Introduction

Introduction

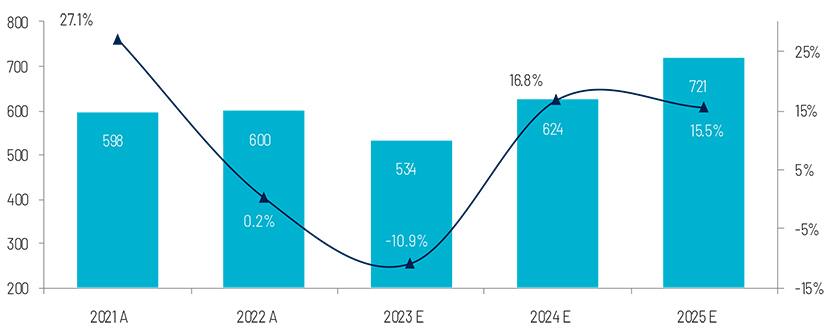

The semiconductor sector has grown consistently over the past two decades. However, it faced headwinds on multiple fronts in 2023. Despite the challenging market conditions last year, 2024 is poised to be a promising year for the global semiconductor market. The optimism stems from the following trends forecast for 2024:

Recovery of the memory chips market: The macroeconomic slowdown in 2023 led to anaemic demand and a substantial oversupply of memory chips. However, the global memory market is expected to recover, growing 66.3% in 2024.

Generative AI (GenAI) market to be a tailwind for the semiconductor sector: As GenAI applications take the world by storm, demand for high-performance graphics processing unit (GPU)-based servers, accelerator cards in data centers and complex large language models (LLMs) will likely continue to skyrocket.

Recovery in semiconductor demand by end market: The automotive and industrial sectors, followed by consumer electronics, are expected to witness pronounced growth from 2024, increasing demand for semiconductor chips.

Navigating geopolitical conflict: Geopolitical conflict due to bans and regulations strongly affects semiconductor companies. For example, the US has already imposed export bans on certain chips, particularly the export of AI chips and advanced semiconductor manufacturing technologies to China, citing the need to protect national security.

Harnessing the transformational power of sustainability: One of the trends in 2024 would be sustainability initiatives taken by semiconductor companies to enhance the sustainability of fabrication plants and buildings, enabling low-power consumption and a reduction in customers’ carbon footprints.

Increasing adoption of smart manufacturing techniques including digital twin in chip manufacturing: Semiconductor fabrication plants and outsourced assembly and test facilities (OSATs) are adopting smart manufacturing techniques by integrating IoT devices, robotics technology, AI/ML, and data analytics.

Shortage of skilled workers in the semiconductor sector to continue: A growing problem for this sector is the scarcity of skilled labour. To address this issue, companies and policymakers would continue to invest in developing new talent pipelines, hire talent from nearshore regions, recruit skilled immigrants, etc.

Key Takeaways

Trends in 2024, such as the spike in demand, driven by the automotive sector and demand for memory chips, strategic government interventions, geopolitical tensions, AI integration and workforce dynamics would redefine the semiconductormarket landscape in 2024.

How Acuity Knowledge Partners can help

We have been providing strategy research support to diverse stakeholders in the technology sector – tech corporates, tech advisory firms and tech-focused investors – for more than two decades. We have a large pool of seasoned professionals who have been tracking the semiconductor sector for over 10 years and providing strategic research support across the value chain. Over the years, we have partnered with leading semiconductor companies, working closely with their strategy, business development, market intelligence and M&A teams to provide them with the information and analysis necessary to achieve their business objectives.