Introduction

Overview

Exchange-traded funds (ETFs) posted significant progress in 2021, in terms of assets under management (AuM) and new issues. As emerging themes, such as artificial intelligence and sustainability, continue to up the ante, here’s a brief account of key developments that took place in the ETF realm.

Introduction of the global ETF environment

Global ETF AuM has been witnessing record growth (c.53% CAGR) over the last two decades, breaching the USD10tn mark. Geographically, North America-focused ETFs continued to hold the lion’s share of the market (USD6.5tn), followed by ETFs in the global (c.USD1.3tn) and emerging (USD0.9tn) markets.

Future of active ETFs

The surge in fund inflow in active ETFs is expected to continue into 2022. The major factors driving increased interest in active ETFs are:

Dominance of bond ETFs

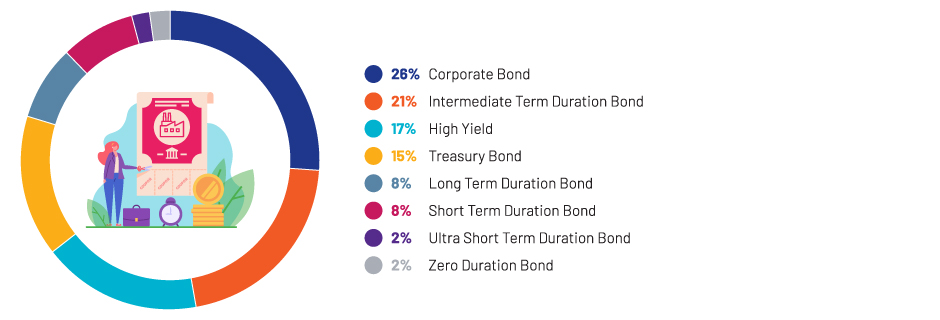

As of 24 November 2021, there were 435 bond ETFs in the US. Of this, the number of corporate bond funds in the US ETF market were higher than Treasury bonds. Intermediate bonds accounted for the majority of the market share compared with other duration bonds.

Inclination towards active thematic ETFs

Most assets invested in thematic funds are actively managed globally; they make up 89% of total AuM in Europe, bucking the trend in the US, where 63% of thematic fund assets are passively managed. This reflects the success of thematic ETFs in the region.

A steady rise in environmental, social and governance (ESG) ETFs

Interest in ESG investing has grown significantly among investors in recent years, fuelled by evolved investors who are socially conscious and strictly adhere to ESG regulations. Although ESG is in its early phase, it has gained acceptance within the mainstream asset management industry, evident from the rapid inflow of capital (to USD2.74tn as of 31 December 2021 from USD1.28tn in 2019).

Outlook

Thematic and innovative ESG and climate-targeted exposures could capture a significant portion of the overall ETF flow. Global endeavours to reduce global warming to 1.5ºC, in line with the Paris Agreement on climate change, is likely to impact most industries – for the better or worse – and ETF investors have the option to choose from a diverse range of solutions that consider these factors.

Conclusion / Acuity’s point of view:

During the pandemic, thematic ETFs grew, both in terms of fund inflows and size of AUM and count, with the highest influx witnessed in Europe where investors were trying to leverage the tech rally from 2020 to end-2021. In terms of performance, the top five thematic ETFs (shown in the flyer) have broadly delivered double-digit returns over the five-year horizon.

However, as we moved into 2022, the market dynamics that drove growth in thematic ETFs have turned upside down. Something like disruptive technology and healthcare that moved the needle in the growth-heavy thematic ETF giants have completely gone off the radar, with the burst of the tech bubble and economies becoming resilient to the resurgence in Covid-19. For e.g., as of 31 March 2022, ARK Innovation ETF delivered -44.07% and -29.93% over the past one-year and YTD periods, respectively.

Headwinds, such as rising inflation, the Federal Reserve’s tighter monetary policy stance and the Russia-Ukraine crisis, could weigh heavily on growth companies. Investors are looking for value-oriented themes – that have lesser volatility vis-à-vis the broader market – and solutions – that can mitigate the wealth-corroding effects of inflation

Also, we should consider the recent bulky allocation of the Biden administration (USD550bn) and the Chinese government (USD2.3tn) towards traditional and digital infrastructure building, especially w.r.t roads, utilities, manufacturing and basic telecommunication. Similarly, in support of the European Green Deal and to wean off Europe’s dependence on Russia for natural gas, European Union nations have proposed to invest EUR1bn in the transition towards clean energy infrastructure.

The next set of growth may come from emerging trends like infrastructure, electric vehicles and battery technology, cybersecurity and disruptive materials.