Introduction

Overview

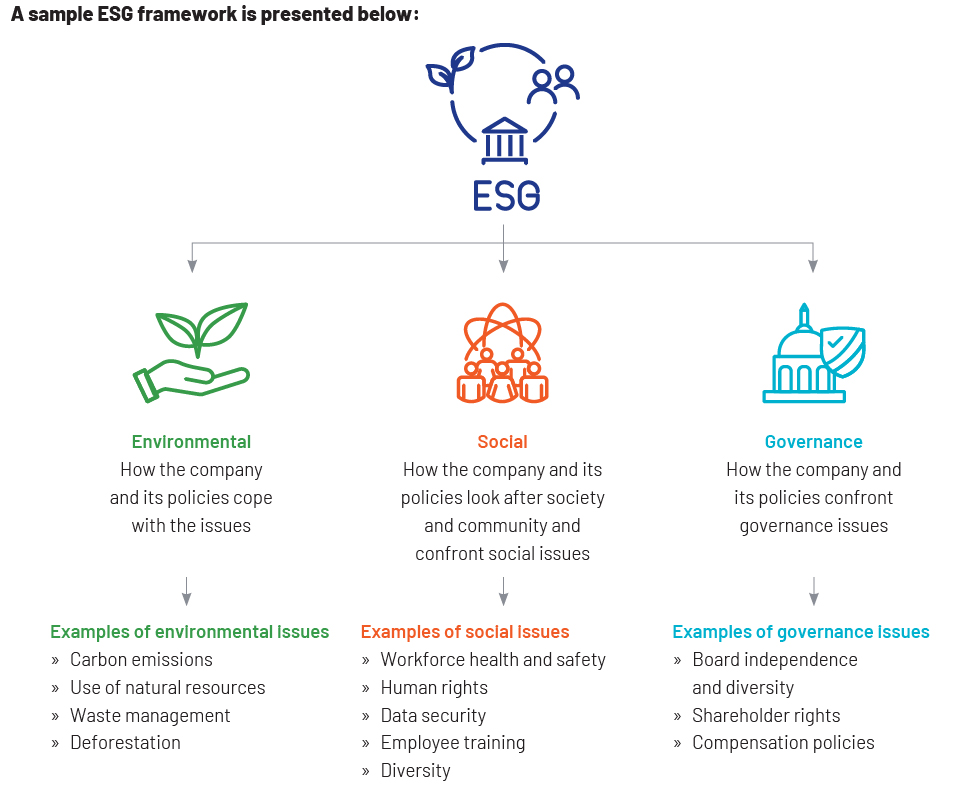

Environmental, social and governance (ESG) factors are non-financial factors relating to an issuer that could prove significant for investors and impact the returns they expect. Investors are now looking not only for investment opportunities with the potential to enhance their returns profiles, but also for issuers with good business ethics and proper policies in place to address environmental, social, and corporate and governance concerns.

Importance of ESG investing

The importance of ESG investing lies in the fact that each factor in an ESG model is mapped to one of the United Nations’ (UN’s) Sustainable Development Goals (SDGs). These goals apply to all countries and aim to end poverty, protect the environment, reduce economic and social inequalities, maintain peace and ensure justice for all by 2030.

The significance of ESG investing varies by asset class and sector as outlined below:

Non-financial corporates

Financial institutions

Structured finance

Sovereigns

Significance of ESG model validation

ESG model validation is required to assess inputs, outputs, processing components, implementation and controls around a quantitative/qualitative model. Model output impacts investment decision-making, and measuring model performance is important to assess its accuracy and efficiency.

The activities involved in ESG model validation are discussed in detail below:

Purpose and scope of the use of models:

The model validation team checks the use of model output, how it is integrated with the risk management framework and how it impacts portfolio management.

Model theory:

The validation team ensures that the model has strong theoretical foundations. For example, ESG factors used in the model quantify the issuer’s adherence to UN SDGs; hence, these factors could help provide an indication of the risk of a credit rating downgrade on the issuer, which could adversely affect investor returns.

Model methodology:

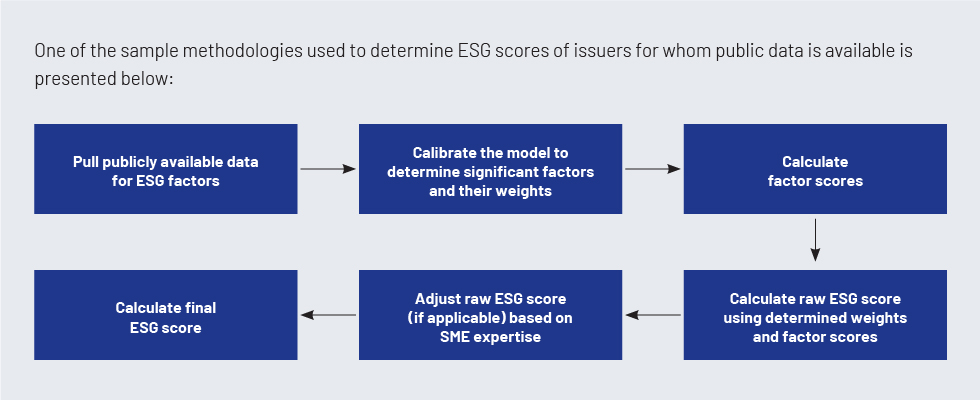

The team examines the methodology and calculations used in determining ESG scores. This may include the use of supervised or unsupervised techniques to determine the significance of ESG factors or their weights. The team also checks if the methodology removes bias from the data and how it deals with missing data for a factor.

Model input:

The model validation team studies the data used to develop the model and checks how it aligns with the model theory. The team also examines if proxies were used in the dataset and if so, the reason for this.

Model output:

The team analyses how model outputs, i.e., ESG scores, are used and if they are within the scope of the model. For example, it checks whether the scores are used directly in investment decision-making or fed as an input to a downstream model used to develop an investment or risk management strategy.

Model assumptions:

The validation team checks assumptions made in the model in terms of model use and methodology and the impact on model output if these assumptions are violated.

Model implementation:

The team also monitors the platform on which the model is implemented – covering the entire process, from the extraction of raw data to the production of final output – to ensure there is no break in the process.

Model calibration:

For in-house models, the team looks for research conducted during model calibration. It would look for supporting literature/research on the new set of weights assigned for ESG factors.

Model alternatives:

The validation team checks for alternatives that could be used if a model does not perform in line with expectations and for benchmarking.

Model limitations:

One of the major limitations of ESG models is the non-availability of public data; the lack of data may result in an ESG score not truly representing a company’s business ethics and policies.

Outlook

Acuity has an optimistic outlook on ESG modelling. The ESG scores of companies and financial institutions are correlated to their financial performance. More companies, financial institutions and countries are expected to announce their strategies to deal with ESG issues and comply with growing regulation in this area. Automobile manufactures, for instance, have to disclose their zero-carbon emission strategy to ensure compliance with climate and planet conservation regulations. Tesla, which was recently pulled out of the S&P 500 ESG index owing to the lack of a low-carbon strategy and claims of racial discrimination, is an example of a company facing consequences due to non-compliance with ESG requirements.

Similarly, banks are expected to showcase strong governance in the integration of their lending criteria with ESG framework, i.e., they are not supposed to fund companies that do not adhere to ESG requirements. Countries are also evaluated based on the policies they have in place to promote ESG, including use of renewable energy, water conservation, waste management, pollution control and reduction of inequality.

If companies, financial institutions and countries ensure that their operations are in line with ESG requirements, it can improve their financial performance in the long run while also accelerating their journey towards SDGs.