Introduction

Executive summary

Global EV development can be traced back to the 19th century. The EV market is growing rapidly, driven by increasing concerns over climate change and the need for sustainable transportation. In recent decades, China has emerged as an EV leader. The rapid development of the EV industry in China is highly correlated to government policies to support and promote EV sales.

The intelligentisation trend in the EV industry has redefined the value proposition of vehicles. The adoption of technologies, such as autonomous driving and smart cockpit, improves the experience of EV users. The supply chain within China’s EV industry significantly localizes, ensuring a reduction in cost and minimising supply chain disruptions.

Industry Background

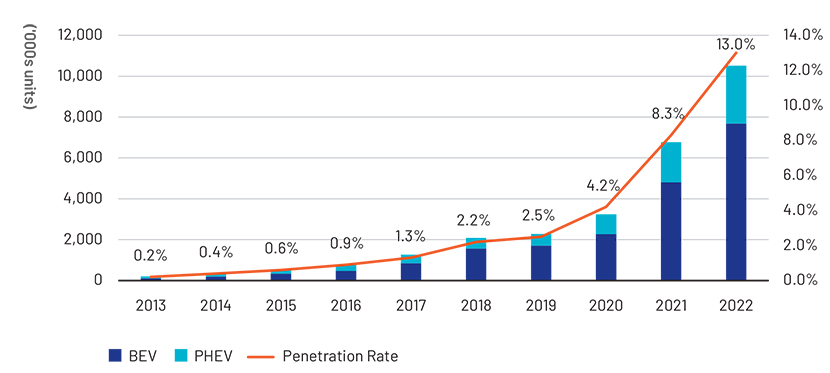

Recent developments: The first commercial plug-in electric vehicle (PHEV) was made available in the US in 2010. Over the next few years, other automakers started rolling out EVs in the US. Given the EV boom, the US government began to introduce regulations and provide financial support to develop the EV ecosystem. At the same time, the government introduced the Recovery Act to build charging infrastructure nationwide to help accelerate EV penetration throughout the country. Other countries have also taken initiatives in recent years, especially after the Paris Agreement, which stressed on a low-carbon economy in 2016. The global EV penetration rate in 2022 was 13.0%, clocking a sales volume of +57% YoY and a five-year CAGR of +58%.

Exhibit: Global BEV and PHEV sales and penetration rate

Value Chain and Bargaining Power of Suppliers

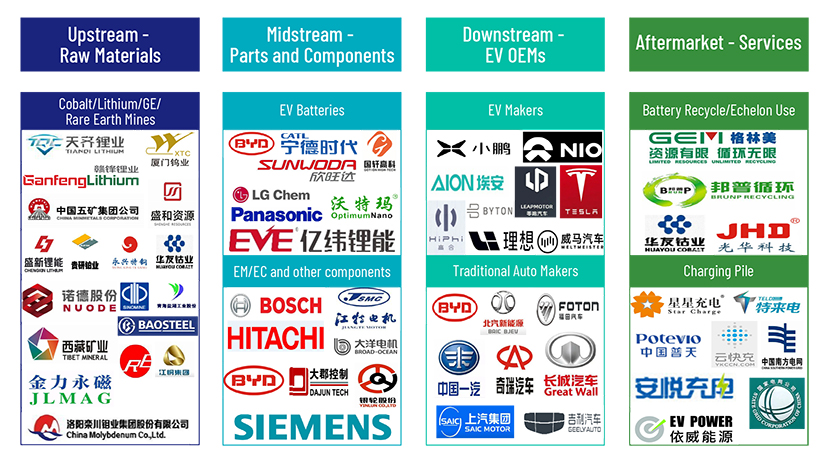

The EV value chain consists of all the processes and industries involved in production, distribution and consumption, which can be divided into four major segments: upstream segment (mineral resources), midstream segment (components), downstream segment (EV OEMs) and aftermarket (EV services). The chart below shows the EV value chain and China’s major players in each industry.

Exhibit: EV value chain and major players in China

In the EV value chain, EV battery production accounts for the largest proportion of EV’s total production cost (approximately 40%), followed by cost of electric motors and electric controllers (20%). In total, EV battery, EM and EC account for about 60% of EV production cost.

Regulation Overview and Growth Driver Analysis

Government’s Purchase Subsidies: Phase 1: China has been implementing effective policies to promote NEVs and EVs since the launch of the ‘Ten Cities, One Thousand Vehicles Program’ in 2009. The programme aimed at the adoption of 1,000 NEVs (including commercial vehicles, buses and taxies) in each of the 10 cities over the next three years. However, the targets were not fully achieved by 2012, owing to technology constraints, limited model availability, lack of infrastructure, consumer attitude, etc.

