Introduction

Executive Summary

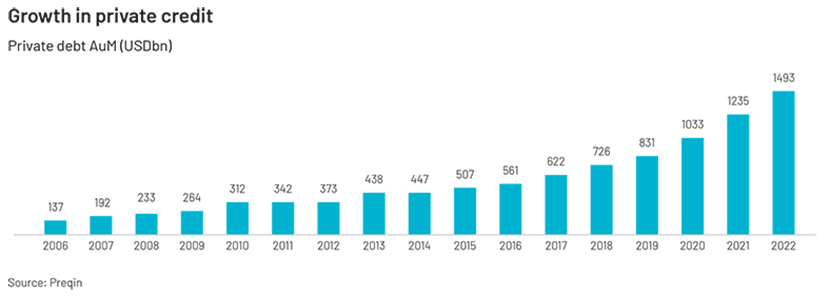

The private credit market grew gradually for a number of years before it gained significant traction among investors and borrowers after the 2008 global financial crisis. One of Wall Street’s previously obscure activities, private credit has now become a highly-sought-after alternative source of capital, rivalling mainstream avenues of financing for all types of business. This segment grew to a substantial USD1.5tn by end-2022 from just USD200bn in 2008 and is expected to reach USD2.3tn by 2027, according to Preqin.

With its potential for higher yields and tailored financing solutions, private credit has solidified its role in the portfolios of discerning investors. However, the path to success in this market is paved with complexity, requiring a deep understanding of the entire deal lifecycle and the ability to navigate its various stages with expertise and precision. This document provides a comprehensive overview of the private credit deal lifecycle, offering fund managers and investors a roadmap to navigate the market’s intricacies and capitalise on its opportunities.

The lifecycle is broken down into five critical stages

Mastering the market – the critical roles of market intelligence, deal sourcing and screening

In the complex and nuanced world of private credit, the ability to rapidly identify and capitalise on investment opportunities is a hallmark of industry leaders. Market intelligence, deal sourcing and screening are critical components of a successful private credit strategy, offering the insights and leads that investors require to maintain a competitive edge. This introductory article delves into the essence of these foundational services and their roles as catalysts for informed decision-making, risk management and strong portfolio performance, setting the stage for the in-depth discussions to follow.

Streamlining investment success – the integral roles of due diligence and investment evaluation

In the complex arena of private credit, the path to investment success is paved with diligent research and meticulous analysis. A streamlined approach to investment evaluation and due diligence is essential for aligning opportunities with an investor’s strategic and financial goals. Understanding the essential components of investment evaluation and due diligence and how they serve to empower investors with the confidence to make sound decisions is paramount.

Navigating the intricacies of transaction support and deal execution in private credit

After assessing the importance of market intelligence and due diligence, we now delve deeper into the next activity of the private credit deal lifecycle. We arrive at a pivotal stage: “transaction support and deal execution”. Here, the insights and preparation from the initial phases of “market intelligence and deal sourcing/screening” and “investment evaluation and due diligence” are translated into strategic action. This article provides insights on how to navigate deal complexities, ensuring informed valuation and strategic decision-making in high-stakes transactions.

Transaction support and deal execution are pivotal in the private credit investment process. By conducting in-depth valuation assessments, performing “what-if” scenario modelling and making strategic decisions, investors can navigate the complexities of high-stakes transactions with confidence. The key to success lies in a meticulous approach to valuation, a readiness to adapt to new information and the strategic foresight to anticipate different outcomes. Following such practices, investors can enhance their ability to execute transactions effectively and maximise the potential of their private credit investments.

Optimising returns through strategic portfolio management and performance monitoring

Following the meticulous processes of market intelligence, investment evaluation and transaction support, the fourth stage of the private credit deal lifecycle emerges as a critical juncture – portfolio management and performance monitoring. This stage is where the strategic planning and analysis from the previous stages are put into action and the real work of maximising returns and managing risk begins. Here, the focus is on the specialised practices that underpin the health and prosperity of a private credit portfolio.

