Published on January 10, 2023 by Rohan Gupta

Scope of automation in document examination

The International Chamber of Commerce (ICC) set up a sub-committee in April 2020 to understand the developments in automating document checking within the trade finance space. It published a white paper based on these findings, classifying the level of automation on a scale of 0 to 5, with 0 being no automation and 5 being full automation. The levels of automation are progressive, and a level of 4 (high automation) was suggested – meaning the entire process will be automated, requiring human intervention only to handle exceptions.

Those engaged in document examination are, therefore, looking forward to reaping the benefits of artificial intelligence (AI). Despite numerous efforts to digitalise it, this highly skilled activity is still largely paper-intensive and a complicated process, with an estimated 4bn pages of trade-related documents in circulation.

In this paperless age, trade documents still rely on traditional courier systems that deliver large numbers of packages containing tens to hundreds of documents to banks for examination daily. These documents move from one hand to another, with the process starting way before entering a bank’s premises. The journey of one trade document involves many stakeholders, and the entire process would need to be digitalised or system-driven to make document examination a success.

To achieve a high level of automation in document examination, a collective effort is required from the point a document is initiated.

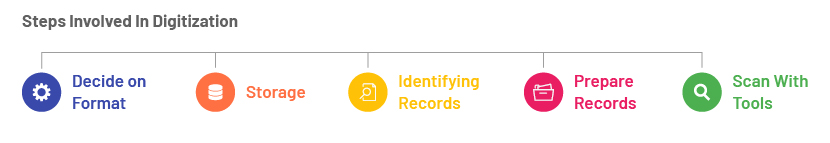

1. Digitisation and classification of documents

It is most important to improve the quality of the documents, and understand the formats of the different documents and standardise them to the extent possible to make them machine-readable.

2. Character recognition

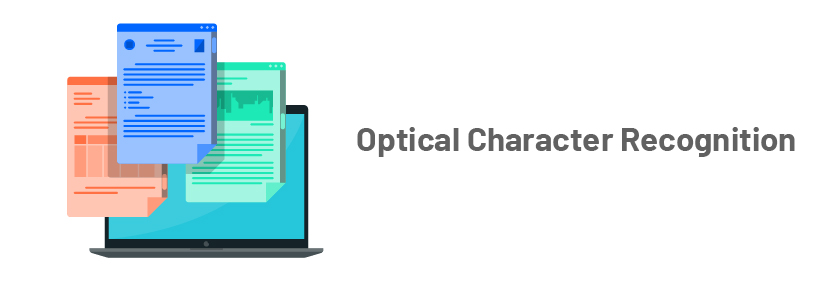

Machine-learning rules can be applied best once the text and data from these documents are extracted using optical character recognition (OCR), which would serve as a base for AI adoption. The success of AI depends on the accuracy of OCR capabilities.

3. Checks and validations

A number of compliance checks and validations such as AML, sanctions, OFAC and vessel checks may be conducted without manual intervention with the help of data extracted through OCR.

4. Data source

The accurately extracted data would serve as a valuable dataset for further activity, such as management analysis and preparing a robust management information system, which would help in strategic decision making.

Once the documents are fully digital, a bank could easily shift to an AI-based trade finance space; this would not only help the document checker focus more on intellectual tasks, but also eliminate the limitations of human vision. With trade guidelines, and compliance and organisation-specific checks embedded into the system, a human could work on the anomalies identified by the automated check instead of going through an entire set of documents. This would also save the checker’s time taken to compare large amounts of data in the documents against documentary credits, which leaves room for error and oversight. Due to its consistency, AI would make document checking more reliable, compared to a human who may often be distracted due to fatigue, mitigate the risk of regulatory non-compliance, handle a large chunk of operational activities and improve data quality.

Although there are significant benefits of going digital, there has been resistance to digitalising the checking of documents such as bills of lading and bills of exchange. Banks would not be able to resolve this issue on their own, but could take a different approach by focusing on improving current processes of current document examination. By engaging a highly skilled team, a bank could use its staff for more meaningful work.

The process of document checking is both an art and a science. Thanks to technological development, the science could be easily handled by machines, but the art of it would still require human involvement. Thus, although with the help of AI, the art of document checking can be transformed into a science to a certain extent, the role of document checker may not be replaced completely. Certified trade experts check documents against guidelines and conditions of LCs, and can assess risk in terms of areas such as compliance, AML and sanctions. This level of knowledge would also help banks communicate with their different stakeholders.

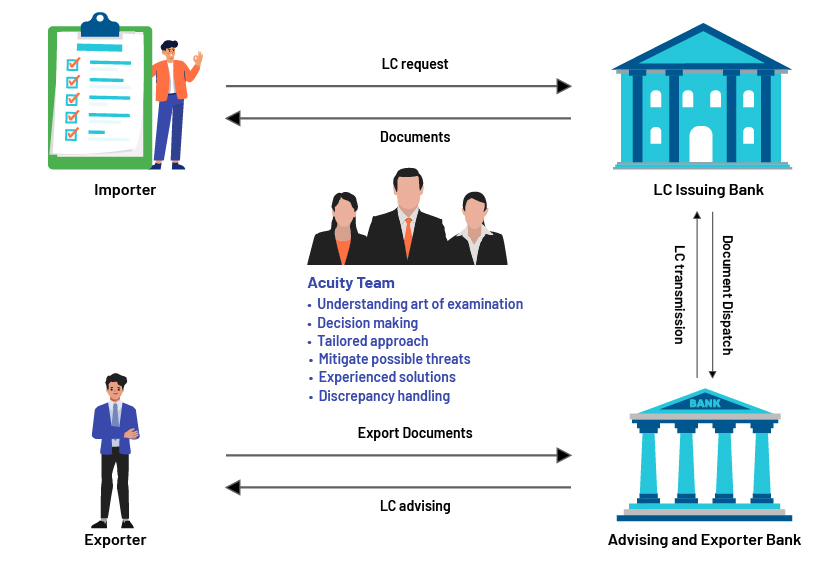

How Acuity Knowledge Partners can help

With more than 20 years of experience in serving our 350+ clients across the globe, we have extensive knowledge of supporting the banking sector and delivering in line with sector standards. Our team of certified document checkers keep themselves abreast of developments relating to trade-related guidelines and have hands-on experience in working with multiple trade platforms used by multiple banks. Our dedicated experts provide customised solutions to stakeholders within frameworks of protocol, ensuring quality and on-time delivery. Our offices follow the highest international standards in terms of data confidentiality while providing an array of services at low cost.

Sources:

ICC Global Survey on Trade Finance, Global Trade – Securing Future Growth, 2018

Tags:

What's your view?

About the Author

Rohan has 12+ years of experience in International Trade Finance, Treasury services & Liability operations. Apart from end-to-end trade finance deliverables, he has been part of many trade operations projects and processes where he was responsible for carrying out pilots, developing SOPs, and setting up teams for final delivery. Rohan is a commerce graduate with an MBA in Finance from Lal Bahadur Shastri Institute of Management, Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox