US Municipal Debt Market – New Winner in Post Covid-19 World

Municipal Debt Market - Executive Summary

Global markets have been in turmoil due to the sharp increase in volatility caused by the war between Russia and Ukraine, expectations of higher benchmark rates and tapering of government stimulus. Investors are, therefore, looking for high-quality bonds less sensitive to interest rate changes. Municipal bonds (munis), which offer a mix of both, are emerging as the preferred option.

This white paper highlights the importance of the US muni market to investors by analysing its performance across economic cycles. It also lists key attributes of the asset class that differentiate it from other fixed income assets and concludes by outlining the growth outlook, challenges facing investors and how Acuity Knowledge Partners’ (Acuity’s) services can help investors across the investment cycle.

Municipal Debt Market - An Introduction

Key takeaways:

1) Gross muni issuances amounted to USD485bn in 2020 and USD480bn in 2021, led by the significant increase in taxable bonds.

2) The broader munis index returned a negative 1.1% in 2021, compared to a negative 5.3% for global IG corporate bonds, a negative 6.0% for EM corporates and a negative 2.56% for US 5-year Treasuries.

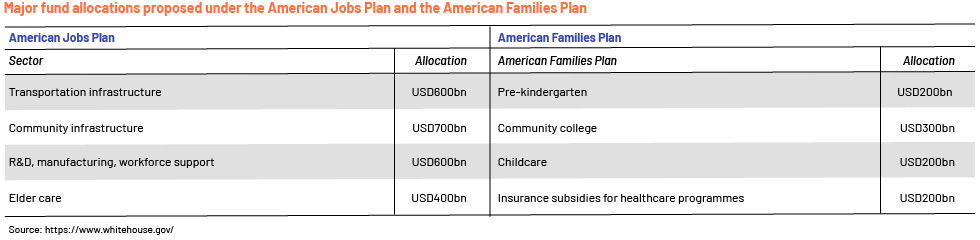

3) Muni demand and supply benefited from government schemes such as the American Rescue Plan, the American Jobs Plan and the American Families Plan under the USD7tn Build Back Better Act.

4) Due diligence and extraction of fallback language across all issuances within a short period of time. Identification of country of legal jurisdiction

5) Munis could face headwinds in FY22 with monetary tightening and the removal of certain fiscal support measures. However, their low interest rate sensitivity, being exempt from federal income tax and the prospects they offer of higher tax collection on improving credit fundamentals add to their allure.

Municipal Debt Market - Key Developments

The USD7tn Build Back Better (BBB) Plan is expected to extend support to all sectors of the economy. On 28 October 2021, the federal government introduced a USD1.75tn combined plan, allocating funds for family aid, Medicare expansion and mitigating climate change.

The BBB Plan, along with the combined plan, would remain supportive of the healthcare, education and infrastructure sectors. Consequently, rating agencies have changed their outlook on these sectors to Stable or Positive from Negative previously.

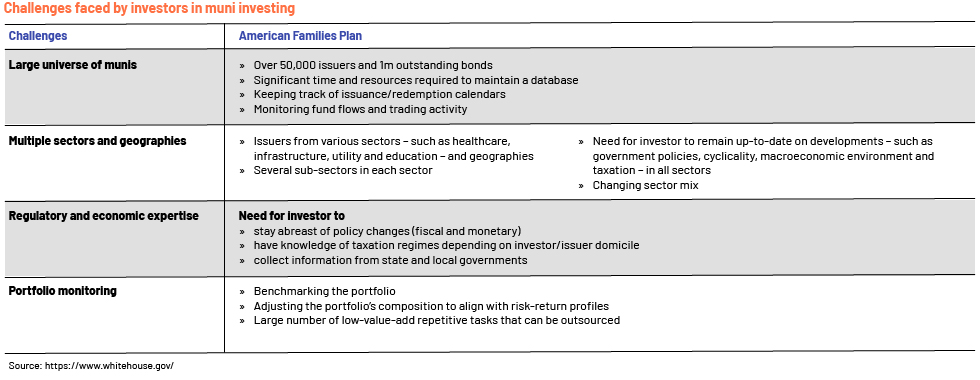

Municipal Debt Market - Key Challenges

Investing in munis presents a number of opportunities to diversify portfolios and enhance tax-adjusted yields, but it also brings challenges. These vary from understanding the macroeconomic landscape; selecting the issuer, sector, geography and muni type; and performing a credit analysis on the sponsoring entity to understanding the legalities involved in transactions.

Outlook

Since 2020, amid the pandemic, municipal entities have incurred additional expenses to meet increased healthcare, community support and governance-related costs. These were partly funded through federal support initiatives, such as the CARES Act, continued through the Build Back Better (BBB) Plan under President Joe Biden. While the BBB Plan is expected to extend support to all sectors of the economy, state and local governments and the healthcare, education and infrastructure sectors are expected to gain the most.

Local government (city and county) revenue was mostly resilient and not affected much by the pandemic owing to the stable nature of their primary revenue source, i.e. property taxes. Most states were expected to experience significant drops in revenue, as they depend heavily on income tax revenue. However, job and income losses were concentrated in low-wage sectors, such as tourism and hospitality; hence, the impact on state revenue was limited. Most states experienced revenue loss in 2020, but these losses were significantly lower than expected. Increasing economic activity, an improving labour market and continued government support should strengthen the credit metrics of state and local governments.

Transportation-related entities were the most severely affected amid the pandemic. The transportation sector was able to survive the pandemic mostly on the back of strong government support. Under the BBB Plan, community infrastructure projects related to water, electricity, housing and transportation are expected to boost the country’s infrastructure development. With the ongoing economic recovery and growing investments, operating efficiency and utilisation levels are expected to rise, leading to an improvement in the credit quality of infrastructure credits.

Operations and finances of healthcare entities were stretched amid the pandemic, but these entities stayed afloat owing to funds from the USD2.2tn CARES Act and are expected to continue to receive support from the BBB Plan. Most of these entities’ liquidity and margins have improved from the levels seen during the pandemic. The education sector was somewhat affected, but the impact was mostly restricted to the medium of instruction, while financial profiles were only minimally affected. Under the BBB Plan, healthcare and education entities stand to benefit from additional support for infrastructure and community development.

Conclusion

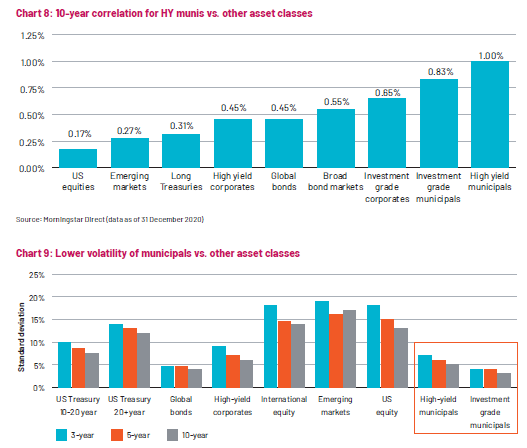

Munis are an attractive investment option because they can cater to investors’ different risk profiles and investment horizons. They are considered to be a safe haven given their relatively strong credit profiles: almost two-thirds of outstanding bonds are rated AA or higher, compared with a paltry 7% for US corporate bonds. Furthermore, default rates on munis have remained low historically, at 0.16% over 1970-2018 vs 10.13% for US corporates. Munis have low correlation with other asset classes, making them a natural portfolio diversifier (10-year correlation for HY munis vs US equities is 0.17 and vs HY corporates is 0.45). Munis have lower volatility than other asset classes.

Source: Nuveen Municipal Bond Market Update presentation. Representative indices: Bloomberg Barclays US 10-20 Year Treasury Index, Bloomberg Barclays US 20+ Year Treasury Index, Bloomberg Barclays Global Aggregate Unhedged Index, Bloomberg Barclays High Yield Corporate Index, MSCI EAFE Index, MSCI Emerging Markets Index, S&P 500 Index, S&P Municipal High Yield Index, Bloomberg Barclays Municipal Bond Index.

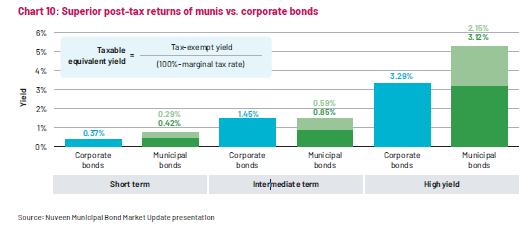

Munis have generated superior risk-adjusted returns against all major asset classes over the past 3-10 years, with low volatility. The asset class has also provided robust post-tax returns, especially in the highest income tax brackets

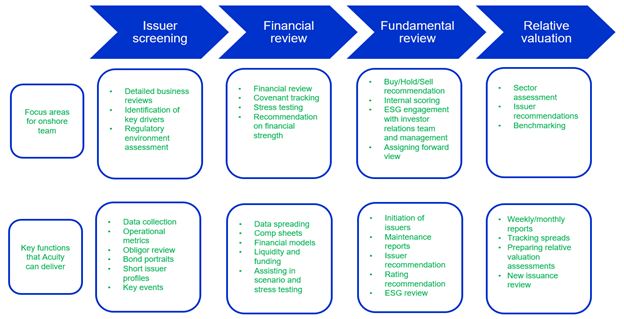

Acuity’s Value proposition

Acuity’s Fixed Income Research team has analysed more than 20,000 municipal debt issuers over the past 15 years. Consequently, the team has built asset class expertise and is able to provide customised solutions to investment managers in line with their risk-reward profiles. Acuity ensures

Enhanced coverage

Customised products

Operational flexibility

Cost savings