Introduction

Introduction

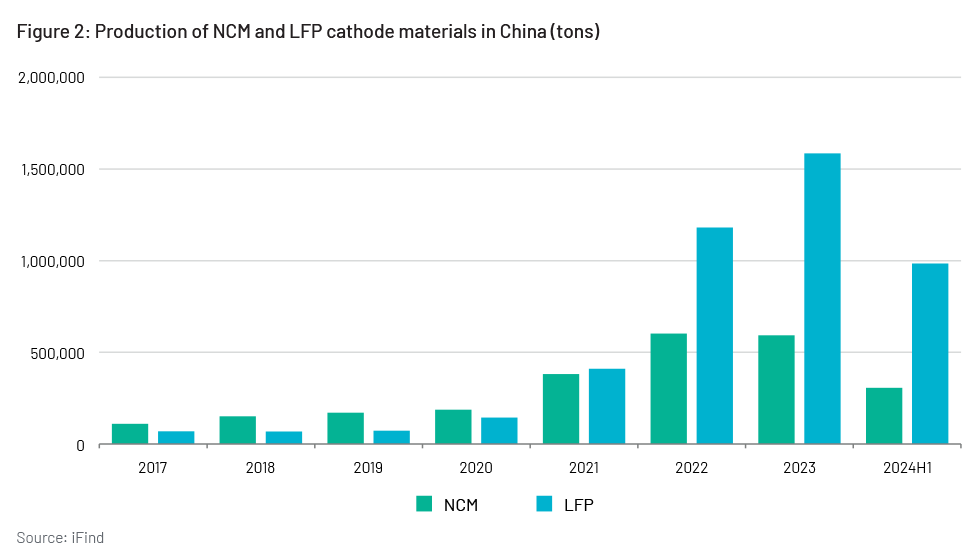

NCM batteries accounted for the largest market share before 2020 due to high energy density and strong subsidies from the Chinese government, while LFP batteries saw a reversal in shipments in 2021 due to technology iteration, lower cost and higher safety. Although LFP batteries account for most of the market share, there are still marginal changes. For example, the price gap between NCM and LFP batteries is shrinking, and NCM batteries are more cost-effective from the perspective of end products. These new changes may lead to a rebound in market share for NCM batteries. This blog analyses the factors driving the rebound in the share of NCM lithium batteries.

Driver 1: Cost and price of NCM raw materials continue to decline, leading to a rebound in market share

The price of key raw material, lithium carbonate, decline. For every 1GWh battery, the NCM cathode requires about 100 tons of lithium carbonate more than does the LFP cathode. The price of lithium carbonate has continued to fall because of oversupply – to RMB80,000/ton in 2024 from its highest of nearly RMB600,000/ton in 2022.

The high-nickel trend of ternary cathode is obvious, leading enterprises have developed upstream industrial chain, Indonesian laterite nickel ore, to reduce costs.

For example, CNGR Advanced Material have established four major nickel raw material industrial bases in Indonesia with a production capacity of nearly 200,000 metal tons. Shenzhen Green EcoManufacture increased investment in the Indonesian laterite nickel project and started construction of a nickel raw material hydrometallurgy plant with annual output of 20,000 metal tons.

Price gap between NCM and LFP batteries is narrowing. The price of NCM cathode has fallen, further narrowing the price gap between NCM and LFP batteries. In the case of the same prismatic battery cells, the price gap once reached RMB0.2/Wh but is now only RMB0.095/Wh, a drop of more than 50%.

Driver 2: New energy vehicles equipped with NCM batteries are more cost-effective, and demand side has driven market share of NCM batteries to rise

Considering factors such as the price of per unit driving range, NCM electric vehicles have more advantages. Vehicles equipped with NCM batteries have a higher price and longer range in China, however, per unit driving range is more cost-effective. We take Tesla Model 3 as an example to analyse the cost-effectiveness of NCM electric vehicles. The price per km of driving range of the NCM model (starter edition) is RMB381, RMB2 less than the LFP model. Further analysis shows that the NCM model is priced RMB40,000 higher than the LFP model, but has extra driving range of about 107km. The unit price of this part of the range is RMB373, which lower than the unit price per km of the LFP model.

Under “range anxiety”, the cost-effectiveness of NCM models may drive sales growth of such models and heat up the NCM battery market. In its consumer survey, the China Association of Automobile Manufacturers found that “driving range” is still the most important consideration when purchasing a new energy vehicle, accounting for 31.8% of the decision.

Obstacles to the increase in market share of NCM batteries

Technology iteration: Technologies relating to cathode materials are developing rapidly; especially, the technical competition between ternary and lithium iron phosphate cathode materials has always existed. If new types of technology or batteries emerge in the future, the existing technical routes will be impacted and face the risk of substitution.

Fluctuation in downstream demand: If the downstream market performs worse than expected in the future, it would result in fluctuations in demand in the lithium battery market and affect the development of NCM batteries.

Conclusion

In summary, the cost of NCM batteries continues to decline due to the drop in the prices of lithium carbonate and ternary precursors, further narrowing the price gap with LFP batteries. Terminal products – new energy vehicles equipped with NCM batteries – have also demonstrated high costeffectiveness. We, therefore, expect the market share of NCM batteries to reach an inflection point.

How Acuity Knowledge Partners can help

We help clients stay ahead of the curve by adopting innovative and sustainable business models and taking first-mover advantage of available market opportunities in the new energy vehicle and electric mobility industry. Our sector experts work with our clients’ strategy, business development, market intelligence and M&A teams, supporting them with critical insights. Through our bespoke end-to-end support and dedicated working models, we ensure our clients are prepared for emerging businesses, regulatory changes, technological advancements and underlying opportunities.