Introduction

- Executive summary

- Chapter 1: M&A activity: possible recovery in 2024

- Chapter 2: Debt capital markets: a resilient outlook amid uncertainty

- Chapter 3: IPO market: building momentum for a strong upturn

- Chapter 4: Changing landscape for technological advancement

- Chapter 5: Emerging markets likely to outperform developed markets

- Conclusion

Executive summary

The year 2023 was challenging for the investment banking sector due to geopolitical conflict, market volatility, supply-chain bottlenecks, rising inflation, higher interest rates and changing financial regulations, resulting in fewer M&A, equity capital market (ECM) and debt capital market (DCM) deals.

Global investment banking revenue stood at USD50bn in the first three quarters of 2023, 20% less than in the first three quarters of 2022. Against this challenging backdrop, investment banking firms were forced to implement measures to increase their operating efficiency and contain costs. They evolved with the changing environment, adopting modern operating models, implementing new technology in their operations and building capabilities in-house, implementing all measures necessary to remain competitive and boost productivity.

Investment banks across the globe are implementing measures to optimise costs amid the economic downturn. However, costmanagement programmes of the different divisions should be integrated, and the focus should be not just on cost cutting, but also cost transformation.

Chapter 1: M&A activity: possible recovery in 2024

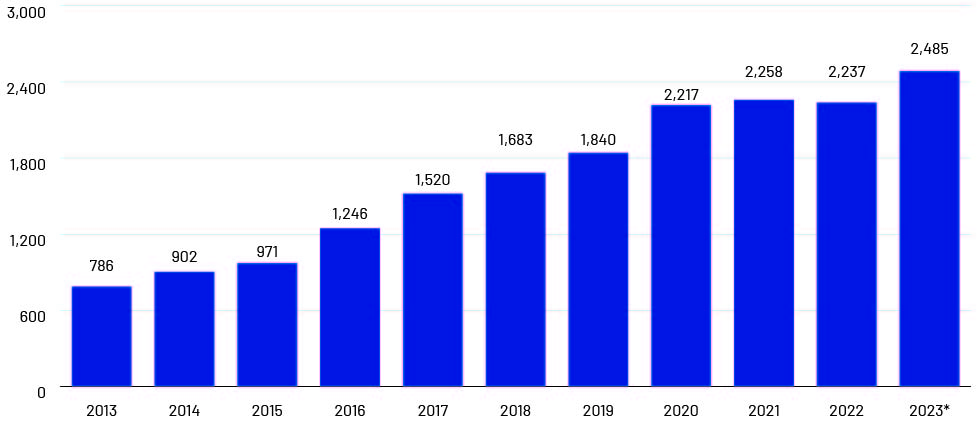

M&A activity has been low since 2013, and market volatility and geopolitical unrest have made IB firms change their outlook and M&A strategies. The number of global M&A transactions in 2023 was almost 25% less than in 2022. High levels of dry powder with financial sponsors and the narrowing price gap between buyers and sellers will likely drive M&A transactions in 2024. To remain competitive, companies need to understand and adapt to the changing environment.

M&A activity is set to gain momentum in 2024, driven mainly by the following:

High levels of dry powder with financial sponsors: Approximately USD2.5tn of dry powder was available in the market as of July 2023. It is imperative that fund managers invest this money in the market, despite market conditions.

Narrowing of price difference between buyers and sellers: The wide price gap between buyers and sellers was another reason for the staggered deals in 2023. The price gap is expected to narrow as sellers and buyers accept the new normal and as rising interest rates, inflation and financing costs gradually stabilise. Learn about how recovery of M&A activity in 2024 is inevitable.

