Introduction

Executive Summary

There now seems to be light at the end of the tunnel. Our survey indicates that investment banks and advisory firms trust that the time of uncertainty is almost over. They have a comparatively better outlook towards the deal pipeline while maintaining their focus on improving operational efficiency by leveraging technology and financial services offshoring solutions.

Optimistic outlook – M&A under the lens

M&A is expected to be the #1 contributor to overall revenue, followed by debt capital markets and equity capital markets.

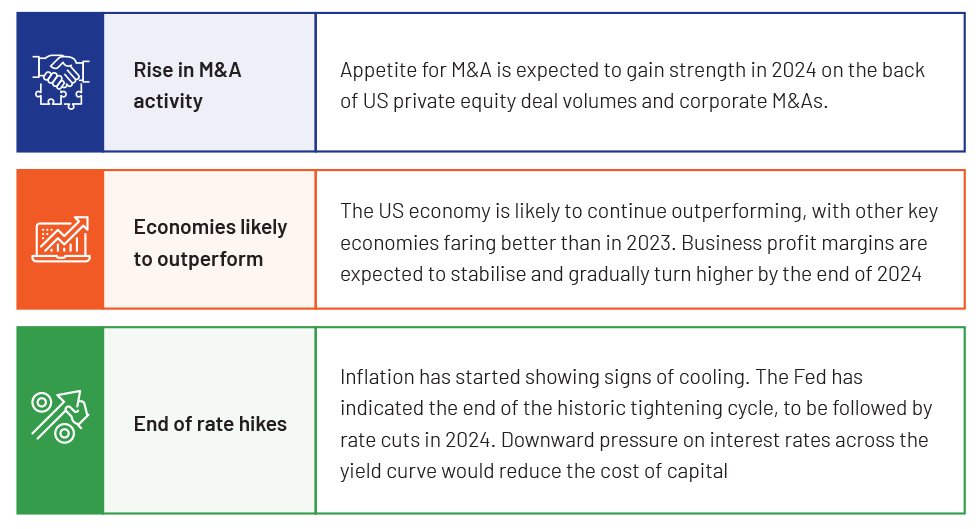

The global economy is expected to overcome most of the uncertainties that weighed heavily in 2023. The deal-making landscape is, therefore, expected to bounce back in 2024.

Although they faced a challenging environment, debt capital markets performed well in 2023, and the momentum is expected to continue. The global volume of convertible bond offerings doubled in 2023 vs 2022. More than USD200bn of convertible debt is set to mature from 2024 to 2026, indicating a need for refinancing.

Deal drivers and headwinds

Reasonable valuations and dry powder available with financial sponsors are seen among the top drivers of deal activity in 2024. Geopolitical uncertainty is viewed as the #1 headwind for the industry this year, followed by valuation mismatch and a higher cost of capital

The ongoing geopolitical headwinds would be offset mainly by the expected decline in interest rates, availability of dry powder, demand for growth capital and cross-border transactions Ranking of factors driving M&A, according to the survey respondents:

