Published on April 14, 2023 by Shreyash Wani

The financial advisory services market is expected to grow at a phenomenal 5.8% from 2021 to 2030, which translates into a USD136bn sector[1]. A wealth management advisor is indispensable in the wealth-creation journey, and to be at the top of the game, the advisor needs to stay constantly connected with the client. However, given the disruptions the wealth management sector is likely to face, the advisor-client relationship may not proceed as smoothly as envisaged, unless the challenges are addressed in a timely manner.

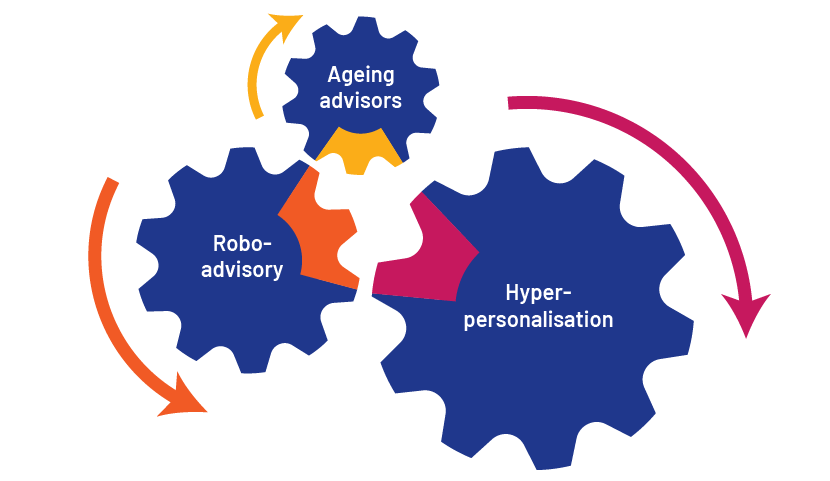

Major disruptions that make the wealth manager’s role demanding include the following:

Ageing advisors and the resulting shortage. Demand for financial advisory services is growing rapidly, particularly among high-net-worth individuals and small and medium-size enterprises. In the US, 64% of the Certified Financial Planner (CFPs) surveyed received higher client inquiries amid the pandemic, primarily relating to managing volatility and liquidity and protecting assets[2]. More than 47% of the wealth advisors are in the 50+ age group, according to the CFP ® Board on professional demographics. The number of professionals over 70 outnumber those under 309. These advisors would, therefore, be spending time planning their own retirement while planning their clients’ retirement10. This shows the sector would need more recruits to meet the shortage of advisors.

Robo-advisory. The advisory model needed to be scalable and efficient, giving rise to robo-advisors. These systems offer automated online portfolios where investment decisions are made based on the investor’s objective and risk appetite. Statista expects robo-advisors’ assets under management (AuM) to reach USD2,845,488m by 2025, with 478,886K users12. Although robo-advisors open new frontiers for wealth advisors in terms of customer satisfaction and data analytics, they also expose institutions to significant regulatory, business and operational risks. Thus, in addition to a winning investment strategy, they would have to establish a robust risk management framework to address the underlying risks[3].

Hyper-personalisation. The pandemic forced us to rethink financial planning, and many investors focused on situation-based planning. By leveraging resources such as behavioural sciences, advanced analytics, artificial intelligence and machine learning, wealth management firms can identify client patterns and gain insight on complex and distinct investor profiles, based on which they could set long- and short-term customer objectives to make client-advisor meetings more effective. However, they should also administer suitable data privacy protection and know your customer (KYC) mechanisms to avoid possible data leakage and data theft. While refraining from poor personalisation practices, they could ensure investment recommendations are relevant and timely.

Responding to disruptions

The pandemic-related disruptions presented a number of challenges to the wealth management sector and advisors. While the debate continues on whether these disruptions would be permanent, wealth managers should proactively do the following so they are not left behind:

Adopt digital channels and technology. Although the pandemic accelerated the adoption of digital technologies, the shift of business practices to a virtual framework and the need for customised, timely communications with increasingly impatient investors were longstanding requirements. Wealth managers should proactively use modern channels to communicate with clients and keep them engaged. This could include leveraging artificial intelligence to create customised emails, white-labelled applications and social media. On the back end, cloud migration has now become a non-negotiable feature for any ambitious wealth management organisation.

In light of these developments, many organisations are already moving or planning to move towards widespread technology adoption. More than half of the financial firms globally are planning to increase spending on next-generation technologies such as artificial intelligence, blockchain, cloud computing and digitalisation in the coming years17, 18 , according to a Broadridge survey of 1,000 C-suite executives globally.

Choose an identity. The sector’s traditionally strong revenue and profitability are under threat from growing competition, including established financial institutions and new entrants prepared to buy market share through M&A, as well as insurers and asset managers who are rapidly expanding their wealth offerings, according to KPMG’s Future of Wealth Management publication.