Chapter 2: Debt capital markets: a resilient outlook amid uncertainty

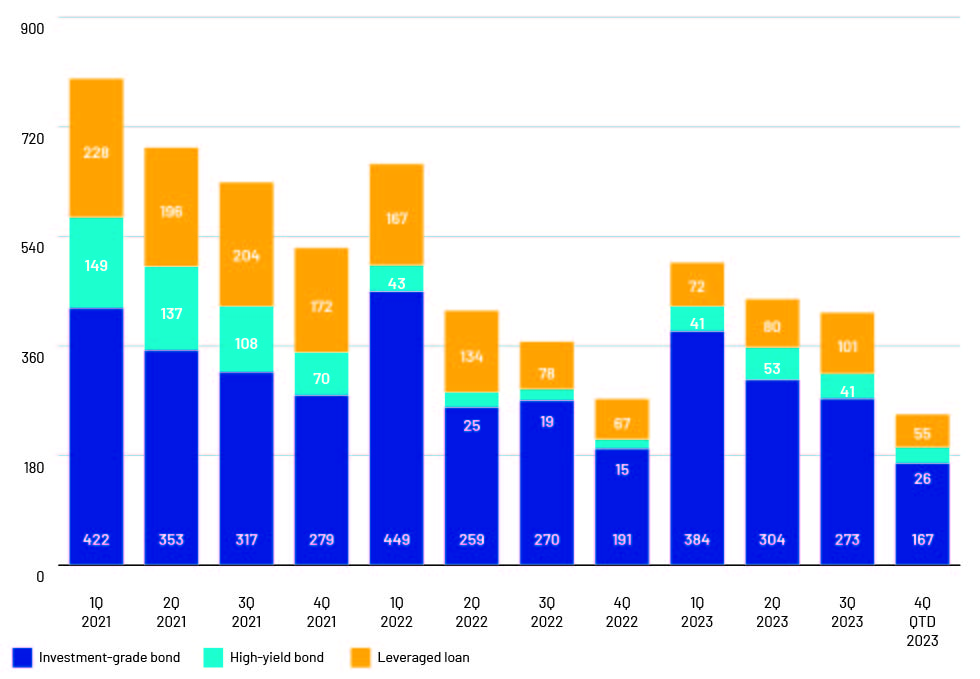

Market volatility, combined with geopolitical tensions and central banks hiking interest rates to offset increasing inflation, led to turmoil in DCMs in 2023. However, as consumer price increases slowed and market sentiment turned positive towards the end of the year, market activity picked up.

The major central banks are gearing up for a potential shift in their interest rate hikes and economic policies in 2024. This paradigm shift would pave the way to reducing financial pressure, benefiting companies and governments.

Debt capital markets: a resilient outlook amid uncertainty

Rising inflation, Fed rate hikes and geopolitical tensions caused turmoil in capital markets in 2023. However, inflation steadying and a pause in interest rate hikes paved the way for optimism during the last quarter of the year, and the market seemed to stabilise. Refinancing volumes in the leveraged financing space increased to 74% of total volumes in the first half of 2023, significantly reducing the number of maturities in 2024 and 2025. USD101bn worth of US leveraged loans mature in 2025 and USD185bn in 2026. Issuers expect a recovery in M&A activity to increase leveraged financing in the market.

Chapter 3: IPO market: building momentum for a strong upturn

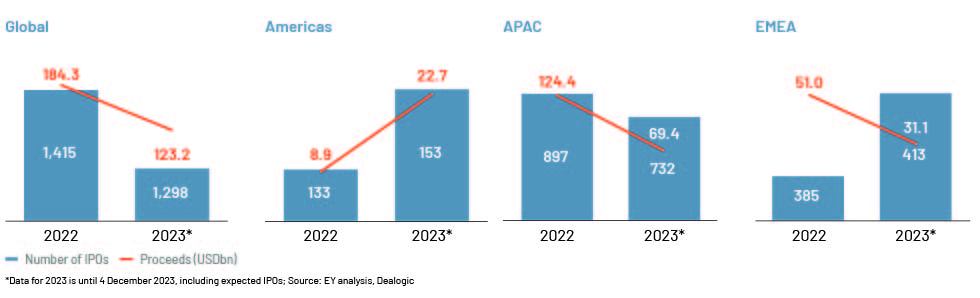

The IPO market saw a shift in sentiment in 2023 and is set to bounce back to pre-2019 levels in 2024. The Americas and Europe, the Middle East, India and Africa (EMEIA) saw a rebound in 2023. Strong economic growth backed by growing capital markets in countries such as Indonesia, India and Japan also resulted in higher yields than benchmark indices.

Improved investor sentiment in Western markets, growing emerging markets (EMs), the large number of private companies backed by venture capital and stabilising inflation are expected to reduce the headwinds and provide opportunities for the IPO market in 2024.

IPO market gaining momentum The IPO market has been struggling since the boom in 2021, when the largest number of IPO deals in the market (2,388 IPOs) raised USD453.3bn1. This level of activity is unlikely to be repeated in the near future, but market experts forecast that the IPO market will stage a rebound to levels such as seen in 2019 and before. USD101.2bn in capital was raised globally through IPOs in the first three quarters of 2023, a 32% decrease y/y. Despite the drop, 3Q alone showed a notable improvement, with September seeing the most recovery after the 2021 put.

