Published on March 1, 2023 by Binura Deniyawatta

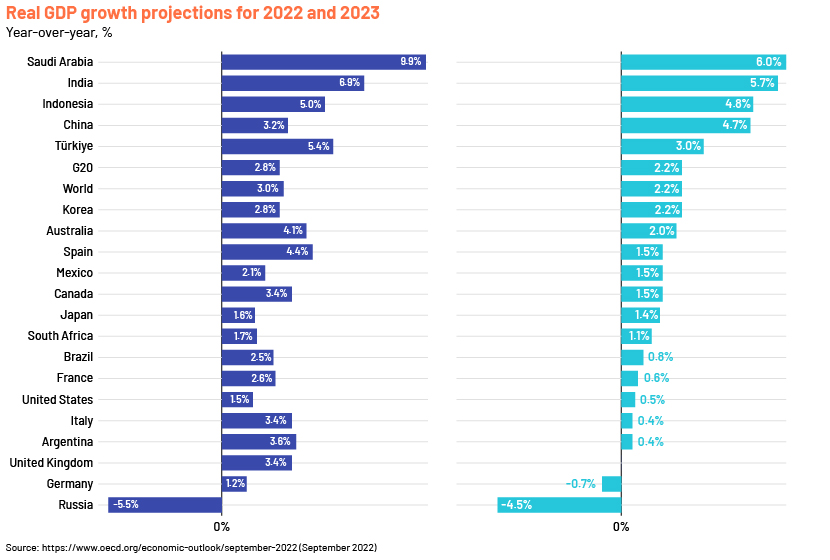

In 2020, the global economy suffered from the effects of the pandemic such as supply-chain disruptions that constrained a number of sectors. Soon after recovering from supply-chain disruptions, Russia’s invasion of Ukraine affected Europe’s economy and elevated global energy prices. Inflation reduced the disposable income of households, and companies are suffering from declines in revenue. Tighter monetary policies are affecting economic activity. Corporate defaults doubled in September 2022, according to Moody’s Analytics, warning of a possible economic crisis in the near future. The OECD also confirmed that economic growth of all major economies (except China) would contract in 2023.

The global financial system is the lifeblood of the economy, and the issues mentioned above would create stress (especially in unpredictable situations such as the pandemic). Therefore, it is essential to increase focus on maintaining the stability of the financial system, particularly the stability of financial institutions, because to face economic uncertainty, both businesses and households have to rely on the financial system to fund both short-term and long-term capital requirements. A strong financial system would increase the ability to withstand sudden macroeconomic tensions. On the other hand, a stable financial system would create an environment where policymakers can easily regulate macroeconomic drivers to achieve long-term economic stability.

Accordingly, regardless of the sector or economy, it is crucial that policymakers and other stakeholders focus on the stability of the global financial system. Both banks and non-banking financial institutions are facing uncertainty because of their complex business models, further aggravated by economic instability.

Most financial institutions provide financial intermediary services through different products. Increased exposure to highly volatile banking products may increase the ability to generate profits. However, these products increase the credit risk of these financial institutions, and the inability to

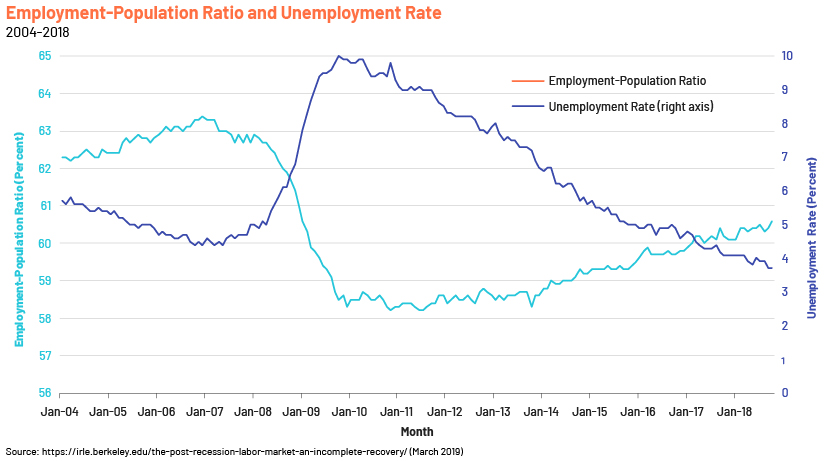

manage such risks (especially risk associated with large banks) would disturb the smooth operation of the global financial system. This could subsequently create adverse socio-economic consequences. For example, the 2008 global economic recession, driven by the subprime mortgage crisis in the US, increased unemployment across the globe.

