Introduction

Executive summary

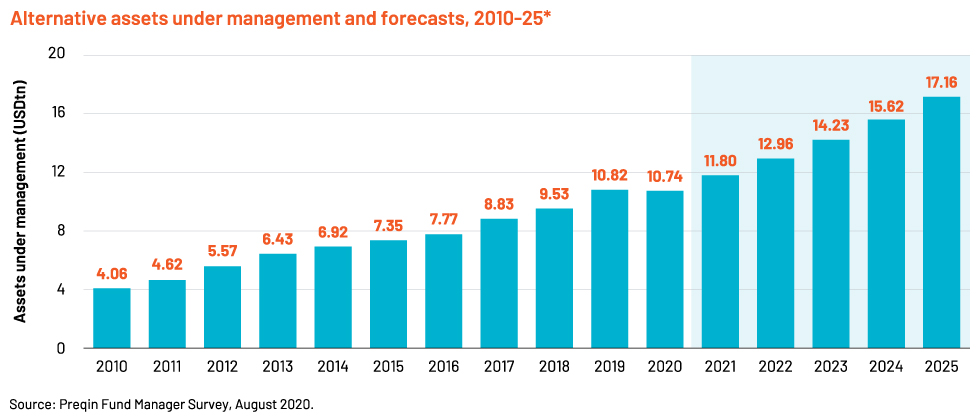

Alternative assets have grown rapidly in the past few decades, assets under management (AUM) are at record highs as both investors and fund managers interest in these asset classes have increased steadily over time because of the high yield they generate when compared to traditional assets. However due to their complex nature, the expertise needed to operate this type of investment is fundamentally challenging. This article outlines the key operating challenges – from the importance of streamlining operational tasks and increasing awareness of alternatives to talent management and the role of technology – and discusses how an outsourcing model can be leveraged to provide solutions.

Introduction

Alternative investment outlook – navigating the operating challenges and leveraging the outsourcing business model for a solution

The alternative asset segment, the new-age sibling of the traditional asset class, is trending in the news again, although it has been around for decades. It came into the spotlight in the 20th century, with venture capital the initial catalyst that drove rapid growth in the private markets in the 1960s and early 1970s. Private equity surpassed venture capital in the 1980s, followed by a boom in leveraged buyouts, and was included in the portfolios of conventional investors, laying the groundwork for the sector today.

In the current environment, traditional investors are looking at alternatives to diversify their portfolios with investments that are uncorrelated to the stock market, less volatile and generate strong returns. Thus, traditional asset managers are offering a number of private-market investment opportunities to clients looking for alternative sources of yield and different return streams. The historical outperformance of alternatives and lower returns from conventional assets such as fixed income are forcing investors to invest more in these assets. Prequin forecasts that

But does the current working model suit asset managers and investors perfectly while they attempt to grow their alternative investment segments? By nature, illiquid assets tend to be more complex than their liquid counterparts for the following reasons:

They have different trade life cycles

They offer less liquidity and operate more in private markets than in public ones

They operate in less efficient markets, where information is not readily available in public domains

Their performance is driven by managers rather than markets

Thus, The expertise needed to operate this type of investment, especially in areas like alternative investment data management and reporting, is fundamentally challenging and requires managers to be more vigilant while tapping the market on a best-effort basis.This article outlines the key operating challenges – from the importance of streamlining operational tasks and increasing awareness of alternatives to talent management and the role of technology – and discusses how an outsourcing model can be leveraged to provide solutions.

Key Challenges

Typical operating challenges in the alternative space

Fund management

Complex fund structure – In order to operate in a tax-efficient way, alternative funds often end up creating a complex fund structure. For example, the number of regulatory, tax and reporting obligations for US and non-US funds delays the fundraising process.

Increased diversification – Hedge fund and liquid alternative fund managers offer diverse private-market products as they take advantage of growing demand for illiquid assets. On the other hand, private equity managers are offering hybrid products – hedge or more liquid funds. Traditional asset managers are also looking to alternative products to offer greater diversification and risk-adjusted returns to investors.

However, broadening the product mix increases the responsibilities of a fund manager, making it challenging to focus on fund administration and operational infrastructure.

