Published on August 5, 2022 by Avishek Suman

Executive summary

China’s GDP appears to be on the path to recovery and growth after possibly bottoming in the second quarter of 2022. The country has successfully reined in the pandemic, and production and consumption are showing signs of a recovery. It is also gathering funds for its infrastructure spending to resurrect its economy. However, the country presents unique challenges to global investors who need timely and customised research to closely track this puzzling market.

China reported lower-than-expected GDP growth in 2Q 2022 thanks to the pandemic

China’s second-quarter 2022 GDP growth slowed to 0.4% y/y from 4.8% y/y in the first quarter. This was also lower than analyst expectations of a moderate 1% y/y growth. China faced a resurgence in COVID-19 cases in the second quarter, leading to strict lockdowns in many important cities including in financial centre Shanghai and the capital Beijing. This affected economic activity severely and resulted in slower-than-expected GDP growth in the April-June quarter.

The worst, however, is likely over, as signs of a recovery are clearly visible.

The painful Zero-COVID policy has ensured a faster return to normal

Active COVID-19 cases are down significantly thanks to strict lockdowns. As the supply chain improved, factories reopened and workforces returned in early June – China’s industrial production increased 3.9% y/y in June compared to a modest 0.7% y/y increase in May and a 2.9% y/y decrease in April 2022.

Along with growth in production, China also posted an impressive 17.9% y/y increase in exports in June 2022. As challenges associated with port operations and logistics ease further, China’s exports should rebound, benefiting from a weaker yuan in the second half of the year.

While the world is in tightening mode, China implements monetary easing to boost growth

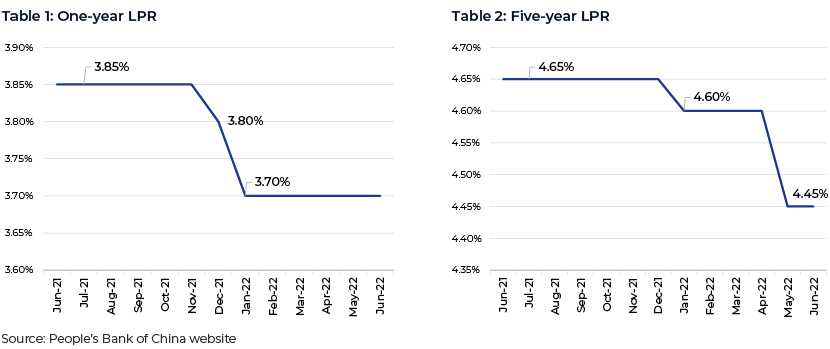

China reduced its one-year loan prime rate (LPR) from 3.85% to 3.80% in December 2021 and further to 3.70% in January 2022. In May 2022, it cut its five-year LPR by a large 15bps to 4.45%, while keeping the one-year LPR unchanged.

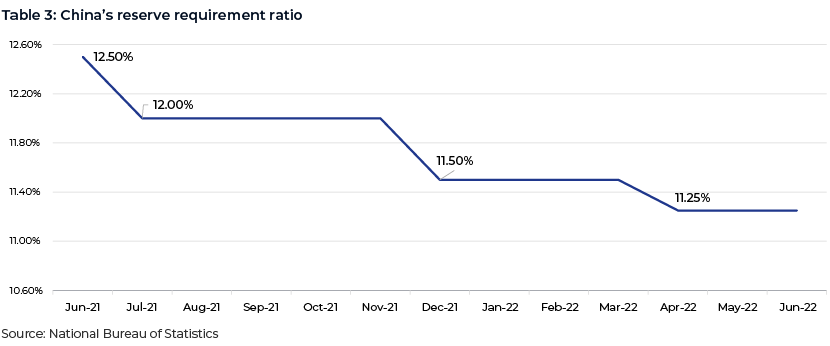

China’s lowering the LPR reduces its yield premium, as most major economies are in a tightening mode to tame domestic inflation. This move, however, is likely to help the troubled property market and investment. In April 2022, China also cut its reserve requirement ratio (RRR) by 25bps, following a 50bps cut each in July and December of 2021. The April cut released an estimated USD83.2bn of liquidity into the banking system.

Domestic consumption and investment should drive China’s economy in the second half

China’s retail sales increased 3.1% y/y in June 2022 after declining 6.7% y/y in May and dropping 11.1% y/y in April due to the impact of the pandemic. It is fair to assume there is pent-up consumption that will be unleashed in the second half of 2022. China is also providing policy support to boost domestic consumption. In late May 2022, Cabinet instructed the provincial government to relax policies for automobile ownership. The government also proposed halving the tax on purchase of small vehicles. This would not only stimulate spending on vehicles, but also help related industries such as the metal and chemical industries. Additionally, many local governments are doling out “consumption coupons” worth billions of yuan to their residents, to be used in selected retail stores and restaurants for purchases.

China is also considering fast-tracking the sale of special bonds by allowing local governments to use next year’s quota. This means local governments will be able to sell bonds worth about USD220bn in the second half of 2022, if permitted. The fund will be used mainly to finance China’s infrastructure spending in its efforts to meet the ambitious target of 5.5% GDP growth in 2022.

China is still a challenging market and needs to be tracked closely through on-the-ground research

While China is moving in the right direction and economic activity should return to normal in the coming quarters, it still remains a difficult market for global investors. Concerns regarding falling housing prices, weak global demand that could potentially impact China’s exports and seemingly disruptive policies scare international investors. Global fund managers interested in the China market find it difficult to take investment decisions because most of them do not have research teams on the mainland to closely track and monitor the market. In addition, research available through local and global sell-side firms on the China market is still insufficient. Many fund managers are, therefore, turning to dependable third-party research firms such as Acuity Knowledge Partners to closely track the China economy.

How Acuity Knowledge Partners can help

We have been serving in Beijing for more than a decade, and our talent pool of bilingual analysts can help investors monitor economic indicators, build macro databases, translate policy documents and prepare macroeconomic and sector reports. They act as an extension of our global clients’ research teams and keep money managers abreast of developments in China through meaningful and bespoke macroeconomic research.

Sources:

China announces detailed stimulus measures to support virus-hit economy | Reuters

China’s H1 GDP expands 2.5% as economy braves mounting challenges – Global Times

China's retail sales continue to see upward trend after gaining 3.1% in June – Global Times

Exclusive: China plans $75 billion infrastructure fund to revive economy | Reuters

China considers $220 billion stimulus with unprecedented bond sales | Business

China's GDP growth misses expectations in the second quarter (cnbc.com)

What's your view?

About the Author

Avishek Suman manages the Investment Research business at Acuity Knowledge Partners, Beijing. He has close to 19 years of work experience in research, including 15 years in Acuity Knowledge Partners. Prior to assuming this responsibility in Beijing, Avishek served as Delivery Manager for buy-side and sell-side clients.

Like the way we think?

Next time we post something new, we'll send it to your inbox