Introduction

Introduction

A code of ethics is a company’s policy for managing and operating its business activities in conformity with applicable laws and standards. All employees must adhere to these standards to maintain the company’s reputation and protect the integrity and confidence of clients’ codes of ethics.

A code of ethics (the code) is a wide range of a company’s rules/principles that seeks to encourage ethical conduct among a group of professionals.

A code of ethics falls under two main categories: compliance-based codes and value-based codes as adopted by financial organisations.

Compliance-based codes aim to follow legal standards and regulations. They establish clearly stated rules aimed at avoiding wrongdoing and detail consequences of non-compliance.

This is especially applicable in highly regulated sectors such as healthcare, banking and financial services.

In contrast, value-based codes focus on an organisation’s core moral values. They promote a culture of integrity consistent with such values; this further encourages employees to make ethical decisions. This approach helps adopt a positive working environment.

Compliance-based and value-based ethics are essential for a comprehensive ethical framework. They ensure ethical considerations are integrated into an organisation’s operations.

Why Financial Firms Need Compliance-Based Code of Ethics

Avoids legal penalties, financial loss and reputational damageIt is important that a code of ethics be implemented in heavily regulated sectors such as finance, healthcare and pharmaceuticals, as they often face stringent regulatory scrutiny.

Maintains a culture of legal awarenessThe code would clearly define the legal boundaries within which the organisation operates, enabling employees to recognise and avoid actions that could lead to legal violations impacting themselves and the organisation.

Manages riskThe code would help an organisation identify potential legal risks and implement measures to mitigate them. Regular training and updates would help employees keep abreast of new and modified laws and regulations, ensuring continued compliance. This is a proactive approach to risk management, helping to avoid legal issues and maintaining the trust of customers and investors.

Establishes monitoring and enforcement structuresManagement would directly control the deployment of compliance officers and committees that would oversee implementation of the code of ethics and investigate alleged violations – from internal disciplinary action to reporting misconduct to the relevant authorities.

Introduces policiesA code of ethics centred on compliance often includes a whistleblower policy, promoting disclosure of unethical or illegal actions regardless of retaliation. This promotes an open environment where ethical concerns can be raised and addressed effectively.

Adapts to changing regulationsThe financial services sector faces constant change in the regulatory environment. A compliance-based code of ethics would help an organisation adapt to new laws, regulations and industry standards. It ensures regular updates on regulatory changes, policies and procedures, and flexible training programmes, enabling an organisation to quickly address new compliance requirements.

Maintains transparency in operationsIn financial services, transparency and accountability are foundational ethics; hence, implementing an efficient code of ethics will promote practices that ensure clear dealings with clients, investors and regulators. It also establishes clear accountability mechanisms for lapses and compliance violations. In summary, a compliance-based code of ethics is fundamental for an organisation that aims to operate legally and maintain high standards.

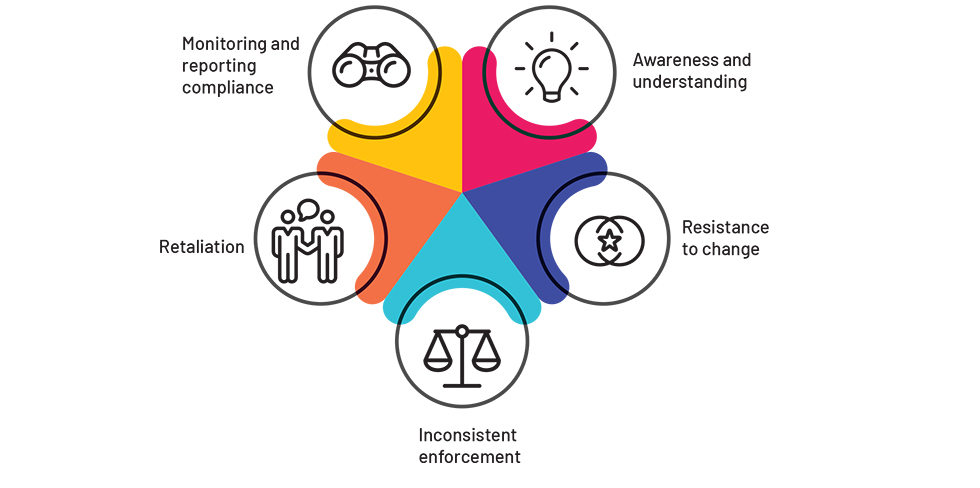

Challenges in Code of Ethics Implementation & Compliance Risks

Design, implementation and conformance with the code require a multi-dimensional approach. Clear policy, effective communication, comprehensive training and strong adherence are critical for remaining compliant. This ensures an organisation upholds the highest levels of ethical behaviour and compliance, safeguarding the interests of its customers, employees and the law of the land.

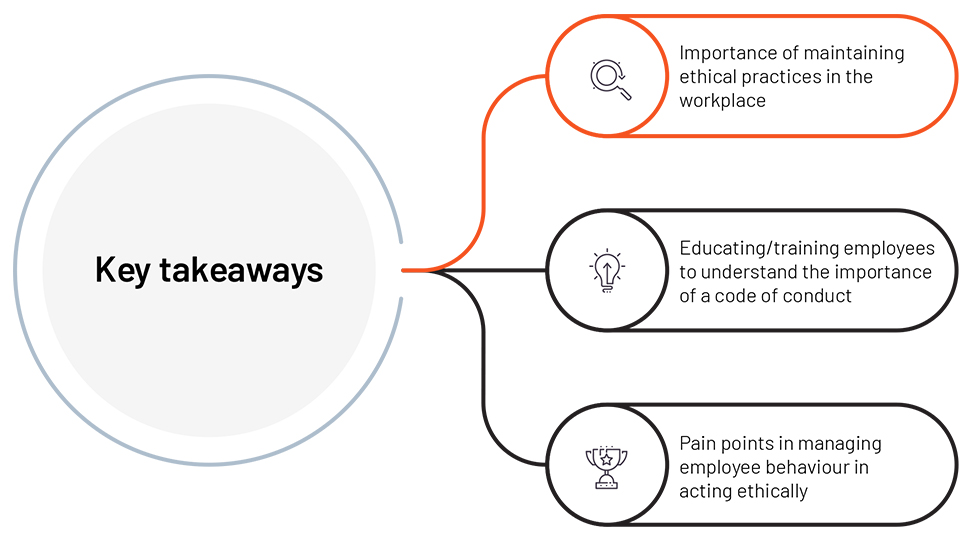

Conclusion

A code of ethics is a living document that guides an organisation’s actions, decisions and interactions. By embracing these principles and values, it can demonstrate its commitment to integrity, transparency and accountability, fostering a culture of trust and respect that benefits the organisation, stakeholders and the broader community.

A solid ethical foundation contributes to the organisation’s long-term success and stability.

Effective education and training programmes are essential for embedding ethical values in the workplace.

To manage consistent ethical behaviour, organisations should establish a transparent channel for discussing ethical dilemmas

How Acuity Knowledge Partners Can Help with Compliance-Based Code of Ethics

We are adept at providing compliance services to several global market segments. We assist businesses with due diligence relating to codes of ethics. To avoid fines and reputational damage in the event of a policy breach, we help develop appropriate procedures to the code in accordance with a client’s policy, provide clear policy communications, implement a streamlined approval process, outline any pre-approval requirements and record/report any expectations, adhering to regulations of the SEC, FINRA and other regulators.