Introduction

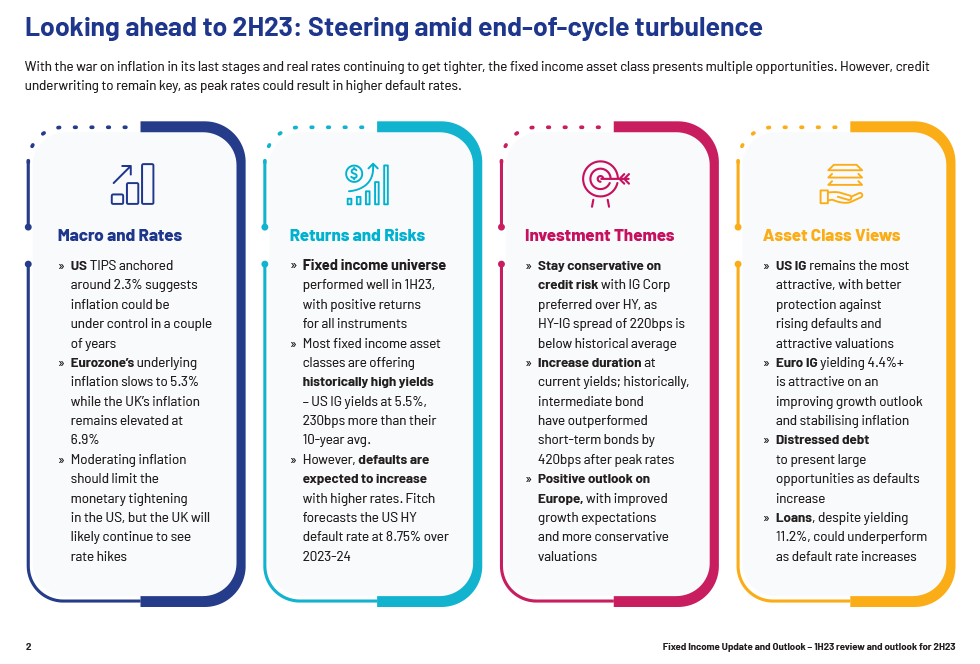

Looking ahead to 2H23

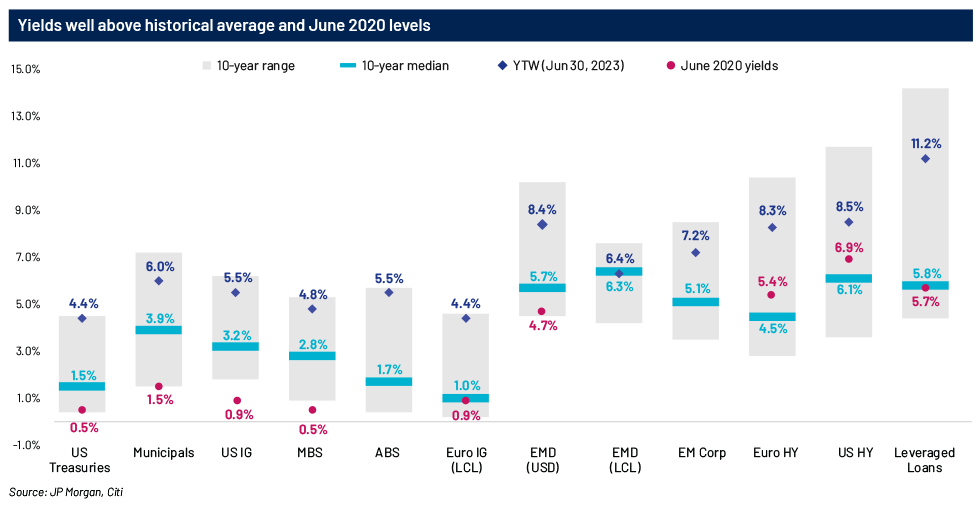

Steering amid end-of-cycle turbulence With the war on inflation in its last stages and real rates continuing to get tighter, the fixed income asset class presents multiple opportunities. However, credit underwriting to remain key, as peak rates could result in higher default rates.

Inflation: Declining; breakeven anchored around 2%

Headline inflation in the US and Europe is trending downwards, according to July 2023 data releases, while the UK is a notable outlier

Meanwhile, Treasury Inflation-Protected Securities (TIPS) breakevens (across tenors) are anchored around 2%. This suggests that the US markets are pricing in an optimistic scenario, inflation will come back down to 2% in a couple of years. However, recently, 10Y was the highest since November 2022 at 4.1%, and 30Y reached a 9M high at 4.2%, indicating pressure on inflation

Nevertheless, TIPS look attractive in the current environment – the 30Y TIPS yield is near 2% for the first time in over a decade, up from -0.5% in 2020-21

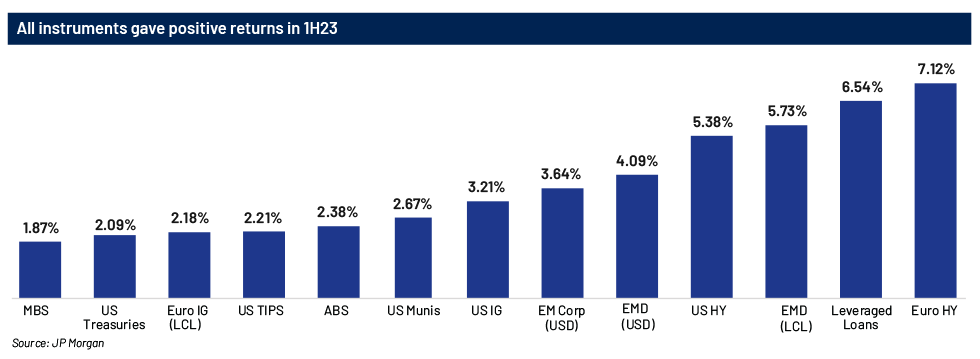

Performance of the fixed income universe

As we revisit our views in January 2023, it feels as if an eternity has passed. 2023 had a turbulent start, filled with a number of significant macro and micro events such as bank failures in the US, the rescue of Credit Suisse by UBS and the debt ceiling drama. Despite this, the fixed income universe has fared well so far, with all instruments giving positive returns over 1H23 after a torrid 2022.

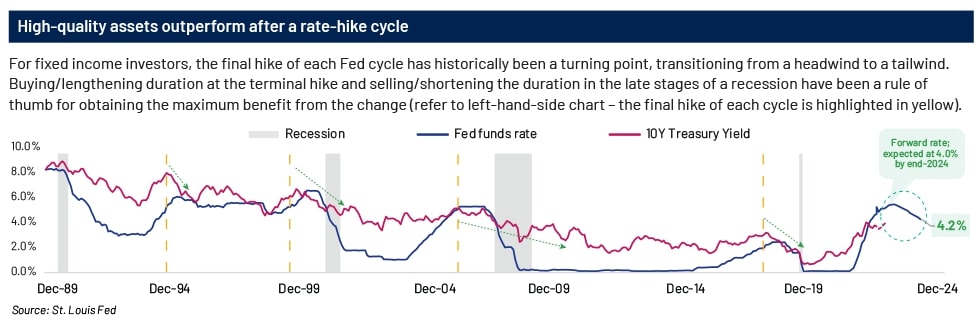

Softening Fed stance call for a shift in strategy

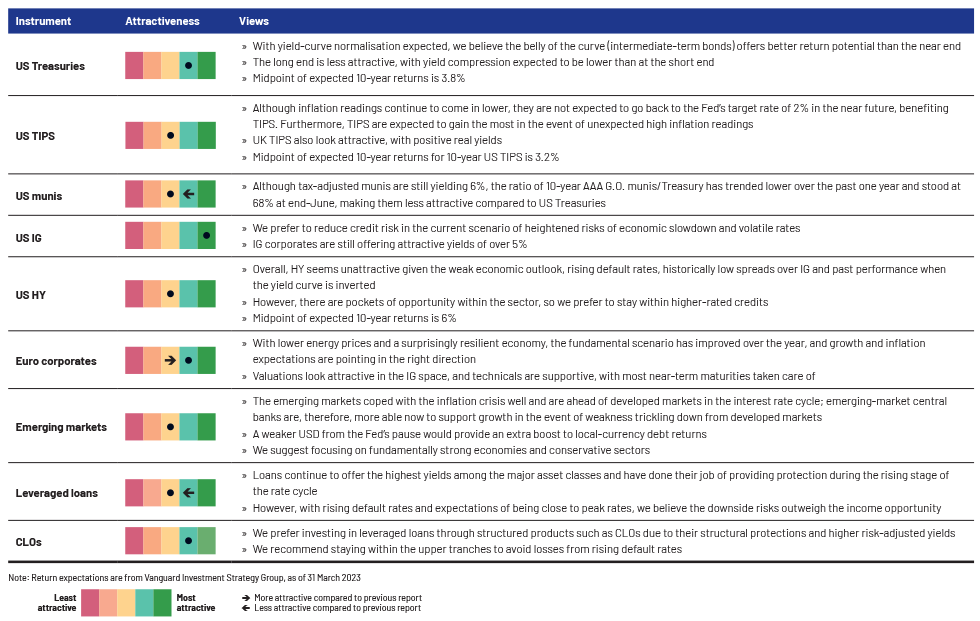

With a low likelihood of further rate hikes by the Fed, we believe benchmark rates are at their peak of this hiking cycle signalling a partial regime change. Accordingly, our investment views have now been adapted to suit the next stage of the interest rate cycle. While there is no overhang from expectation of further rate hikes, growth in the US, Europe and China is expected to remain weak. In this low-growth scenario, fixed income is even more attractive, as the high yields provide some downside protection. The following are a few high-level investment themes to consider

Performance of the fixed income universe