Introduction

Introduction

When all economies were recovering from the effects of the pandemic at the start of 2022, Russia’s invasion of Ukraine in February 2022 dealt them another blow. The protracted crisis led to substantial global disruptions, including a steep oil price increase, supply-chain disruptions, gas crises in strong economies, irregular bond and equity selloffs, the USD gaining a 20-year high, an increase in interest rates, global inflation shocks, along with a downturn in portfolio flows, currency devaluation and declining reserves due to financial instability in many emerging market economies including in India.

The decline in developed economies resulted in a drop in India’s exports of several items such as engineering goods, petroleum products, gems and jewellery, and textiles in FY23 (ended March 2023). However, since exports account for less than one-fifth of the domestic economy, India remained one of the fastest-growing countries in FY23.

Purpose of study

The study intends to analyse the impact of changing macroeconomic conditions on India’s economy and illustrate its strength amid the current sensitive global economy.

It analyses the effects of geopolitical tensions, as reflected by consumer price index (CPI) inflation that has been above the tolerance benchmark of 6% since January 2022.

It also throws light on the effects of inflation; although inflation has eased from a peak of 7.8% in April 2022, it remains a concern despite the Monetary Policy Committee increasing the policy repo rate and the RBI narrowing the policy corridor.

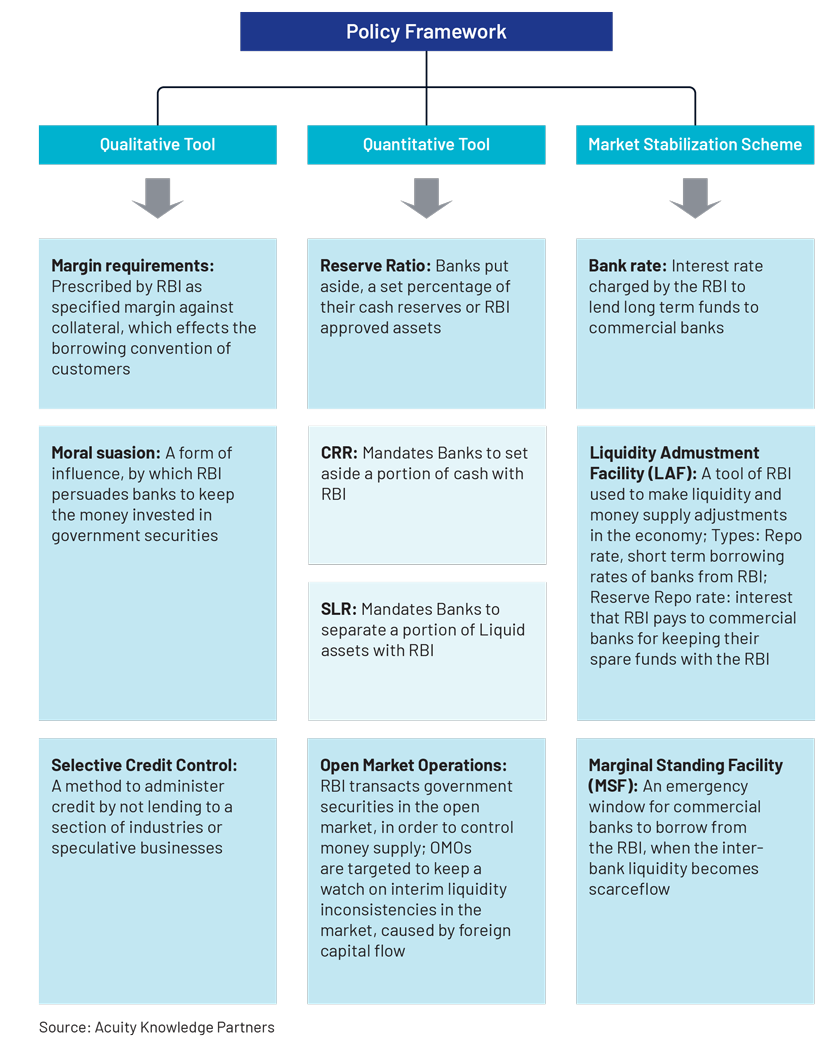

Framework of India’s monetary policy

Conclusion

India has put itself on a very high global pedestal. Its large domestic demand and rapidly growing infrastructure are safeguarding it from recession. Corporate tax revenue reached an all-time high of USD171bn in FY22, with GST collections rising every month because of heavy domestic consumption. The Indian government has prioritised “enhancing the ease of doing business”.

It has recorded 23% growth in FDI inflows after the pandemic versus before the pandemic, and the country is on track to attract FDI equity inflow to prominent sectors such as the information technology, manufacturing and service sectors. The government’s holistic efforts to develop the rural economy and rapid urbanisation have helped the country maintain its position as a top investment destination, currently unscathed by the recession facing developed economies.

To further curb the rising influence of the USD, capitalising on the current scenario, India should promote the inclusion of Saudi Arabia in the BRICS alliance. To avert the crisis the carbon border tax could cause, India should focus on developing green hydrogen and using it the most, instead of the grey hydrogen it currently uses. Being a front runner in green hydrogen production and export, will strengthen India globally, as the world seeks alternatives to oil to reduce carbon emission risks.