Introduction

Introduction

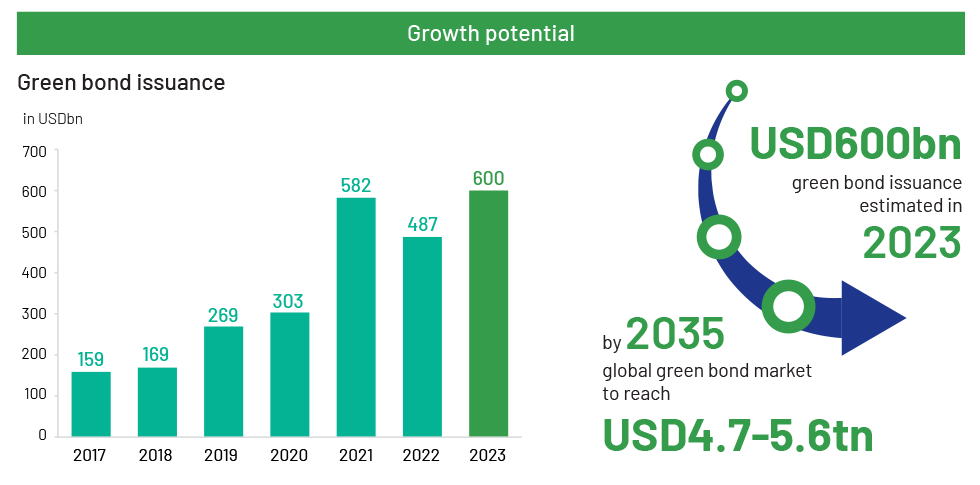

Green bond issuance is soaring and attracting large fund inflows. However, no two green bonds are the same; c.25% of green bond issuance fails to meet the Climate Bonds Initiative’s evaluation criteria and are, therefore, excluded from its database.

Portfolio managers’ capacity to conduct due diligence at the issuance level, capturing all relevant information, is critical to successful green bond investing. However, this is a tedious task, and most portfolio managers lack the resources and appropriate framework for such analysis of a large universe of green bonds.

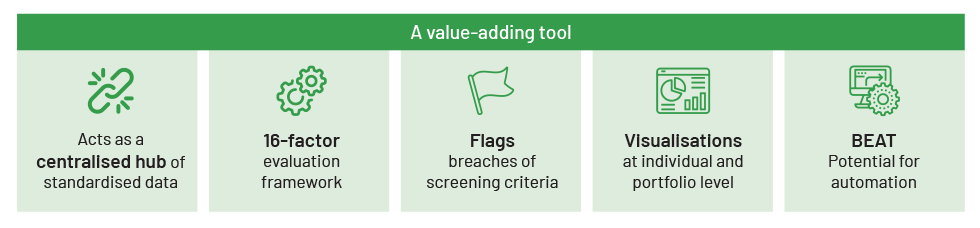

Acuity Knowledge Partners’ (Acuity’s) green bond analysis framework enables portfolio managers to overcome this challenge; it not only extracts all relevant information from multiple documents and presents it in a standardised format, but also analyses issuances using its 16-factor rating framework to make comparison of issuances comprehensive, fast and dynamic.

Acuity’s framework helps portfolio managers conduct deep due diligence of a large universe of issuances within a short period of time, enabling them to achieve their sustainability objectives and generate alpha.

