Published on November 16, 2021 by Jiao Liu

Background

Chinese tea chain HeyTea closed a series D financing round of USD500m on 13 July 2021, led by firms such as Sequoia China, Hillhouse Capital, Tencent Investment and Temasek, implying total valuation of RMB60bn (c.USD9bn). This was a new record in China’s tea drink market, almost three times more than the valuation of RMB16bn (USD2.2bn) from the series C financing round.

Founded in 2012, HeyTea sells high-quality cheese tea, fruit tea and milk tea to white-collar workers and the young. It is currently China’s largest premium freshly made tea chain. Its rapid growth in popularity and expansion (the number of stores increased at a 106.5% CAGR over 2018-20) are mainly due to promotions and advertising on internet-based social media platforms (such as WeChat) and online new media, making HeyTea an internet celebrity brand. HeyTea and peers such as Nayuki and LeLeCha have revolutionised China’s tea drink industry, now in its third stage of development, characterised by freshly made tea and referred to as the modern tea drink market.

The three stages of development of China's tea drink industry

First stage 1990-95(low-end tea drinks) |

Second stage 1996-2015 (mid-range tea drinks) |

Third stage 2016-present(freshly made tea drinks) |

|

|---|---|---|---|

Ingredients |

Synthetic additives, artificial colouring , creamer, milk-tea powder |

Canned fruits, jam, flavoured syrup, broken tea, creamer |

High-quality tea, milk and fresh seasonal fruits |

Product |

Bubble tea |

Flavoured milk tea such as mango green tea |

Fresh fruit tea such as cheese strawberry tea, cold-brewing tea |

2020 average selling price |

No more than RMB10 |

RMB10-20 |

Not less than RMB20 |

