portfolios. Bloomberg forecasts that ESG assets globally could surpass USD53tn by 2025, accounting for over one-third of the USD140.5tn in projected assets under management. After the US, Asia could experience the next wave of ESG growth . Some wealth management firms are currently proactively developing capabilities to merge conventional data points with ESG-related insights to assess investee companies’ ESG scores.

-

Consolidation in wealth management to drive efficiencies

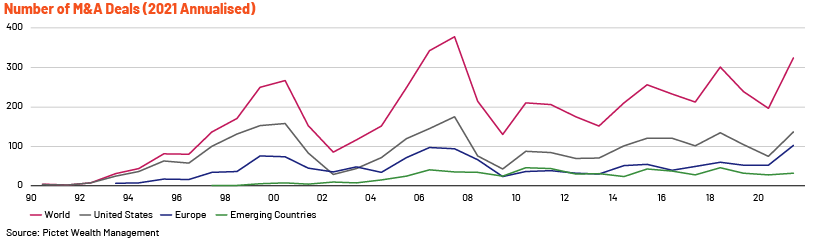

As traditional models become redundant due to changing client preferences, legal pressures, increasing technology costs and margin reduction, small/mid-size/large wealth managers expect consolidation in the near future. They may merge with futuristic wealthtech startups or even abandon their obsolete departments. For instance, Morgan Stanley acquired E*Trade along with its entire digital banking arm to grow its wealth management franchise . As a result, firms may benefit from economies of scale, remodelling, hyper-personalised offerings and competitive advantage. Pictet indicates that approximately 325 M&A deals were entered into globally as of 13 September 2021 compared to only about 250 in 2016. Most of the deals were in the technology sector, mainly in the US and Europe .

-

Embracing digital orientation and hybrid advice

In-person meetings may become thing of past as interaction over digital channels becomes the norm for wealth management firms. In addition to hybrid advice, firms may adopt digital onboarding, omni-channel and app-based interactions to facilitate vibrant conversations. For instance, BBVA Asset Management’s hybrid model employs “remote managers” who serve customers globally via mobile apps, online chats and video conferences. It combines automated portfolio management, advisory tools and human managers’ recommendations to offer the best advice.

Deloitte’s 2021 survey found European firms leading the digital transformation wave, followed by Asia Pacific and North America. Thirty-eight percent of the respondents from digitally advanced firms expected significantly better revenue prospects in 2022 compared to just 13% of the respondents from less digitally advanced firms .

-

Growing relevance of data analytics

Data-savvy investors have become adept at using multiple data formats to manage their portfolios. They expect wealth managers to offer richer reports, incorporating alternative data from non-traditional sources such as sentiment analysis. Refinitiv’s Investor Survey 2021 found that 54% of the investors view news analytics as a valuable information source . By manipulating everyday news stories mathematically, news analytics can provide insights that could help frame trading strategies. This calls for wealth management firms to strengthen their data analytical capabilities to make sense of data they gather and offer meaningful insights to the user.

-

Democratisation of investing

Access to digital tools has raised demand for wealth management among all age groups and income levels. Hence, wealth management firms need to adapt to the changing demographics. This could mean looking closely at how they could use digital tools to interact with clients. For instance, instead of spreadsheets, tools such as gamification could help investors test scenarios and allocate assets appropriately. Likewise, the optimum use of robo-advice could help firms reach affluent communities profitably while simultaneously revamping automation and data storage. For example, leading robo-advisory platform Vanguard Personal Advisor Services provides access to both automated portfolios and human advisors at the lowest minimum balance requirements.

-

Inclination towards cryptocurrencies

A University of Chicago 2021 survey found that 13% of the respondents in the US traded in cryptocurrencies over the previous 12 months compared to 24% of the respondents who engaged in stock trading. Additionally, over 41% of crypto traders were women, and more than half of the crypto traders did not hold college degrees . This indicates how rapidly cryptocurrencies are gaining in popularity and becoming one of the most sought-after investment options across investor groups. Some advisors have already began allocating as much as 1-2% of a client’s portfolios to cryptocurrencies, while others are building on their knowledge of digital assets to address growing client queries around crypto assets. Digital assets have entered mainstream investing, and it is time advisors frame their conventional wealth management discussions around cryptocurrencies.

-

Building wealth around health

Healthcare spending accounts for a large 18% of the US economy. It is also a fact that 62.1% of bankruptcies are due to high medical bills . Besides the pandemic-induced health risks, rapidly ageing populations in the West and the increasing number of Americans opting for private healthcare plans have sparked conversations in the healthcare domain. With the advent of telemedicine and AI-powered drug discovery potential, investors are increasingly interested in building their investment portfolios around healthcare sector stocks. Wealth managers could capitalise on this opportunity to multiply their client bases.

How Acuity Knowledge Partners can help

We support wealth managers to evolve in this rapidly changing market. Our managed solutions are handled by skilled, financially adept personnel who deliver solutions across the presales, client services and digital marketing landscapes. Our marketing and reporting solutions suite helps us support and enhance bespoke collateral such as collectives/fund investment research reports, competitor analysis, fund factsheets and presentations, commentaries and talking points; we also provide support on design and slide library management solutions such as Seismic, UpSlide and Shufflrr.

We use the latest in automation tools to elevate your wealth management collateral in the most hassle-free manner, providing solutions that are pivotal to increasing output volumes and staving off competition. Additionally, our Digital Marketing arm covers web solutions across the digital marketing value chain, enabling advisors to maintain a unique digital footprint. By creating an offshore model that is similar to that of our clients, we are able to deliver economies of both scale and scope and ensure strategic goals are met.

What's your view?

About the Author

Shanteri K Rao has over 7 years of experience in developing content for personal finance, wealth management and mutual funds. At Acuity, her responsibilities as a Delivery Lead include creating high-quality and insightful content via blogs, whitepapers, thought leadership pieces, investment commentaries and attribution reports. Additionally, she is actively involved in working with teams to identify efficiencies and improve work flow, training team members on trending concepts in asset management domain, and implementing industry best practices in the Acuity team for content development. Previously, she has worked with leading Indian fin-tech startups like Paytm Money and Cleartax where she assumed the role of lead content strategist..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox