Published on August 24, 2022 by Himashi Wickramasinghe

The global economy has faced severe supply chain disruptions since the start of the COVID-19 pandemic. Factories were shut down, particularly hitting countries in Asia, and regional and countrywide lockdowns were imposed to mitigate the impact of the pandemic. Shipping costs increased, exacerbated by labour and container shortages, which also led to delays in deliveries. 2021 brought on a whole new gamut of supply chain issues, from the Suez Canal blockage to natural disasters such as Hurricane Ida and winter storms in Texas, resulting in empty shelves in stores around Christmas. The worsening of the global chip shortage was another fallout of the supply chain disruption, resulting from increased demand for laptops and mobile phones to facilitate working from home; these shortages are yet to come back to normal.

In August 2021, China closed a key terminal at its Ningbo-Zhoushan port after an employee tested positive for the Delta variant of COVID-19. The country continues to implement stringent measures in line with its zero-tolerance policy to keep COVID-19 in check. US ambassador to China, Nicolas Burns, mentioned in June 2022 that the government of China is indicating the zero-COVID policy will most likely continue into the beginning of 2023.

Logistics networks and shipping and other cargo lines are yet to fully come back to normal levels of activity. In January 2022, major shipping hubs such as the Port of Long Beach, California, reported record-breaking container ship traffic. This was due to lack of port staff and lorry drivers, which caused the vessels to move to other ports and ultimately resulted in increased costs and congestions. Although these port congestions improved by mid-year, experts predict that conditions could take a turn for the worse again when China lifts its zero-COVID policy, leading to a return to earlier levels of exports from the country and a surge in accumulated orders into the US and other countries.

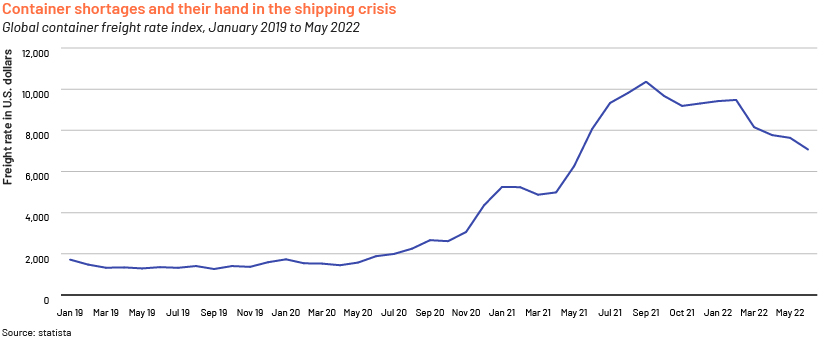

Given the prevailing COVID-19-related delays and continued demand for ocean freight between the US and Asia, ocean freight rates are expected to remain elevated. Persistent schedule disruptions and port congestions, combined with slowdowns caused by variants of COVID-19, mean that importers have yet to see a significant improvement in shipping conditions in 2022.

Amid the pandemic, containers remained stuck at cargo terminals, inland depots and even onboard vessels. The surge in global demand for consumer goods added to the strain on the shipping industry. Owing to this acute shortage, container manufacturers and leasing companies were able to increase their prices, with rates up as high as nearly four times of what was charged in 2020. Taking advantage of the current crisis, a number of carriers are also forcing shippers into long-term contracts at the current elevated prices.

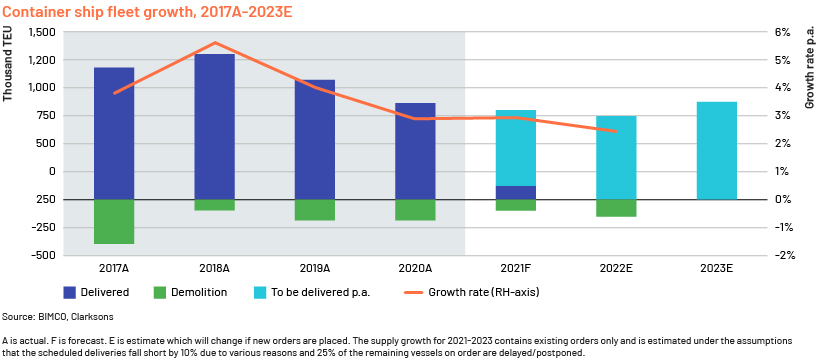

According to the Baltic and International Maritime Council (BIMCO), the strong demand for the container market is expected to continue until the end of 2023.

