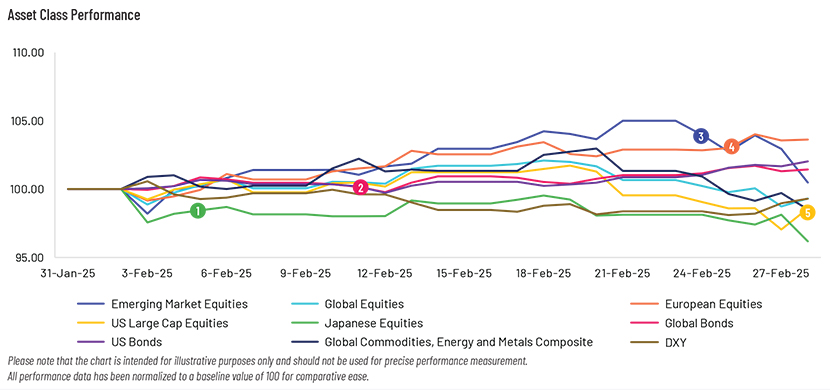

“February saw widespread volatility across asset classes, stemming from developments I had talked about last time. The Trump administration’s tariff announcements and actions has laid the foundation for increased uncertainty for the rest of 2025. This coupled with the Federal Reserve’s decision to tread cautiously when cutting rates further, reduces the chances of a return to a strong bullish scenario this year. As signs of a weakening US economy emerge, investors might be encouraged to look across the Atlantic to UK, Asia and European equities where valuations continue to be more attractive. The Chinese government’s new initiatives with leading businesses and its change in stance towards AI have spurred hopes of a growth recovery in China. The global economic prospects remain mixed, given policy uncertainties and geopolitical tensions. However, as global inflation cools amid softer demands due to lagging effects of tight monetary policy, investors would do well to focus on strong economic fundamentals in weathering this current wave of volatility.”

– Narendra Babu, Senior Director, Financial Marketing Services

Market Pulse

Top Performing Asset Class:

Global REITS (+2.2%): Global REITs have surged as the office real estate sector focuses on attracting tenants back to the workplace post the end of the Covid-19 pandemic. Prime, amenity-rich properties, typically owned by REITs, have effectively reinforced the workplace’s role in corporate culture.

Worst Performing Asset Class:

Global Commodities (-1.5%): Global commodities are being impacted by President Trump’s new tariffs on all steel and aluminium imports to the U.S., affecting agricultural markets with China, Mexico, and Canada as key destinations for American farm products.

- February 5: The U.S. dollar dropped to its lowest level in over a week as concerns about a global trade war eased, while the Japanese yen surged due to robust wage data.

- February 11: Global bonds saw a boost as the Reserve Bank of India doubled its bond purchases to INR 40,000 crore due to changing liquidity conditions.

- February 24: Emerging markets are seeing a shift as DeepSeek prompts a move from Indian stocks to Chinese equities, though experts recommend caution.

- February 26: European shares hit a record high as corporate earnings took centre stage and investors assessed the impact of a critical minerals agreement between the U.S. and Ukraine.

- February 28: US equities ended February on a turbulent note, with the Dow dropping 1.6% (700 points), the S&P falling 1.4%, and the Nasdaq declining 4%.

