Published on May 10, 2024 by Viral Shah

The past year was challenging for the US banking sector, mainly due to rising interest rates to curb inflation. Three regional banks – Silicon Valley Bank, Signature Bank and First Republic Bank – collapsed. Following this turbulence, interest rate cuts and their impact on US banks will likely be a key theme in 2024, with the US Federal Reserve (Fed) making significant rate cuts on the back of slowing inflation towards the end of 2023.

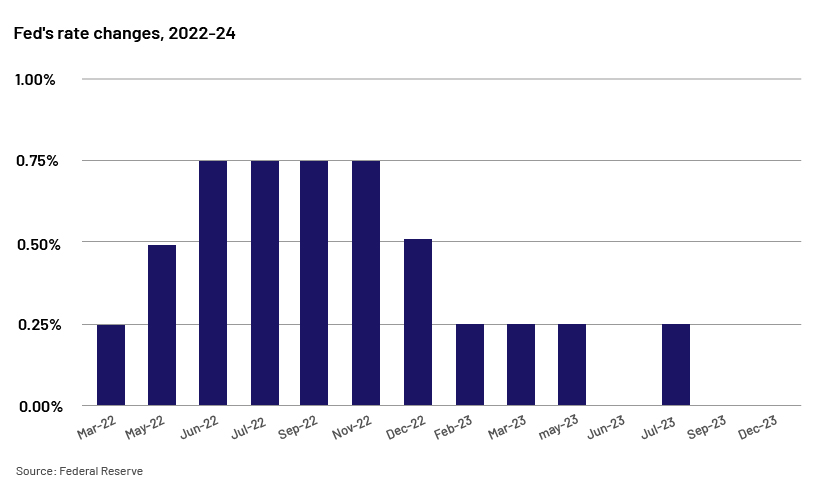

Interest rate hikes so far:

To control inflation, the Fed started raising the interest rate, an effective tool for reducing consumer spending and price increases. It raised the benchmark rate 11 times – from a low of 0.25-0.50% before 1Q FY22 to 5.25-5.5% — the fastest monetary tightening cycle since the 1980s, bringing it to the highest level in 22 years.

Rate-cut expectations in 2024:

The steep increase in the interest rate helped the Fed reduce inflation – to 3.1% in January 2024 from a high of 9.1% in June 2022 – although higher than forecast and above the Fed's target of 2%. The market expects three rate cuts in 2024, down from the previous expectation in December 2023 of six rate cuts.

Will US banks benefit from interest rate cuts in 2024?

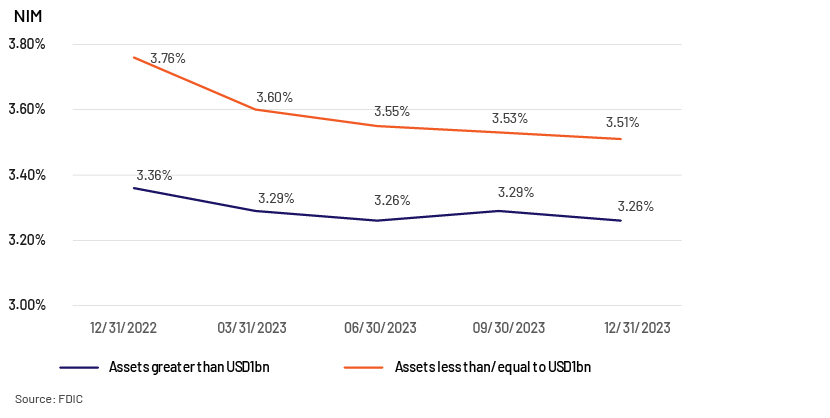

Compressed margins

Banks’ net interest margins (NIMs) were compressed in the past one year due to the increased rates and intensifying competition for deposits from digital banks. Even if the Fed cuts rates, NIMs would be affected adversely by lower loan volumes and higher funding costs. Analysts project a fall in NIMs for 16 of the 20 largest US banks in 2024, with a median decline of 14bps, according to S&P Global Market Intelligence data.

Even if the Fed cuts rates, NIMs would be affected adversely by lower loan volumes and higher funding costs. Analysts project a fall in NIMs for 16 of the 20 largest US banks in 2024, with a median decline of 14bps, according to S&P Global Market Intelligence data.

-

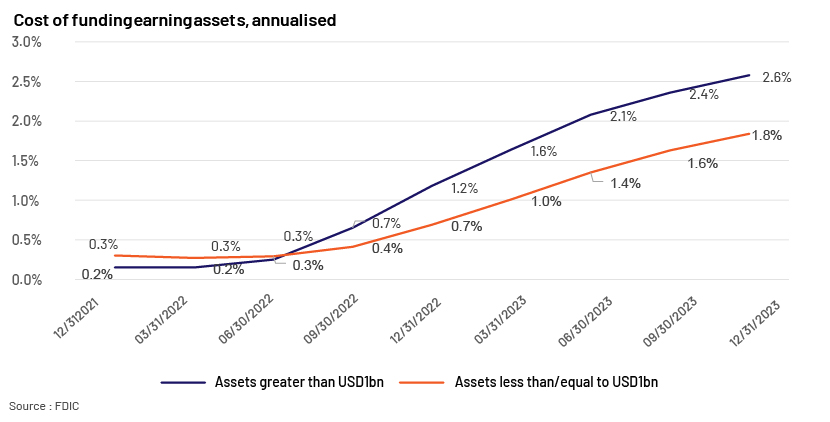

Higher funding costs: US banks’ costs of funding have risen due to the steep rise in interest rates. Costs rose to 2.58% of total costs as of 4Q23 from a low of 0.15% as of 1Q22 for banks with assets worth more than USD1bn and to 1.84% from 0.30% for those with assets worth less than/equal to USD1bn.