Leveraging Acuity’s solution

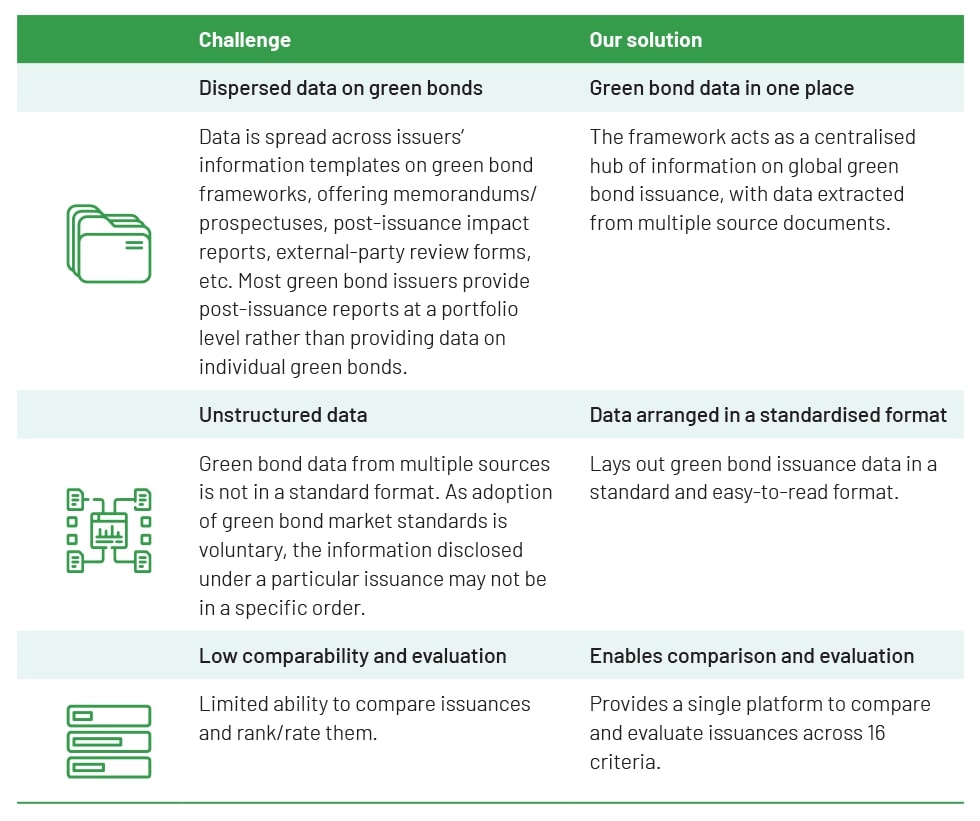

Acuity’s proprietary green bond analysis framework is a solution developed to overcome these challenges. It enables investors/asset managers to screen the green bond universe and build their investment portfolios. It also enables a comparative assessment of green bond offerings across 16 criteria under six categories.

Figure 1: Overcoming market challenges with Acuity's solution

Acuity’s green bond analysis framework

Acuity is the #1 provider of research, analytics, operations and technology services to 520 global financial institutions, equipped with an ESG practice providing customised and bespoke support to buy-side and sell-side clients across the ESG research value chain, including SDG research, analysis of ESG-linked credit instruments, ESG/SDG/greenwashing risk ratings, net zero alignment ratings, issuer engagement research and questionnaires, data science for ESG research and SFDR/EU Taxonomy disclosure preparation support.

Acuity’s proprietary green bond analysis framework is a robust and comprehensive tool designed to provide a thorough and objective evaluation of the performance of individual green bonds by screening and ranking green bonds based on a 16-criteria rating system. The framework is built on a central green bond database, where key information relating to global green bond issuance is stored in a standardised format. This database serves as the foundation for the analysis, providing a comprehensive repository of information on the green bond market.

Green bond scoring – evaluation categories

Alignment with market standards: The scoring system checks the alignment of green bonds with globally accepted market standards, including EU Taxonomy and those developed by international organisations such as the International Capital Market Association (ICMA) and the Climate Bonds Initiative. The alignment of green bonds with these market standards serves as a benchmark for verifying the green credentials of a bond.

External verification: Our evaluation checks whether the issuer’s green bond framework has been externally verified by a third-party entity. This involves an independent review of the issuer’s green bond framework to ensure it meets industry standards and is aligned with the use of proceeds. External verification improves credibility and transparency of the issuer’s green bond framework and assures investors that the funds raised through the green bond will be used in a way that aligns with the stated environmental goals.

Alignment with the issuer’s overall sustainability objectives: Alignment of the green bond issuance with the issuer’s overall sustainability objectives ensures the issuance is not merely a greenwashing exercise but is aimed genuinely at financing environmentally sustainable projects. Moreover, it helps establish a clear link between the issuer’s sustainability objectives and the specific green projects being funded, providing greater transparency and accountability in the use of funds.

Use of proceeds: The evaluation category assesses the use of proceeds from the bond issuance. This includes analysing how the funds raised will be allocated to finance specific green projects. The assessment looks at several sub-criteria including the split of proceeds between green capex and opex, whether the bonds will be used to refinance existing projects and how the use of proceeds aligns with UN SDGs. This helps ensure the funds raised are used to finance environmentally sustainable projects, assess the bond’s potential environmental impact and build investor confidence.

Relative environmental impact: Each green bond is assessed to determine the extent to which it meets the environmental objectives stated in the issuer’s green bond framework through its use of proceeds. Green projects are categorised as green buildings, clean water, clean transport, renewable energy and energy efficiency. We assess the environmental impact using an internal rating for each project category separately through the use of standardised metrics such as the level of carbon emissions mitigated. The overall internal rating for the green bond is derived as an average of the ratings assigned under each individual project category funded by the particular green bond. For green bond projects not covered under these project categories, an internal rating is assigned by referring to the assessments of external verifiers. Green bonds with alternative disclosures that are not considered in our internal rating methodology are rated based on the information available on a case-by-case basis. This internal rating provides a transparent, objective and comparable evaluation of a bond’s environmental impact.

Disclosures: The category aims to evaluate the level of transparency and accountability of the issuer in disclosing information on the use of proceeds and the environmental impact of the financed projects. The quality of disclosure is crucial for investors to make informed decisions and understand the actual impact of their investments. The sub-criteria used to evaluate this category are designed to ensure the issuer provides timely and accurate information on the green projects being financed, including the allocation of funds and any temporary use of proceeds.

Conclusion

Growing demand for green bonds necessitates transparent and standardised performance data to support investments in the sector. Existing sources of green bond analysis are insufficient in terms of data coverage and lack an opinion on what qualifies as “green”. These sources primarily act as data aggregators, lacking a method of evaluating green bond issuance.

With Acuity’s proprietary green bond analysis framework, users overcome these limitations and stand to benefit from comprehensive information, customisable screening tools and informative visualisations that will light the way to smarter green bond investments. Through a 16-criteria rating system, we offer a robust method for assessing the environmental impact of green bond investments that goes beyond data aggregation and provides valuable direction for investors.

Our analysis is complemented by insightful visualisations that present green bond assessments at both the bond and portfolio level. In addition, our screening process flags potential breaches of key criteria, highlighting concerns associated with specific green bond issuances, as investors continue to grow their green bond portfolio holdings.