Store type |

Corner stores for takeaway |

Corner stores and malls for takeaway |

Premium teahouses, other innovative stores |

Source: China Insights Consultancy, Industrial Securities Research

Investors are scrambling to invest in China’s modern tea drink market

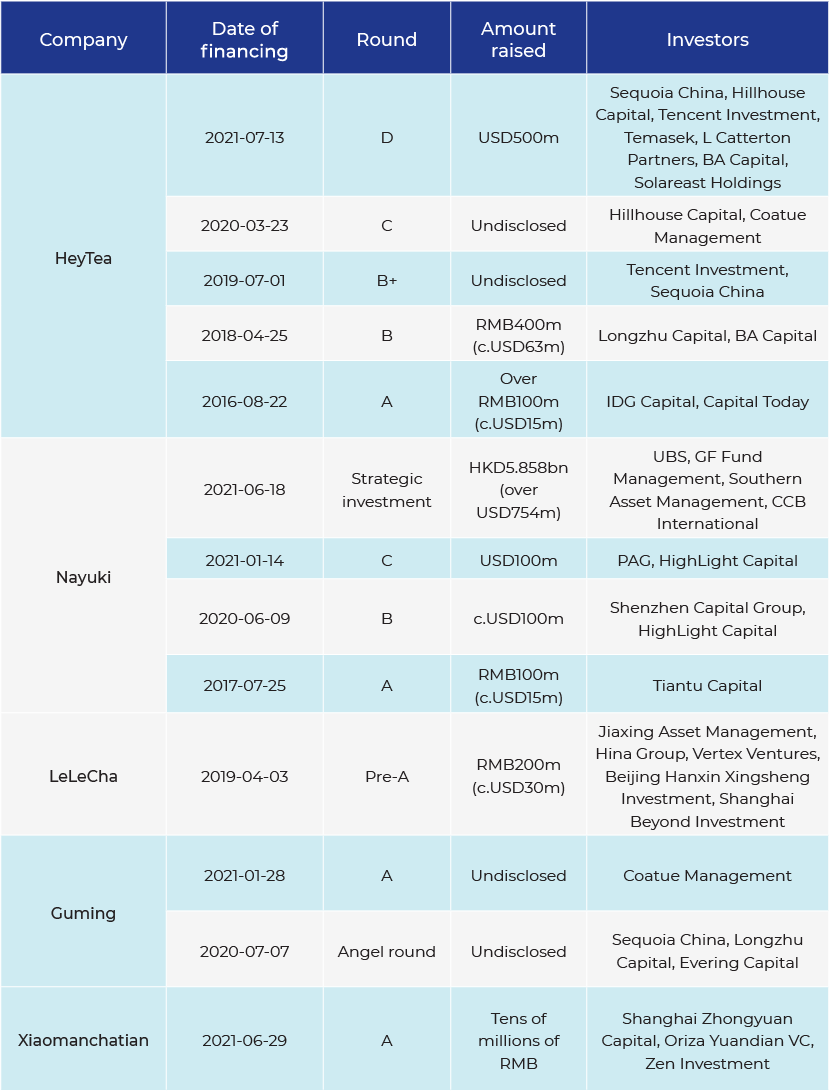

Investors are now focusing on this growing market, and tea drink manufacturers are raising capital from different sources, including private equity (PE) and venture capital (VC) firms. In HeyTea’s case, the number of investors has grown from its series A financing round to its series D financing round. All are large investors, and funding raised has spiked to USD500m in 2021 from c.USD15m in 2016. A large number of investors are scrambling for its shares, according to PEdaily, while only existing shareholders can join the latest round of financing. Nayuki obtained a strategic investment of HKD5.858bn (over USD754m) in June 2021, introducing UBS as its cornerstone investor, and LeLeCha generated RMB200m (c.USD30m) in a pre-A round of financing in April 2019, highlighting that the modern tea drink market has become a new favourite attracting capital.

Why China’s modern tea drink market attracts capital

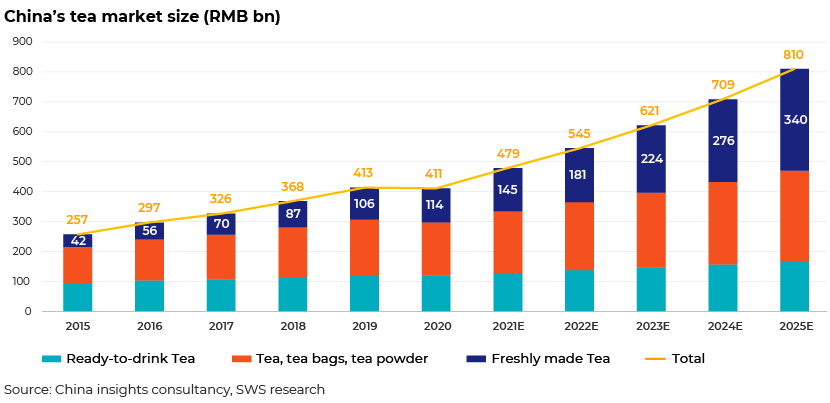

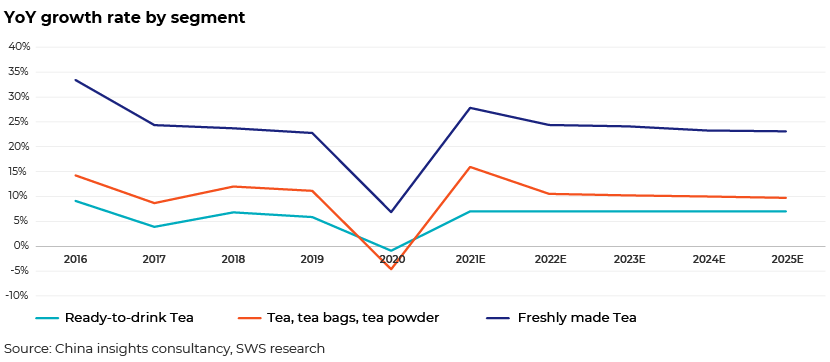

• It is a rapidly growing market with significant growth potential, especially for premium freshly made tea. China’s freshly made tea market was worth RMB114bn by end-2020, growing at a five-year CAGR of 22%, and accounted for c.28% of China’s total tea market, according to China Insights Consultancy and SWS Research. It is expected to grow at a five-year CAGR of 25% to RMB340bn by end-2025 and account for c.42% of the total market.

