Introduction

Introduction

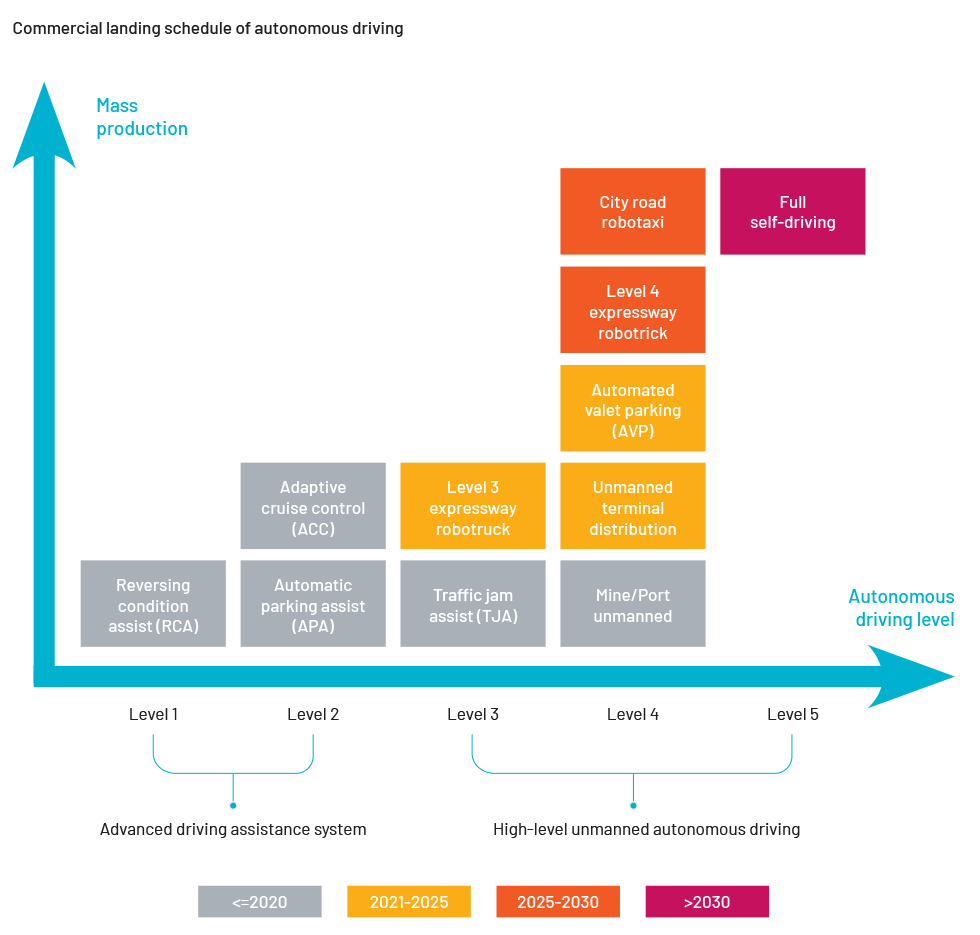

The Society of Automotive Engineers (SAE) defines six levels of driving automation ranging from 0 (fully manual) to 5 (fully autonomous). Most vehicles on the road today are Level 0, manually controlled. Levels 1 and 2 are the lower levels of automation, supported by automated systems such as for steering or accelerating. Level 3 is the technological upgrade of Level 1 and Level 2 that enables vehicles to detect the environment and make decisions. Level 4 is advanced autonomous driving: in most situations, the vehicle can drive itself, with only a few scenarios needing humans. Level 5 is the ultimate level of vehicle, which does not require any human intervention.

What is a “robotaxi”?

Autonomous driving technology is now being used in public manned transport. A robotaxi, also known as a self-driving taxi or driverless taxi, is an autonomous car (SAE automation Level 4 or 5) controlled by an autopilot system and operated for the ridesharing market.

The commercialisation timeline of the robotaxi

Level 3 refers to shared autonomy, a technological upgrade from Level 2, where some of the driving is done by the car. Vehicles with Level 4 autonomy are able to function completely autonomously in specific settings without the assistance or intervention of a human driver.

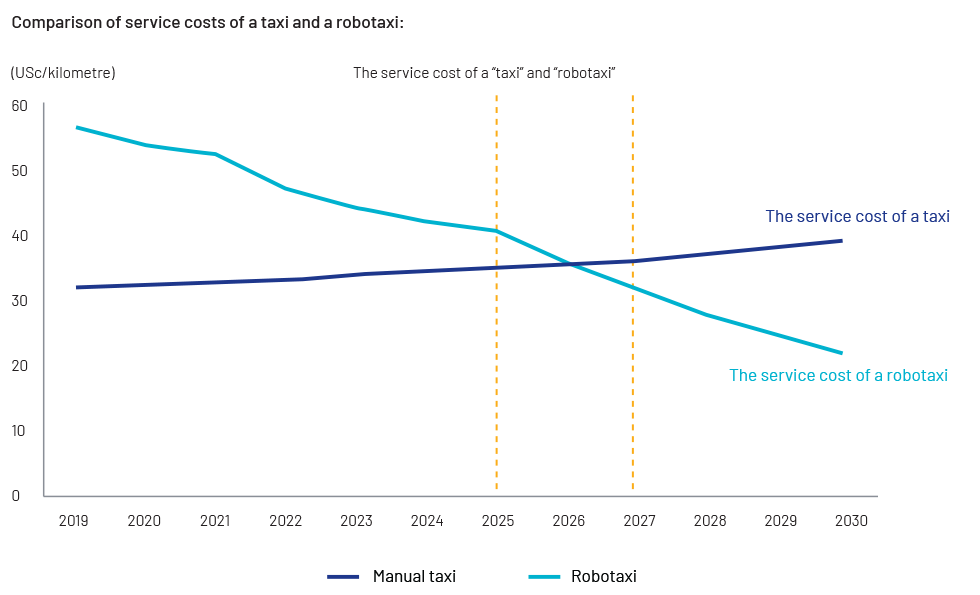

Level 3 highway conditional autopilot, Level 4 autonomous valet parking, mining area autopilot and unmanned terminal distribution are likely to be mass-produced before 2025. The Level 4 unmanned robotruck/robotaxi is expected to be commercialised over 2025-30:

Challenges in commercialising the robotaxi in China

Technological difficulties:

The robotaxi is a shared mode of mobility controlled by an autopilot system. It is difficult for current autonomous driving technology to ensure safe driving and provide sophisticated sensing systems and artificial intelligence chips for vehicles. The hardware and software, including vehicle operating systems, high-precision maps and positioning, and V2X vehicle-road cloud collaboration technology, face challenges in adapting to the various and complex traffic environments.

Cost of large-scale transformation:

The cost of building a robotaxi is still the largest capital investment in this sector. To ensure safe driving, redundant sensor systems, high-precision maps and autonomous driving kits needed to be installed in vehicles to assist with autonomous driving. The cost of such large-scale transformation directly increases the manufacturing cost and time cost of autonomous vehicles.

High operating costs:

Operating a robotaxi requires the support of a number of areas. In the effort to commercialise it, players such as robotaxi operating platforms, asset management companies and vehicle service operating platforms have invested in the robotaxi market to develop the model

How Acuity Knowledge Partners can help

As a leading knowledge process outsourcing service provider, we offer comprehensive sector coverage support to investment banks and advisory firms. We research a wide range of sectors globally and work with our clients to assess strategic opportunities. Our knowledge of the broader EV sector enables us to provide buy- and sell-side clients in the EV and autonomous-driving sectors with tailor-made solutions and fundamental research and analysis across developed and emerging markets.