Introduction

Introduction

Bonds take many forms and have evolved over the years to align with stakeholders’ needs. Green and blue bonds have been trending recently, owing to increased awareness of sustainability and ESG considerations, with many individual investors, companies and even governments stepping up their preference for such bonds. Stakeholders are increasingly concerned about the environmental impact of business operations. Carbon emissions are the main cause of climate change and global warming, which affect the agricultural business sector and the health of humans and animals.

Governments, renewable-energy companies and environmental activists are keen to allocate investment, time and knowledge towards promoting a greener and sustainable economy. The United Nations Framework Convention on Climate Change (UNFCCC): 196 nations were party to the 12 December 2015 Paris Agreement, which aims to reduce greenhouse gas emissions to levels consistent with holding the increase in global average temperature to well below 2° Celsius above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5° Celsius above pre-industrial levels. Meeting these targets would require an unprecedented allocation of capital, measured in trillions of dollars a year.

Major emitters

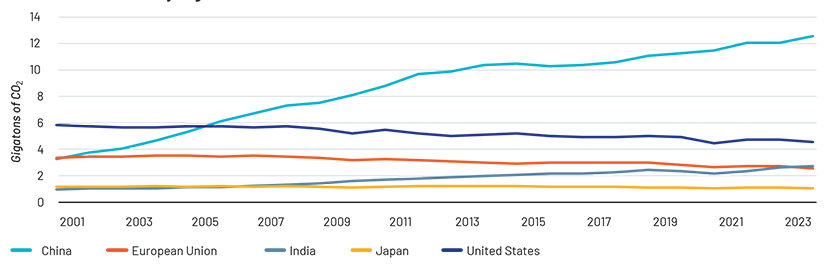

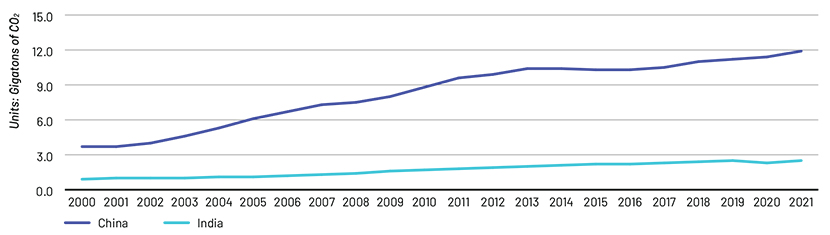

The global emissions landscape has continued to evolve over the past decade. China’s total CO2 emissions exceeded those of the advanced economies combined in 2020, and in 2023, were 15% higher. India overtook the European Union (EU) to become the third-largest emitter in 2023. In developing Asia, countries now produce about half of the world’s emissions, compared to about two-fifths in 2015 and about a quarter in 2000. China is responsible for 35% of the world’s CO2 emissions. Advanced economies’ per capita emissions were approximately 70% more than the global average in 2023.

India’s per capita emissions, at approximately 2 tonnes, are still less than half of the global average. Emissions per capita in the EU have decreased significantly and are currently only about 15% more than the global average and approximately 40% lower than China’s. In 2020, China’s emissions per capita surpassed those of all advanced economies combined and are now 15% higher; in 2023, they surpassed Japan’s for the first time, but remain one-third lower than those of the US.

Transitioning towards sustainable finance – Green and blue financing

What are green and blue bonds?

Green bonds are fixed-income securities that could be taxable or tax-exempt and are used to finance or refinance environmental and sustainable projects. These bonds may include debt obligations with or without recourse to issuers and projects tied to collateral. Compared to traditional bonds, green/blue bonds trade at lower yields or higher prices.

The proceeds from green financing should be used only for environmentally friendly projects. From a banking perspective, issuance of green bonds plays a significant role in promoting a greener economy.

Blue financing is where bond proceeds are used for ocean- and water-related initiatives such as protecting coral reefs and ocean biodiversity. These pave the way to funding ocean- and water-related solutions, creating sustainable business opportunities. Blue bonds are a subset of green, social and sustainable bonds and should adhere to globally recognised principles.

Role of regulators and financial institutions

Regulators Regulators play a major role in financial markets and economic growth. They ensure financial services markets function effectively and efficiently by setting guidelines, promoting financial products, allowing an efficient level of capital and ensuring the highest level of disclosures and scrutiny. This boosts stakeholder confidence, resulting in more capital injections and better returns.

Regulators are taking the lead in green banking, providing assurance for both lenders and borrowers to go ahead with investments. They have set the following green banking policy in place:

Macro-prudential

Assess the impact of climate risks on the financial system – achieved by stress testing

Assign higher risk weights to carbon-intensive assets when evaluating banks’ capital-to-risk assets ratios – monitoring via loan-to-value and loan-to-income caps

Limit the flow of resources and credit exposure of banks to sectors or companies that exceed specified carbon-emission targets – banks to decide on loan allocation to carbon-intensive borrowers

Limit an overleveraged position to carbon-intensive assets – monitoring the sectoral leverage ratio (to ensure the calculated ratio lies within the threshold)

Introduce an incentive mechanism for liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) requirements to link climate targets and liquidity/maturity mismatch requirements – liquidity restrictions on carbon-intensive companies

Micro-prudential

Disclosure requirements – banks to disclose climate-related financial risk

Environmental and social risk management – banks to have environmental and social risk management measures in place

Reserve requirements – green loans can be encouraged by stipulating lower reserve requirements for green portfolios

Market Making

Provide guidelines to banks on sustainable finance and issuance of green bonds, promoting green financing

Credit Allocation

Encourage banks to allocate funds for ESG purposes

Formulate refinancing and concessional loan arrangements for green financing initiatives

Green bond framework

It is recommended that issuers explain how the green bond programme is aligned with the bond framework. This would help lenders and other stakeholders make qualitative decisions.

Use of proceeds and project evaluation process

To qualify as a green bond and receive the proceeds thereof, the legal document should specify how the proceeds will be used on green projects. These green projects should provide clear environmental benefits, which the issuer will assess and, where feasible, quantify. In the event the bonds are used for refinancing purposes, the issuer would need to specify the percentage of funds that would be used, along with the applicable projects and lookback periods.

The following are examples of eligible projects:

Renewable energy

Energy efficiency

Pollution prevention and control

Environmentally sustainable management of living natural resources and land use

Blue bond framework

Ocean health and productivity

- Assessing and incorporating both the short- and long-term impact of ocean-related activities on ocean health in strategy and policies

- Considering sustainable business activities that could help protect the health and productivity of ocean dependencies

- Taking measures to reduce greenhouse gas emissions to prevent ocean warming and acidification

Planning the use of marine-related resources and ensuring long-term sustainability with precautionary measures in place

Governance and engagement

Continuing to engage with ocean-related regulatory or enforcement bodies

Following, supporting and adhering to the procedures developed, contributing to a healthy and productive ocean, and secure livelihoods

Respecting all stakeholders involved in the company’s ocean-related activities, ensuring due diligence is conducted before project initiation and continuing to communicate with stakeholders in a timely manner while the project is in the work-in progress stage. This would ensure an immediate response to issues and the development of preventive measures.

Data and transparency

Sharing relevant scientific data to support ocean-related research

Being transparent on the ocean-related activates undertaken and their impact and dependencies, in line with the relevant reporting framework

How can Acuity Knowledge Partners help?

We keep our clients apprised of evolving ESG and sustainable trends. Our Commercial Lending vertical helps lenders with loan monitoring, covenant monitoring and customised risk rating, and notifies them of early warning signals. Our detailed sector and company research adds value to credit reviews, helping lenders decide on loan extension or termination and changing loan covenants.