Data management

Unstructured data – Timely and accurate data is key to making investment decisions. Alternative investment data management is extremely challenging, as most of the data is unstructured and not updated regularly. Unlike traditional strategies that are liquid and where prices are available publicly, valuations of private asset classes are often driven by a manager’s outlook and could reflect an incorrect investment value. The current data model is, therefore, unsuitable for handling non-standard data, making onboarding private assets to the system a lengthy process.

Non-standard reporting – Although quarterly reporting is the standard reporting frequency for private equity and other alternative investment, hedge funds are an exception, with reporting frequencies ranging from annually and monthly to weekly.

Large investors demand customised reports with more information and require non-standard data streams to be developed in their reports. Even regulators, internal management and other stakeholders want complex information delivered faster than ever.

Technology

The challenge – “Big data” refers to large and complex datasets that cannot be managed by traditional software. Companies need to deploy advanced data analytics tools to analyse such data if they are to improve their decision-making skills. While hedge funds are already using such tools successfully, private equity firms still rely on traditional data reporting techniques; it is not unusual for private equity firms to rely on spreadsheets for data analysis. There is increased pressure from all stakeholders to transform digitally in areas such as deal sourcing, fundraising, fund operations, portfolio management, trade execution and investor reporting.

Talent management

Scarcity of SMEs – The alternative investment sector requires skilled professionals to handle the complexities of the underlying asset classes. The role of alternatives can be cryptic for both investors and asset managers as the market continues to evolve, rendering many asset classes obsolete while creating new opportunities elsewhere.

Service providers need to be highly skilled to screen and select those investments with the most growth potential. This requires in-depth knowledge of the sector, which is likely to perform well over a long investment period, and the ability to identify suitable times to buy and sell an investment.

Regulation and compliance

Increased regulation – In the past, alternative investments were subject to less regulations than other financial instruments. This changed with the Dodd-Frank Wall Street Reform and Consumer Protection Act and the EU Alternative Investment Fund Managers Directive (AIFMD), which increased regulations relating to the alternative asset management sector. The new rules are aimed at protecting investor interests through more transparency.

Lack of ESG-compliant funds – Environmental, social and governance (ESG) investing is gaining prominence in the alternative investment space. Socially responsible investing has also gained importance in recent years, and managers have to accommodate these requirements to attract investors. Limited partners are rejecting investments with ESG issues. Ethical considerations, investor demands and regulations are the main reasons for ESG investing moving to mainstream alternative investments.

Common concerns nowadays are whether, for example, funds are ESG-compliant. Sectors such as oil and gas have international standards and metrics in place to gauge whether a fund is compliant, but in other sectors, either the measurements are very complex or they do not exist.

Solution: Leveraging Outsourcing and Data Management Support

Outsourcing operations to low-cost countries is very common among traditional investment banks and has produced benefits for over a decade. Outsourcing is now also prevalent in the private equity sector, in an effort to reduce costs. Asset managers are considering outsourcing non-core functions such as financial reporting, fund accounting, tax reporting, portfolio monitoring and trade support functions to third-party vendors so they can focus on generating investor returns.

All operational aspects of fundraising such as capital calls, cashflow and capital contributions could be outsourced

Fund administration could also be outsourced to manage costs

Investment-related tasks that can be outsourced effectively include analysing industry and country reports and target company profiles, conducting target-company due diligence and financial modelling

It also makes sense to let a third party handle financial reporting such as compiling fund performance reports, which would result in unbiased reporting to investors

Meeting investor demands – This is one of the reasons fund managers are considering outsourcing. With fund structures and investment types more complex in the alternative investment space, outsourcing enables managers to focus on the fund itself rather than on administrative and back-office functions.

For example, institutional investors would receive monthly NAV reports from their hedge fund managers in the post, but this is no longer the case. Investors now demand more information and frequent reporting. While these expectations could be met internally, managers would eventually find it costly, especially if they have to upgrade their technology or infrastructure or hire additional manpower to meet increasing expectations.

Focus on core functions – Outsourcing support functions to outside partners would help fund managers focus more on the following:

Identifying investment opportunities

Performing research and delivering superior investment products

Investment analysis and selection

Monitoring valuations and performance

Generating strong returns for investors

Managing investor relations

Access to a wider talent pool – Asset managers and investors can have easy access to resources who will help with analysis and have the operational skills required to support back-office, middle-office and front-office functions. This would be a better option than hiring resources to perform non-revenue-generating activities.

