Introduction

Executive summary

The year 2022 was set to see a recovery from the effects of the pandemic as business returned to normal, but the Russia-Ukraine war again subdued global economic growth.

The Federal Reserve (Fed) allowed interest rates to plummet amid the crisis while pumping in trillions of dollars to support distressed companies and the unemployed. The supply-chain disruptions faced post-pandemic meant increasing demand could not be met. This resulted in economies plagued with higher prices and surging inflation. Sanctions on Russia led to increased oil prices and this, coupled with geopolitical turmoil, resulted in global inflation reaching a 25-year high. While the rest of the world resumed business, lockdowns continued in China until very recently, amid the country’s real estate crisis.

Central banks resorted to interest rate hikes to try to cool inflation. Investment banks and private equity (PE) investors felt the effects the most amid the increasing cost of capital and reduced deals.

Debt capital market (DCM) activity poised to reverse by mid-2023

Fees from DCM activity dropped to levels last seen in 2011. Volatility in the market and interest rate hikes reduced demand and supply.

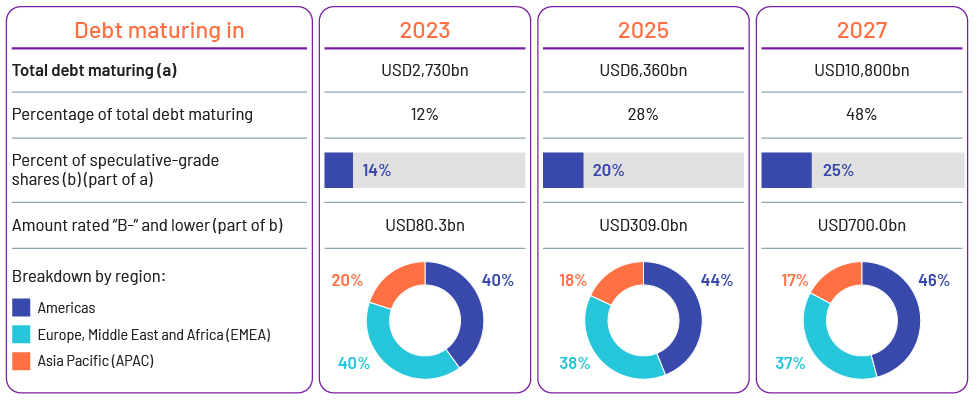

Financially favourable conditions until March 2022 allowed companies to raise capital at historically low rates and extend maturities. This led to debt maturing in 2023 falling by 11%. Until late 2022, companies managed with high liquidity and extended maturities. However, if interest rate hikes continue, a financial crunch may necessitate additional funding. Signs of a crunch are emerging, with companies resorting to cash preservation strategies and layoffs.

On the debt supply side, banks are being vigilant as leveraged finance builds up on their balance sheets. On the demand side, companies with hoarded cash may have fewer opportunities for new issuance. At the prevailing prices, direct investment offers better scope for companies with strong credit performance.

M&A activity to increase in 2H 2023

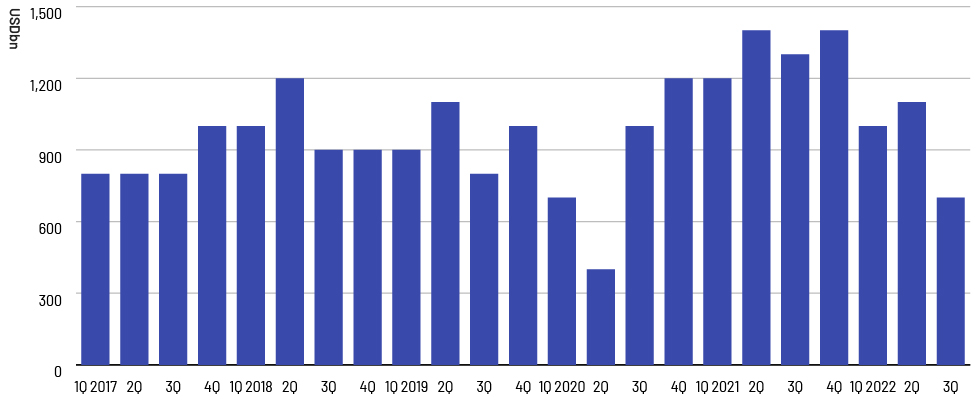

M&A activity continued to decrease in 2022 from the record-high levels of 2021. Global deal volume was down for three consecutive quarters. 3Q 2022 was the third lowest quarter since 2017; the decline in 1Q 2020 and 2Q 2020 was due to the pandemic.