Equities

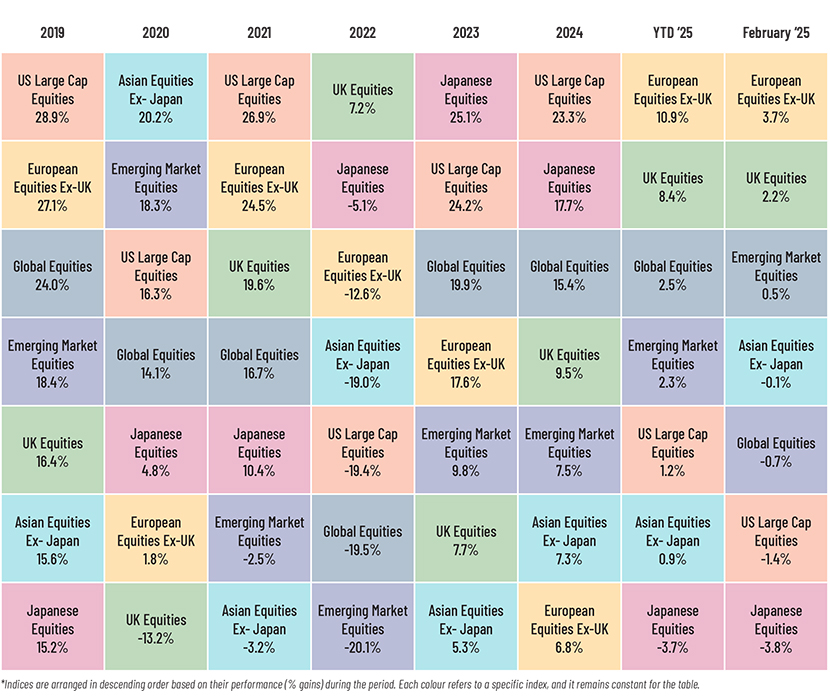

Global equity markets ended February in negative territory, hurt by trade tensions, economic slowdown and increased short selling. While developed markets struggled, emerging markets saw modest gains. US markets saw a notable decline, due to a sell-off in technology stocks, economic uncertainty, weak consumer confidence and disappointing manufacturing and retail sales data. The Federal Reserve (Fed), in its January meeting minutes, highlighted the need for a cautious approach amid ongoing uncertainty. European markets, bucking the trend, performed well, nearing record highs. Gains were supported by optimism around corporate earnings, progress in Russia-Ukraine peace talks and attractive stock valuations, with Germany’s stimulus measures and increased defence spending adding to the positive momentum, despite some market volatility, due to trade-related worries. The European Central Bank, meanwhile, maintained its restrictive stance, carefully balancing ongoing inflation concerns with sluggish economic growth while still anticipating multiple rate cuts this year. UK stocks reached record levels, supported by strong earnings and a 25-basis point (bp) rate cut by the Bank of England. The central bank signalled a measured approach to further easing, considering economic growth challenges. In Asia, Japanese equities experienced their sharpest monthly decline since 2022, with concerns over US export tariffs and a sell-off in semiconductor shares contributing to the deterioration. China’s stock market also gained, driven by optimism surrounding AI advancements, positive government engagement with businesses and encouraging outlook on AI’s impact on equities. On the other hand, India’s market struggles continued for a fifth straight month – the longest streak since 1996. Anaemic corporate earnings, ongoing foreign outflows and uncertainty over US trade policies led to a 15% drop in the Nifty from its September 2024 peak. The Reserve Bank of India lowered its key interest rate by 25bps to 6.25% in response to slowing economic growth.

Fixed Income

Momentum in global bond markets continued in February amid robust economic growth on elevated consumer spending and business investment. Steadily falling inflation supported bond prices globally amid rate cuts by major central banks. Performance continued to be positive across Treasuries, investment-grade and high-yield corporates and emerging markets. Emerging market debt (EMD) gained, due to its resilience to external shocks, broad-based growth and attractive opportunities in segments such as Asia high-yield credit and frontier EMD. Improved fundamentals, including higher currency reserves and lower external imbalances, also supported bond performance. On the other hand, US Treasury yields declined on weaker economic data and policy uncertainty from the Trump administration. Meanwhile, investment-grade corporates advanced but lagged behind similar-duration Treasuries, while high-yield corporates saw strong supply and demand.

The yield spread between the 10- and 2-year US Treasuries narrowed in February, due to economic growth concerns, coupled with sticky inflationary and the Fed’s policy uncertainty. Credit spreads widened marginally as economic slowdown fears, policy uncertainty and stagflation risks drove investors towards safer government bonds. Global sovereign bonds outperformed their global investment-grade and high-yield counterparts.

