Introduction

Introduction

AbbVie defines HUMIRA as an anti-TNF monoclonal antibody that currently treats Crohn’s disease, rheumatoid arthritis, ulcerative colitis, hidradenitis suppurativa, psoriasis, psoriatic arthritis, juvenile idiopathic arthritis, ankylosing spondylitis, and uveitis. HUMIRA stands for HUman Monoclonal antibody in Rheumatoid Arthritis and was initially developed to treat patients with rheumatoid arthritis. Rheumatoid arthritis used to be difficult to treat, but after the advent of tumour necrosis factor (TNF ) inhibitors, specifically the biologic adalimumab – HUMIRA, treatment became easier, boosting sales of HUMIRA significantly.

HUMIRA’s dominance of the autoimmune market

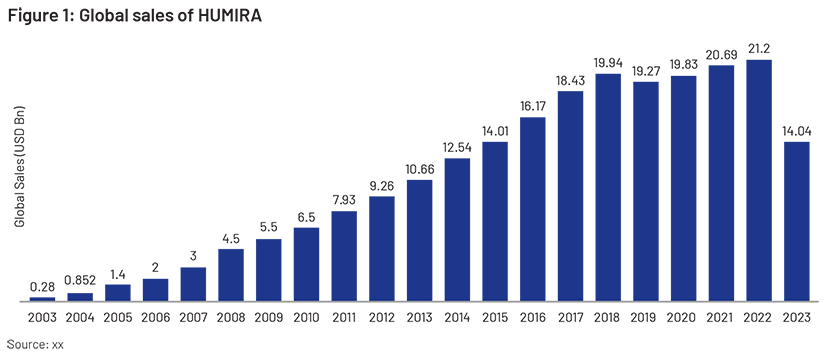

In 2002, the FDA approved HUMIRA (adalimumab), the first fully human monoclonal antibody, for treating rheumatoid arthritis in the US. In 2003, it was approved in the EU. As the third TNF inhibitor in the US, HUMIRA stands apart due to its fully human monoclonal antibody structure, unlike infliximab (a mouse-human chimeric antibody) and etanercept (a TNF receptor-IgG fusion protein). HUMIRA was the world’s top-selling drug for 10 consecutive years, with almost USD20.69bn in sales in 2021. Through a series of clinical trials, it was able to prove itself worthy enough to be used to treat a number of autoimmune diseases including rheumatoid arthritis, psoriatic arthritis and Crohn’s disease in adults.

Is HUMIRA a blockbuster drug?

“Blockbuster drugs” are drugs that generate at least USD1bn in revenue a year for the pharmaceutical companies that produce them. HUMIRA is sold in almost 100 countries and regions, making it one of the best-selling drugs for decades. Since its launch, it has generated more than USD150bn in revenue. It can, therefore, rightly be designated as the king of medicine. In 2022, it generated USD21.2bn in revenue globally and was the second-highest revenue-generating blockbuster drug. Decades of presence in the global market and the trust it has earned among physicians and patients have helped HUMIRA maintain its market position.

Delay in launch of biosimilars

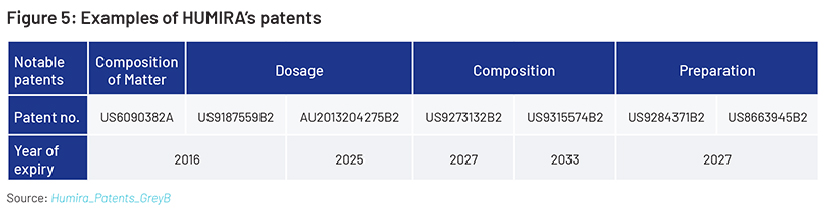

Amjevita (HUMIRA’s first biosimilar) took more than six years to launch after first being approved by the FDA in 2016. Many other biosimilars have also been approved by the FDA since 2016. AbbVie entered a settlement with biosimilar manufacturers to keep biosimilar drugs out of the US market until 2023. Amgen’s agreement with AbbVie also gives Amjevita six months of biosimilar exclusivity study in the US market. AbbVie has been involved in a number of legal cases for using HUMIRA. The settlements involved agreements where other companies would wait before selling a biosimilar and pay AbbVie a fee when they did.

Conclusion

With 10 HUMIRA biosimilars approved by the FDA and many more in the pipeline, it would be difficult for AbbVie to maintain its position. However, things are not that easy for biosimilars either. A sudden shift to HUMIRA biosimilars could result in a costrebate power play and a financial loss for PBMs and other stakeholders. The competition from biosimilars would be dominated by the economics, rebates and discounts offered by AbbVie, making it difficult for biosimilar competitors to capture HUMIRA’s market share.