Introduction

Introduction

The asset management sector is at a crucial juncture. Shrinking fees, increasing market volatility, changing investor demand, rising regulatory pressure and a continued push for operational efficiency are compelling firms to adapt to a more dynamic and competitive landscape. AI offers asset managers a way of addressing these challenges, creating opportunities to optimise operations, improve client engagement and streamline risk and compliance systems. In this report, we explore the Asset Management Industry Outlook for 2025, focusing on how AI might assist firms as they navigate these challenges and prepare themselves for long-term success.

The report also examines the role of knowledge process outsourcing, particularly for midsize firms, as a low-cost, low-risk and high-speed strategy in driving AI adoption and building agile and scalable operating frameworks. Aided by an analysis of potential opportunities and risks, this paper provides insights and strategies for asset managers to steer through the complexities of the future, ensuring they remain competitive and agile in an evolving market.

Key Takeaways

AI as a strategic enabler: AI may deliver efficiency, agility and competitive advantage across the asset management sector. Combining AI with human expertise and sound strategic planning will maximise these benefits.

Sustained structural challenges: Fee compression, increasing market volatility, evolving client expectations and regulatory complexity will continue to challenge asset managers, especially midsize firms. Navigating these challenges will require adaptive and resilient business models.

Outsourcing as a low-hanging fruit: Strategic outsourcing, especially in knowledge-intensive processes, is an essential solution offering a high-speed, low-risk and low-cost way of accessing specialised skills and technologies, optimising operational efficiencies and increasing focus on core competencies.

Advanced risk management: AI-driven risk and compliance frameworks will become essential for effectively managing increased market volatility and navigating a stringent regulatory landscape, shaping the asset management outlook for years to come.

Agility and scalability as differentiators: Firms will require agile and scalable operating models to adapt quickly to rapid industry changes and capitalise on emerging trends.

Challenges unique to midsize asset managers

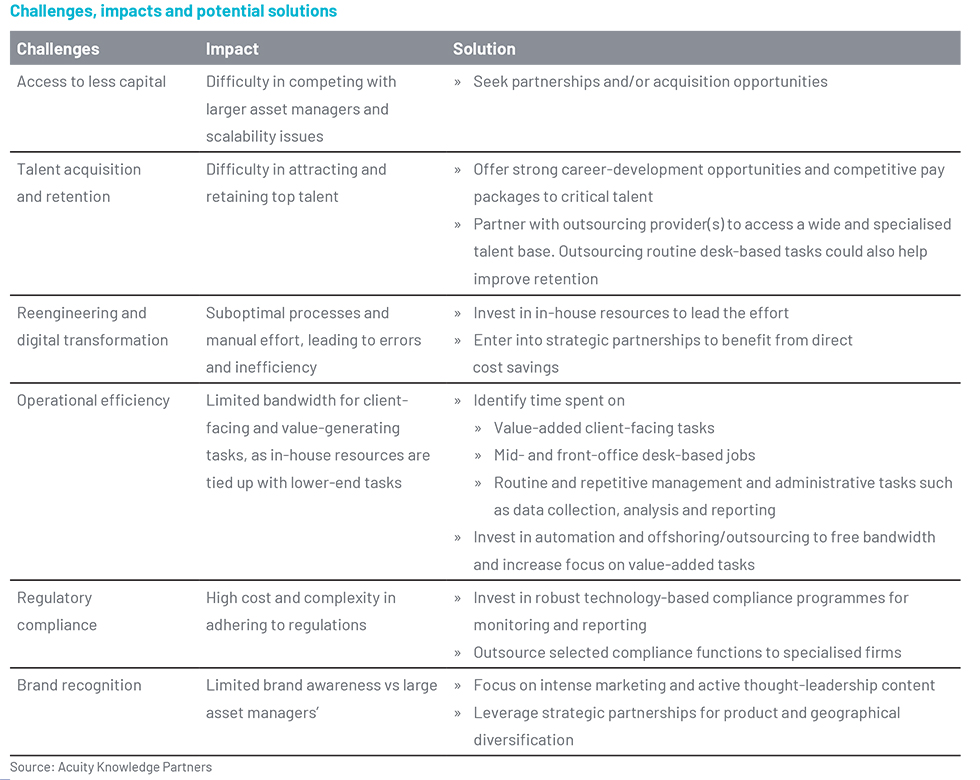

Midsize asset managers focused on active investing are more impacted by the structural challenges affecting the overall asset management sector. Rising costs, diminishing revenue pools and heightened capital investments required to maintain a competitive edge have been challenges in recent years. It is a rather gloomy outlook for many of these managers because of the lack of capital to undertake technological advancements or meet revenue and cost pressures, making them potential candidates for consolidation with larger players. Midsize firms are finding it increasingly difficult to attract and retain top talent; this has impacted portfolio performance against benchmarks. Similarly, their efforts to streamline operations have often run into low staff morale, impacting quality and client satisfaction. These trends would trap more and more midsize asset managers in a vicious cycle of attrition.

Can AI mitigate these challenges?

Embarking on an AI journey may enable asset managers to achieve sustained operational efficiency. AI offers tools through automation and improved data management, enhancing decision-making and cutting costs across functions.

AI’s potential as a transformative tool for the asset management sector is clear; however, it is not a silver bullet that can solve all challenges. AI-driven solutions would be a crucial part of strategies to enhance operational efficiency, improve client management and mitigate risk, particularly in the medium to long term. However, the limitations of these technologies cannot be ignored. For instance, AI systems are only as good as the data they are trained on. They may lack the subtlety of human judgement, ethical perspective and emotional intelligence in maintaining client relationships. Additionally, the brisk pace of technological advancement means that AI solutions require continued updates and refinements to remain relevant.

AI’s transformative potential is undeniable, but its effectiveness depends on data quality, human judgment, and relevancy in dynamic markets.

Role of outsourcing in easing structural challenges in the asset management sector

The rapid evolution of AI and the range of structural challenges faced by the asset management sector demand cutting-edge technologies, specialised expertise and significant investments in both personnel and infrastructure. This is especially true for midsize firms that may not have sufficient resources to invest heavily in these areas in a timely manner.

For them, outsourcing becomes an indispensable strategy. They can strategically integrate outsourcing to navigate their transformation journey through a low-risk, low-cost and high-speed path. Outsourcing enables these firms to access specialised skills and advanced technologies without the significant upfront investment required to develop these capabilities in-house. This strategy not only expedites the transformation journey but also ensures that these firms stay competitive and responsive to market changes without overstretching their financial and operational capabilities.

Conclusion

The asset management sector is at a crossroads, with a need for transformation due to structural challenges intensified by rapid advancement in AI technology. AI has the potential to transform the sector by offering powerful tools for enhanced operational efficiency, client engagement and risk management. However, most AI solutions will take significant time to perfect, in addition to the substantial investment required. Therefore, as we approach 2025, it is clear that AI alone is not sufficient. Successfully executing AI-oriented solutions will require an inclusive approach, combining talent development, strategic partnerships, robust governance and stronger data infrastructure. Future trends in asset management also emphasize the need for outsourcing as a complementary strategy to leverage AI effectively.

Outsourcing is a low-cost, low-risk, high-speed path to access specialised skills and cutting-edge technology across operations to respond to the complexities of AI integration and achieve greater efficiencies. Moreover, outsourcing enables firms to direct more resources to core activities such as investment strategy, product innovation and client relationship management, enhancing overall profitability and growth.