Introduction

Introduction

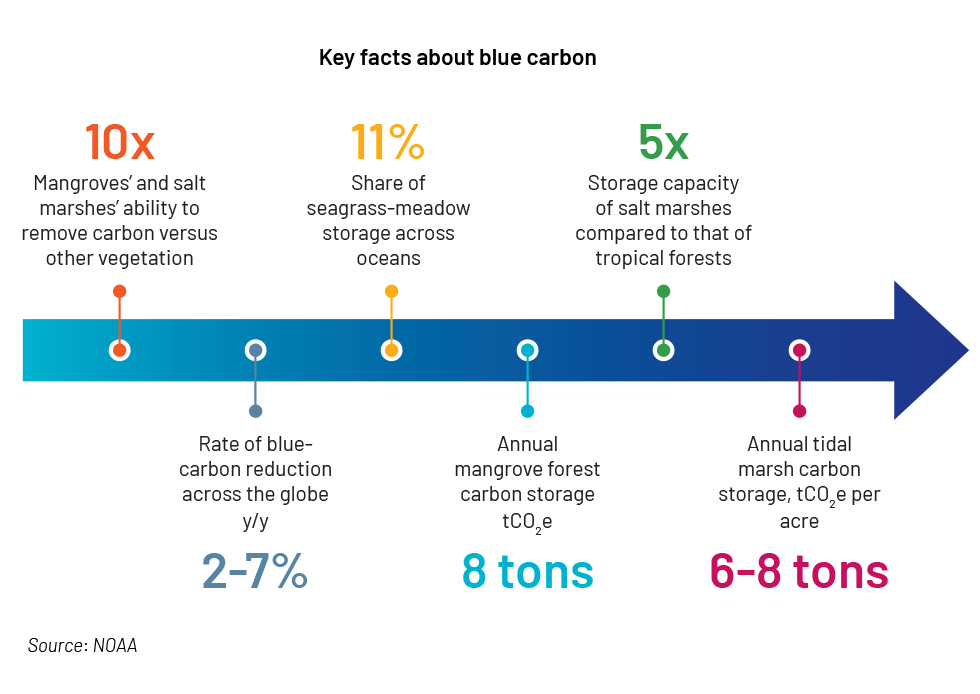

Climate change is challenging the planet but is being addressed, with natural ecosystems stabilizing habitats in the deep seas and on large landmasses. Flora and fauna help stabilize the deep seas by controlling facets of the ecosystem including marine life, the food chain and minerals and deposits on the ocean floor. Mangroves, tidal marshes and seagrass meadows, for example, help prevent the effects of climate change along coasts, including from downpours, rising sea levels and shoreline erosion, and control coastal water quality, protect the habitat of commercially valuable fishery resources and threatened marine species, and ensure nutrition security for coastal regions. Seagrass meadows, mangroves and salt marshes capture and store carbon, functioning as a carbon sink.

Evolution and significance of blue-carbon ecosystems

Climate change is endangering economies and accelerating the extinction of marine life and their ecosystems. Growing awareness of the serious effects of environmental harm on social and economic wellbeing, and human health and wellbeing, is creating a sense of urgency for change. In the years before and after the two world wars, industrialisation gathered pace to meet significant demand for infrastructure and resources. This, combined with global population growth, resulted in a loss of habitat along shorelines and coastal areas.