M&A activity typically picks up pace in the last quarter of the year, seeking closure on open transactions. With low volume expected to have continued in 4Q 2022, 2022 is expected to have closed with deal volume at the historical average.

Small deals saw less heat and fell, on average, only by 13%, due to their ability to create longer-term value, compared with bigger deals that plunged 72%.

Global conditions led to many deals being postponed to 2023. Deal makers and buyers are focusing more on the fundamentals of the deals to strike the right synergies.

IPO window waiting to re-open in 2023

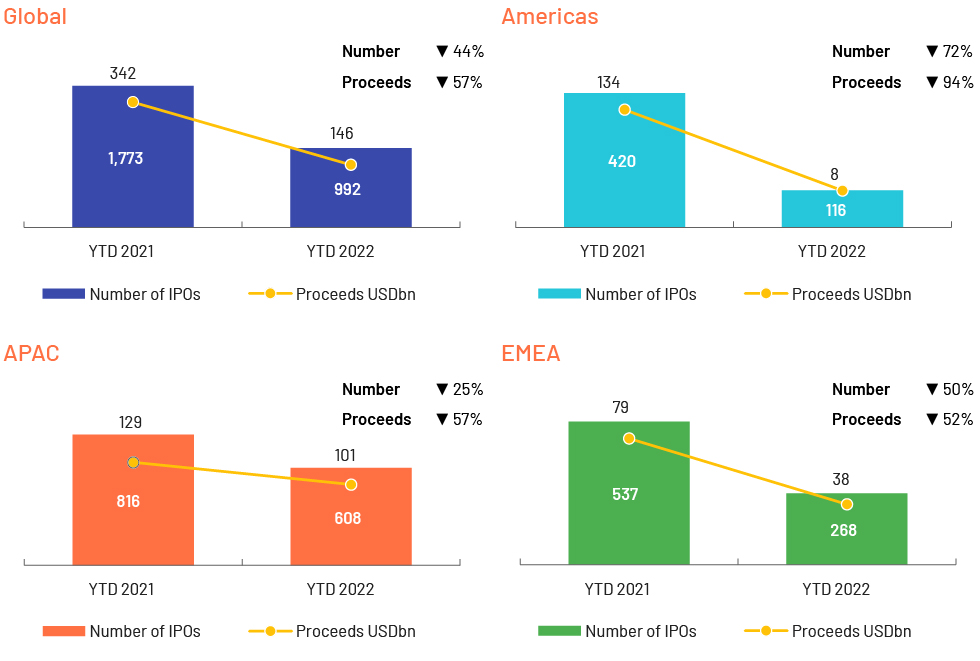

The Americas and EMEA faced headwinds in the IPO space:

Rising interest rates crushed stock valuations including last year’s high-profile IPOs, which saw significant declines from their issue prices

Chinese shell companies listed in the Americas are facing scrutiny, further slowing IPOs

Chinese companies led the pack with USD71.2bn on offer, although down by approximately 8% from 2021

Chinese markets were resilient to the global volatility; the country actually cut interest rates in an effort to end the real estate crisis

APAC was comparatively well placed to avoid recessionary pressures and continued to uphold the IPO trend

PE firms have pushed new IPOs and are monitoring the markets for further adjustments in valuations. Venture capitalists expect IPO activity to pick up after 2Q 2023. Major deals have been postponed to 2023 with expectations for interest rates stabilising and the economy returning to normal.