The outsourcing services provider could, therefore, be a one-stop shop offering recruitment of the right talent, training and continuous learning to meet the ever-changing demands of the sector.

Data management – The alternative investment sector produces and consumes large amounts of data in the different phases of the trade lifecycle. Instead of managing this data internally, companies are partnering with service providers with expertise in managing voluminous and unstructured datasets using automated data collection and management techniques.

Partnership with a technology-driven firm – Instead of adopting intelligent automation tools in-house, which increases the overall cost, alternative investment firms find it profitable to collaborate with a partner that can provide these and other services at a lower cost.

For example, fund accounting used to be done on Excel. Now, complex datasets are run on specialist fund administration software that enables the data of fund structures to be tracked at each level and generates automated reports with the desired attributes and output. Implementation and maintenance of in-house technology and training staff on using it are time-consuming and costly. Hence, fund managers find it beneficial to partner with a third-party administrator.

Monitoring regulations and compliance – The regulatory landscape, operational governance and ESG practices continue to evolve, changing reporting obligations. Partnering with a firm with the required skills, knowledge and experience to monitor and interpret changing regulations is critical to ensure funds remain compliant.

For example, investors need to be on-boarded by fund administrators but only after meeting the region-specific regulatory requirements relating to KYC checks. There could be serious consequences if this goes wrong, making it critical to work with a partner with a strong compliance function.

Cost saving and economies of scale – Using a “centre of excellence” in a low-cost country results in large cost savings. This would translate into higher profits for fund managers and higher returns for investors.

Fund managers could also use the expertise and experience of third-party fund administrators that manage multiple funds for different clients around the world to leverage economies of scale.

Different time zones – Fund managers could take advantage of outsourcing to locations in different time zones so that critical work is completed faster and output is ready for clients at the start of their day. This creates a global network covering multiple time zones to support critical functions for 24 hours a day.

Conclusion: The Future of Alternative Investment Data Management and Outsourcing

Alternative asset management will undergo a drastic transformation in the years to come. The industry will become more segmented and narrow and provide sustainable growth. Increased standardization, closer relationships with fund manager, transparency in reporting and product innovation with financial engineering will offer higher profitability in the years ahead. The outsourcing model will continue to rise in popularity as this is no longer a luxury but rather a necessity and firms develop meaningful partnerships with this model.

Acuity’s Value proposition

How Acuity Knowledge Partners can help

Our Private Equity Consulting (PEC) team has a strong track record of providing a number of services including portfolio valuation, portfolio management, client reporting, trade support and fund accounting services to private equity (PE) and hedge funds and other PE verticals such as investor relations and business development.

We create tailor-made dynamic functions with a robust, responsive and proficient control framework to assist our clients in the different phases of the trade lifecycle. We also take adequate measures to ensure there is no leakage of confidential client information.

Fund structure – Our experts conduct due diligence to ensure a fund is set up correctly and in line with defined terms and conditions.

Fund formation – Our skilled professionals review legal documentation and ensure the fund is compliant.

Fund launch – We manage all back-office operations such as gathering information on investments, capital deployment, capital call notices, wire reconciliation and reporting requirements, freeing up client analysts’ time.

Fund closing – Validating client information, distribution notices and financial statements, and conducting additional closing process are the last steps in fund creation. Our tool-agnostic experience helps us handle these operations efficiently.

Our focus on research-driven insights, powered by an efficient talent pool, advanced technology and risk management expertise, has made us a trusted outsourcing partner in the alternative investment sector. We provide hedge fund research services, fund accounting services tailored to client-specific needs and ensure a high level of customer satisfaction. Our biggest strength is our talent pool who develop integrated operating models well suited to client needs.

Sources:

ey-how-to-achieve-agility-in-alternative-investments.pdf

The New Alts Manager: Expanding an Alts Strategy the Right Way for the Right Reasons

Alternative Asset management: The Current State and Way Ahead – Wipro

The Past, Present, and Future of the Alternative Assets Industry | Preqin

Why private equity firms get meaningful partnerships by outsourcing – Consero Global

The Advantages to Outsourcing Fund Management and Administration – PPB Capital Partners