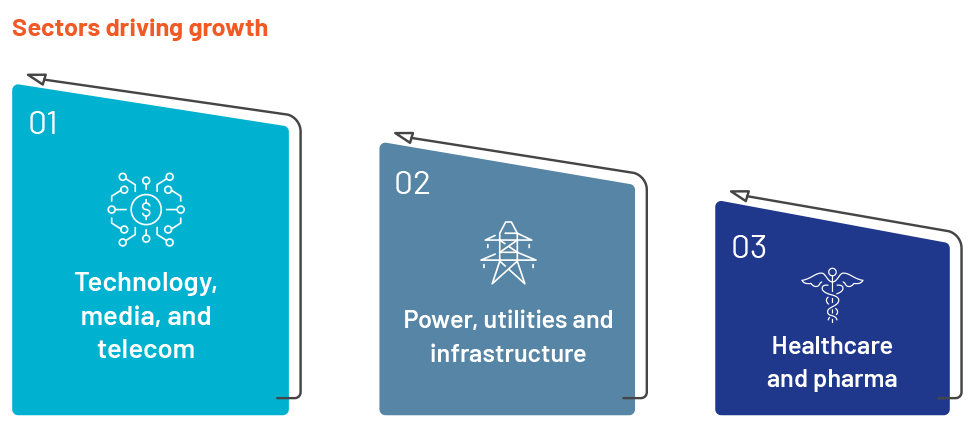

Outlook by sectors

Technology, media and telecom to remain the primary sector driving the recovery in revenues, followed by the power, utilities and infrastructure sector. The healthcare and pharmaceuticals sector to remain resilient.

The top drivers of M&A activity in the TMT sector include innovative technologies such as cloud technology, robotics, AI, supply-chain automation and innovation in the sustainability space.

US infrastructure spending is likely to dominate the public finance space; the primary focus of M&A deals would be to reduce carbon footprint, and private equity funds would be deployed to enhance deal flow in the EV sector.

Healthcare and large pharma will be compelled to participate in M&A deals due to the expiry of patents in the near term and close to end of life holding period for numerous healthcare companies in private equity portfolios.

Strategic priorities and focus areas for C-suite executives

While expanding/augmenting products and services for revenue growth, investment banks and advisory firms are keen to continue focusing on idea generation and origination despite these being the most time-consuming tasks.

63% of the respondents highlighted that their firms are likely to face constraints in terms of employee bandwidth in 2024.

Technology as a growth driver

68% of the respondents agree that investment banking and advisory firms’ tech spending will increase in 2024. Majority of the firms have technology roadmaps targeting productivity and efficiency.

Technological advancements and innovations have altered the way investment banking firms operate. To address and keep pace with evolving market dynamics, investment banks and advisory firms are formulating digital transformation strategies.

Digital tools and platforms are being increasingly leveraged by investment banking and advisory firms to evaluate global markets, revisit and review their portfolios, enter new economies and capture cross-border deal opportunities.

Sustainable finance and ESG

M&A and capital markets are likely to be dominated by ESG and sustainable finance in 2024. Also, Private equity firms are focusing on impact investing.

Sustainable debt markets were resilient in 2023, and dynamics are expected to remain favourable in 2024. The sustainable bond market is lucrative, and the sustainable debt market would continue to focus on green bonds.

ESG disclosures are becoming increasingly essential for M&A deal closure across sectors and are impacting the due diligence process.

Outsourcing as a strategic channel to scale and achieve efficiencies

Offshoring offers unparalleled benefits and is reshaping the global investment banking and advisory industry. Offshoring services can be leveraged across the deal lifecycle, with varying complexities. Investment banks and advisory firms are moving away from the traditional tactical offshoring support towards a more strategic partnership for assistance across live deals and strategic tasks.

Our survey captured increased interest of the top leaders of the investment banking industry in offshoring. While traditional advantages continue to generate proven value propositions, valueadded advantages are increasingly catching attention. Over and above the cost arbitrage advantage, offshoring offers savings in terms of lower supervision time, ready access to a skilled talent pool and operational flexibility

Conclusion

2024 presents significant potential for investment banking and advisory firms Our survey results present an optimistic outlook for the investment banking and advisory business. 77% of the respondents expect significant or at least marginal revenue growth in 2024. Deal makers expect a buyer-led market. M&A is expected to be the #1 contributor to overall revenue, followed by debt capital markets, equity capital markets and private capital advisory/ placements.

The TMT sector will likely remain the primary sector driving the recovery in revenue, followed by power, utilities and infrastructure and leisure, retail and consumer. ESG is expected to be a main factor influencing private equity investment and M&A deals. With this expected growth, investment banks and advisory firms would need more bandwidth. Gap in bandwidth to be bridged by technology and offshoring.