Investors are realigning, and the valuation gap between issuers and investors is narrowing. Investors are now looking at new IPO pricing as a benchmark versus valuations of previously priced IPOs. Strong company fundamentals and their avenues to profitability are a major concern for investors due to the tighter liquidity and higher cost of capital in the market. We expect inflation to slow in 2024 and do not consider the possible economic downturn a threat any longer.

Chapter 4: Changing landscape for technological advancement

Technology has been evolving, and a number of processes are being automated. IB firms, too, are adopting technological tools to improve their efficiency. Wall Street has also adopted technology to improve operational efficiency and streamline processes and is positioning itself to offer better-quality services. The future of IB depends largely on how well IB firms adapt to the changing technological advancements and keep abreast of regulations.

Automating redundant tasks with AI:

- JPMorgan Chase recently introduced ChatGPT-like software, a trademark product called “IndexGPT” that analyses and selects securities customised based on customer needs

- Deutsche Bank has been developing AI strategy since 2021; it invested in expanding its AI workforce in September 2023

- ING Group introduced Holmes, a tool to help front-end office employees accelerate background processes such as finding and using rating reports and credit documents

- Wells Fargo introduced Fargo™, a virtual assistant to answer banking related questions IB service vendors use AI-enabled offerings and are investing heavily in new technology.

Chapter 5: Emerging markets likely to outperform developed markets

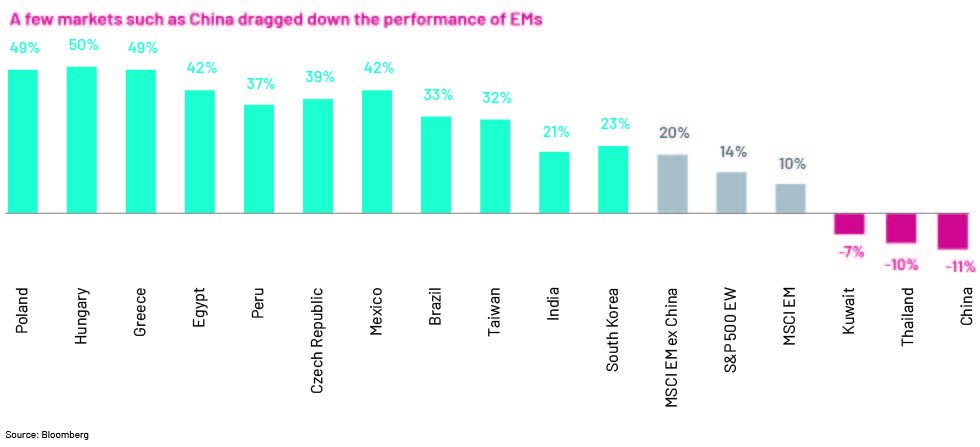

Emerging markets (EMs) have recovered faster than developed markets (DMs). We expect EMs to enjoy a positive environment in terms of equities, the debt market and the general economy in 2024 due to inflation declining and macroeconomic momentum increasing. Against the backdrop of a lagging China market, the EM Index (except China) is outperforming the S&P Index and other major indices. With positive economic growth due to inflation declining and a strong middle class, we expect EMs to perform better in 2024. The IMF forecasts a number of EMs to grow more than DMs.

We expect EMs to enjoy a positive environment in terms of equities, the debt market and the general economy in 2024 due to inflation declining and macroeconomic momentum increasing. EMs account for around 60% of global GDP, with tailwinds from increased consumption by a growing middle class. We expect the middle class in these economies to account for more than 50% of the global middle-class population by 2030.

We expect EM debt to lead financial markets in 2024. EM debt has historically been correlated positively with market volatility/cyclicality. The trend seems to be changing due to recent improvements in infrastructure and sectors, and as wealth increases. The US and China dominate the global economy, and their slower growth would have a major impact globally, but EMs are likely to be resilient, with the IMF forecasting higher growth among EMs than among DMs. Banking outsourcing services

Conclusion

This year promises hope for the IB sector. On the back of expectations for a recovery in M&A and ECM activity and more DCM deals, IB firms have started responding positively and expect modest growth in 2024. We expect an increase in restructuring activity, especially in sectors such as commercial real estate, technology and consumer. Corporates will likely look at smaller deals to gain momentum before considering mega deals. We expect investors to be more vigilant and consider performance before making an investment.

We also expect a number of IPO deals after the prolonged suspension, and a spike in refinancing in DCMs. Large private equity firms earned a substantial amount of cash in 2023 and have high levels of dry powder available; they would be under pressure to start investing these funds irrespective of market conditions. This could increase the number of take-private and LBO deals in the market. A large number of activities that were paused in 2023 due to market conditions are set to recover, and we expect the market to grow modestly.