Introduction

Introduction

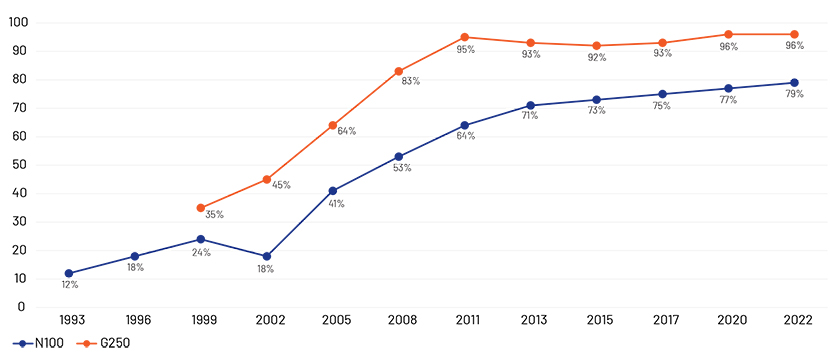

Corporate reporting practices have evolved from a concentrated focus on financial performance disclosures towards a balanced reporting focusing on both financial and non-financial reporting practice. This has been fueled by demand for information by a number of stakeholder groups for informed decision-making paving the way for a broader focus on corporate performance, marking a shift away from a mere focus on shareholder value creation towards a shared value creation for a number of stakeholder groups.

The paper offers a historical overview of the evolution of corporate reporting practices and the growth in reporting guidelines such as the GRI framework, SASB, UNSDGs etc. providing a formal structure for sustainability related disclosures. The application of such reporting guidelines facilitates the uniformity in disclosure practices making it convenient to compare sectoral performance. Additionally, the paper also discusses how macro-level changes, for example, in Oman, South Africa, Saudi Arabia etc. is stimulating the growth in sustainable corporate practices.

Key Takeaways

The paper subsequently narrates the rationale and motivations for corporates to report on their extra-financial performance. It lists a number of key reasons for the growth in sustainability disclosure practice. Factors include the need for accountability and legitimacy; fulfilling informational needs for diverse stakeholder groups; financial benefits accrued through such reporting practices; risk management and talent management; amongst a number of other reasons.

The report also answers key questions on:

Why companies engage in sustainability reporting

How to get a broader focus on performance, among other metrices

The financial benefits of sustainability reporting

Conclusion

Sustainability reporting will continue to play a major role as a communication tool for companies to reach out to different stakeholder groups – not only to shareholders and providers of financial capital, but also to non-financial stakeholder groups affected by the company’s performance. Through such tools, companies can renew their licences to operate in society through deliberate and positive accountability.