The portfolio management and performance monitoring stage is crucial, reflecting the need for continued vigilance and strategic oversight of the investment process. It is at this juncture that the true value of the preceding stages is realised as investors strive to optimise their portfolio performance and align each investment with its respective strategic and financial objectives.

However, this stage is not without its challenges, such as market volatility, credit risk management, data accuracy and regulatory compliance. The integration of automation technologies offers a robust solution to these challenges, enhancing efficiency, precision and responsiveness. Automated systems provide real-time data processing, risk assessment and compliance monitoring, which are indispensable for informed decision-making and effective management. By leveraging both meticulous management practices and the latest advancements in automation, investors are better equipped to navigate the complexities of the private credit market and propel their portfolios towards sustained success.

Strategic advisory and growth support in private credit

The private credit market is a complex and evolving landscape, where an investment’s journey is marked by a series of critical stages. Before we delve into the nuances of “strategic advisory and growth support”, it is essential to understand the foundational stages that precede it.

The lifecycle begins with “market intelligence and deal sourcing” where investors harness expert insights to pinpoint and vet potential opportunities. This leads to the “investment evaluation and due diligence” phase where the viability of investments is rigorously assessed against strategic and financial goals. The third stage, “transaction support and deal execution”, involves meticulous deal structuring and valuation based on comprehensive due diligence.

The process is then solidified by “portfolio management and performance monitoring” aimed at optimising returns and adhering to investment covenants. Each stage is crucial, laying the groundwork for the final phase where strategic advisory services play a key role in fostering growth and achieving long-term objectives.

Strategic advisory services are crucial for investors seeking success in the private credit market. By offering M&A support, market insights and growth strategies, advisors enable clients to realise their business ambitions and manage the intricacies of private credit investments. Comprehending the significance of strategic advisory is key for any investor looking to foster growth and secure successful exits in this dynamic field.

Conclusion

With this final stage, we bring our comprehensive exploration of the private credit deal lifecycle to a close. We have journeyed from the foundational stage of market intelligence through to the sophisticated realm of strategic growth support. Each stage of the lifecycle presents its own set of challenges and opportunities, requiring a blend of analytical acumen, strategic insight and operational expertise. The initial phase of market intelligence, deal sourcing and screening is foundational, setting the stage for all subsequent activities. It is here that the groundwork is laid for identifying and pursuing the most promising investment opportunities.

Due diligence and investment evaluation follow, serving as the critical juncture where potential deals are scrutinised for their financial soundness, operational efficiency and regulatory compliance. This rigorous analysis is essential for ensuring that investments align with strategic goals and risk profiles. Transaction support and deal execution translate the meticulous preparation of earlier stages into concrete action. The ability to navigate the complexities of dealmaking can significantly influence the success of an investment. In the portfolio management and performance monitoring stage, the focus shifts to the ongoing task of optimising returns and managing risks.

This requires continued vigilance and the ability to adapt strategies in response to market dynamics and portfolio performance. Finally, strategic advisory and growth support encapsulate the lifecycle, leveraging accumulated knowledge and expertise to guide investments towards growth and successful exits. Understanding the critical importance and interconnectedness of each phase is essential for investors who aspire to master the complexities of private credit.

How Acuity Knowledge Partners can help

We offer comprehensive support across the lifecycle of private credit investments. From providing market intelligence, deal sourcing and screening expertise to fortifying investment evaluation and due diligence processes, we are an integral part of our clients’ teams. Our specialised services in transaction support, deal execution, portfolio management and performance monitoring ensure that investments are not only compliant but also primed for optimal performance. With strategic advisory and growth support, we guide clients through market complexities, leveraging the latest analytical tools and regulatory insights to develop customised growth strategies and identify new opportunities. Our commitment to operational excellence and innovative solutions enables clients to navigate the private credit market confidently, harnessing its full potential for sustainable and profitable investments.