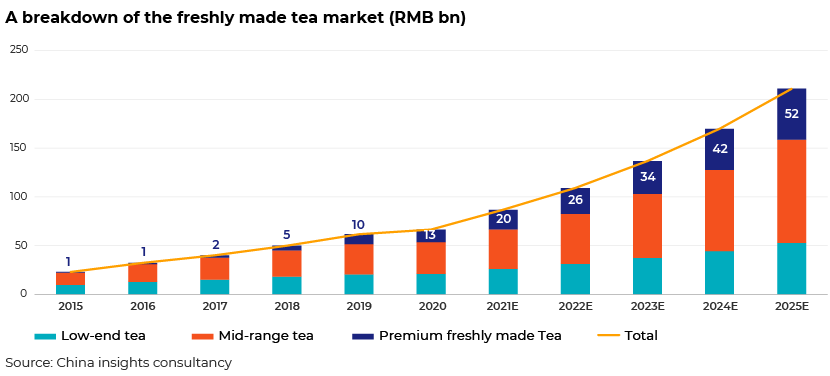

The premium freshly made tea subsector recorded the strongest momentum, growing at a five-year CAGR of 75.8% to be worth RMB13bn by end-2020. China Insights Consultancy expects it to grow at a five-year CAGR of 32.2% to RMB52bn by end-2025 and to account for nearly 25% of the total tea market. Due to increased purchasing power and disposable income per capita, demand for both high-quality tea drink products and a pleasant tea drinking experience is increasing, driving up consumption of premium freshly made tea.

• It offers strong profitability at a mature stage. The market is at an initial growth stage, and the competitive landscape is a duopoly, with the top two companies, HeyTea and Nayuki, accounting for 46.6% of the market. Although gross margins are high (60-65%1 for the top companies; raw materials such as tea and milk account for most of the costs), net margins are low, with some companies even making losses. This is because most of them are focused on rapid expansion to grab market share, making it difficult to control other important operating costs such as personnel and rental expenses.

However, when the market enters a mature stage, those companies that survived would see strong and sustainable profitability through economies of scale that significantly reduce average operating expenses per store.

Source: Industrial Securities Research

• It continues to innovate to attract younger generations. HeyTea and peers have revolutionised the industry. An analysis of tea drinkers shows that 52%2 were born after the ’90s and 28%2 after the ’80s; 41%2 consume tea drinks three to five times a week and 33%2 one to two times a week. The younger generations are drinking more tea and are likely to become the main consumers, with potentially more purchasing power.

Tea is popular among the younger generations for the following reasons: (1) Companies that are part of China’s internet celebrity economy are good at building strong brand recognition to acquire loyal customers from among the younger generations. (2) The high quality of raw materials used satisfies their need for healthier drinks. (3) Continuous innovation meets changing tastes and provides a wider selection of flavours. (4) Brand collaboration with big names, such as HeyTea with Corona, helps introduce new products, for example, the seasonal product “intoxicated grape beer”.

Source: CBN Data, SWS Research

• It is a perfect match for companies looking to diversify investment. The consumer goods sector has a number of subsectors, such as food and beverages and lifestyle goods. Modern tea drinks is a new and promising segment, and PE/VC firms are likely to invest in it not only to diversify their portfolios, but also to capitalise on potential growth.

Conclusion

China’s modern tea drink market is in a high-growth stage, and an increasing number of investors are tapping into it to capture potential growth. It has reshaped the tea drinking culture in China and fostered a habit among the younger generations. Potential for market growth is, therefore, likely to be significant.

How Acuity Knowledge Partners can help

We are experienced in both quantitative and qualitative research analysis. We support clients with deep-dive research on sectors from healthcare, TMT and financial services to consumer goods. In the consumer goods sector, we help clients identify pre-investment opportunities and provide post-investment management, assisting with financial modelling and valuation analysis. We also provide other value-added services to help clients understand the China market to explore investment opportunities.

What's your view?

About the Author

Jiao Liu has over 7 years of experience in financial services industry. In her current role at Acuity Knowledge Partners, Jiao is leading a PE team to provide post-investment management services for a Top Asia PE fund, covering a wide range of industries. Prior to this, she was working for an equity research team with a focus on China utility market for a Top investment bank client. Jiao holds a master degree in Finance from Syracuse University.

Like the way we think?

Next time we post something new, we'll send it to your inbox