Market Share and Competitive Landscape

Upbeat Consumer Demand on Government Support Measures: The Chinese government has introduced some NEV-industry-focused development plans and incentive measures as a major strategic mandate to achieve ‘peak CO2 emissions’ by 2030 and ‘carbon neutrality’ by 2060. In October 2021, the State Council of China set a target of increasing the proportion of incremental vehicles fuelled by new and clean energy to 40% by 2030 under the Action Plan for Carbon Dioxide Peaking Before 2030.

Read about Intelligentisation Trend to Create Competitive Advantages and Cost Reduction Throughout EV Value Chain Owing to Localisation here.

Market Share

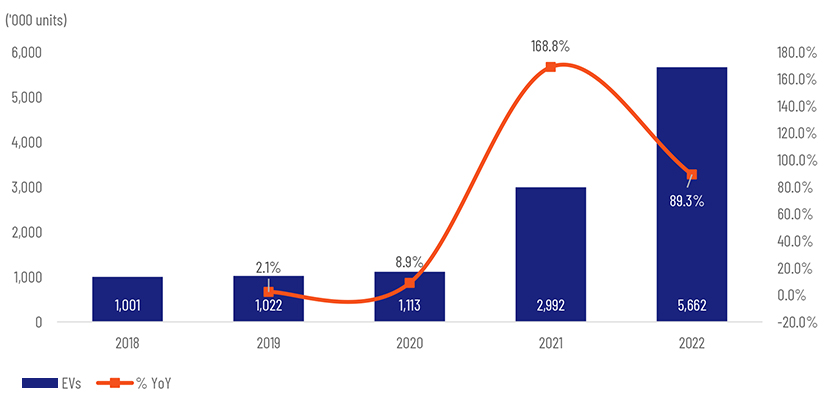

2018-2022 Sales Volume and Penetration Rate: China’s NEV sales have seen rapid growth, from 1.0mn units in 2018 to 5.7mn units in 2022. Thanks to effective market education in the early stage, NEV sales grew at a CAGR of 125% in 2020-2022, outpacing ICE vehicles’ -9% CAGR in the same period. Also, NEV penetration rate rose from 4.4% in 2018 and 5.7% in 2020 to 27.2% in 2022 before touching a record high of 37.8% in October 2023.

Exhibit: China NEV sales volume and YoY growth

Competitive Landscape

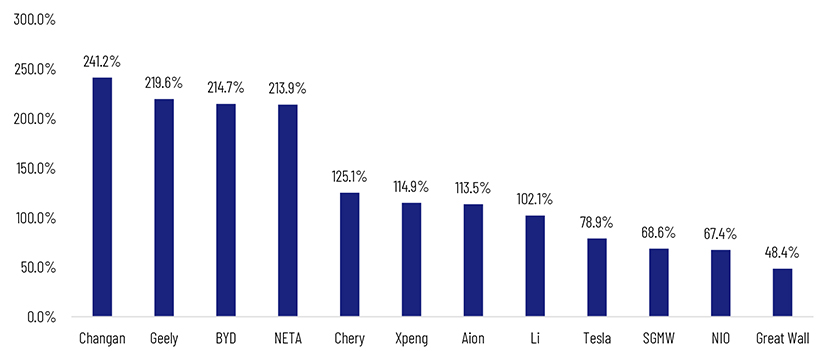

Domestic Competitive Landscape: Domestic EV brands can be categorised into traditional automakers (such as BYD, Geely, GAC Aion, SAIC, Chery and Changan) and new entrants (Tesla, NIO, Li, XPENG, NETA, etc.).

Traditional automakers have an edge in supply chain, technology and channels. Read more on them here.

Exhibit: Top 12 brands’ EV retail sales CAGR, 2020-2022

Emerging Opportunities

The EV industry is growing rapidly, as more consumers are turning to environment-friendly transportation methods. Emerging opportunities are creating new paths for growth and innovation. One such opportunity is EV battery charging, which includes both charging infrastructures and battery swapping. Charging infrastructures enable drivers to charge their EV batteries (at home, work place or public charging stations). Battery swapping is an efficient alternative, which allows drivers to exchange their depleted EV batteries for fully charged ones at designated stations. Another emerging opportunity is battery recycling, which includes cascade utilisation and disassembly recycling.

Conclusion

The comprehensive analysis of China's EV industry has revealed a dynamic and rapidly evolving sector that is poised to play a pivotal role in the global shift towards sustainable transportation.

The industry's background is rooted in the country's strategic push for innovation and environmental sustainability, which has been supported by a robust value chain.

Regulatory frameworks have been instrumental in shaping the industry, with government policies promoting EV adoption through subsidies and infrastructure development. The growth drivers of the industry are multifaceted, encompassing technological advancements, economic incentives, cost reduction due to localization and consumer awareness. These factors have contributed to a notable increase in market share for EVs within China, signaling a broader acceptance and integration of electric mobility solutions.