Foreign Exchange

Currency markets saw notable fluctuations in February, triggered by several economic and geopolitical factors. The US dollar softened in early February, due to weak consumer confidence data and a drop in US yields, while markets oscillated as the spotlight fell on the ongoing crucial talks between the US and other countries on geopolitical concerns. However, by end-February, the greenback appreciated thanks to strong inflation data and January meeting minutes, which increased expectations of delayed rate cuts by the Fed. The JPY/USD strengthened significantly on anticipation of further rate hikes as inflation remained strong. In Europe, tariff risks remained a significant challenge for the euro. Additionally, weak macroeconomic data exacerbated the situation, indicating potential further rate cuts by the ECB. The British pound benefited from a weaker euro, owing to its lower exposure to trade risks. In emerging markets, the USD/INR weakened to historic lows, due to tariff uncertainty and continued portfolio outflows. The Mexican peso remained under pressure as Trump reaffirmed a 25% tariff effective 4 March, coupled with Banxico’s dovish stance.

Commodities

ICE Brent declined nearly 5% month-on-month in February, due to demand concerns and increased supply from Iraq. Fears of a global trade war, the potential for a Russia-Ukraine peace settlement and uncertainty about OPEC+ oil production levels for April and beyond further strained crude oil prices. Meanwhile, US natural gas emerged as the best-performing commodity in the month, as freezing temperatures in the US hastened the seasonal drop in storage. As of 21 February, total gas stockpiles stood at 1.84tcf, down 23.4% from last year and 11.5% below the five-year average. US natural gas storage has returned to a deficit scenario after two years of surplus compared to the previous year’s levels.

Meanwhile, the metal complex continued to experience gains, with gold reaching another record high of c.USD2,950/oz last month. The upward rally was bolstered by a weakening US dollar index and new tariff threats from President Trump. LME copper prices increased more than 3% month-on-month in February after the US president instructed the US Commerce Department to investigate potential import tariffs on copper. In agricultural commodities, grain performance remained sluggish last month, with CBOT corn and wheat declining over 5.9% and 4% month-on-month, respectively. The price drop was primarily driven by expectations of a robust supply in the US and concerns over the effect of US tariffs.

Outlook

The proposed tariff changes by the US have injected volatility into the equity markets globally. While the Fed does not seem to be favouring aggressive rate cuts at the moment, it is likely to trim rates if economic data suggests that the US economy is slowing. Meanwhile, options traders are bracing for a looming crash in equity markets driven by an impending recession in the US. The latest data from Cboe Global Markets showed that options traders were seeking cash protection as they engaged in buying deep out-of-the money VIX Index call options to profit if the index – also known as the market’s fear gauge – spikes in an outcome tied to a market crash. The lack of policy clarity from the Trump administration amid tariff threats has spooked investors. However, experts have been advising market participants to focus on long-term opportunities, citing an expected fall in inflation and a pro-business environment.

Central Bank Quotes

JJerome Powell, Chairman, Federal Reserve (11 February 2025)

Michele Bullock, Governor and Chair of the Reserve Bank of Australia (18 February 2025)

In case you missed it

- Explore the future of finance: Embrace the wave of sustainable regulations and ESG integration in 2024! – September 2024

- Ready to uncover the balance of privacy and protection? Turn to voice surveillance! – September 2024

- Discover the impact of high Fed rates on US housing: affordability drops, demand slows, and supply tightens – September 2024

- Brace for impact: BBB-rated borrowers face rising downgrade risks amid economic uncertainty! – September 2024

What’s Ahead

| Date | Country | Event |

|---|---|---|

| Mar 15 | Argentina | Inflation Rate YoY |

| Mar 18 | US | Fed Interest Rate Decision |

| Mar 19 | Japan | Interest Rate Decision |

| Mar 21 | EU | European Council Meeting |

| Mar 24 | Singapore | Core Inflation Rate YoY |

| Mar 31 | China | Manufacturing PMI |

| Apr 1 | Australia | Interest Rate Decision |

| Apr 3 | UK | Services PMI |

| Apr 4 | India | Foreign Exchange Reserves |

| Apr 5 | Italy | Retail Sales YoY |