Labour shortage as a contributing factor

Layoffs implemented during the lockdowns led to workforce scarcities when demand recovered. Moreover, resurgence of COVID-19 variants led to staff facing movement restrictions and quarantines. Shortages of lorry drivers were particularly evident in the UK and other countries. The supply chain sector in the UK had already been struggling to hire and retain drivers given an aging labour force, pressures of rising demand, and deteriorating work conditions. Added to this were the impact of COVID-19 as well as Brexit, as a large number of immigrant workers were forced to leave owing to changes in regulations. Warehousing has also become a major concern for businesses – 30-40% of warehousing costs are related to labour charges, whereas rents make up only c.5-7%.

With the labour shortage escalating amid the COVID-19 pandemic, Brexit and now the Ukraine war, there have been substantial delays in the transportation of containers moving between Asia, Russia and Europe. Given these factors, an end to the labour shortage is highly unlikely in 2022.

How technology can help contain the impact

Although companies can hedge against supply chain disruptions through other means, the use of technology is among the more prudent methods owing to the costs involved. New technologies such as artificial intelligence (AI), blockchain and automation can allow supply chain leaders to enhance the efficiency and resilience of their operations, if implemented well.

Leading global organisations are already using a number of technologies in their businesses. For example, Procter & Gamble (P&G) has implemented a cloud-based platform supported by AI and internet of things (IoT) to automate supply chain planning. The system enabled the company to project which of its plants, suppliers and distribution centres would be affected by hurricanes. As a result, it was able to make timely decisions and avoid the delays and monetary losses that other businesses had to endure.

This system has also been helping P&G make more precise plans to respond to varying demand conditions and thus improve operational efficiency. In early 2020, the company reported its highest sales increase in the US in a number of years as, amid the pandemic, it rapidly mobilised its manufacturing resources and supply chain to meet the surge in demand for cleaning products.

Amid the pandemic, Nike relied on its radio-frequency identification (RFID) technology to identify and track all its clothing and footwear products. According to CFO Matthew Friend, the company was able to track one billion units at 99% accuracy, enabling it to take advantage of demand across geographies and retail stores. Through this technology, the company was able to place inventory at locations that would allow it to reach consumers swiftly and, in turn, lower the cost of warehousing and transportation.

The bottom line is that 2022 does not seem to be the year in which things turn around. Bottlenecks such as labour and capacity shortages will remain widespread as we navigate the year. Understanding that supply chain disruptions are unavoidable means that organisations must plan ahead. 2022 is not the year to wait and see if the dust settles. Only through embracing new trends and technologies, organisations can mitigate the consequences of these disruptions on their business.

How Acuity Knowledge Partners can help

We at Acuity Knowledge Partners provide comprehensive support to supply chain management (SCM) consultants so they can help their clients manage supply chains better. Our organisation partners with SCM consultants to provide subject matter expertise across a spectrum of services in the supply chain sector, including

-

Supplier market assessment

-

Vendor selection

-

Cost modelling

-

Monitoring

Acuity also provides a number of other solutions and services to clients across the globe. For a detailed overview of our capabilities, please visit our website Acuity Knowledge Partners – Our Solutions.

References:

How Long Will the Semiconductor Shortages Last? (goldmansachs.com)

Shipping Container Crisis 2021 | GMDH (gmdhsoftware.com)

Shipping disruption: Why are so many queuing to get to the US? - BBC News

Shipping Delays & Freight Cost Increases 2022 | Freightos

2021 Logistics and Supply Chain Industry Recap (logisticsplus.com)

Can digital technologies make supply chains more resilient? - IoT Agenda (techtarget.com)

https://www.reuters.com/world/asia-pacific/vietnam-seeking-fix-labour-shortage-soon-pm

https://think.ing.com/articles/the-rise-and-rise-of-global-shipping-costs/?msclkid

Semiconductor shortage: Intel CEO says chip crunch to last into 2024 (cnbc.com)

-

China stands by ‘zero COVID’ policy amid global economic squeeze - National | Globalnews.ca

-

China's Zero Covid policy to renew U.S. West Coast port congestion (freshfruitportal.com)

Tags:

What's your view?

About the Author

Himashi is a delivery lead attached to the Commercial Lending division at Acuity Knowledge Partners. She is currently a part of Corporate Sector Lending team performing risk raters and undertaking covenant monitoring, validation and other credit workflows for a leading European bank. Prior to joining Acuity Knowledge Partners she worked as an Executive in Advisory Division of one of the big four audit firms. Himashi is an ACMA and holds a BBA in Accounting and Finance from Hariot Watt University, Edinburgh, Scotland.

Like the way we think?

Next time we post something new, we'll send it to your inbox