Key frameworks and initiatives supporting blue-carbon ecosystems

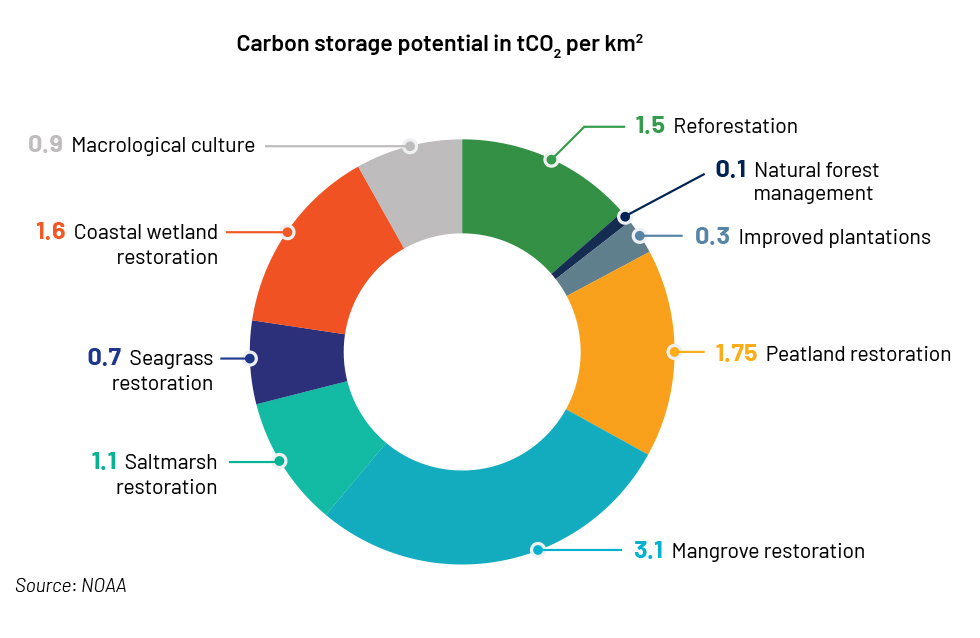

Forest preservation and restoration, and more recently, peatland restoration, have been acknowledged as crucial for mitigating climate change. Several countries are formulating laws and programmes to ensure ecological sustainability by reducing the carbon footprint that comes with economic expansion. These include measures to protect and promote sustainable natural systems essential to the United Nations Framework Convention on Climate Change (UNFCCC), for example, through the REDD+ framework and Nationally Determined Contributions (NDCs). These policies and scientific analysis mechanisms have been integrated across multiple levels of implementation and are taken up through specific platforms and multi-level initiatives. The International Union for Conservation of Nature (IUCN), Conservation International (CI) and the International Olympic Committee (IOC) jointly formed one such platform, called the Blue Carbon Initiative (BCI). This aims to create management strategies, financial incentives and regulatory frameworks to ensure the preservation, rehabilitation and self-sustaining use of shoreline blue-carbon ecosystems to provide an international forum for governmental organisations, non-governmental organisations, intergovernmental organisations and research organisations that aim to safeguard, sustainably manage and restore the world’s coastal blue-carbon ecosystems.

Trends in blue-carbon investment and financing

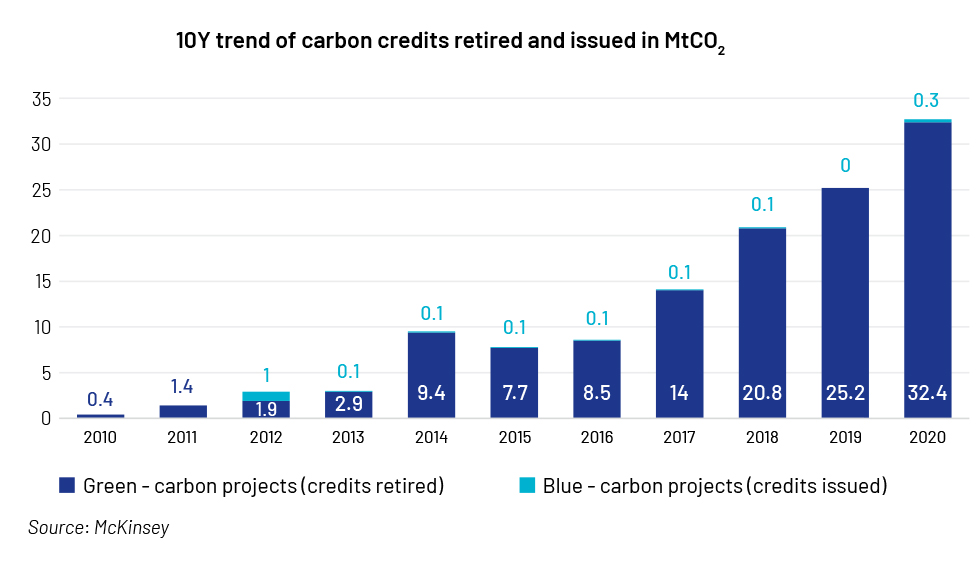

Seagrass meadows and mangroves are significant carbon sinks considered to be driving credit markets to start supplying carbon credits to international carbon markets. There is currently a gap in the scientific understanding of how different environmental factors affect the rate at which marine habitats absorb atmospheric carbon dioxide. According to scientific assessments, a credit equals one ton of emissions averted or eliminated from the atmosphere; this could lead to new investments as a collaborative effort towards saving these ecosystems from extinction or repairing damaged areas. Emitters in other nations can purchase credits from blue-carbon programmes or green-carbon projects such as projects to restore a forest to reduce carbon footprint.