In such circumstances, those who choose to uphold their identity would always stand out. Rather than trying to appease demands of an increasing number of customers, a manager should adopt an identity that is true to their core values. The KPMG report identifies three models that wealth managers can adopt: the financial wellbeing provider, the domestic wealth manager and the global investment expert.[4] Managers would do well to choose an identity that best suits their modus operandi.

Capitalising on a niche audience. It is equally important that wealth managers identify a demographic that presents the most opportunity. With some of the largest wealth transfers in history soon to materialise, managers would do well to prepare to serve the beneficiaries of these transfers (largely millennials)[5]. Millennials do not look for compartmentalised financial and investment advice, i.e. in terms of retirement planning, inheritance wealth planning or tax planning. They seek comprehensive advice, focused on their financial goals. Choosing a niche audience, such as millennials, could provide a steady direction and game plan. That said, there are other ways in which advisors could group their existing and potential clients, based on needs and interests, to personalise their services and advice19, 20.

Investing in talent. After the Great Resignation of 2021, wealth and asset managers were faced with the prospect of a workforce (and a target market) that could change much faster than ever before. As employees seek more fulfilling opportunities, wealth managers would be wise to invest in top talent and retain those who show the necessary potential. Although the Great Resignation brought this issue to the fore, this, too, was a longstanding problem.

While retaining investible talent is one way of having a good workforce, recruiting talent straight out of campus could be a viable option as well. With universities providing graduates with programmes on financial planning, it could be a worthy avenue to explore, both in terms of talent and diversity. Nearly 23% of CFPs were female, but less than 4% were black or Latino as of 2020, according to the CFP Board. To have more diversity, Northwestern Mutual has developed a task force to encourage racial diversity across the firm and boosted efforts to attract more people of colour as financial advisors and leaders.

The financial advisory sector is shifting to gig workers to solve the talent crunch15, 16, 21, according to a hiring firm. This could help the wealth management space as well in the current circumstances. To find viable, long-term technological solutions, contractual gig workers who could set up the infrastructure for a digitalised future could be an added boon for a wealth manager, if it suits their agenda.

How Acuity Knowledge Partners can help

We support wealth managers to evolve in this rapidly changing market. Our managed solutions are handled by skilled, financially adept personnel who deliver solutions across pre-sales, client services and digital marketing. With our marketing and reporting solutions suite, we support and enhance bespoke collateral such as collectives/fund investment research reports, competitor analysis, fund factsheets and presentations, commentaries and talking points; we also provide support on design and slide library management solutions such as Seismic, UpSlide and Shufflrr.

We uses the latest in automation tools to elevate wealth management collateral in the most hassle-free manner, providing solutions that are pivotal to increasing output volumes and staving off competition. Our Digital Marketing arm covers web solutions across the digital marketing value chain, enabling advisors to maintain a unique digital footprint. By creating an offshore model that is similar to that of our clients, we deliver economies of both scale and scope, and ensure strategic goals are met.

Sources:

-

https://www.nerdwallet.com/article/investing/what-is-wealth-management

-

https://www.forbes.com/sites/forbesfinancecouncil/2019/08/13/a-wealth-management

-

https://web-assets.bcg.com/37/f8/5f033c4b451084efda22ee34998d/bcg-global-wealth-2020-jun-2020.pdf

-

https://silverlinecrm.com/blog/financial-services/3-wealth-management-trends-to-focus-on-in-2021/

-

https://www.cfp.net/knowledge/reports-and-statistics/professional-demographics

-

https://silverlinecrm.com/blog/financial-services/3-wealth-management-trends-to-focus-on-in-2021/

-

Disrupting Wealth Management – The Age of Hyper-Personalization | Deloitte Canada

-

Blockchain relevance wealth management | Deloitte Switzerland

-

https://www.cnbc.com/2019/10/17/financial-advisers-need-to-change-to-succeed-in-the-next-decade.html

-

https://www.fa-mag.com/news/gig-workers-meeting-adviser-shortage--hiring-firm-says-62656.html

-

[1] Financial Advisory Services Market Report 2022: Increase in Demand for Financial Advisory

-

[2] Survey CFP Professionals Primary Recommendation to Clients | CFP Board

-

[4] https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2022/03/future-of-wealth-management.pdf

-

[5] https://www.broadridge.com/_assets/pdf/broadridge-the-great-wealth-transfer-is-coming.pdf

Tags:

What's your view?

About the Author

Shreyash Wani has over 12 years of experience in investment research, content development, and market risk management. Working as a Delivery Manager with the Fund Marketing service team at Acuity, he is responsible for developing fund commentaries, formulating Institutional investment reports, framing public responses for the research analysts, diagnosing financial statements for funds’ holdings, authoring sales pitches for clients to attract additional AUM and monitoring multi-asset analytical reports. Previously, he was associated with an IT company working as a Business Analyst in enhancing the capabilities of the Market Risk management tool used by large commercial banks. Shreyash holds a CFA charter and FRM charter and has completed B.Com..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox