Introduction

The Road Ahead: ETF Market Outlook for 2025

2025 brings a blend of hope for another bullish year and cautious optimism about the future. The ETF market outlook for the coming year is shaped by the events of 2024, which marked only the fourth soft landing ever recorded. Historically, such events have been followed by robust growth, but uncertainty persists due to factors like lower taxes, elevated tariffs, accelerating inflation, controlled immigration, increased stimulus measures, and relaxed regulations.

The ETF industry saw record inflows in 2024, driven by a bullish US market, innovative cryptocurrency and options-oriented products, and the growing popularity of cost-effective, liquid Index and ETF solutions over traditional mutual funds. Despite this growth, the ETF market trends indicate that 2025 is expected to witness record ETF closures, eclipsing the previous high of 253 closures in 2023. In 2024, asset managers closed 186 funds, 91% of which had assets under $250 million. This declining lifespan of ETFs raises concerns about sustainability in the face of ETF market growth.

Overall, the ETF market outlook for 2025 holds the potential to generate robust investor returns. Following the US economy skirting a recession in the post-COVID-19 era, the equity market has seen strong momentum, the credit outlook has improved (favoring bond markets), and the 'crypto winter' has ended. These factors could bring a plethora of opportunities for investors to consider diversification, which may help restore balance and mitigate potential heightened market volatility.

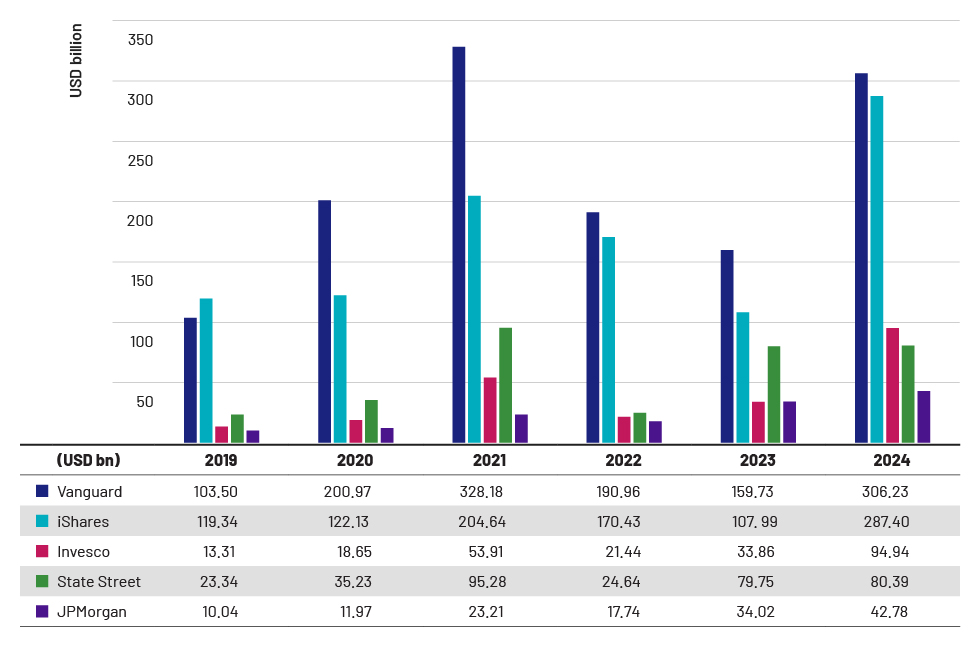

Top 5 ETF brands by net flow

Vanguard and iShares dominated the ETF market in 2024, as expected, capturing approximately 60% of the total inflow. Vanguard led with $308 billion (compared to iShares' $287 billion), achieving pole position for five consecutive years. This dominance highlights the ongoing ETF market growth and the competitive landscape of the industry.

Active ETF Market (and Growth)

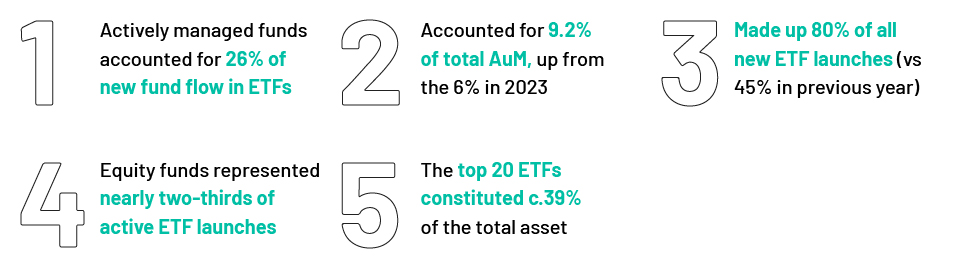

Following a strong rally in 2023, active ETFs posted a record in 2024, attracting around $290 billion in assets and over $1 trillion in inflows. Their unique ability to offer distinct defensive and offensive benefits compared to passive ETFs has significantly raised their popularity among investors. The debate between active vs passive ETF strategies continues to shape the market, with active ETFs gaining traction due to their flexibility and potential for higher returns in volatile markets.

ETF Trends Shaping the Market

The ETF industry experienced explosive growth in 2024, fueled by resilience in global stock markets. Here are the key ETF market trends that defined the year:

Bitcoin ETFs: Gained immense popularity in 2024, capturing 8 of the top 10 spots in new fund launches. This trend reflects the growing interest in cryptocurrency as part of a diversified ETF market outlook.

Options-Based ETFs: These ETFs, which employ strategies involving options to boost returns, generate income, or cushion against losses, gained significant traction in 2024. They are becoming a key tool for investors looking to navigate market volatility.

Buffer ETFs: Also known as defined-outcome ETFs, these have gained popularity due to their ability to limit potential losses while offering some upside potential. They are particularly appealing in uncertain market conditions.

Single-Stock ETFs: Unlike traditional ETFs, which track a broad index or sector, single-stock ETFs focus on the performance of a single company using derivatives. This trend highlights the evolving nature of ETF market growth and investor demand for more targeted exposure.

Conclusion

The ETF market outlook for 2025 is a mix of optimism and caution. While the industry is poised for continued growth, driven by trends like Bitcoin ETFs, options-based strategies, and active ETFs, challenges such as record fund closures and market volatility remain. Investors are increasingly turning to ETFs for diversification, particularly in emerging markets, where the emerging markets ETF outlook offers both risks and rewards.