Introduction

Introduction

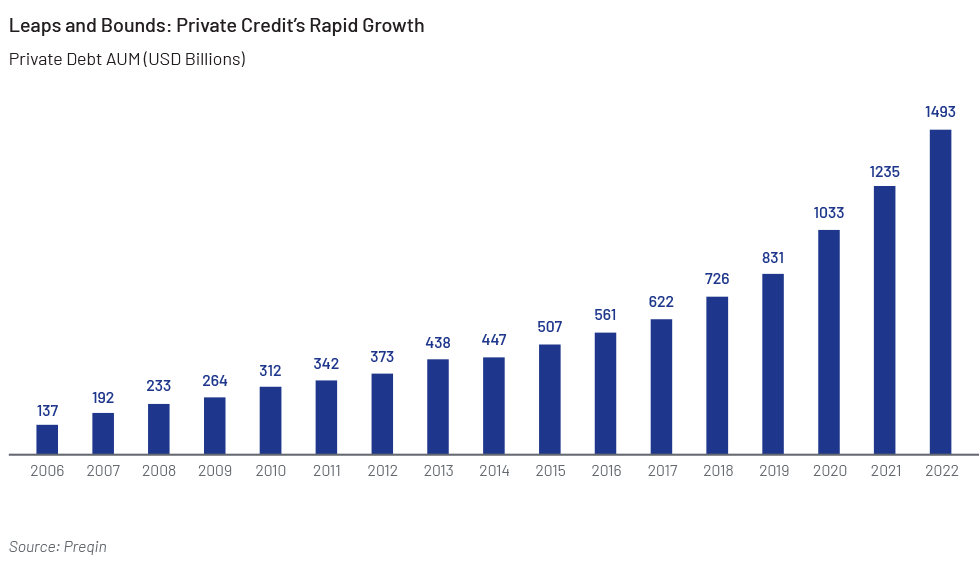

Private credit (PC) is a type of lending that operates outside the traditional banking channels. In this market, lenders deal directly with borrowers to issue debt that is privately held and not publicly traded. Although the PC market emerged around three decades ago as an alternative source of financing for companies deemed too large or risky for traditional banks and yet too small to issue loans in public markets, it gained significant traction particularly after the 2008 global financial crisis, which resulted in tighter lending norms for banks that led private credit starting to fill the gap. There has also been a spike in demand for PC from borrowers as well as investors in recent years.

Growth and Challenges of Private Credit

The Private Credit market has become an important alternative source of financing, including features such as speed, certainty and flexibility of terms, with assets under management (AuM) reaching new heights. However, PC managers are facing challenges across the PC deal lifecycle – from market intelligence and deal sourcing to portfolio management and strategic advisory. Offshoring research and analysis tasks can provide a solution to these challenges.

Key takeaways

Increasing competition and tougher regulation are driving PC fund managers to target ways to add cost-effective scale and analytical depth to their investment decisions

Offshoring provides access to a global talent pool, helps ensure 24x7 up time and, most importantly, enables fund managers to deploy onshore resources to cover high-value activities

Offshoring is a proven concept in the financial services sector, providing cost benefits and flexibility of scaling in line with business requirements

Strategic Offshoring for Enhanced Efficiency

A strategic approach to offshoring, identifying and sequencing tasks can be outsourced based on the complexity and business requirement and impact. It advises starting with low-complexity tasks and gradually moving to more complex ones, ensuring a smooth transition and building a strong foundation for offshoring operations. Financial services offshoring is a proven concept, providing cost benefits and scalability to support evolving business needs.

Activities range from gathering market intelligence to identifying suitable investment opportunities amid a plethora of options, to proactively sourcing and screening deals to build a robust dataset of potential targets, performing deeper due diligence to evaluate the feasibility of these investments and executing transactions with precision. After investment, PC managers manage portfolios of companies by regularly monitoring their performance, ensuring compliance with covenants and regulations, and working towards successful exits or supporting growth. However, tasks involving research and analysis are ideal for offshoring, as they are both more structured and measurable, and capable of being objectively defined.

Choosing the Right Operating Model

The paper outlines three offshoring models: Extension, Co-working and Carve-out. The choice of model depends on factors such as task complexity, business criticality, the client's business situation and the stage of the offshoring programme.

Implementing an Offshoring Programme

To ensure offshore programmes are implemented in a timely and efficient manner, PC managers must first align their internal organisation and resources with the objectives. Subsequently, the selected offshoring partner should be engaged to establish the offshore team, requisite infrastructure and service rollout. Aligning internal resources and organisation with programme objectives. To ensure the programme’s long-term success, PC managers must internally align all key stakeholders by defining clearly its objectives, structure, participants and roles, and governance model.

The Future of Offshoring in Private Credit

As the Private Credit space continues to thrive, offshoring emerges as a key strategy for Private Credit managers to gain a competitive edge. We believe Private Credit managers will benefit significantly by including offshoring in their basket of response strategies. In fact, our experience has shown that partnering with an offshoring vendor enables managers to scale their operations cost-effectively and secure incremental capabilities to increase the breadth and depth of analysis at each stage of the deal lifecycle, while ensuring key personnel remain focused on critical tasks and core analysis.

Acuity Knowledge Partners’ Comprehensive Offshoring Services

We offer comprehensive support across the PC investment lifecycle, including market intelligence, deal sourcing, investment evaluation, transaction support, portfolio management and strategic advisory. Our commitment to operational excellence and innovative solutions empowers clients to harness the full potential of the PC market for sustainable and profitable investments.