Published on April 28, 2020 by Jalaj Jonker

Surprise or “black-swan” events have a significant impact on economies and financial markets. The COVID-19 outbreak has, in addition, exposed the social fabric through the global lockdowns, resulting in a shift in behaviour that to a large extent impacts the “what” and “how” of financial transactions (i.e., what we buy and how we pay). This poses unique challenges to anti-money laundering (AML) teams of financial institutions (FIs). The industry has historically been plagued with large volumes of alerts that end up being false positives. One of the reasons for this is inefficient model settings; this problem is now compounded, as current settings do not correctly capture changes in behaviour (either micro or macro). (E.g. customer now withdraws more cash in fear of rundown at banks and starts spending in cash versus previous using the non-cash channels.) We also need to understand that changing settings will not be a one-time activity; it needs to be dynamic. The global response to the pandemic is changing daily, and individual behaviour will likely change with each response. (E.g. Surge in spending immediately after end of lockdowns, on certain services which were important but not essential, like saloons). Hence, FIs would need to constantly reconfigure the models to ensure there is no spike in false positives and they do not miss out on “true” suspicious reports.

The current models are rules-based and designed to factor in three input parameters: (1) segmentation, (2) threshold and scoring and (3) business logic.

Let’s discuss these parameters one by one:

Segmentation

It helps identify the correct group of customers who must be considered and who must be filtered out for any given business. In the current circumstances, we understand there will be unprecedented variations in the segments. However, looking at current lockdown trends and transactional behaviour of customers in countries where COVID-19 started, we can ascertain which segments will likely be the most impacted. Retail segments will probably have the most variations in terms of transaction behaviour, be it, for example, the actual value of transactions made, channels used for transaction or sub-groups in retail segments opting for online payment channels. We could also infer that small- and medium-scale businesses – such as restaurants, bars, pubs and construction businesses – will experience a substantial reduction in revenue. Hence, we can consider the following to beef up our segmentation, as required.

i) Segregate the segmentation into smaller groups that have possible deviations from previously defined groups

ii) Identify new segments thus obtained to be filtered out from unnecessary processing and alert generation

Thresholds and scoring

These apparently work as filtering and validation criteria for advancing the transactions for business logic validation. Not only would these have to be recalculated for existing models, but new values will be required for the new segments. For threshold and scoring calibration, we need to perform the following:

i) Understand the changes in transactional behaviour

ii) Recalibrate thresholds and scoring for the sub-groups based on these findings

iii) Synchronise the thresholds and scoring scales

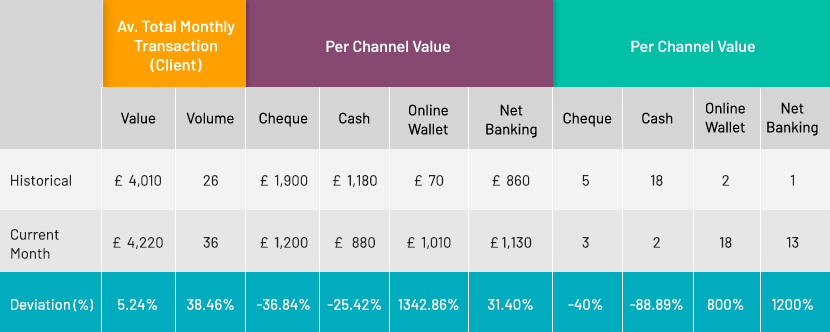

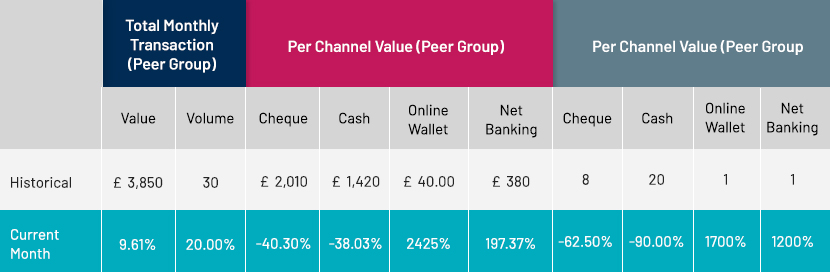

Let us consider an example of historical behavior deviation for retail segment, here the model considers the following:-

a) deviations in client’s behavior w.r.t client’s own historical profile– in terms of value and volume

b) deviations in client’s behavior w.r.t client’s own historical profile – in terms of value per channel and volume per channel

c) deviations in client’s behavior w.r.t peer group profile – in terms of value and volume

d) deviations in client’s behavior w.r.t peer group profile – in terms of value per channel and volume per channel

We have the data for client’s historical profile, peer group profile and current month’s behavior for an account belonging to a senior citizen and client’s transaction behaviour is mentioned below;

Clearly, some deviations are well beyond normal ranges however, can be explained because of-

-

excessive purchasing/buying of the utilities hence rise in the monthly expense value and volume

-

extensively using the digital payment methods for payments

Based on the observations thresholds calibration and optimization should be done at the earliest to avoid large number of false positives.

Business logic

Business logic is the core of the model that flags suspicious transactions. It should not be altered but should be validated to identify and understand the following:

i) Which models should/should not be used for the identified new segments and sub-segments?

ii) As per the risk assessment and historical data, identify the transactional behaviour that may result in a majority of the false positive cases

iii) The need to focus more on models that show a deviation of behaviour rather than on fixed-value models, to detect suspicious activity

These technical challenges will constrain teams, more so when they are working remotely, impacting their efficiency. The need of the hour is to pool resources and technology to find a solution to the current framework. Will COVID-19 push FIs to embrace artificial intelligence / machine learning as the alternative? Will this be the moment that redefines the AML space?

We at Acuity have experts across AML domain, AML Analytics and Data Sciences, which can work closely with the client teams in not only addressing the short terms goals of re-configuring the models but conceptualize and implement next gen solutions within the AML regime.

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business around the world. Businesses will need to be agile to adapt to this new normal of business as they rethink their strategy for 2020.

Here is where Acuity Knowledge Partners can help you navigate through these challenging times. Our global offices can enable you to handle business demand and uncertainties with ease. Currently, we are helping many of our clients with our understanding of the market to chart their 2020 strategy.

To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought leadership content and action oriented guides and best practices.

Tags:

What's your view?

About the Author

Jalaj heads the Compliance Analytics team, with experience in anti-money laundering, customer due diligence, and market abuse prevention. He has worked in the areas of compliance, trading surveillance, and financial crime and information security and risk analytics. He holds a Bachelor of Engineering (Hons.) degree in Electronics and Communication.

Like the way we think?

Next time we post something new, we'll send it to your inbox