Published on December 11, 2020 by Anup Dhanuka

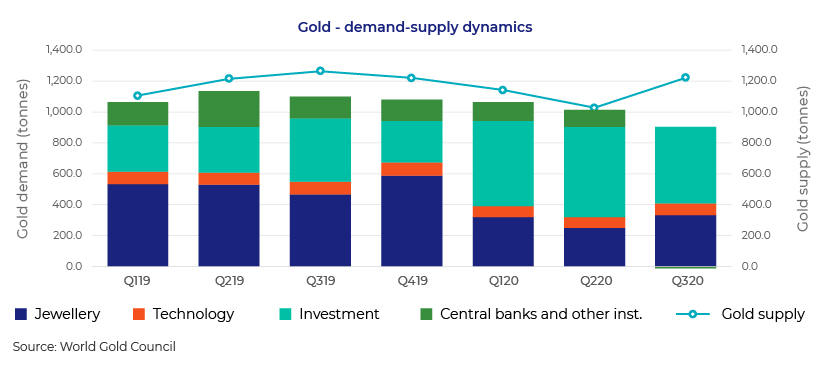

Gold has had a spectacular rally this year and been one of the best-performing asset class. However, with a vaccine for the coronavirus almost ready, the markets have turned to risk-on mode, expecting a faster economic recovery, which is negative for gold. We believe gold has passed its peak levels, at least in the near term, unless we see a meltdown in the markets like in March 2020. The largest contributor to gold demand this year has been investment demand, as shown in the chart below, followed by jewellery and central banks. However, gold demand has started declining since 1Q 2020, with central banks turning net sellers of gold in 3Q 2020, while investment-related demand also weakened, partially offset by a recovery in demand for jewellery. On the other hand, gold supply increased in 3Q 2020; this does not bode well for gold price.

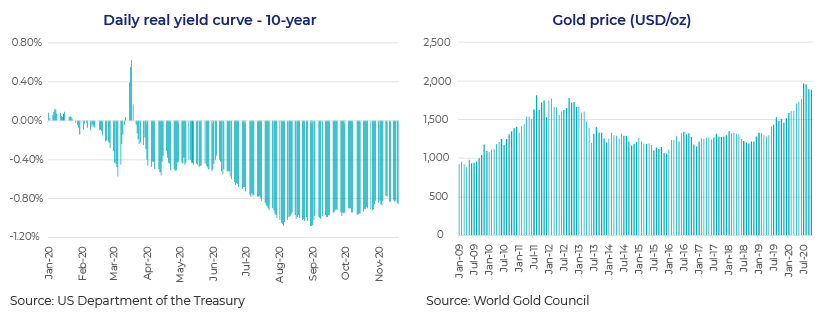

Ten-year real yields, although still negative, have started moving up again since August. At some point, the Federal Reserve (Fed) would have to roll back its stimulus, leading to a meaningful up-move in real yields. This would shift investors away from gold. One may argue, however, that we are nowhere near that scenario, which, perhaps, is true. Nevertheless, catalysts for gold’s upward move from here are also not visible. In addition, investors will likely remain worried about the Fed’s moves on stimulus, as was the case with the “taper tantrum” in 2013 – when the Fed announced plans to taper off QE by reducing Treasury bond purchases, rates spiked and gold prices fell. We are moving towards the same path again, but this time, balance sheet expansion is significantly larger and slower tapering, with a sustained rise in yields, would imply an even longer bear market for gold unless we see higher inflation levels.

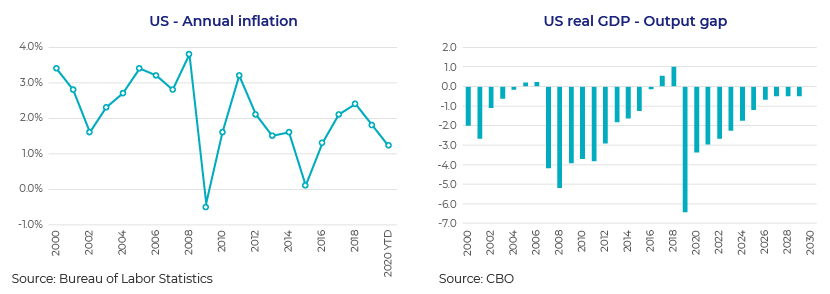

Gold's bull run in the long term really depends on how inflation shapes up. Real upside from here hinges on inflation rising, with real rates remaining low for a long period of time, which will make bond investments or holding cash very unattractive, resulting in a shift towards holding gold. However, the likelihood of inflation rising despite large stimulus remains low, if history is anything to go by. Data published by the Congressional Budget Office (CBO) shows that the US real GDP output gap turned negative after the 2008 financial crisis and it took 10 years for real GDP to reach its full potential. This kept the threat of higher inflation low. The CBO projects that even this time, it will take years for the output gap to turn positive, implying that the economy will have enough slack for inflation to remain in check.

Also favourable for lower inflation would be expectations of an improved US-China relationship under the Biden administration. This would keep tariffs in check and improve supply of lower-cost Chinese goods in US markets, keeping prices low. With Republicans controlling the Senate, another large stimulus package may not be likely, again positive for the dollar and negative for gold.

We remain cautious on gold at current prices and recognise that some of the drivers that triggered gold’s sharp rally this year are fading. We see a higher likelihood of gold prices consolidating in the near term and moving into bearish territory once stimulus is rolled back and on expectations that inflation remains at lower levels.

Acuity Knowledge Partners supports global investors to internalise more of their investment research process by building dedicated teams of research analysts out of our delivery centres in South Asia, Beijing and Costa Rica. Our analysts (MBA’s, Chartered Accountants, CFAs) work as an extension of the client team and support them on various types of client-specified research assignments, including financial modeling and valuation, conducting background research, gathering primary and secondary data, preparing for company visits, providing earnings season support, and a whole host of value-added research. Each research output produced by us is customized for each client and reflects the clients’ proprietary and differentiated research process. This gives our clients a unique edge, which is sustainable.

References:

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20200916.htm https://fred.stlouisfed.org/series/PCECTPICTM https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/inflation-forecasts https://www.gold.org/goldhub/data/gold-pricesWhat's your view?

About the Author

Anup Dhanuka has eight years of experience in equity research, supporting both buy-side and sell-side clients. He has been with Acuity Knowledge Partners for five years and has worked with buy-side fund managers in the consumer, real estate and healthcare sectors. In his current role, he supports a buy-side fund manager with coverage of real estate and healthcare stocks in the MENA region. He holds a Post Graduate Diploma in Management from T.A.Pai Management Institute in Manipal, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox