Introduction

Introduction

With the recent amendments relating to financial regulators terminating use of the London Interbank Offer Rate (LIBOR), borrower concern about financial stability has increased. The shift to a new benchmark rate [the Secured Overnight Financing Rate (SOFR)], which would require constant monitoring and impose the additional burden of documentation, comes amid banks raising interest rates to the highest levels in the past 22 years and high inflation. The pace of transition to the new rate is surprisingly rapid, as LIBOR is higher than its counterpart and the borrower has room to save borrowing costs although central banks are on a tightening cycle. The benchmark replacement will be specified as “Term SOFR + Adjustment”, according to the Alternative Reference Rates Committee’s (ARRC’s) new guidelines. This means the adjustment addresses the gap between SOFR and LIBOR with the following adjusted spreads:

It has recently been claimed that SOFR tracks overnight transactions in the Treasury repurchase market; this is a preferred metric for estimating borrowing cost. LIBOR has been in existence for the past 36 years, and moving away from such a benchmark would be a challenge for stakeholders. Although its replacement has been in the works for a decade, the transition after the official announcement by regulators has been a hindrance for market participants and banks. We have yet to see collaboration among rating agencies, lenders, investors and regulators to ensure a smooth transition that would preserve borrower confidence.

Background

In 2017, the ARRC identified SOFR as an alternative to LIBOR, which is based on actual transactions in the US Treasury repurchase (repo) market. This was in an effort to make available a secured overnight borrowing rate that reflects a broader range of market participants and transactions. Its inherent robustness makes it less prone to manipulation. The transition was not limited to the US. Markets across the globe also explored alternative refinancing metrics.

For example, the Sterling Overnight Index Average, popularly known as “SONIA”, is the preferred benchmark in the UK. The USD LIBOR benchmark rates, the British pound (GBP), Japanese yen (JPY), Swiss franc (CHF) and euro (EUR), and the one-week and two-month USD LIBOR ceased to exist in January 2022.

The discontinuation of these rates is part of the final cessation of LIBOR; the remaining USD LIBOR rates were discontinued on 30 June 2023. On a global level, 2021 was considered to be the beginning of the end of LIBOR as a benchmark. In October 2021, federal financial regulators agreed that supervised institutions with LIBOR exposure would transition away from the benchmark. To this end, the agencies advised the institutions to not use LIBOR as a reference rate on fresh contracts after 31 December 2021 and ensure existing contracts have strong and sufficient fallback language clearly defining the alternative reference rate. LIBOR was retired on 30 June 2023. It is critical that market participants and businesses comprehend how markets, regulators and companies may be affected by this and the different transition deadlines.

Impact on international floating-rate bond markets

Bond investors are now exploring how to navigate a prolonged period of higher interest rates expected to weigh on the US economy after the Fed left open the possibility of more rate hikes, eliminating the likelihood of easing financial conditions in the near term. With the latest 25bps hike, the Fed has raised the terminal rate by 525bps since March 2022, to a level seen before the 2007 housing crisis, to curb persistently high inflation. Fixed income investors remain concerned about how long central banks can keep rates at restrictive levels without causing an economic downturn. Timing a shift in benchmark rates is, therefore, critical, as a weaker economy would cause the central banks to cut rates.

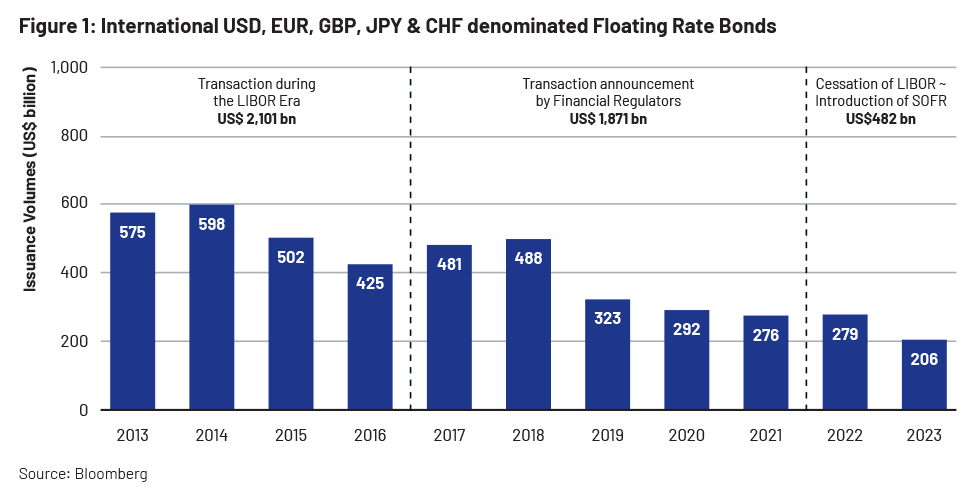

Yields at the longer end of the curve are near their highest levels since 2007 as investors speculate the Fed will avoid recession while meeting its ultimate goal of curbing inflation. Other developed economies such as the UK and Europe have also seen a sell-off in bonds; UK 10-year gilts reached their highest levels since 2008, and Germany’s benchmark reached levels not seen since 2011. Amid the current interest rate regime and the transition from LIBOR to SOFR, international floating-rate bond markets have seen significant downward pressures in issuance volumes, with issuers adapting to tapping the markets or recalibrating their models to ensure suitable pricing levels

The way ahead

The transition from LIBOR to SOFR would require the markets to be prepared to meet the challenges. The pain points for market participants would relate mainly to adapting pricing and risk estimation models, addressing liquidity concerns as a new benchmark comes into play, dealing with complexities in calculating and estimating future cash flow with respect to floating-rate notes and new structured products.

The banking sector is exploring how structured products could be used to mitigate risk between interest rate swaps referencing the US SOFR and term SOFR piling up on dealers’ balance sheets. The transition could encounter regulatory roadblocks, and overseeing the transition away from LIBOR, which was the benchmark for more than 36 years, may create conflict with guidelines on the use of forward-looking rates.

To ensure they meet regulatory norms, market participants need to efficiently analyse rate estimations, demarcate risk and return, be thoroughly familiar with regulatory information and documentation processes and protect investor interest at all times, as the transition may be dynamic and result in volatility in pricing mechanisms.

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence to the financial services sector. We support over 440 financial institutions and consulting companies through our specialist workforce of over 4,250 analysts and delivery experts across our global delivery network.

We provide bespoke support to the debt capital market (DCM) teams of investment banks and advisory firms across the world through a wide range of solutions for corporate DCM, financial institutions group (FIG) DCM, sovereign, supranational and agencies (SSA) DCM, sustainable DCM and HY teams. We also provide assistance with pricing mechanisms for debt securities and estimations across different types of debt products such as fixed-rate, floating-rate and cross-currency/reverse cross-currency swaps.

Our team of experts regularly tracks macroeconomic factors affecting markets and provides end-to-end support, from deal origination to execution, including the most intricate financial analysis and aftermarket support. The DCM team also provides assistance with covenant analysis on different types of debt products by actively monitoring and capturing the covenants being incorporated by issuers in the offering circular, interpreting the ultimate purpose of the investments and how far they will benefit investors, and helping issuers raise funds.