Introduction

Introduction

Economic downturns were the direct trigger for the unravelling of some well-known accounting scandals including Satyam (2009), Tyco (2002) and Parmalat (2003).

A forensic analyst’s role has gained prominence over the last decade as hedge funds and asset managers now turn to them for inputs to short positions and an extra layer of due diligence on investments since the surge in high-profile scandals has eroded the confidence in auditors. Forensic analysts are unaffected by the conflicts inherent in the issuer-pays business model (auditors being paid by the companies they audit) followed by auditors.

Acuity’s forensic analysts flag the following selected current trends for investors during a recession: — Business development companies (BDCs) in the US have direct investments in the debt issued by startups. Interest rate hikes coupled with credit scarcity is likely to trigger a multifold increase in the default risk of these investments and depress asset valuations.

Global economic slowdown

Rising interest rates have caused significant stress on US regional banks, with the fallout threatening to spread across the Atlantic. The embattled Swiss bank, Credit Suisse, has hit headlines yet again for all the wrong reasons. Accounting for held to maturity (HTM) investments is under scrutiny, and many are trying to comprehend why these were not at fair value in the first place? If history is anything to go by, the rise in interest rates could also force firms to manipulate numbers to protect their market value as well as avoid covenant breaches, interest rate escalation triggers and credit rating downgrades, which can make borrowing more difficult, increase interest costs and restrict borrowings under credit lines.

Key trends to watch out for during a downturn:

The following list prepared by Acuity’s forensic analysts shows some accounting red flag trends that could serve as catalysts for market corrections in the event of a global downturn

1. Companies exposed to cyclical industries:

A key factor that led to the collapse of SVB was its exposure to venture capital and startups. Nearly half of venture-backed tech and life sciences startups in the US banked with SVB and private equity and venture capital firms accounted for more than 50% of SVB’s loans in 2021. Similarly, there are other companies/sectors that are either directly exposed to a downturn or have investment accounting that is likely to fail the ‘smell’ test during a downturn. One example is BDCs in the US.

2. Relatively large companies audited by low-tier auditors tend to attract scrutiny

One of the more impactful findings in short seller Hindenburg’s report was that certain companies in the Adani Group were audited by lesser-known auditors. There does not seem a plausible explanation for why a massive conglomerate would employ auditors whose experience and capabilities seem limited. Our analysis indicates that compared with the top-listed companies in other EMs, use of services of non-big four audit firms as statutory auditors is much more common among India’s top companies. For instance, non-big four audit firms audited 15 of the top 50 companies in India, whereas all the top companies in Hong Kong and South Korea and most of the top companies in Japan, Indonesia and Malaysia were audited by big four audit firms.

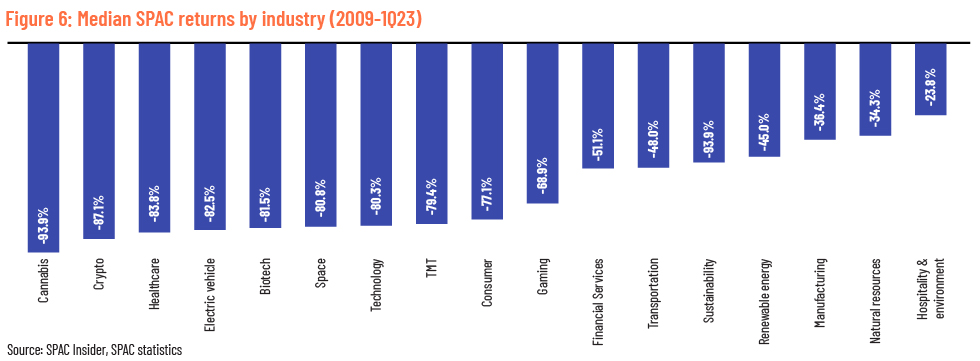

3. Surge in SPAC listings over 2020-22

The surge in SPAC listings during the pandemic years resulted in the listing of several companies with zero revenue, unproven business models, products or technology, and in some cases with no clear path to profitability at considerably high valuations (e.g., Joby aviation, Hyzon Motors Inc and Heliogen Inc). We see a trend of these companies increasingly running out of continued funding and throwing up red flags around their accounting choices, specially related to revenue and earnings accounting. These companies have also attracted close scrutiny by activist short sellers, mainly on their accounting and business issues (e.g., Clover Health Investments Corp, DraftKings Inc. and EVgo Inc). Although the SPAC listings have gone through a considerable correction in valuation over the last 12-18 months, opportunities still exist for the discerning investor with an appetite for deep due diligence on the financials of these companies.

How Acuity Knowledge Partners can help:

In this context, forensic analysis adds an extra layer of scrutiny. It inspects elements such as sustainable earnings, revenue and earnings aggression, valuation of assets and compliance with International financial reporting standards (IFRS) and generally accepted accounting principles in the United States (US GAAP). It provides the required assurance to asset managers keen on taking advantage of low valuations and/or taking short positions on stocks with correction potential. Our expertise also extends to hedge fund accounting services, helping clients navigate complex financial reporting and compliance requirements. A forensic analyst helps them get familiar with the accounting practices of those companies and spot any risks hidden in their financial statements.