Interest rates are likely to decline in the second half of 2024. In the current high interest rate environment, funding costs would remain high as deposit beta catches up. In addition, due to high competition for deposits and customer expectation of higher yield, US banks would continue to offer deposits at high rates to retain customers and bolster liquidity.

-

Modest loan growth: Given subdued economic growth and high borrowing costs, loan growth is likely to be modest or decline. Many banks have tightened credit policies and would continue with conservative underwriting standards due to an unfavourable economic outlook and a likely deterioration in credit quality and collateral values on the back of high interest rates.

Credit risks remain elevated, leading to higher provisions

-

Credit quality is likely to deteriorate amid unfavourable macroeconomic conditions and higher interest rates for longer, reducing customers’ ability to pay off debt and weighing on corporates’ repayment capacity. Many banks increased provisions for anticipated credit defaults. Provisions for loan losses of the top 18 US banks surged by around 27% q/q in 4Q23.

-

Sluggish economic growth and higher interest rates, coupled with falling property prices due to weak demand for office space, impacted the commercial real estate (CRE) sector and pushed delinquency rates higher in 2023. The CRE loan delinquency rate rose to 4.5% in December 2023 from 2.9% in January 2023, according to Trepp. Rising delinquency in the CRE sector heightens asset quality-related risks for banks, particularly for regional and small banks, which are more exposed to office property, according to research from JPMorgan and Citigroup. Rating agencies expect stress in the CRE sector to continue to increase in 2024 and weigh on banks’ asset quality, even as the Fed starts reducing interest rates.

Decline in unrealised losses. US banks reported large unrealised losses on their investment securities in 2023 because of the high interest rate environment. Although unrealised losses on securities of institutions insured by the Federal Deposit Insurance Corporation (FDIC) declined by USD206.3bn (30.2%) q/q to USD477.6bn in 4Q23, they remain significant. Bond prices are inversely related to the interest rate. As the Fed moves towards easing monetary policy, these losses would decline in the coming periods on the back of a recovery in bond prices, reducing liquidity and capital risks.

Proposed risk framework (Basel III Endgame) relating to unrealised losses on AFS investments/balance sheet optimisation

US federal banking regulators proposed a new risk-capital framework (also known as Basel III Endgame) to improve the strength and resilience of the US banking system. This new rule will impact the regulatory capital frameworks of banks with more than USD100bn in assets (about 36 banks) and smaller banks engaged in significant trading activity. Accordingly, all large banks would have to account for unrealised losses on available-for-sale (AFS) securities in their capital ratios. The regulators estimate that the changes recently proposed by the Fed will result in a c.16% increase in CET1 capital levels and a c.20% increase in risk-weighted assets (RWAs) of large bank-holding companies. However, some regional banks not engaged in much trading activity estimate a modest increase in their RWAs (e.g., PNC Financial has stated that Basel Endgame would increase its RWAs by 3-4%). In addition, banks would need to further increase their total loss-absorbing capacity (TLAC). This proposed regulation may require large regional banks to issue more TLAC-eligible debt, leading to increased funding costs.

Conclusion

Higher funding costs, coupled with modest loan growth and expectation of higher loan losses, would put pressure on banks’ profitability in 2024. Moreover, to meet the requirements under Basel III Endgame, banks will likely preserve capital by reducing or exiting businesses that require higher amounts of capital, such as unsecured lending and trading activities. Such efforts would lead to lower profitability and subdued loan growth to reduce RWAs. Having more sources of non-interest income/different business lines and cost-control measures may help banks offset the shortfall in net interest income and improve profitability.

Sources:

-

Change in interest rates – https://www.federalreserve.gov/monetarypolicy/openmarket.htm

-

Inflation data – https://ycharts.com/indicators/us_inflation_rate#:

-

https://finance.yahoo.com/news/wall-street-is-pushing-back-its-interest-rate-cut-hopes-

-

https://www.marex.com/news/2024/03/the-basel-iii-endgame-a-new-era-for-non-banks-in-the-financial-

-

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Tags:

What's your view?

About the Author

Viral has over 17 years of experience in credit risk assessment and investment banking research. At Acuity, he manages a financial institution team handling North America and LatAm portfolio of a Paris based bank. Previously, he worked for multiple Acuity clients including one of the largest US Investment Banks, and UK and European commercial banks. He has extensive experience in credit risk analysis of FIG counterparties. Viral holds a Master’s in Financial Analysis from ICFAI University and a Master of Commerce from Gujarat University.

Like the way we think?

Next time we post something new, we'll send it to your inbox