Published on March 15, 2023 by Nitish Khurana

Inflation has lasted way longer than expected in the US. After the country witnessed a record high inflation of 9.1% in June 2022 – the most significant yearly increase since 1981 – January’s Consumer Price Index (CPI) data showed signs of cooling off, coming in at 6.4%. But this is far from the country’s 2-4% inflation target. Simply put, inflation has become a hard target to hit.

In its initial statements, the US Federal Reserve (the Fed) had emphasised that inflation was “transitory” – meaning the price rise was a temporary outcome of supply chain disruptions. But soon, the Fed changed its stand, terming it “sticky”.

But how did inflation become sticky? The answer can be drawn by looking at the inflation timeline from the beginning of the pandemic.

Impact of the pandemic on the US economy

Amid the COVID-19 outbreak being declared a pandemic and a national emergency, the country implemented stringent lockdown orders, with most non-essential businesses ordered to shut down temporarily. Consequently, 43% of businesses were temporarily closed by early April 2020.

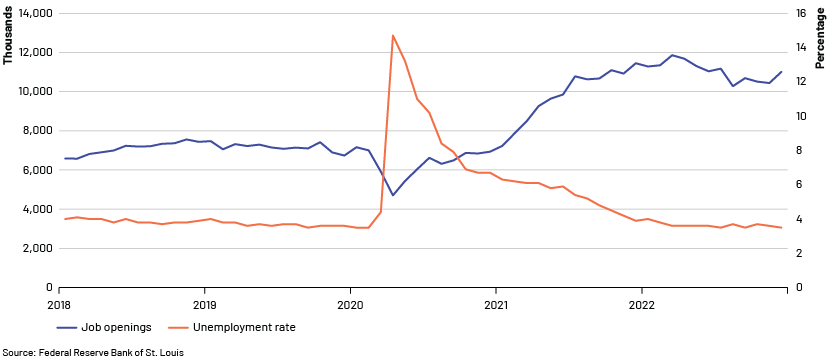

The service sector – retail, entertainment, restaurants, bars and personal services such as hair stylists – felt the worst impact. As a result, in April 2020, the unemployment rate in the US went up to 14.7% – the highest since the Great Depression.

The Dow lost 37% between 12 February and 23 March, as investors were worried about the prospect of economic destruction owing to the pandemic. Lower stock prices meant companies could not get enough funding for operations and expansion. In addition, firms that had their cash invested in stocks were left unable to pay their employees or to fund pension plans.

Furthermore, the lockdown orders, massive layoffs and the temporary shutting down of businesses pushed GDP down by as much as 25% – which sent the stock market tumbling.

Stimulus packages and their impact on the US economy

The pandemic-led lockdown restrictions made it difficult for many Americans to generate income. Nearly 31% of US renters did not pay their rent in April 2020. Families were running up credit card debts to pay rent and manage daily groceries.

To combat the dire situation and provide relief to the people and to businesses, the Fed and the government stepped in with a comprehensive action plan. The government rolled out stimulus packages of a total of USD5tn, including direct cheques to households. The Fed also eased its interest rates – first by 0.50% to a range of 1% to 1.25%, then by 1.00% to a range of 0% to 0.25%.

The stimulus packages and lower interest rates were meant to infuse money into the economy and in turn increase spending and enhance households’ and businesses’ demand for goods and services.

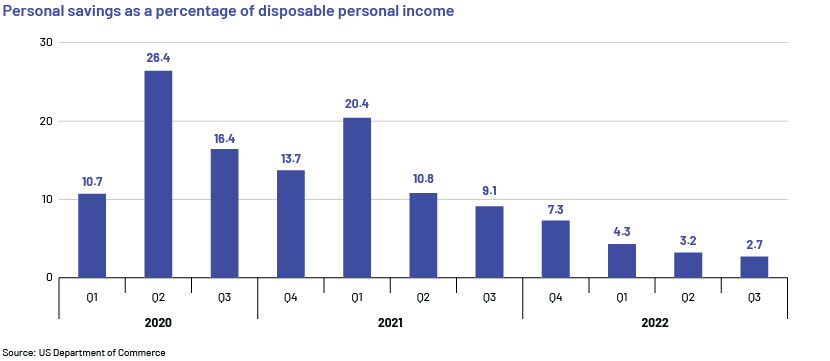

However, people were locked in their homes. While there was demand, supply-side problems such as a dearth of goods caused by labour shortages and supply chain disruptions led to lower spending and increased personal savings.

The US Department of Commerce recorded a 26.4% increase in personal savings as a percentage of disposable personal income in 2Q20.

Eased lockdown restrictions and the labour market

As the lockdown restrictions eased, people began to return to their everyday lives, and demand for goods shifted to demand for services such as dining out, travelling and going to the movies. Seeing this growth, companies started hiring for various positions. However, the positions were not filling in as quickly as they had expected. The pandemic had caused a significant disruption in the US labour market – in 2021, more than 47 million workers quit their jobs in pursuit of an improved work-life balance and flexibility, strong work culture and increased compensation.

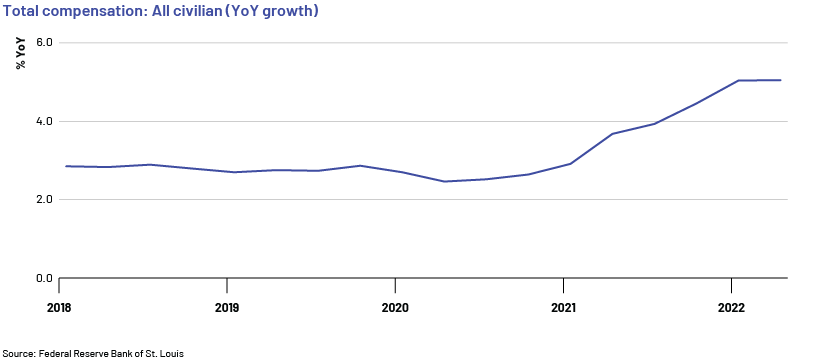

It took much work for the companies to fill those vacant positions and encourage workers to stay. Companies also had to raise wages; total civilian compensation grew 5% in 2022 from 2021.

As households had saved up much of their income during the lockdown, they could afford to spend higher on services. Companies took advantage of this increased demand and shifted their high cost of labour onto the customer in the form of increased prices – creating inflation.

In theory, when prices rise, the cost of living also increases. In turn, people demand higher wages to fill the gap between their income and expenses. This cycle of higher prices - higher wages started to feed on itself.

Shifting target

Aside from the rise in prices due to increased spending power and higher wages, global geopolitical factors also contributed to inflation. Over 2021 and 2022, the reasons for the rise in prices kept shifting, making it difficult for the Fed to target inflation.

2021

Vaccines were introduced for adults in the first half of 2021, and the lockdown was eased. Energy prices went back to their pre-pandemic levels as people returned to their everyday lives. As a result, while outdoor activities saw a rise, the shortage of new vehicles caused by a lack of semiconductors worldwide increased used car sales.

In the second half of 2021, the cost of groceries spiked owing to high demand and supply shortages of beef and pork, caused by labour shortages and higher transportation costs. The labour shortage was the result of people leaving their jobs in pursuit of jobs that offered higher pay scales and better flexibility. On the other hand, transportation costs soared owing to a rise in oil prices.

In September, demand dwindled because of a resurgence of COVID-19 cases.

2022

In early-2022, the Russia-Ukraine war led to a surge in oil prices, driving up the cost of transportation further, including airline fares.

Demand for houses with larger spaces grew during the lockdown, leading to a surge in housing rents, and this trend has continued thereon. The limited number of vacant spaces and high demand led landlords to capitalise on the strong demand by charging higher prices.

In essence, many forces that drove inflation – including supply disruptions due to COVID-19, higher food prices following severe storms, and soaring oil prices – did not discourage demand.

Instead, the increased employment and savings from the stimulus made people demand more.

Interest rate hikes

In March 2022, the Fed decided to increase interest rates to combat the soaring inflation. Since then, it has increased the target range eight times, from 0.5% in March 2022 to 4.5% in February 2023.

In theory, consumers spend less if it becomes more expensive to borrow money or to carry a balance on a credit card. When spending becomes expensive, demand falls and eventually, the price of everyday goods also decreases. However, despite the rate hikes implemented to curb inflation, demand for goods and services has remained higher than expected.

The stimulus cheques were intended to cushion US households against rising prices, but the rising cost of living did not affect all sections of society equally. According to research conducted by Harvard, the pandemic had a disproportionate impact on lower-income Americans, with their spending remaining largely unchanged from levels seen before the pandemic – this despite the personal savings rate hitting a record high in April 2020.

Instead, the middle- and upper-income Americans accounted for much of the drop in consumer spending and increase in savings, which led to high demand following recovery from the pandemic.

As prices rose, inflation expectation also grew; the Fed’s slow response in tackling rising prices and the persistent high demand made it difficult for the Fed to bring down prices, leading inflation to stick around.

In the current scenario, although the savings accumulated during the first year of the pandemic have been on a decline, consumer spending is still supported by solid wage gains. This would mean that inflation is likely to remain “sticky” over the near future.

How Acuity Knowledge Partners can help

Global organisations and research houses leverage Acuity’s industry- and country-specific expertise to make sound strategic decisions. We set up dedicated teams of analysts and macro-level associates to support our clients in areas including macroeconomic research, industry profiling, financial analysis, econometric modelling, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

What's your view?

About the Author

Nitish has 5+ years of experience in Economic Analysis. He has previously worked with Mckinsey and Company. His expertise spans across data science and macroeconomic forecast, focusing on impact of micro and macro-economic activities on countries, globally. At Acuity Knowledge Partners he is part of the private equity team and specializes in Economic Research and Insights. Nitish has a M.Sc. in Healthcare Economics and Econometrics from Erasmus University, Rotterdam.

Like the way we think?

Next time we post something new, we'll send it to your inbox