Current investment by financial institutions in blue-carbon initiatives stems from a larger mismatch between operational capabilities and climate-related ambition.

Many banks and investors outside of the top tier lack the strategy and ability to invest in a relatively marginal asset class. Compared to the effort needed, ticket sizes are frequently modest, and there is often a pricing disparity with more established technology. Financial institutions are racing to assess and include blue carbon into frameworks for portfolio allocation and to identify the knowledge resources that could help them navigate new markets to address these issues.

Representation of blue carbon at COP27

The inclusion of blue carbon and carbon sequestration in emission-reduction pathways has created a significant opportunity to strategically utilise these technologies as a long-term solution to rising CO2 emissions. However, this calls for defining the precise capacity of blue carbon and its habitats. At the most recently held annual Climate Change Conference (COP27) in Egypt, the International Atomic Energy Agency (IAEA) disclosed its presence in more than 30 countries through blue-carbon projects. The IAEA is collaborating with 12 nations just on the African continent to increase the capacity for blue carbon. It is educating experts and assisting in the creation of labs with the capacity to precisely assess carbon sequestration rates through this regional technical cooperation project.

How Acuity Knowledge Partners can help

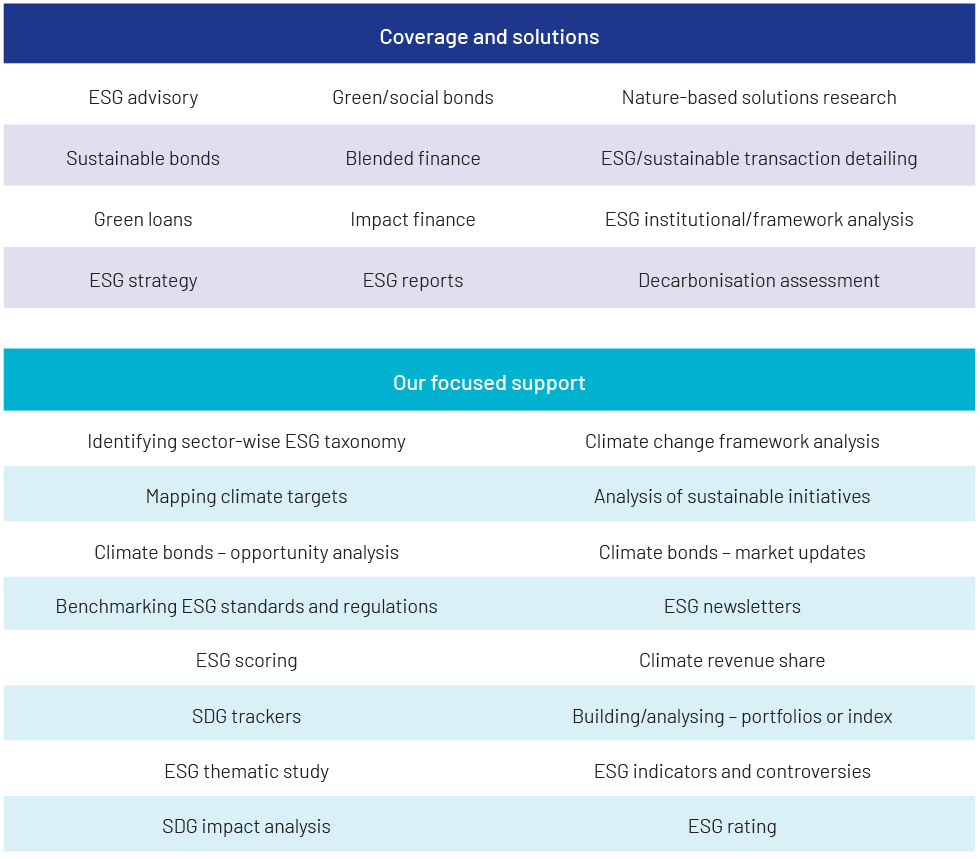

Our wide range of customised analysis and support covers the entire spectrum of financing products along the sustainable finance investment lifecycle and enables investment banks and advisory firms to establish and grow their sustainable finance practices:

We have ESG domain expertise and help banks ramp up their onshore verticals, focusing on incorporating ESG in client analysis, saving a significant amount of senior bankers’ time. We standardise templates and provide coverage across APAC, EMEA, the US and Sub-Saharan Africa.