Introduction

Introduction

Amid growing geopolitical tensions and sluggish growth of the global economy, India stands out as one of the fastest-growing major economies in the world – the fifth largest in terms of GDP (USD3,942bn) (after the US, China, Germany and Japan). The country’s projected GDP growth of 6.8% for 2024-25 (according to the IMF) is markedly higher than other developing and advanced economies’, backed primarily by strong domestic demand and a growing working-age population.

Ironically, India’s traditional banking system is unable to meet the evolving credit needs of corporate borrowers, due to heightened risk aversion and regulatory constraints. Furthermore, non-banking financial companies (NBFCs) have substantially reduced their exposure to mid- to large-cap financing, following the shockwaves from multiple default stories in recent years, including those of IL&FS, DHFL, IndiaBulls Housing Finance and Yes Bank.

India’s growing alternative investment fund (AIF) ecosystem

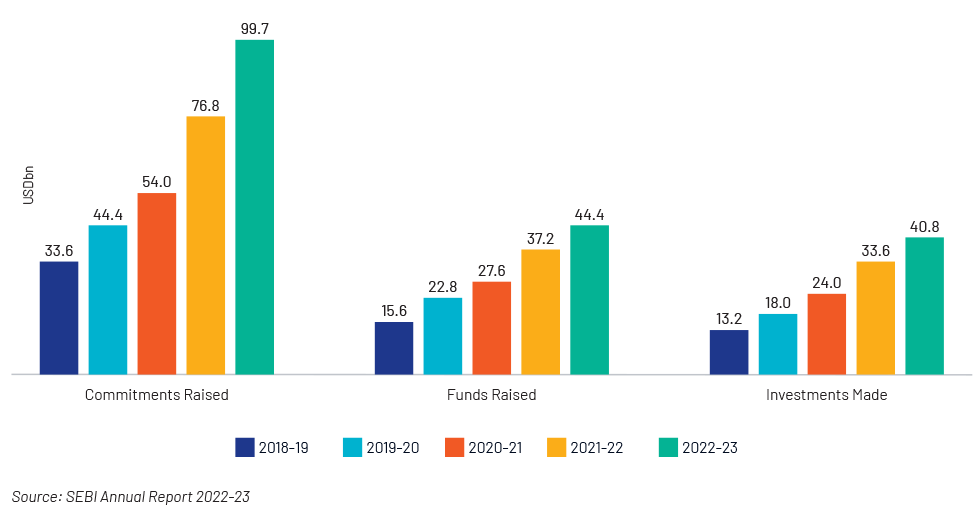

A conducive environment within the credit landscape, coupled with government initiatives (e.g., the Insolvency and Bankruptcy Code 2016 legislation; IBC) over the past five years, has led to the development and rapid growth of the AIF-driven private credit market. Since FY18-19, AIFs have witnessed sizeable growth in terms of commitments, funds raised and investments

Commitments raised by AIFs were up by 30% y/y to INR8.34tn (c.USD100bn2 ) in 2022-23 vs the prior period. Funds raised and investments made increased by 19% and 21%, respectively. This was primarily the result of an expanding pool of domestic HNWIs, flexibility to invest in different sectors, the need to optimise returns, higher investor risk appetite, and a higher pool of foreign capital inflow. Category II AIFs (which focus on real estate, private equity, and distressed assets) exhibited remarkable y/y growth of 34% and accounted for 73% of overall funds raised by AIFs.

India’s burgeoning private-credit deal flow

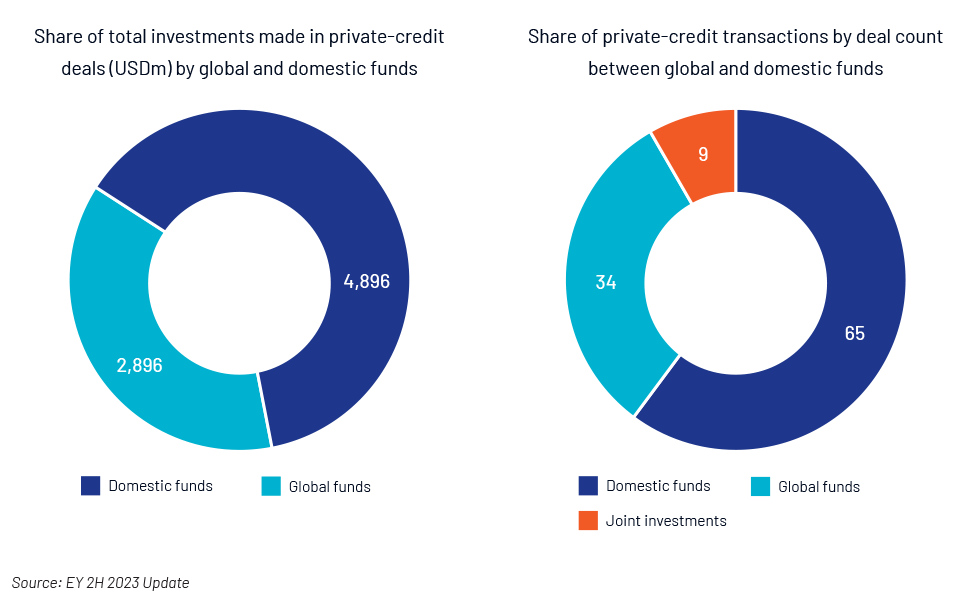

Private-credit funds are becoming increasingly popular, both as a source of capital for borrowers of varying sizes and needs and as an investment opportunity for lenders. India saw record deal flow in 2023, with 108 deals valued at USD7.8bn, significantly higher than the 77 deals worth USD5.3bn in 2022, driven mainly by stabilised interest rates in CY23 and increased real estate private-credit deal activity.

This trend is likely to remain robust over the next one to two years. The share of global funds in Indian privatecredit transactions stood at 63% (in value terms) in FY23; however, domestic funds accounted for 61% of deals (in volume terms) due to their focus on the corporate middle market, local presence and dealorigination capabilities.

Conclusion

Private credit is expected to play a major role in driving the next phase of the India growth story

The private-debt sector is still a relatively emerging asset class in India, but it has witnessed encouraging growth over the past 10 years at a CAGR of 23% (in terms of AuM). Private-credit AUM in India is expected to reach USD60- 70bn by 2028 (c.3x USD20bn as of September 2023), backed by a multitude of factors.

India is predicted to surpass Japan and Germany by 2027 to become the third-largest economy in the world and to have the fifth-largest stock market, with a market capitalisation of about USD10tn by 2030. Given its growth prospects and being considered as a capitalshort country, private-credit strategies – ranging from performing credit to esoteric high-yield credit strategies – would have significant room to grow in the coming decade. Beyond regulatory challenges, private credit is deemed to be essential for financing large, “risky” projects (as defined by banks) and providing flexible financing solutions.

How Acuity Knowledge Partners can help

Our private debt/credit support vertical offers several services to private debt/credit middle and back offices – ranging from deal origination and target screening to portfolio-monitoring services. We also help private-credit managers with live deal support including due diligence, relative valuation and scenario and bond yield analysis.