Introduction

Introduction

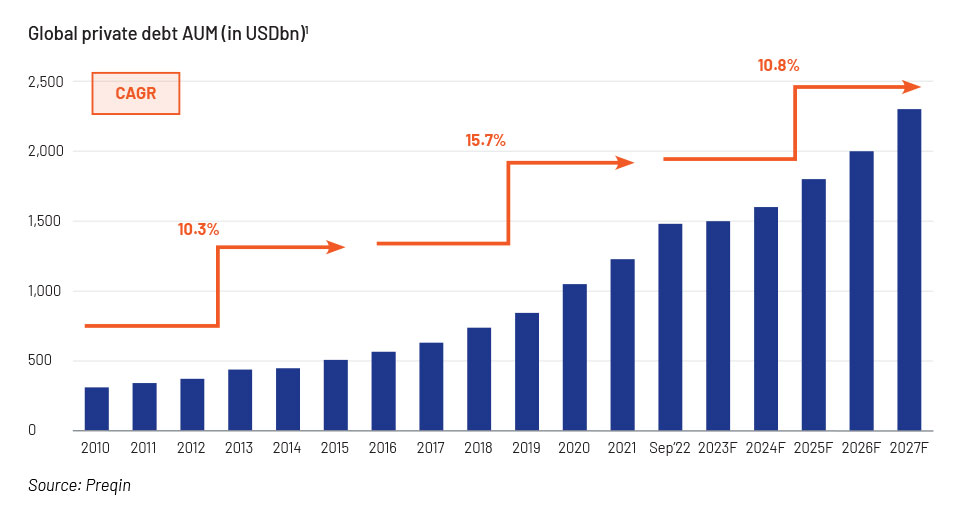

The global financial crisis (GFC) in 2007/08 paved the way for and initiated the rapid evolution of the private debt sector as banks retrenched from mid-market lending due to regulatory changes. Total AuM has grown swiftly, reaching USD1.4tn globally at the end of 2022, up from about USD500m in 2015, and is expected to reach USD2.3tn by 2027.

Overall fundraising in 2021 reached a record USD227bn across private debt strategies1 , +26% vs 2020 and almost 5x the amount raised a decade ago. More than a decade later, another global event in the form of the pandemic boosted the alternatives sectors. Managers have been resilient and are coming up with varied product offerings to meet increased investor demand while trying to gain an edge in the private credit ecosystem.

In this insight paper, we discuss the two key themes that have emerged in the private credit space since the pandemic, strictly from an offering point of view:

1. Specialised financing: In pursuit of a “differentiated offering”, seasoned managers (such as Blackstone, Ares, Blue Owl, HPS, Apollo, KKR and Sixth Street) have moved “up-market” to focus on larger (USD1bn+) credit opportunities through specialised/niche offerings

2. Expansion in regions outside developed markets has become a regular channel for raising commitments, and managers are increasing their exposure to Asia, South America and other lucrative markets. Managers (such as Cerberus, Goldman Sachs, HPS, Ares, Bain Capital, Barings and KKR) have successfully scaled up by tapping markets outside North America and Europe

What is specialised financing?

Specialised lending is a tailored capital solution that predominantly targets a set of asset classes or sectors. Continued growth in the private credit space and the changing socio-economic landscape have prompted managers to shift their focus from the traditional “business as usual” to something that initially was nuanced but is now becoming the next big thing. Specialty lending, sustainable impact-/ESG-focused opportunities and NAV financing are some of the offerings that have gained relevance recently. Managers have amassed larger commitments, as these offerings are stable and have forecastable income flows with relatively lower risk. These new niche areas are set to become well-established platforms within the private credit space.

1. Specialty financing – the next generation of private credit lending

What is specialty financing? Simply put, specialty finance is a financing activity that is largely asset- or revenue-backed and can be broadly bucketed into three categories:

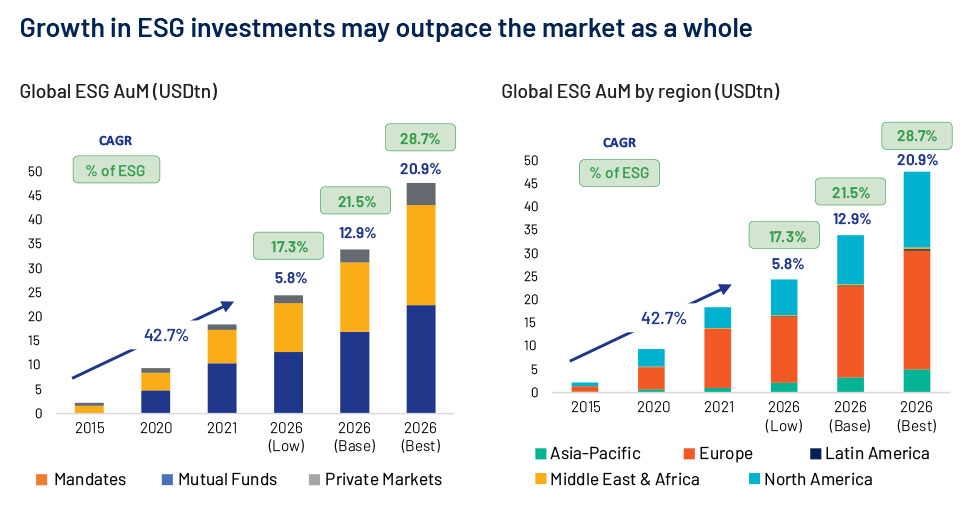

2. Sustainable/impact/ESG – offerings for a changing world

With the world’s largest institutions (both public and private) pledging to back the energy transition, another noticeable trend within private markets is the launch of new funds and strategies that are ESG- or impact focused. Many private equity (PE), infrastructure, private credit, venture capital and even hedge fund managers are actively seeking capital for these dedicated strategies

What are ESG-/impact-focused funds? An “environmental, social and governance (ESG) fund” is any investment vehicle for which the fund manager uses ESG criteria to inform its composition and asset-allocation strategy.

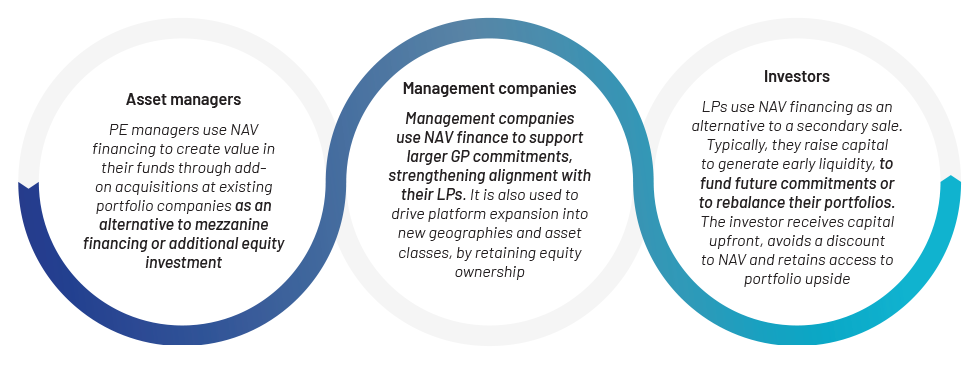

3. NAV financing – a new niche

Apart from the sector-oriented mandates, asset managers are benefiting increasingly from NAV financing to improve fund returns or achieve other objectives.

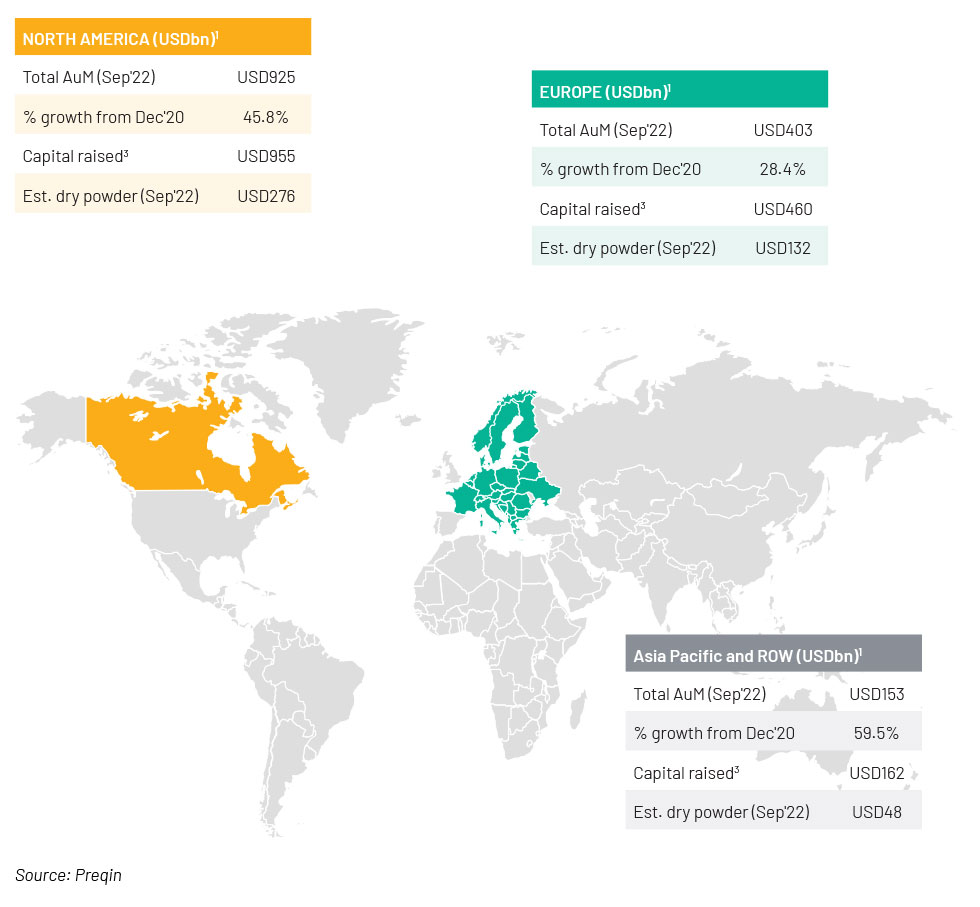

Expansion into other regions

Private debt markets have witnessed rapid growth over the past decade, and North America has by far emerged as the dominant region within this space. Preqin expects AuM in this region to reach USD1.4tn by 2027, growing at 21.7% from 2021 to 2027. North America is projected to outpace the rest of the world, with stronger AuM growth than the global average of 10.8%.

This would be driven mainly by the region’s strong economy and asset allocators’ preference for the US over other geographies. Despite the fear of recession, factors such as market depth, liquidity and maturity in an uncertain macro environment are expected to drive strong AuM growth in this region. The region is home to the bulk of fundraising activity, and Preqin forecasts fundraising for North America-focused direct lending funds to grow at a CAGR of 6.8% – to USD110bn by 2027 from USD74bn in 2021.

That said, the asset class (private credit) is gaining momentum in other parts of the world as well. Another major geography for private markets is Europe, where AuM is estimated to grow 10% annually, to USD636bn in 2027 from USD359 in 2021. As in North America, direct lending is expected to dominate in Europe as well, growing to USD415bn in 2027 from USD209bn in 2021 and accounting for 65% of assets in the region. However, the challenging economic conditions and the Russia-Ukraine war are expected to affect investor appetite, and fundraising in Europe is forecast to grow at just 2.6% annualised from 2021 to 2027.

Conclusion

Despite the macroeconomic challenges, investor demand remains strong across private debt strategies. Preqin’s November 2022 survey results indicate that private debt investors are satisfied with their investments, with 28% claiming the asset class exceeded return expectations and 60% saying it met expectations.

In a recent webinar hosted by Acuity Knowledge Partners , “Unlocking value in private markets”, Venu Rathi from Morgan Stanley, one of the panellists, explained why they see tremendous growth in investors’ asset allocation to private credit. This growth is largely attributed to the following:

The rise in PE valuations of underlying assets in the past 5-10 years and institutional investors’ preference for diversification

Active M&A in recent years and support from private credit for buyout deals

All-time-high levels of dry powder and a corresponding rise in private credit deployment

Rising inflows from retail investors through non-traded BDCs and other retail vehicles

On the impact of the recession, Venu mentioned that robust deal flow requires market stability and is, therefore, likely to remain sluggish in the near term. However, the outlook for private credit is positive and it should continue to grow, albeit at a slower pace, given active M&A and rising LIBOR rates; 2023 vintage funds are projected to achieve higher returns. In a nutshell, private credit managers are benefiting from market tailwinds and remain bullish on business prospects in 2023.

How Acuity Knowledge Partners can help

Our private debt/credit support vertical offers a number of services to private debt/credit middle and back offices; these range from deal origination and target screening to portfolio-monitoring services. We also provide private credit managers with live deal support including due diligence, relative valuation, and scenario and bond yield analysis.