While developing a stable financial system, it is essential that decision makers and other stakeholders understand the risks faced by financial institutions so they can make informed decisions. Risk faced by a typical financial institution can be discussed under four sub-categories:

-

Credit risk (failure of a counterparty to meet contractual obligations)

-

Liquidity risk (failure to meet payment obligations)

-

Market risk (unpredictability of market conditions such as interest rates and commodity prices)

-

Operational risk (intentional or unintentional interruptions in the ordinary course of business)

This blog covers credit risk (the most critical risk faced by a typical financial institution) and risk mitigation strategies from the perspective of lending institutions.

Credit risk faced by a typical financial institution

Credit risk is broadly defined as the possible loss due to failure of a counterparty to meet financial obligations. This depends on the probability of the counterparty’s default. A typical financial institution can be exposed to credit risk due to its nature of operations. Complex transactions such as lending, trade finance, forex transactions, hedges and working capital solutions create payment obligations that need to be settled immediately or within a prescribed period. If these obligations are not settled, it would create credit risk for the financial institution. From a lending perspective, if a borrower fails to service its debt and borrowing costs as agreed, the lender’s balance sheet and profit would suffer, creating credit risk for the lender.

These credit failures also create risks other than credit risk such as inability to meet payment obligations due to lack of funds (liquidity risks), profitability issues, regulatory pressure and reputational damage. The failure of large financial institutions (e.g., wholesale banks and investment funds) would create credit risk for other financial institutions due to the interdependency of the financial system [e.g. in 2008, the credit defaults of mortgage holders of multinational banks affected the liquidity of American International Group (NYSE: AIG), a multinational insurance company]. Loss of confidence in financial institutions, with the investor community (both individuals and institutions) questioning their trustworthiness, would create long-term and short-term fund shortages in the financial system. This could prompt them to invest in alternative sources including non-regulated investment vehicles. For example, ABC News reported a survey by the Independent Community Bankers of America that found that in 2008, 70% of US community banks reported an increase while more than a quarter of the respondents showed double-digit growth due to a lack of confidence in the US banking system.

Therefore, it is essential to focus on alternative strategies, termed credit risk mitigation (CRM) strategies, to counter extreme credit risk weakening the financial system. Simply put, from a lending perspective, CRM refers to attempts by lenders to minimise the probability of losing their investments (i.e. loans or debt) due to borrowers defaulting on their interest and principal payments. Having robust CRM strategies in place would help maintain profitability and prevent insolvency.

CRM strategies in practice:

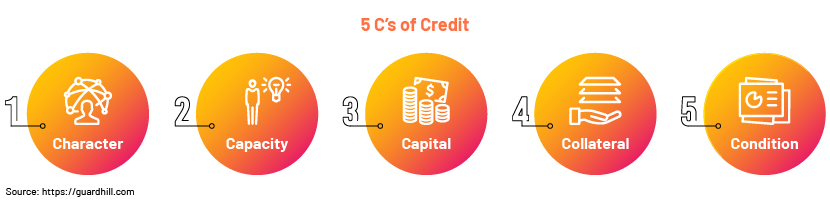

1. Following the five C’s of credit: The five C’s model shows how to identify inherent risks of a loan, based on which lenders can implement appropriate safeguards where applicable. A lender can assess the creditworthiness of its portfolio using this concept. If the portfolio is not performing well, the lender should implement appropriate safeguards to mitigate the credit risk (e.g., through debt restructuring or diversifying the portfolio).

2. Collateralising loans:

Collateralising refers to use of an asset to secure a loan. If the borrower defaults, the lender has the right to recover losses using the collateralised asset.

3. Risk-based pricing:

The risk-versus-return trade-off is a key concept in traditional financial risk management. In risk-based pricing, varying interest will be charged based on risk factors such as the borrower’s creditworthiness and past record. If the borrower’s financial strength is weak, there is a higher probability of default than with a borrower with a stronger financial position/creditworthiness. Therefore, lenders should charge higher interest for riskier deals. In the worst-case scenario (i.e. debt default), the lender’s loss would be minimal since a significant amount of the expected cashflow would already have been recovered. However, this is subject to the lender’s risk appetite.

4. Limited exposure to high-risk sectors:

Diversifying loan portfolios would increase the ability to face unprecedented negative situations with borrowers. If a significant percentage of the loan portfolio depends on a particular sector, the success and even survival of the particular institution would depend on the underlying conditions in that sector (e.g., Lehman Brothers collapsed because of concentrating on the US housing market). As Modern Portfolio Theory suggests, diversification would minimise aggregate volatility of a portfolio and, therefore, the total risk of the lender.

5. Post-disbursement monitoring:

In this particular process, lenders obtain financial reports and management information from borrowers frequently to ensure borrowers make proper use of loans disbursed and generate sufficient funds to meet debt obligations. Reporting frequency depends on factors such as the risk faced by the borrower and the sector in which the borrower operates.

6. Contractual debt covenants:

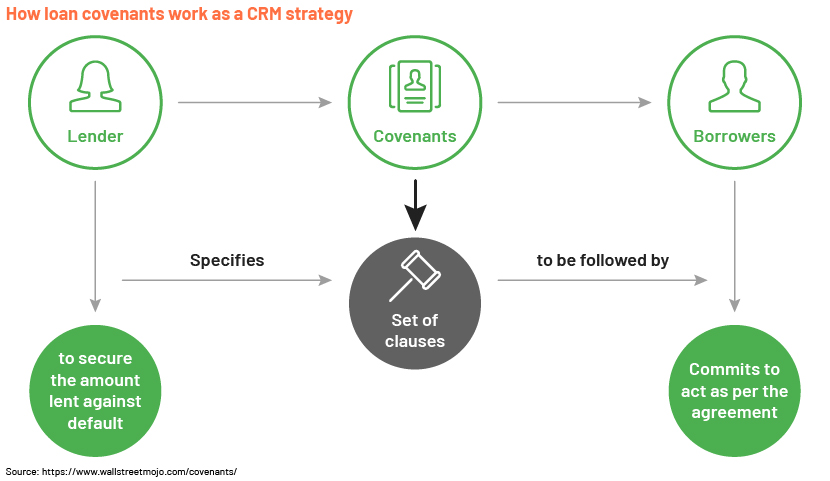

Debt covenants are pre-determined restrictions/requirements placed on borrowers to protect lenders from potential credit risk. Covenants are a control mechanism and a tool for maintaining the lender-borrower relationship (i.e. senior management of a company, in the case of an institutional borrower) after loan origination.

Note: In contemporary lending practices, post-disbursement monitoring also classifies as a covenant (an information covenant) since the information required for covenant calculations is included in such reports.

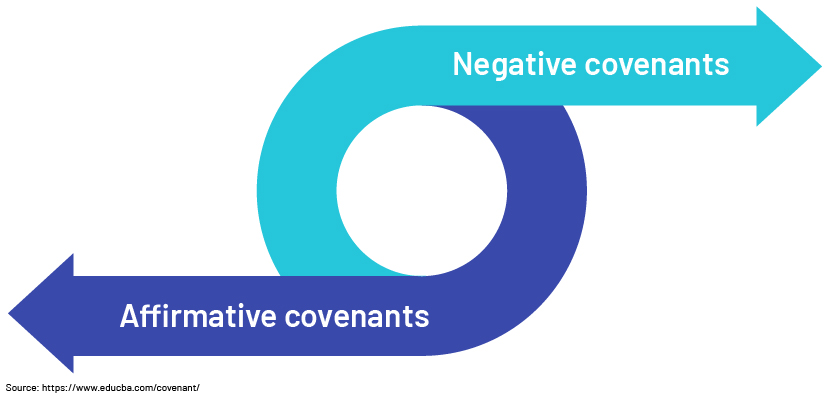

Loan covenants are the contractual obligations borrowers agree to comply with throughout a loan period. Positive covenants (i.e., affirmative covenants) promote conditions that ensure the stability of a borrower, so a lender can monitor the borrower’s compliance and take the necessary action if the covenant has been breached or a red flag is raised. On the other hand, if the borrower continues to perform well, the lender can ease certain restrictions placed on the borrower. This would benefit the borrower (e.g., in terms of easing restrictions and lower interest rates driven by low credit risk) and the lender (e.g., in terms of reduced monitoring costs due to lower credit risk, ability to offer competitive terms and ability to focus on high-risk deals that need close monitoring). In contrast, negative covenants restrict borrowers from certain actions that would increase the lender’s credit risk. These covenants restrict economic activities of the borrower, for which they are compensated (e.g., through reduced borrowing costs) at the value forgone.

Lending contracts contain financial covenants that enforce minimum financial performance conditions on the borrower. There are two separate categories under financial covenants: maintenance covenants and incurrence covenants. Maintenance covenants are financial conditions (such as leverage, minimum liquidity, interest cover and capex) the borrower needs to comply with as of each test date. Breach of maintenance covenants affords the lender a right (but not an obligation) to accelerate the loan since such circumstances signal warnings about the borrower’s creditworthiness. In contrast, incurrence covenants are not regularly tested covenants. The borrower should comply with incurrence covenants if and only if certain actions (such as issuing debt and dividend payments) specified in the credit agreement are undertaken. If the borrower fails to comply with incurrence covenants, the borrower should obtain the lender’s consent before proceeding.

These loan covenants are not a pre-decided set of principles that are applicable uniformly across transactions. Covenant structures usually change based on the type of borrower, such as the sector engaged in, geographical presence, risk faced by the borrower and nature of the facility. If the borrower’s bargaining power is high (mostly due to availability of alternative borrowing channels, driven by strong performance), the deal will be a covenant-lite transaction. Although such deals may seem low-risk, covenant-lite transactions also have inherent risks because of a lack of restrictions. Furthermore, covenant-lite transactions mostly take place with complicated leveraged buyouts, with the participation of private equity sponsors.

How to monitor covenants effectively and efficiently

Regardless of the type of covenant, they provide early warning of potential issues with borrowers. Covenants are, therefore, important both as a communication tool and as a control mechanism. In addition to checking compliance of borrowers, lenders should focus on understanding the trend of a borrower’s performance [lenders can analyse trends using financial ratios such as net leverage ratio (NLR), interest cover ratio and loan to book value (LTV)]. However, this should be decided by considering the sector the borrower is engaged in. Sound knowledge of macroeconomic conditions and developments in the sector would enhance the quality of this analysis. It is important to have a separate team of credit analysts perform this task, so they can make independent professional assessments affected neither by the relationship manager who originates loans nor by risk managers who are the gatekeepers for lenders.

The covenant-monitoring process typically starts within two or three quarters after the closure of a deal and ends on the facility termination date. Non-compliance with covenants creates a situation where lenders can control borrowers (e.g., place restrictions on certain types of business activity and dividend payments). The interest rate may vary based on covenant calculations, and the level of compliance/non-compliance would decide the level of monitoring required for a single borrower. If non-compliance is extremely risky, the lender may prefer to shorten the maturity period. Covenant monitoring would help lenders conduct annual credit reviews and rating faster, as the borrower’s creditworthiness would already have been evaluated to a certain extent.

Regulatory background for covenant monitoring

Covenants between borrowers and lenders were an integral part of almost all credit agreements for a long time. However, the covenant-monitoring process was not as effective before the 2008 financial crisis, and covenant breaches were not a major concern for most borrowers or lenders. (A study conducted by a team of Harvard scholars found that c.25% of loans breached at least one covenant in a typical year before the 2008-09 financial crisis.) In the post-crisis lending scenario, debt covenants have become an important risk concern, as creditworthiness of a loan portfolio is a key measure of the health of a typical financial institution. Therefore, regulators also started focusing on supervising covenant-monitoring processes followed by financial institutions.

According to the European Banking Authority’s (EBA’s) guidelines on Loan Origination and Monitoring, lenders must focus on maintaining monitoring frameworks supported by adequate data infrastructure. This is so credit risk exposure can be managed in line with a lender’s (1) credit risk appetite, (2) strategy and (3) policies and procedures at both the portfolio and individual exposure levels. Using such infrastructure, lenders should conduct regular credit reviews to identify changes in risk profiles, financial position or creditworthiness compared with the criteria and assessment at the point of loan origination. To ensure this infrastructure has up-to-date information, lenders should focus on executing requirements listed in credit agreements (mostly under information covenants).

The EBA specifically highlights that lenders should monitor borrowers’ adherence to covenants already agreed to by both parties (during loan origination). Borrowers’ adherence to covenants, together with timely delivery of covenant information, should operate as early warning tools. The EBA also emphasises that covenant monitoring must include monitoring all relevant financial ratios highlighted in credit agreements and any deviation should be detected early so the necessary action can be taken to protect the lender.

Contemporary issues in loan covenant monitoring

As discussed, covenants favour lenders while borrowers may have to face some costs. Therefore, the lender must play the role of gatekeeper, even though both parties benefit in the long run. On the other hand, lenders generate revenue by lending money financed from a third party (shareholders, depositors or other creditors), so it is their responsibility to manage their investments proactively. Accordingly, the lender is responsible for monitoring covenants in line with provisions in the credit agreement. However, it is essential to put extra cost and effort into the covenant-monitoring process, especially at the beginning.

Broadly speaking, the lender’s risk officers are responsible for assessing the risk of each transaction as part of portfolio monitoring. However, in a typical financial institution, relationship managers have to deal with borrowers while monitoring covenants as they manage front-end activity. Given that loan origination is a continuing process for lenders, relationship managers may be fully occupied with new-deal origination and related issues. Therefore, in practice, the covenant-monitoring process may need to be allocated to the portfolio management team responsible for back-office operations. Portfolio managers are already responsible for complex activity such as risk ratings, credit reviews, processing waivers and negotiating debt restructuring, and may not have the time to focus on each and every covenant under their purview. Therefore, there is a probability that they will miss certain triggers regarding borrowers’ creditworthiness. Similarly, if a borrower realises the covenant-monitoring process is not that strong, they could act in their best interests instead of complying with covenant requirements.

Although compliance breaches may be revealed later, during internal annual reviews or audits, it is always recommended that covenants are monitored as and when they are overdue so lenders can comply with regulatory requirements; this is also risk management best practice. Lenders can ensure this by having a separate team responsible for monitoring loans already originated until their maturity. Relationship managers may also be prone to conceal information/early warning signals regarding a borrower’s creditworthiness due to long-term relationships with them. It is, therefore, best to release them from covenant-monitoring responsibilities so they would not be tempted to make subjective decisions regarding a borrower’s creditworthiness.

Lenders should focus on establishing a separate team of qualified credit analysts to liaise between relationship managers and risk teams. Although this would entail additional cost, it would generate favourable outcomes in the long run. The ultimate responsibility of this team is to manage relationships with borrowers while monitoring covenants and supporting internal risk reviews under the supervision of the risk team while coordinating with the respective relationship managers. Having qualified sector experts in this team would enhance the quality of output they generate. Hence, the risk team could make independent judgments on each transaction, reducing the firm's credit risk. Relationship managers would be released from covenant-monitoring responsibilities and could focus on loan origination with new borrowers, so the firm's profitability will increase.

How Acuity Knowledge Partners can help

We are a leading bespoke research provider to the financial services sector, with 520+ financial services clients including leading investment and commercial banks, and fund managers. Our 5,750+ SMEs and industry experts provide services across the lending value chain to lenders' relationship managers and risk managers, including covenant monitoring, periodical credit reviews, financial modelling, forecasting and internal risk ratings, among others.

We help lenders build centralised offshore locations so they can standardise middle-office operations across the firm (regardless of geographical boundaries). This helps them implement and monitor enterprise-level risk management best practices.

Our suite of Business Excellence and Automation Tools (BEAT) assists lenders with automating their covenant-monitoring tasks using a proprietary platform CovenantPulse. CovenantPulse is a bespoke covenant-monitoring and validation tool that provides in-depth understanding of covenant performance, delivers early warning signals of deteriorating covenant quality and generates advanced covenant analytics. Our clients use this solution as a self-service model (a SaaS approach) or as an exhaustive managed services model that combines the domain expertise of our SMEs with CovenantPulse. Click here for more information and a free demo of its functions.

References:

-

https://www.sas.com/en_us/insights/risk-management/credit-risk-management.html

-

https://www.fe.training/free-resources/credit/credit-risk-mitigation/

-

https://corporatefinanceinstitute.com/resources/knowledge/finance/loan-covenant/

-

https://corporatefinanceinstitute.com/resources/knowledge/deals/negative-covenant/

-

https://corporatefinanceinstitute.com/resources/commercial-lending/positive-covenants/.

-

https://www.moodys.com/creditfoundations/Default-Trends-and-Rating-Transitions-05E002

-

https://thirdeyecapital.com/diversification-does-it-really-matter-in-a-loan-portfolio/

-

https://www.investopedia.com/articles/economics/09/lehman-brothers-collapse.asp

-

https://scholar.harvard.edu/files/chodorow-reich/files/covenant_channel.pdf

Tags:

What's your view?

About the Author

Binura Deniyawatta is an associate in the Lending Services at Acuity Knowledge Partners. Currently, he is supporting the Acquisition Finance team and is responsible for carrying out periodical credit reviews, credit package creation, risk ratings, financial spreading, covenant migration, validation and monitoring, and other credit-related workflows for a leveraged portfolio of borrowers of a European Wholesale Bank. Previously he supported the Real Estate and Infrastructure Finance and Corporate Sector Lending sector teams with covenant monitoring and financial spreading. Binura started his career in a local accountancy firm as an intern in the audit and assurance division. Prior to Acuity, he worked for PwC. Binura holds a BSc. Accounting..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox