Introduction

Introduction

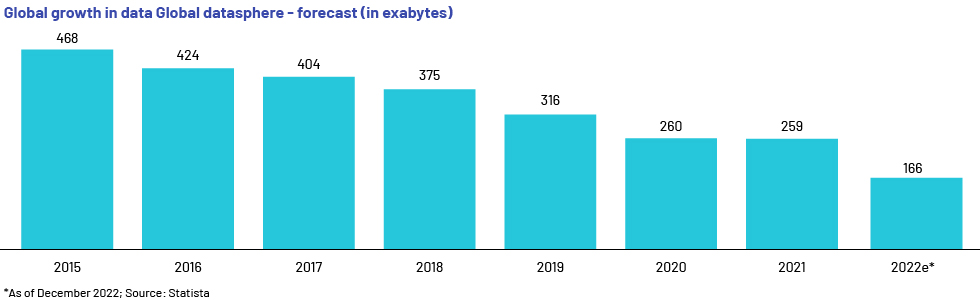

The greater the amount of data globally, the higher the chances for breaches/scams and demand for secure data‑sanitisation. Data-erasure, also known as data clearing or data wiping, is a software-based method for securely overwriting digitally stored information, using binary data in line with standards specified, and then verifying and certifying the process in terms of a formal record that details how the data deletion occurred, while meeting the requirements set out in the General Data Protection Regulation (GDPR).

The process is usually considered to be similar to partial data-sanitisation methods such as data deletion, reformatting, factory reset, file shredding and data wiping, although it is a means of permanently deleting data from storage devices. Data-erasure aims to overwrite sensitive data with a series of 0s and 1s (or pseudorandom digits) and ensure that the deleted data cannot be recovered or accessed by unauthorised users. The method is employed when the devices containing the data are recycled, repurposed or discarded; when data is no longer required; or for compliance with data protection regulations

Data-erasure software replaces & protects costlier methods of physical data destruction

Such software complies with data‑security regulations, and to ensure proper procedure is followed, companies adhere to global data‑sanitisation guidelines or standards, such as those issued by the National Institute of Standards and Technology (NIST) or by Sustainable Electronics Recycling International (SERI), limiting the risk of data leakage or breach.

Unlike traditional techniques such as shredding, data-erasure is eco‑friendly, as the software does not damage storage media and allows execution at any location. This reduces the cost of device replacement/movement and also enables companies to resell or repurpose storage devices without risk of data leakage, reducing the amount of electronic waste.

Data-erasure solutions market is estimated to reach USD4.3-USD4.8bn by the end of 2031

In terms of region, North America accounts for the largest market share. Europe also holds a prominent position in the market owing to its technological advancements, the presence of a number of business enterprises and increasing demand for data-erasure in the region. In terms of product and type of end user and deployment, the market is expected to grow the fastest among PCs in the forecast period, followed by laptops and data centres.

The banking, financial services and insurance (BFSI) sector is expected to account for the largest market share, followed by IT and telecom, government and healthcare. In terms of cloud and on-premise deployments, the cloud sector is expected to grow at the highest CAGR owing to the increased preference for cloud storage.

Tech dynamics entering the market

Hard disk drive (HDD) shipments declined slightly in recent years due to reasons such as uncertain demand for consumer electronics and nearline HDDs, and cooling economies, while SSD shipments have grown. However, HDD shipments have started to recover in recent quarters, according to the Digital Storage Technology Newsletter of February 2023.

Advances in flash technology and the long-term decline in NAND flash prices may provide some market share for SSDs in the future. However, HDDs are likely to continue playing a significant role in data storage globally. SSDs are considered to be the default choice for storage, after data centres, and their adoption is expected to continue increasing due to advancements in Non-Volatile Memory Express (NVMe) protocol, the rise of storage-class memory and increasing demand for composable architectures built around flash technology. Although SSDs may gain some market share, they still have a way to go to catch up in terms of the price gap with HDDs, primarily in the case of high-capacity drives.

Conclusion

The global datasphere is expected to expand significantly; data-erasure would, therefore, become more attractive in the effort to ensure the security of large amounts of data while keeping businesses environmentally friendly. Investments are also growing, as evidenced by the recent acquisition of major participant Blancco by a PE firm. Large players looking to expand by acquiring small players could present profitable and good exit opportunities for PE firms that have invested or may invest in SMEs.

How Acuity Knowledge Partners can help

With our vast pool of research-based professionals, we are well equipped to help investors in private markets conduct research on new investment opportunities and on how to maintain existing investments. We support global PE and venture capital firms with research on any sector they wish to invest in, including technology, consumer, entertainment and healthcare