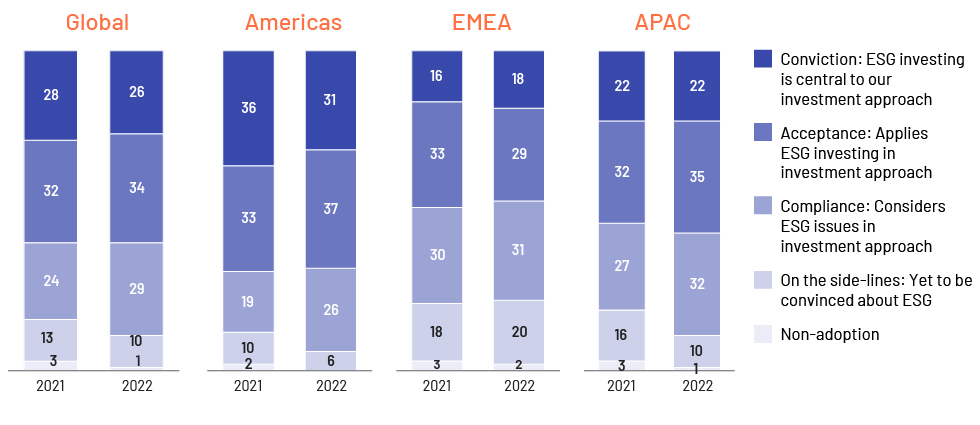

The future is in green and ESG deals

ESG adoption and integration have been in the limelight for a while. Investors and dealmakers have realised the impact of sustainable finance and green deals in their flight to quality. Recent trends show how strategies on the ground have moved from traditional screening to more thematic screening. Consideration of long-term impact, combined with regulatory pressure to meet sustainable goals, has led to integrating ESG in the investment process. The number of firms not integrating ESG in their investment approach has dropped significantly

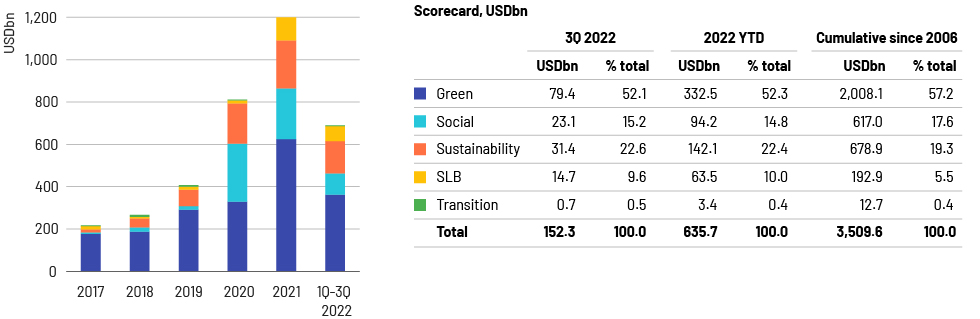

Sustainable finance activity declined along with other capital market activity amid the global economic collapse. Sustainable bond issuance reached pre-pandemic levels in the first three quarters of 2022, although lower than the unprecedented activity in 2021.

Technology a catalyst for future deals

2022 saw banks gaining a competitive advantage through technological transformation. The pandemic institutionalised change and forced a technological revolution. The banking sector lagged the curve in terms of adopting technology but is now forging ahead. From digital interactions to adopting digital fintech solutions, they are testing new waters by collaborating with metaverse platforms to improve and create a unique customer experience. Customer preferences are constantly evolving, requiring investment banks to have a competitive edge. Companies are looking to reduce operational costs and easing processes, as evidenced by SPAC deals.

Around 90% of the world’s central banks are running pilot programmes on central bank digital currency (CBDC). Countries such as the US, South Africa and India are exploring CBDC, and many European countries are in the development phase.

The speed of recovery across regions varies owing to changes in the geopolitical environment and the state of the economy. Supply chain- and energy-related issues will likely persist, as these require long-term solutions. This would present an opportunity for deal makers to venture into technological transformation and enhance funding capacity.