China’s fragile economic condition raises concern that deflationary pressure may persist, despite signs of stabilisation

Introduction

Introduction

While most major economies continue to struggle with stagflation, with low growth coupled with high inflation, China, the world’s second-largest economy, slipped into deflation in July. Deflationary pressure moderated in August, with the Consumer Price Index (CPI) rebounding from negative territory.

However, the CPI dipped 0.2% y/y in October, renewing concerns of increasing deflationary pressure, after being flat in September. Despite signs of an economic rebound, the economy remains fragile amid weak consumer demand and business activity and the property slump.

The Producer Price Index (PPI) dropped by 2.6% y/y, for a 13th consecutive month in October (-2.5% y/y in September vs -3.0% y/y in August, -4.4% y/y in July and -5.4% y/y in June), underlining continuing weakness in the industrial sector.

Drivers of China’s deflationary pressure

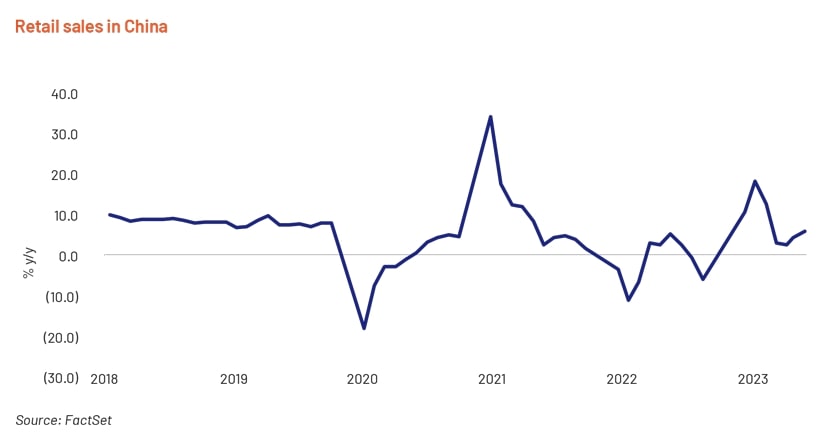

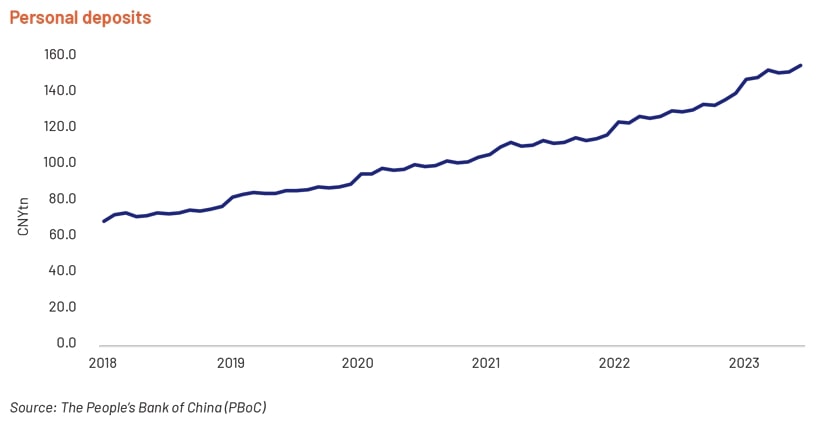

Weak consumer spending, with a high level of precautionary saving - China’s consumer spending remains weak with a gradual recovery in retail sales – growth of 5.5% y/y in September vs 4.6% y/y in August and 2.5% y/y in July, due to low consumer confidence, with growth below the pre-pandemic level (c.8% y/y in 2019). The household savings rate continued to grow, with the personal deposit base reaching CNY135.6tn in September, on a continued increase from CNY132.3tn in July. Tepid domestic demand is due to government policies aimed at supporting production and investment more than consumption, CNY weakness and economic headwinds due to weak business activity and high unemployment.

Real estate slump weighs heavily on the economy - China's property sales and investment posted double-digit declines as the government’s efforts to support big cities failed to bolster confidence in the sector. The decline in property sales by floor area narrowed to -19.8% y/y in September vs -24.0% y/y in August. However, property sales contracted at a higher rate of 7.5% y/y over 9M23 vs a 7.1% y/y decline over 8M23.

New construction starts measured by floor area dropped by 23.4% y/y in 9M23 vs -24.4% y/y in 8M23, suggesting that developers remain cautious amid muted demand.

Shattered consumer confidence resulted in a contraction in property investments by 18.7% y/y in September for a 19th consecutive month vs -19.1% y/y in August and -17.8% y/y in July. For 9M23, property investment declined by 9.1% y/y vs an 8.8% y/y drop in 8M23.

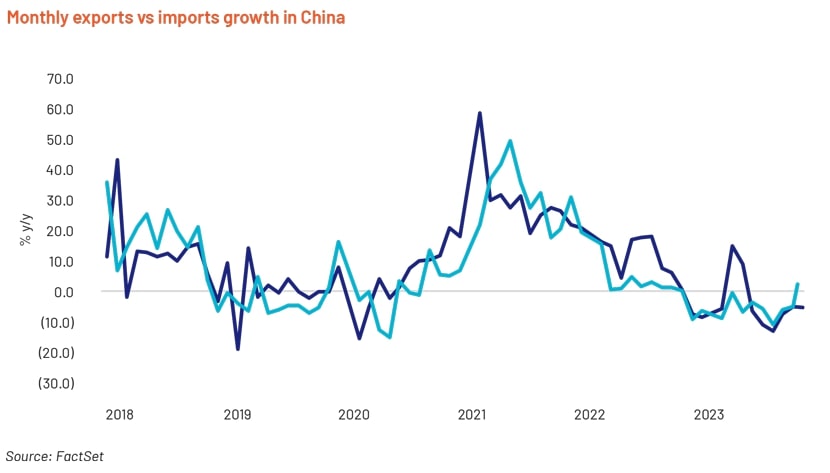

Trade slump has a long recovery pending – China’s trade balance deteriorated to USD56.5bn in October, after rising to USD77.7bn in September vs USD68.4bn in August. Exports fell by 6.4% y/y in October vs -6.2% y/y in September, -8.8% y/y in August and -14.5% y/y in July. Imports rose by 3.0% y/y in October, after slipping 6.2% y/y in September vs -7.3% y/y in August and -12.4% y/y in July. In addition, manufacturers have recently faced weakened orders from both domestic and overseas customers due to the war between Israel and Hamas, resulting in the manufacturing PMI falling to 49.5 in October.

How could China overcome deflationary risk?

The latest CPI suggests that the economy is still fragile, with deflationary pressure continuing, and we believe that ongoing policy support is needed maintain the recovery momentum.

Policymakers have rolled out targeted measures designed to boost demand; however, the stimulus has not been impactful enough to boost household income and reduce precautionary saving to drive a complete economic revival.

China plans to implement fiscal stimulus measures to support its economic recovery, relying on debt and state spending. The stimulus plan rolled out towards end-October aims to boost growth in competitive sectors such as advanced manufacturing and renewable energy as the government plans to replace previous economic drivers such as the property sector, while cautiously monitoring the debt level. China has announced plans to issue sovereign debt of CNY1tn in 4Q23 to support disaster recovery and construction.

The PBoC injected CNY289bn into the financial system via a one-year policy loan in mid-October, the largest amount of cash support since late 2020.

At its latest meeting, the PBoC kept its benchmark lending rates unchanged given the ongoing economic stabilisation. However, we cannot rule out further rate cuts given the persistent deflation risk.

How could deflationary pressure impact the economy?

Slowdown in economic growth - Deflationary pressure could lead to a major setback in China’s economy, as widespread price declines for goods and services could lead to a downward spiral of economic contraction, job losses and financial instability.

Inflated real burden of debt - Deflationary pressure is particularly risky for countries such as China with high debt burdens (debt to GDP at c.280%) since it adds to debt-servicing costs for borrowers and is likely to prompt them to reduce resource allocation for spending and investment. Deflation elevates the actual burden of debt, as the rising value of money makes fixed loan payments more expensive than other goods and services.

Negative demand cycle - Deflationary pressure could initiate a damaging cycle, with the anticipated price decrease prompting consumers to postpone purchases, leading to reduced demand, lower production and lower corporate profitability. Reduced profitability could lead to measures such as wage cuts, hiring freezes and layoffs, reducing consumer spending in an infinite loop. Reduced income results in deferred borrowing and investments, adding to deflationary pressure.

What is the likely impact on the rest of the world? China is the world's second-largest economy; it generated USD17.9tn in GDP in 2022. Hence, its economic health can influence global trade, investment flows and commodity prices.

Easing price pressure in other economies

Putting the global demand-supply balance at risk

Increasing competitive pressure in overseas markets

Conclusion

While China's economy is showing signs of stabilising, there are concerns over the sustainability of the recovery. The latest CPI slipping back into negative territory raises concern over the continued deflationary pressure.

Underlying issues such as the real estate crisis, weak consumer spending, weak business activity, the trade slump, elevated debt levels and an ageing population continue to weigh on the economy. Measures rolled out by the government have not been impactful enough and would take time to feed through to the wider economy. We believe that ongoing policy support is needed to maintain the recovery momentum given the fragile economic condition. The PBoC kept its benchmark lending rates unchanged at the latest fixing, given signs of economic stabilisation. Further monetary easing is also constrained by a weaker CNY, although we cannot rule out additional rate cuts.

We emphasise the importance of further fiscal stimulus and structural reforms focused on shifting the economy to consumer-led growth while driving urbanisation and addressing the real estate crisis. China does plan to implement fiscal stimulus measures to support its economic recovery, relying on debt and state spending, despite the already elevated debt levels. The stimulus plan rolled out towards end-October aims to boost growth in competitive sectors such as advanced manufacturing and renewable energy as the government plans to replace previous economic drivers such as the property sector, while cautiously monitoring the debt level. China has also announced plans to issue sovereign debt of CNY1tn in 4Q23 to support disaster recovery and construction. We believe that the recent measures are steps in the right direction for maintaining its economic recovery; however, further measures would be needed to control the prevailing deflationary pressure.