Introduction

Introduction

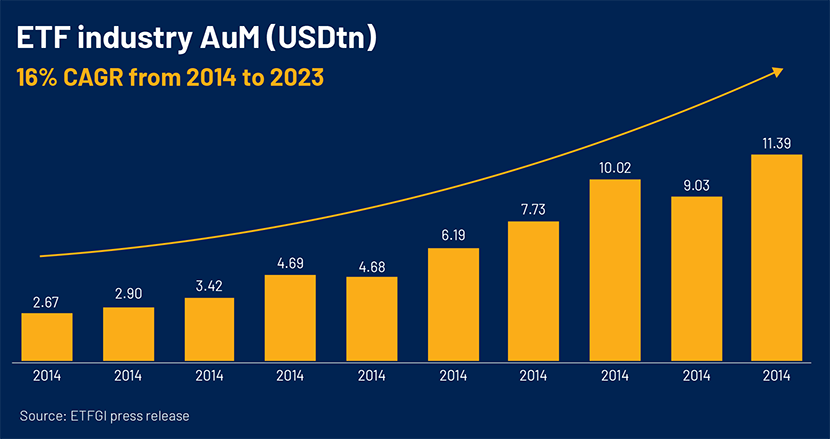

ETFs have demonstrated remarkable resilience and value over the past three decades, enduring market strength and stress. Offering investors diversification, flexibility and resilience in their portfolios, ETFs have proven their ability to deliver value across market cycles, making them particularly useful during volatile times.

ETFs have not only endured but thrived over the past decade. Up 26% from last year, the industry reached a colossal c.USD11.4tn in assets under management (AuM) as 2023 came to an end.

Where is the money flowing to?

The Americas were a leading market for ETF launches in the year ended December 2023, followed by Africa, with 48% and 25% y/y increases in the number of newly launched ETFs, respectively.

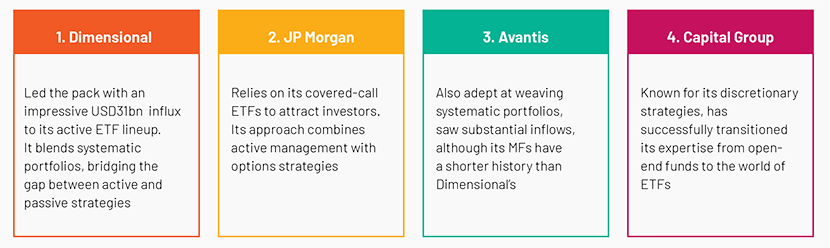

In the race for actively managed ETFs, four major providers emerged as frontrunners:

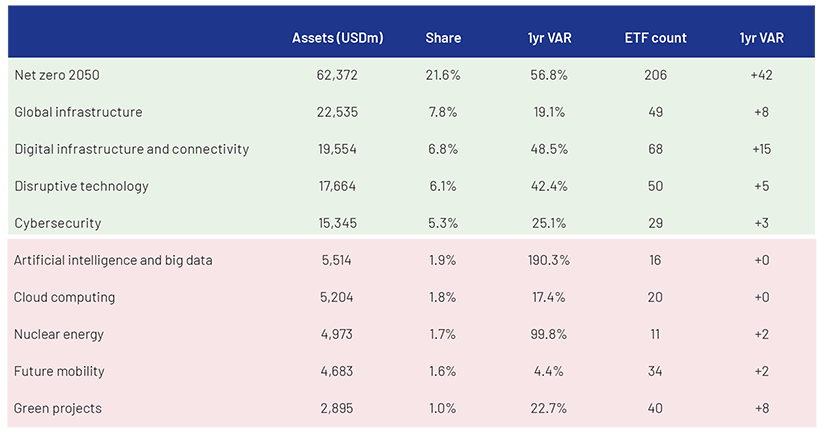

Themes that played out at the end of 2023

Conclusion

In 2023, investors displayed a strong interest in megatrends such as technology, innovation, environmental changes, demographic shifts, and rising urbanization. However, the investment strategies did not reflect these trends well, with these themes accounting for only a small percentage. Actively managed ETFs made a comeback, with record-high inflows, comprising ~22% of net flows.

Dive into the insights of our complete 2023 ETF landscape report to stay ahead of the curve, and unlock the power of informed decisions.